|

市場調查報告書

商品編碼

1536887

汽車燃料箱:市場佔有率分析、產業趨勢、成長預測(2024-2029)Automotive Fuel Tank - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

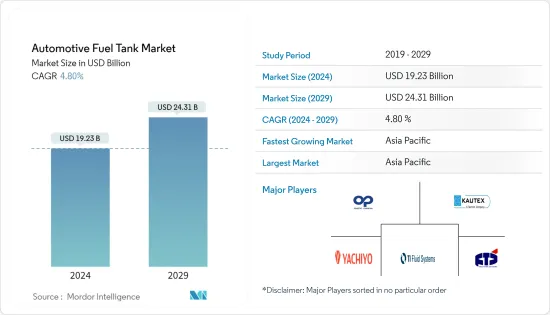

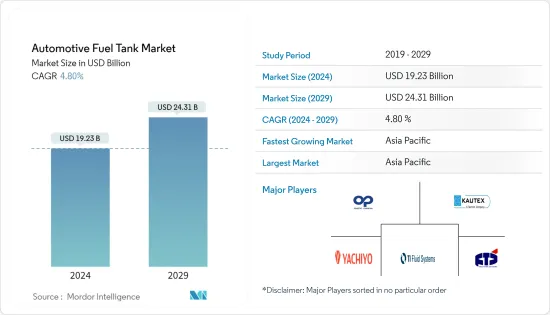

預計2024年汽車燃料箱市場規模為192.3億美元,2029年將達243.1億美元,預測期間(2024-2029年)複合年成長率為4.80%。

從中期來看,由於燃油效率提高而對輕型車輛的需求增加、汽車產量增加以及快速都市化等因素預計將推動市場成長。由於商用車需求的增加,特別是在物流和建築領域,該市場正在成長。電子商務行業的興起正在推動這一需求。

由於電動車的日益普及和普及,汽車燃料箱市場的需求正在迅速增加。然而,該市場的成長可能會受到鋁等基底金屬價格上漲的阻礙。

世界各地的製造商正在用塑膠取代金屬燃料箱,以減輕車輛重量並滿足不斷成長的需求。塑膠燃料箱深受汽車製造商和客戶的歡迎,因為與金屬燃料箱相比,塑膠油箱具有多種優勢。因此,塑膠已成為燃料箱的首選材料。

汽車燃料箱市場趨勢

45-70公升佔主要市場佔有率

過去五年汽車製造商發布的大多數新車車型的油箱容量至少為45公升。此外,透過增加燃料箱的尺寸,可以有效地利用車體內的死角。額外的重量也提高了汽車的穩定性和動力。

大多數小型轎車的燃料箱容量為45公升,而轎車的油箱容量通常為45至70公升。另一方面,SUV需要燃料箱。日本、中國、印度、德國、法國和西班牙等國家對轎車的需求正在增加,預計45-70公升容量範圍將成為最大的市場。

由於人均收入的增加,乘用車在新興國家越來越受歡迎,這可能會對市場產生正面影響。

印度等新興國家正在尋找更好的乘用車替代燃料,例如乙醇。此舉預計將對市場成長產生正面影響。汽車市場的成長可能面臨排放法規收緊、電動車興起以及由於內燃機(ICE)汽車對環境造成有害影響而導致石化燃料蘊藏量枯竭等挑戰。

然而,一些新興國家缺乏電動車基礎設施和充電設施可能會導致預測期內市場擴張。另一方面,SUV等商用車在美國、中國和德國很受歡迎,預計這些地區將帶動70公升以上的細分市場。

由於各個經濟體可支配收入的增加以及全球汽車使用量的增加,預計未來幾年該市場將大幅成長。技術繁榮可能會導致內燃機的進步,降低排放氣體和提高燃油效率,進一步推動該領域的成長。

亞太地區佔市場主導地位,預計成長最快

由於乘用車需求的增加,亞太地區的汽車工業正在不斷擴張,其中中國和印度對汽車銷售的貢獻最大。中國在汽車加工能力和汽車零件生產方面在該地區佔據主導地位。

該地區領先的OEM、汽車供應商和引擎製造商在全球範圍內保持穩定的車輛供應。 2022年中國汽車總銷量為26,863,745輛,較2021年的26,274,820輛成長2.2%。

印度是重要的汽車出口國,目前的流動性擴張計劃預計很快就會帶來強勁的出口成長。此外,印度政府和印度市場領先汽車製造商的各種舉措預計將使印度成為全球汽車出口市場的主要企業。

根據汽車經銷商協會聯合會(FADA)的數據,1月乘用車產業零售量總計393,250輛,打破了2023年11月創下的歷史紀錄。

由於汽車需求大幅增加,印度在汽車和汽車零件方面的專業知識正在推動市場成長,從而導致OEM和汽車零件製造商的崛起。

由於輕型和中型汽車銷量的不斷成長,預計該地區將在未來幾年在整個市場中發揮重要作用。

汽車燃料箱產業概況

汽車燃料箱市場由於幾家主要企業開發的產品以及與各汽車製造商的網路而佔有很大的市場佔有率。其中包括 Compagnie Plastic Omnium SA、Kautex Textron GmbH &Co.KG、YAPP Automotive Parts、TI Fluid Systems 和工業。新材料和設計的發展可能會影響現有公司和新公司的市場佔有率,這可能會推動未來幾年的市場成長。例如

- 2023 年 11 月,豐田合成在日本宣布推出新型高壓氫氣罐和無頂塗層熱沖壓格柵。豐田新款皇冠轎車採用了新型氫罐。

- 2023 年 9 月,Plastic Omnium SA 在韓國開設了一個新的研究中心,專注於開發氫動力燃料電池汽車的高壓罐。該中心的主要目標是坦克最佳化,研究成果將應用於韓國完州的坦克生產。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 省油車的需求不斷增加

- 市場限制因素

- 電動汽車的快速普及

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按容量

- 小於 45 公升

- 45-70升

- 70公升以上

- 依材料類型

- 塑膠

- 鋁

- 鋼

- 按車型

- 客車

- 商用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Magna International Inc.

- Compagnie Plastic Omnium SE

- TI Fluid Systems PLC

- Kautex Textron GmbH & Co. KG

- YAPP Automotive Systems Co. Ltd

- Fuel Total Systems(FTS)Co. Ltd

- Sakamoto Industry Co. Ltd

- Yachiyo Industry Co. Ltd

- SRD HOLDINGS Ltd

- Donghee America Inc.

- Aptiv PLC

- SKH Metals Ltd

第7章 市場機會及未來趨勢

第8章 主要供應商訊息

The Automotive Fuel Tank Market size is estimated at USD 19.23 billion in 2024, and is expected to reach USD 24.31 billion by 2029, growing at a CAGR of 4.80% during the forecast period (2024-2029).

Over the medium term, factors such as growing demand for lightweight vehicles due to fuel efficiency, increasing vehicle production, and rapid urbanization are expected to drive market growth. The market is experiencing growth due to the increasing demand for commercial vehicles, particularly in the logistics and construction sectors. The rise of the e-commerce industry has driven this demand.

The automotive fuel tank market has been experiencing a surge in demand due to the increasing penetration and popularity of electric vehicles. However, the growth of this market may be hindered by the rising prices of base metals like aluminum.

To reduce vehicle weight and cater to the growing demand, manufacturers worldwide are replacing metal fuel tanks with plastic ones. Plastic fuel tanks offer several advantages over metal fuel tanks, making them popular among automakers and customers. Consequently, plastic has become the most preferred material for building fuel tanks.

Automotive Fuel Tank Market Trends

45-70 Liters Hold Major Market Share

The majority of new vehicle models released by automobile manufacturers in the last five years have a minimum tank capacity of 45 liters due to the increasing demand for vehicles suitable for long journeys and with a greater mileage range. Additionally, larger fuel tanks help utilize the dead space available within the vehicle's chassis. The extra weight also adds to the car's stability and dynamics.

Most compact cars have a fuel tank capacity of 45 liters, while sedans usually have a capacity of 45-70 liters. On the other hand, SUVs require fuel tanks that can hold more than 70 liters of fuel. Countries like Japan, China, India, Germany, France, and Spain are experiencing an increase in demand for sedans, which means that the 45-70 liter capacity range is expected to be the largest market.

Passenger cars are becoming increasingly popular in developing countries as per capita income rises, which could positively impact the market.

Emerging economies like India are seeking better fuel alternatives for their passenger cars, such as ethanol. This move is expected to have a positive impact on market growth. The growth of the vehicle market could face some challenges due to increasing emissions regulations, the rise of electric vehicles, and the depletion of fossil fuel reserves caused by the harmful effects of internal combustion engine (ICE) vehicles on the environment.

However, in some developing countries, the lack of EV infrastructure and charging facilities could lead to the expansion of the market during the forecast period. Meanwhile, SUVs and other commercial vehicles are popular in the United States, China, and Germany, which is why these regions are expected to drive the above 70-liter market segment.

The market under consideration is expected to surge significantly in the years ahead due to the rise in disposable income in various economies and the growing usage of vehicles worldwide. The technology boom has led to advancements in low-emissions and fuel-efficient internal combustion engines, which could further boost the growth of this segment.

Asia-Pacific Dominates the Market and is Expected to Witness the Fastest Growth Rate

The Asia-Pacific automotive industry is expanding due to increasing demand for passenger cars, with China and India being the largest contributors to vehicle sales. China dominates the region in terms of auto industry throughput and automotive component production.

Leading OEMs, auto suppliers, and engine manufacturers in the region continue to maintain a steady supply of vehicles globally. In 2022, the total number of vehicles sold in China was 26,863,745 units, a 2.2% increase from the 26,274,820 units sold in 2021.

India is a significant exporter of automobiles, and with its current mobility expansion projects, it is expected to experience strong export growth shortly. Additionally, various initiatives by the Indian government and major automakers in the Indian market are expected to position India as a major player in the global automobile export market.

According to the Federation of Automobile Dealers Associations (FADA), the passenger vehicle segment achieved a new all-time high in January, retailing 393,250 vehicles and surpassing the previous record set in November 2023.

India's expertise in automobiles and auto components has propelled market growth due to a significant increase in automobile demand, leading to the emergence of more OEMs and auto component manufacturers.

Owing to the increasing sales of mini and medium-segment cars, the region is expected to play a crucial role in the overall market during the coming years.

Automotive Fuel Tank Industry Overview

Due to their developed products and a network of various automobile manufacturers, the automotive fuel tank market is highly dominated by several key players that hold major market share. These include Compagnie Plastic Omnium SA, Kautex Textron GmbH & Co. KG, YAPP Automotive Parts Co. Ltd, TI Fluid Systems, and Yachiyo Industry Co. Ltd. New material and design developments may impact market share for established and new players, which will likely to boost the market's growth in the coming years. For instance,

- In November 2023, Toyoda Gosei Co. Ltd introduced a new high-pressure hydrogen tank and a topcoat-less hot-stamped grille in Japan. The new hydrogen tank has been introduced in the all-new Toyota Crown Sedan.

- In September 2023, Plastic Omnium SA inaugurated a new research center in South Korea, focusing on developing high-pressure tanks for hydrogen-powered fuel cell vehicles. The center's main objective is to optimize the tanks, and the research findings will be applied to the production of tanks at Wanju City in South Korea.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Driver

- 4.1.1 Rising Demand for Fuel-efficient Vehicles

- 4.2 Market Restraint

- 4.2.1 Rapid Adoption of Electric Vehicles

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Capacity

- 5.1.1 Less than 45 liters

- 5.1.2 45-70 liters

- 5.1.3 Above 70 liters

- 5.2 By Material Type

- 5.2.1 Plastic

- 5.2.2 Aluminum

- 5.2.3 Steel

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Magna International Inc.

- 6.2.2 Compagnie Plastic Omnium SE

- 6.2.3 TI Fluid Systems PLC

- 6.2.4 Kautex Textron GmbH & Co. KG

- 6.2.5 YAPP Automotive Systems Co. Ltd

- 6.2.6 Fuel Total Systems (FTS) Co. Ltd

- 6.2.7 Sakamoto Industry Co. Ltd

- 6.2.8 Yachiyo Industry Co. Ltd

- 6.2.9 SRD HOLDINGS Ltd

- 6.2.10 Donghee America Inc.

- 6.2.11 Aptiv PLC

- 6.2.12 SKH Metals Ltd