|

市場調查報告書

商品編碼

1536948

房車租賃:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Recreational Vehicle Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

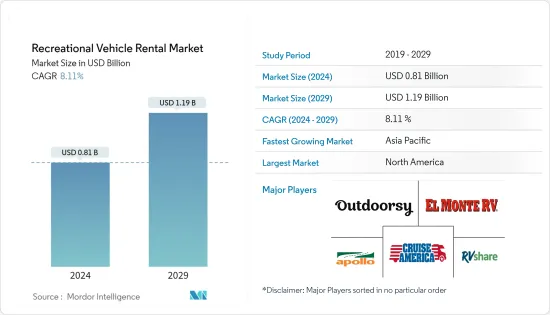

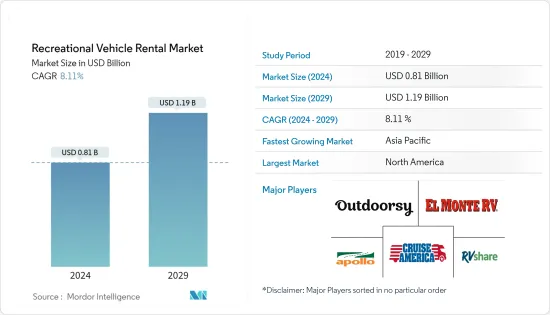

休閒車租賃市場規模預計到 2024 年將達到 8.1 億美元,到 2029 年將達到 11.9 億美元,在預測期內(2024-2029 年)複合年成長率為 8.11%。

由於越來越多的年輕人和老年人選擇房車摩托車旅行,房車租賃市場預計將顯著成長。此外,旅遊業的發展和房車露營的日益普及正在推動全球房車租賃服務的需求。

購買房車非常昂貴,因此北美、歐洲和亞太地區的許多人轉向房車租賃服務,以消除與購買、保險和維護車輛相關的成本。房車租賃服務的便利性以及世界各地房車租賃服務供應商數量的不斷增加正在吸引預算有限且不想投資購買新房車的客戶。

隨著時間的推移,租賃新房車的過程變得越來越簡單。房車租賃提供優惠優惠來吸引客戶。隨著技術先進的新車型每年上市,並提供線上和線下預訂方式,客戶有多種選擇。每次新的旅行,您都可以乘坐不同型號的房車並配備其他設施。公司正在客製化他們的預訂服務,以使房車預訂變得更容易。

房車租賃市場趨勢

從產品類型來看,電動房車是最大的細分市場

隨著旅行和旅遊在世界各地越來越受歡迎,人們正在尋求獨特和冒險的體驗。對體驗式和沈浸式旅行的渴望正在推動電動房車租賃的需求。許多國家缺乏可用的露營地也促進了電動房車市場的發展。

此外,全球範圍內對旅居車的需求正在顯著成長,尤其是在歐洲國家。日益富裕的人口和休閒車停車場的廣泛使用正在推動休閒車在北美和歐洲的普及。到 2022 年,歐洲將在全球房車和旅居車市場中佔據很大佔有率,旅居車銷售將超過北美。

自疫情爆發以來,由於大多數人出於安全預防措施而避免乘坐大眾交通工具,因此對休閒車的需求激增。在新冠肺炎 (COVID-19) 疫情期間,歐洲多家房車租賃公司的預訂量大幅增加。

此外,近年來,B級和C級旅居車因其優點而需求增加。例如,在美國,近年來參加露營的人數呈現上升趨勢。 2023年,美國露營人數將超過5,700萬,2022年約5,500萬。

此外,各國政府正在投資基礎設施開發以吸引旅遊業,這可能會對預測期內電動房車租賃的成長產生正面影響。例如,2022年6月,西班牙政府核准了總額為1.1億歐元的下一代歐盟資金,以增強巴利阿里群島、休達和梅利利亞等多個地區的旅遊業競爭力。

所有這些因素加在一起可能會支持預測期內對電動房車的需求。

亞太地區將在預測期內快速成長

雖然北美佔據休閒車租賃市場的最大佔有率,但亞太地區預計在預測期內將成長最快。中國、印度、日本和東南亞國家等經濟體可支配收入的增加和中階人口的成長正在推動人們對休閒和戶外體驗的興趣。

2019年,中國旅遊業銷售額激增11.7%,達到約5.7兆元(約7,960億美元)。這種成長發生在 COVID-19 大流行爆發之前。 2022年,中國旅遊收入將達到約2兆元(約2,800億美元)。值得注意的是,2020年、2021年和2022年的大部分收入來自國內旅遊,因為自2020年2月以來嚴格的旅行限制對入境旅遊產生了重大影響。

此外,亞太地區基礎設施和道路網路的改善正在改善前往各種旅遊目的地的交通,包括非常適合休閒車旅遊的偏遠地區和風景名勝區。在印度,旅遊基礎設施發展和促進國內旅遊業的 Swadesh Darshan 計劃等政府舉措是支持旅遊業的基礎設施發展的典型例子。

此外,該地區房車租賃公司和平台的數量不斷增加,創新租賃模式和服務的引入正在促進市場成長。

房車 (RV) 租賃業概覽

市場分散,許多國際和國內公司在世界各地運作。然而,該行業正在整合,少數企業控制著大部分市場。

在此市場營運的主要企業包括 Outdoorsy Inc.、Indie Campers 和 McRent Europe。房車旅遊租賃市場也見證了區域和全球層面新進業者的湧入。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 旅遊和遊客的增加帶動市場需求

- 市場限制因素

- 房車租賃車輛維修成本高

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模)

- 租賃公司類型

- 個人/個人業主

- 車隊營運商

- 預訂類型

- 線下預訂

- 網上預約

- 產品類型

- 電動房車

- A級旅居車

- B級旅居車

- C級旅居車

- 露營者

- 拖曳式房車

- 第五輪圈拖車

- 旅行拖車

- 卡車/露營車

- 運動型公共事業拖車

- 電動房車

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Apollo Tourism & Leisure Ltd(ATL)

- McRent

- El Monte RV

- RV Share

- Cruise America

- Just Go Motorhome Hire

- Outdoorsy, Inc.

- Indie Campers

- RoadSurfer GmbH

- MotorVana(Ideamerge LLC)

第7章 市場機會及未來趨勢

- 對永續和環保車輛的需求不斷成長帶來了成長機會

The Recreational Vehicle Rental Market size is estimated at USD 0.81 billion in 2024, and is expected to reach USD 1.19 billion by 2029, growing at a CAGR of 8.11% during the forecast period (2024-2029).

The recreational vehicle rental market is expected to witness significant growth due to an increase in the population of young and old opting for RV touring. Moreover, the development of the tourism industry and the growing popularity of recreational vehicle camping are driving the demand for RV rental services around the globe.

RVs are significantly expensive to purchase, so a large population across North America, Europe, and Asia-Pacific is opting for RV rental services, eliminating the cost associated with vehicle purchase, insurance, and maintenance. The ease of accessing RV rental services and the increase in the number of RV rental service providers across the globe are attracting customers who have budget constraints and are unwilling to invest in purchasing new RVs.

The process of renting a new RV has become simpler over time. RV rentals offer lucrative deals to attract customers. Customers have many options, with new technologically advanced models arriving on the market every year using both online and offline modes of booking. Every new trip can be in a different RV model with other amenities. Companies are customizing their booking services to make it easy for RV customers.

Recreational Vehicle (RV) Rental Market Trends

Motorized RVs are the Largest Segment by Product Type

With travel and tourism gaining popularity across the globe, people are seeking unique and adventurous experiences. The desire for experiential and immersive travel experiences has increased demand for motorized RV rental. The shortage of available campgrounds in many countries has also contributed to the market for motorized RVs.

Further, motorhomes are witnessing significant growth in demand worldwide, especially in European countries. The increasing number of HNWIs and the availability of widespread parking areas for RVs are driving their adoption in North America and Europe. In 2022, Europe accounted for a significant share of the global caravan and motorhome market due to more motorhomes sold than North America.

The demand for recreational vehicles has boomed after the outbreak of the pandemic, as most people started planning their holidays while avoiding public transportation due to safety precautions. Several RV rental companies across Europe witnessed significant booking growth during the COVID-19 pandemic.

Moreover, over the past few years, the demand for Class B and Class C motorhomes has increased owing to their advantages. For instance, the population of the United States participating in camping has seen an upward trajectory over the last few years. In 2023, the number of users opting for camping in the United States stood at over 57 million, compared to around 55 million in 2022.

Additionally, various countries' governments are investing in infrastructure development to attract tourism, which will positively impact motorized RV rental growth during the forecast period. For example, in June 2022, the Spanish government authorized a total expenditure of EUR 110 million from Next Generation EU funding to strengthen tourist competitiveness in numerous territories, including the Balearic Islands, Ceuta, and Melilla.

All these factors combined will positively boost the demand for motorized RVs during the forecast period.

Asia-Pacific Will be the Fastest Growing Region During the Forecast Period

While North America holds the largest recreational vehicle rental market share, Asia-Pacific is expected to be the fastest-growing region during the forecast period. Increasing disposable income and a growing middle-class population across economies like China, India, Japan, and Southeast Asian nations show greater interest in leisure and outdoor experiences.

In 2019, the Chinese tourism industry witnessed an 11.7% surge in revenue, reaching approximately CNY 5.7 trillion (~USD 796 billion). This growth occurred just before the onset of the COVID-19 pandemic. In 2022, the revenue from tourism in China reached around CNY 2 trillion (~USD 280 billion). Notably, most of this revenue during 2020, 2021, and 2022 was generated by domestic tourism, as strict travel restrictions have significantly impacted inbound tourism since February 2020.

Additionally, infrastructure development and road network improvements across APAC have enhanced accessibility to various tourist destinations, including remote and scenic locations that could be best explored through RVs. In India, the government's initiatives, such as the Swadesh Darshan scheme for developing tourist infrastructure and promoting domestic tourism, are the best examples of infrastructural development supporting tourism.

Moreover, the increasing availability of RV rental companies and platforms in the region and the introduction of innovative rental models and services contribute to the market's growth.

Recreational Vehicle (RV) Rental Industry Overview

The market is fragmented with numerous international and domestic companies operating across the globe. However, the industry is on the verge of consolidation, with few players capturing most of the market.

Some of the key players operating in the market include Outdoorsy Inc., Indie Campers, and McRent Europe. The RV tourism rental market is also witnessing an inflow of new entrants both at the regional and global levels.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increased Travel and Tourism to Fuel Market Demand

- 4.2 Market Restraints

- 4.2.1 High Maintenance cost of RV Rental Fleets

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value in USD Million)

- 5.1 Rental Supplier Type

- 5.1.1 Private/Individual Owners

- 5.1.2 Fleet Operators

- 5.2 Booking Type

- 5.2.1 Offline Booking

- 5.2.2 Online Booking

- 5.3 Product Type

- 5.3.1 Motorized RVs

- 5.3.1.1 Class A Motorhomes

- 5.3.1.2 Class B Motorhomes

- 5.3.1.3 Class C Motorhomes

- 5.3.1.4 Campervans

- 5.3.2 Towable RVs

- 5.3.2.1 Fifth-Wheel Trailers

- 5.3.2.2 Travel Trailers

- 5.3.2.3 Truck Campers

- 5.3.2.4 Sports Utility Trailers

- 5.3.1 Motorized RVs

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Apollo Tourism & Leisure Ltd (ATL)

- 6.2.2 McRent

- 6.2.3 El Monte RV

- 6.2.4 RV Share

- 6.2.5 Cruise America

- 6.2.6 Just Go Motorhome Hire

- 6.2.7 Outdoorsy, Inc.

- 6.2.8 Indie Campers

- 6.2.9 RoadSurfer GmbH

- 6.2.10 MotorVana (Ideamerge LLC)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Sustainable and Eco-Friendly vehicles Presents Ample Growth Opportunities