|

市場調查報告書

商品編碼

1523313

汽車液壓系統:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Automotive Hydraulic Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

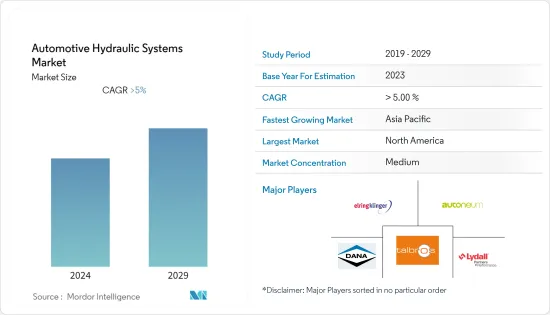

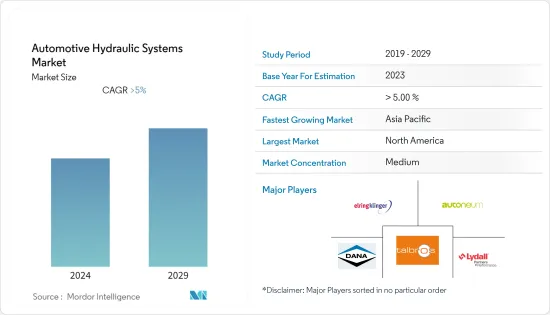

汽車液壓系統市場規模預計將從 2024 年的 372.7 億美元增至 2029 年的 492.9 億美元,在預測期內(2024-2029 年)複合年成長率為 5.75%。

近年來,汽車液壓系統市場一直在穩步成長。全球汽車產量的持續成長,特別是中國和印度等新興市場的汽車產量,是汽車液壓系統市場的主要促進因素。乘用車和商用車需求的不斷成長正在推動液壓系統在各種應用中的採用,包括煞車和動力方向盤。例如

主要亮點

- 2022年中國商用車總銷量為3,300,458輛,印度為933,116輛,日本為753,023輛。

液壓系統具有能夠以低成本安裝在車輛上的巨大優勢,這已被證明是推動市場的最重要因素之一。液壓系統可以比電池更有效地儲存和排放能量。事實證明,在需要大量動力的車輛中,油壓混合動力驅動比電動驅動更有效率。汽車液壓系統最常見的應用是動力方向盤、避震器和煞車。

電液系統、智慧液壓元件等先進技術的整合正在提高汽車液壓系統的整體性能和效率。隨著汽車製造商優先考慮技術創新以保持競爭力,這一趨勢正在增強。

然而,電動車的日益普及給傳統液壓系統帶來了挑戰。隨著汽車產業轉向電氣化,某些應用(例如動力方向盤)對液壓系統的需求可能會減少。

儘管存在這些挑戰,汽車液壓系統市場預計將繼續其成長軌跡,儘管速度較慢。

汽車液壓系統市場趨勢

商用車將成為成長最快的市場領域

由於經濟成長、都市化和運輸需求的增加,商用車市場正在全球擴張。隨著商用車需求的增加,對先進、高效能液壓系統的需求也增加。

全球產業部門擴張導致建築和電子商務活動增加,增加了貨物運輸的需求,導致商用車銷售大幅成長。由於汽車液壓系統在這些車輛中大量使用,因此這種成長預計將推動汽車液壓系統市場。

2022年,全球商用車產量約2,374萬輛,全球銷售量為2,410萬輛。最大的商用車市場是美國,總銷量超過1,130萬輛。

商用車輛,特別是重型卡車和公共汽車,需要堅固而強大的液壓系統來處理高負載,提供可靠的動力方向盤。液壓系統非常適合這些重型應用,使其成為商用車領域的重要組成部分。

商用車有多種用途,從送貨卡車到工程車輛。液壓系統具有高度可自訂性和多功能性,可讓製造商客製化解決方案,以滿足不同商用車領域的特定要求。此外,在這個市場上營運的公司擴大整合先進技術以提高性能和效率。包含感測器和智慧組件的智慧液壓系統非常符合商用車製造商所需的技術進步。

因此,由於運輸和其他工業應用的需求不斷增加,預計商用車領域在預測期內將繼續大幅成長,從而對這些車輛中的液壓系統的需求不斷增加。

亞太地區預計將創下最高成長率

預計在預測期內,亞太地區的汽車液壓系統市場將出現最高成長。該地區由中國和印度等迅速崛起為汽車中心的國家組成。中國是全球最大的汽車市場。中國經濟的成長和人民可支配收入的增加正在增加該國對汽車的需求。

中國的低生產成本也推動了汽車製造業的成長,最終刺激了對液壓系統的需求。 2022年,中國乘用車銷量突破2,383.6萬輛,商用車銷量突破330萬輛。

此外,由於中國和日本的存在,亞太地區的電氣化也呈現較高的滲透率。中國是電動車的主要市場,在電動車技術方面取得進展的汽車製造商大多是日本企業。與亞太地區其他國家相比,中國的電動車銷售呈現強勁成長。 2022年,中國電動車銷量突破600萬輛,其中純電動車459萬輛。

因此,隨著亞太地區汽車產業的快速成長,預計未來幾年對液壓系統的需求也將出現積極成長。

汽車液壓系統產業概況

汽車液壓系統市場適度整合。汽車液壓系統市場的主要企業包括羅伯特·博世有限公司、愛信精機、採埃孚集團和大陸集團。全球汽車液壓系統市場主要由技術創新驅動。主要企業大力投入研發,不斷推出新產品。這些公司也舉辦技能提升課程來培訓員工。例如

- 2023 年 9 月,博世力士樂宣佈在賓州伯利恆開設新的液壓訓練中心。中心設有三個先進的培訓站,包括設備齊全的教室、會議室、休息區和咖啡館。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 商用車需求和銷售的成長推動液壓系統市場

- 市場限制因素

- 全電動液壓系統擴大取代傳統液壓系統成為限制因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 目的

- 煞車

- 離合器

- 暫停

- 其他(挺桿等)

- 成分

- 主缸

- 工作缸

- 水庫

- 軟管

- 車輛類型

- 客車

- 輕型商用車

- 中大型商用車

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Aisin Seiki Co. Ltd

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- BorgWarner

- Warner Electric LLC

- Continental AG

- Schaeffler Technologies AG and Co.

- WABCO

- GKN PLC

- JTEKT Corporation

- FTE Automotive Group

第7章 市場機會及未來趨勢

The Automotive Hydraulic Systems Market size is estimated at USD 37.27 billion in 2024, and is expected to reach USD 49.29 billion by 2029, growing at a CAGR of 5.75% during the forecast period (2024-2029).

The automotive hydraulic systems market has been growing at a steady pace in recent years. The continuous rise in global automotive production, particularly in emerging markets such as China and India, is a primary driver for the automotive hydraulic systems market. The increasing demand for passenger and commercial vehicles propels the adoption of hydraulic systems for various applications, including braking and power steering. For instance:

Key Highlights

- In China, the total commercial vehicle sales in 2022 totaled 3,300,458 units, while India and Japan registered 933,116 and 753,023, respectively.

The low cost at which hydraulic systems can be fit into vehicles is a major advantage and has proven to be one of the most important factors driving the market studied. Hydraulic systems can store and discharge energy more efficiently than electric batteries. Vehicles that require a lot of power are finding hydraulic hybrid drives to be more efficient than electric drives. The most common use of hydraulic systems in an automobile is power steering, shock absorbers, and brakes.

The integration of advanced technologies, such as electro-hydraulic systems and smart hydraulic components, is enhancing the overall performance and efficiency of automotive hydraulic systems. This trend is gaining momentum as automakers prioritize technological innovation to stay competitive.

However, the increasing adoption of electric vehicles poses a challenge to traditional hydraulic systems. As the automotive industry shifts toward electrification, the demand for hydraulic systems in certain applications, like power steering, may decline.

Despite the challenges, the automotive industry's hydraulic systems market is expected to continue its growth trajectory, albeit at a slower pace.

Automotive Hydraulic Systems Market Trends

Commercial Vehicle will be the Fastest Growing Segment in the Market

The commercial vehicle market has expanded globally, driven by economic growth, urbanization, and increased transportation needs. As the demand for commercial vehicles rises, the demand for advanced and efficient hydraulic systems also increases.

The increasing number of construction and e-commerce activities due to the expansion of the industrial sector across the world has resulted in increased demand for material transportation, which, in turn, has led to a significant increase in the sales of commercial vehicles. This growth is expected to drive the automotive hydraulic systems market, as they are used at large in these vehicles.

In 2022, around 23.74 million units of commercial vehicles were produced worldwide, whereas worldwide sales stood at 24.1 million units. The United States was the largest market for commercial vehicles, with a total sales of over 11.3 million units.

Commercial vehicles, especially heavy-duty trucks and buses, often require robust and powerful hydraulic systems to handle heavy loads, provide reliable braking systems, and ensure efficient power steering. Hydraulic systems are suitable for these heavy-duty applications, making them integral components in the commercial vehicle segment.

Commercial vehicles often have diverse applications, ranging from delivery trucks to construction vehicles. Hydraulic systems offer a high degree of customization and versatility, allowing manufacturers to tailor solutions to meet specific requirements across different commercial vehicle segments. The players operating in the market are also increasingly integrating advanced technologies for improved performance and efficiency. Intelligent hydraulic systems, incorporating sensors and smart components, align well with the technological advancements sought by commercial vehicle manufacturers.

Thus, owing to their increasing demand in transportation, as well as other industrial usage, the commercial vehicle segment is anticipated to continue to grow significantly during the forecast period, giving rise to increased demand for hydraulic systems in these vehicles.

Asia-Pacific is Expected to Witness Highest Growth Rate

Asia-Pacific is expected to be the region with the highest growth in the automotive hydraulic system market during the forecast period. The region consists of countries like China and India, which are rapidly emerging as automotive hubs. China is the biggest automotive market in the world. The growing Chinese economy and the growing disposable incomes of people in the country have increased the demand for vehicles in the country.

The low production costs in China have also favored the growth of vehicle manufacturing, ultimately fueling the demand for hydraulic systems. In 2022, China accounted for 23,836 thousand units of passenger car sales and over 3,300,000 units of commercial vehicle sales.

Furthermore, electrification in the Asia-Pacific region has also witnessed a high penetration rate due to the presence of China and Japan, as China is the leading market for electric vehicles, and most of the automakers advancing in electric vehicle technology are from Japan. Sales of electric vehicles in China have seen huge growth as compared to other countries in Asia-Pacific. In 2022, China had over 6 million unit sales of electric vehicles (EVs), with BEVs totaling 4.59 million units.

Thus, with the rapid growth of the automobile sector in the Asia-Pacific region, the demand for hydraulic systems is also expected to witness positive growth in the coming years.

Automotive Hydraulic Systems Industry Overview

The automotive hydraulic systems market is moderately consolidated. Major players in the automotive hydraulic systems market are Robert Bosch GmbH, Aisin Seiki Co. Ltd, ZF Group, and Continental AG, among others. The global automotive hydraulic systems market is driven mainly by innovations. Major companies are investing heavily in R&D and are continuously launching new products. These companies are also organizing upskilling courses to train their associates. For instance:

- In September 2023, Bosch Rexroth announced a new "Hydraulics Training Center" in Bethlehem, Pennsylvania. The center features three advanced training stations, including a fully equipped classroom, conference room, lounge area, and cafe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand and Sales of Commercial Vehicles is Driving the Market for Hydraulic Systems

- 4.2 Market Restraints

- 4.2.1 Increasing Replacement of Conventional Hydraulic Systems with Fully-electric Hydraulic Systems Acts as a Restraint

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Brakes

- 5.1.2 Clutch

- 5.1.3 Suspension

- 5.1.4 Other Applications (Tappets, etc.)

- 5.2 Component

- 5.2.1 Master Cylinder

- 5.2.2 Slave Cylinder

- 5.2.3 Reservoir

- 5.2.4 Hose

- 5.3 Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy-Duty Commercial Vehicles

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Aisin Seiki Co. Ltd

- 6.2.2 Robert Bosch GmbH

- 6.2.3 ZF Friedrichshafen AG

- 6.2.4 BorgWarner

- 6.2.5 Warner Electric LLC

- 6.2.6 Continental AG

- 6.2.7 Schaeffler Technologies AG and Co.

- 6.2.8 WABCO

- 6.2.9 GKN PLC

- 6.2.10 JTEKT Corporation

- 6.2.11 FTE Automotive Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Scope of Application of Hydraulic System Opens New Growth Routes