|

市場調查報告書

商品編碼

1521844

日本資料中心實體安全:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Japan Data Center Physical Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

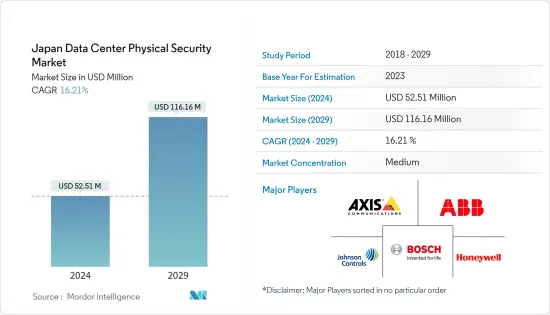

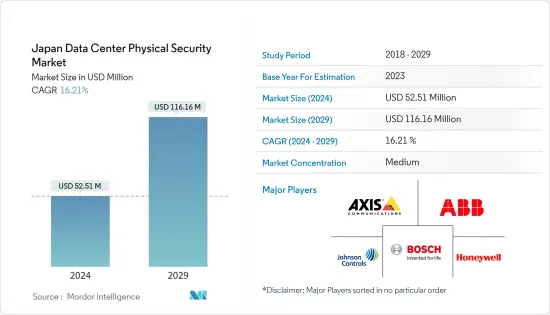

日本資料中心實體安全市場規模預計到 2024 年為 5,251 萬美元,預計到 2029 年將達到 1.1616 億美元,在預測期內(2024-2029 年)複合年成長率為 16.21%。

安全措施可分為四層:周界安全、設施管理、機房管理、機櫃管理。資料中心安全的第一層可防止、偵測和延遲外圍人員詐欺。如果周邊監控被破壞,第二層防禦將拒絕存取。這是一個使用刷卡和生物識別的存取控制系統。

第三層實體安全涉及監控所有限制區域,部署旋轉門等進入限制,提供生物識別存取控制設備,檢查手指、指紋、虹膜和血管圖案等,並提供 VCA,透過各種檢驗進一步限制存取。例如使用射頻識別。前三層確保只有授權人員才能進入。限制進入的額外安全措施包括櫃子鎖定機制。這一層解決了對惡意員工等「內部威脅」的恐懼。

主要亮點

- 在建IT負載能力:日本資料中心實體安全市場未來IT負載能力預計到2029年將達到2000MW。

- 正在建造的高架建築面積:到 2029 年,日本的占地面積預計將增加到 1,000 萬平方英尺。

- 規劃的機架:預計到2029年,全國安裝的機架總數將達到50萬個。到 2029 年,東京將安裝最多數量的機架。

- 規劃中的海底電纜:連接菲律賓的海底電纜系統有近30個,其中許多正在建造中。其中一條海底電纜計劃於 2023 年投入使用,即東南亞-日本 2 號電纜 (SJC2),該電纜全長超過 10,500 公里,登陸點從千倉(日本)到志摩(日本)。

日本資料中心實體安全市場趨勢

視訊監控領域佔據主要佔有率

- 資料中心儲存敏感且重要的資料,因此安全性是重中之重。資料中心營運商依靠視訊監控系統來確保滿足安全標準和法規。這使您可以監控存取、偵測未授權存取並保持合規性。

- 資料保護法對資料中心營運商提出了嚴格的要求。視訊監控透過改善實體安全措施來幫助維持合規性。

- 2021年,智慧型手機在日本家庭的普及率達到近89%。近年來,人們平均使用行動網路的時間不斷增加,為電子商務等相關產業創造了商機。隨著網路購物平台的出現,小型企業也開始轉向線上付款方式,並在電子商務世界中建立數位化存在。即使是大型、成熟的公司也正在將電子商務平台整合到其傳統業務實踐中。其結果是資料流量增加、資料中心增加,進而增加了對視訊監控的需求。這可以作為防止使用者資料中心惡意或錯誤操作的證據,並在發生事件時識別責任人。

- 2021年至2022年,日本網路使用者數量將增加84.4萬人(成長0.7%)。與 2019 年 COVID-19 之前的水平相比,2020 年網路流量增加了 1.6 倍,因為疫情導致家庭視訊會議、遠距學習和視訊串流激增。此外,連網型設備和智慧家庭的使用增加了對數位資料的需求並改善了網路流量。這使得該國成為該地區移動商務的先驅之一。這意味著跨資料中心的資料消耗增加,從而推動資料中心實體安全市場的發展。

- 2021年初以來,日本行動電話企業加速推動5G。國際通訊部希望進一步提升日本的 5G 體驗。目標是到 2024 年 3 月底實現 98% 的 5G 人口覆蓋率。總體而言,日本希望增加可用於 5G 服務的頻率數量。通訊業的成長正在擴大資料中心的規模,從而增加了對視訊監控的需求。視訊監控具有強大的威懾作用,減少物理攻擊和未授權存取關鍵資料的可能性。

IT/通訊部門佔主要佔有率

- 日本是SONY、Panasonic、富士通、NEC 和東芝等主要 ICT 公司的所在地,並且在日本作為主要 ICT 中心的擴張中繼續發揮著重要作用。此外,該國眾多現代化和擴建計劃的有序開拓以及政府為維持品質和先進基礎設施而增加的支出也支持了市場成長。

- 日本政府正在努力加速私營部門的數位轉型,並支持新興中小企業。 2021年,日本政府以經濟產業省和內務部主導,發布了促進組織內部數位轉型的指導方針,特別針對中小企業。同樣,同年發布了有關人工智慧、網路安全和安全雲端服務部署的指南。

- 政府繼續推動 5G 和其他最尖端科技的推出,這些技術能夠實現比目前 LTE(長期演進)更快的資料傳輸。 NTT Docomo、KDDI、Softbank Corporation和樂天移動於 2019 年 4 月分別獲得內務部分配的 5G 頻段。這四家行動服務供應商於2020年推出了5G通訊服務。這種情況可能會增加資料消耗和資料中心利用率,從而推動所研究市場的成長。

- 日本政府數位機構正在中央和地方政府辦公室推廣雲端服務的使用。例如,數位機構於2022年10月宣布,政府機構將在年底前採用「政府雲端」服務。

- 從2017會計年度開始,經濟產業省向進行IT投資(包括雲端服務)的組織提供「IT引進補貼」。 2021 年,厚生勞動省向受 COVID-19 大流行影響的組織提供了「工作方式改革促進」津貼,以支持向遠距工作的過渡。厚生勞動省將為中小企業承包雲端服務和其他IT設備時的合約費和設備成本提供支援。

日本資料中心實體安全產業概況

該市場高度分散,Axis Communications AB、ABB Ltd 和 Bosch Sicherheitssysteme GmbH 等參與者在提高公司能力方面發揮重要作用。市場導向導致競爭激烈的環境。零售和批發資料中心市場中最大的公司正在努力保護其系統免遭盜竊。市場正在經歷一波整合浪潮,中小企業尋求擴大生產規模以參與競爭,而大公司則專注於產品創新和推出以維持其市場地位。例如

2023年4月,Schneider Electric推出了一項新服務「模組化資料中心的EcoCare」。此創新服務計畫的成員可以利用我們的專業知識,透過 24/7 主動遠端監控和基於狀態的維護來最大限度地延長模組化資料中心的運作。專用會員的支援包括專門的客戶成功管理團隊,該團隊領導遠端和現場服務團隊,僅在出現問題時為每項資產提供零碎的方法,而是解決系統層級的基礎設施和維護需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 資料流量的增加和對安全連接的需求推動資料中心實體安全市場的成長

- 網路威脅的增加推動資料中心實體安全市場的成長

- 市場限制因素

- 有限的 IT 預算、低成本替代方案的可用性以及盜版正在阻礙資料中心實體安全市場的潛在成長。

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 影響評估

第5章市場區隔

- 按解決方案類型

- 視訊監控

- 門禁解決方案

- 其他(陷阱、圍籬、監控解決方案)

- 按服務類型

- 諮詢服務

- 專業服務

- 其他(系統整合服務)

- 最終用戶

- 資訊科技/通訊

- BFSI

- 政府機關

- 衛生保健

- 其他最終用戶

第6章 競爭狀況

- 公司簡介

- Axis Communications AB

- ABB Ltd

- Bosch Sicherheitssysteme GmbH

- Honeywell International Inc.

- Johnson Controls

- Schneider Electric

- ASSA ABLOY

- Cisco Systems Inc.

- Boon Edam

- Dahua Technology

第7章 投資分析

第8章 市場機會及未來趨勢

The Japan Data Center Physical Security Market size is estimated at USD 52.51 million in 2024, and is expected to reach USD 116.16 million by 2029, growing at a CAGR of 16.21% during the forecast period (2024-2029).

Security measures can be categorized into four layers, i.e., perimeter security, facility controls, computer room controls, and cabinet controls. The first layer of data center security discourages, detects, and delays any unauthorized entry of personnel at the perimeter. In case of any infringement in the perimeter monitoring, the second layer of defense denies access. It is an access control system utilizing card swipes or biometrics.

The third layer of physical security further restricts access through various verification methods, including monitoring all restricted areas, deploying entry restrictions such as turnstiles, providing biometric access control devices to verify finger and thumbprints, irises, or vascular patterns, providing VCA, and using radio frequency identification. The first three layers ensure the entry of only authorized people. Further security to restrict admission includes cabinet locking mechanisms. This layer addresses the fear of an 'insider threat,' such as a malicious employee.

Key Highlights

- Under Construction IT Load Capacity: The upcoming IT load capacity of the Japanese data center physical security market is expected to reach 2,000 MW by 2029.

- Under Construction Raised Floor Space: The country's construction of raised floor area is expected to increase to 10 million sq. ft by 2029.

- Planned Racks: The country's total number of racks to be installed is expected to reach 500 K units by 2029. Tokyo is expected to house the maximum number of racks by 2029.

- Planned Submarine Cables: There are close to 30 submarine cable systems connecting the Philippines, and many are under construction. One such submarine cable that is estimated to start service in 2023 was the Southeast Asia-Japan Cable 2 (SJC2), which stretches over 10,500 kilometers with landing points from Chikura, Japan, to Shima, Japan.

Japan Data Center Physical Security Market Trends

The Video Surveillance Segment Holds Significant Share

- Sensitive and important data are stored in data centers, so security is a top priority. Data center operators use video surveillance systems to ensure that security standards and regulations are met. This allows one to monitor access, detect unauthorized access, and maintain compliance.

- Data protection laws set strict requirements for data center operators. Video surveillance can help maintain compliance by improving physical security measures.

- In 2021, the smartphone penetration rate in Japanese households was nearly 89%. In recent years, the average amount of time people spend using mobile internet has increased, creating business opportunities for related industries such as e-commerce. With the advent of online shopping platforms, small and medium-sized businesses are also switching to online payment methods and a digital presence in the world of e-commerce. Even large, well-established companies are integrating e-commerce platforms with traditional forms of business. This leads to an increase in data traffic and, thus, an increase in data centers and, in turn, an increase in the demand for video surveillance. This helps prevent malicious or erroneous operations in the user's data center and provides evidence to identify those responsible in the event of an incident.

- Internet users in Japan increased by 844 thousand (+0.7%) between 2021 and 2022. Internet traffic increased 1.6x in 2020 compared to pre-COVID-19 levels in 2019 as the pandemic led to a surge in home video conferencing, distance learning, and video streaming. In addition, the increased use of connected devices and smart homes increased the demand for digital data and improved network traffic. This makes the country one of the pioneers of mobile commerce in the region. This means an increase in data consumption across data centers, thereby boosting the data center physical security market.

- Since the beginning of 2021, Japanese mobile phone companies have been accelerating the rollout of 5G. The Ministry of International Communications wanted to advance Japan's 5G experience further. The goal was to achieve 98% 5G population coverage by the end of March 2024. Overall, Japan wants to increase the number of frequencies available for its 5G services. The growth of the telecommunications industry is increasing the size of data centers, thereby increasing the need for video surveillance. Video surveillance has a powerful deterrent effect, reducing the likelihood of physical attacks and unauthorized access to critical data.

The IT and Telecommunication Segment Holds the Major Share

- Japan is home to major ICT organizations such as Sony, Panasonic, Fujitsu, NEC, and Toshiba, which continue to play a key role in the country's expansion as a major center for ICT. In addition, the orderly development of numerous modernization and expansion projects in the country, along with increasing government spending on maintaining high-quality and advanced infrastructure, are also driving the growth of the market.

- The Japanese government is making efforts to accelerate the digital transformation of the private sector and support emerging SMEs. In 2021, the Japanese government, led by the Ministry of Economy, Trade and Industry and the Ministry of Internal Affairs and Communications, published guidelines for promoting digital transformation within organizations, especially targeting small and medium-sized enterprises. Similarly, guidelines on implementing AI, cybersecurity, and secure cloud services were also published in the same year.

- The government is continuing to push the rollout of 5G and other cutting-edge technologies capable of transferring data at even higher rates than currently possible with long-term evolution (LTE). NTT DOCOMO, KDDI, Softbank, and Rakuten Mobile were each allocated a 5G spectrum by the Ministry of Internal Affairs and Communication (MIC) in April 2019. These four mobile service providers launched 5G telecommunication services in 2020. This scenario may increase the consumption of data and use of data centers, thereby driving the growth of the market studied.

- The Government of Japan's Digital Agency promotes the utilization of cloud services for both central and local government offices. For instance, the Digital Agency announced in October 2022 that the government agencies would adopt "Government Cloud" services for the fiscal year.

- The Ministry of Economics, Trade and Industry (METI) provided an IT Adoption Subsidy to organizations investing in IT, including cloud services, from FY 2017. In 2021, the Ministry of Health, Labour and Welfare (MHLW) provided organizations affected by the COVID-19 pandemic with a "Workstyle Reform Promotion" subsidy to help them transition to remote work. MHLW supports SMEs to cover the contracting fees and equipment costs of cloud services and other IT devices.

Japan Data Center Physical Security Industry Overview

The market is highly fragmented due to players like Axis Communications AB, ABB Ltd, and Bosch Sicherheitssysteme GmbH, which play a vital role in upscaling the capabilities of enterprises. Market orientation leads to a highly competitive environment. The biggest retail and wholesale data center market companies are trying to make their system secure and safe from thefts. There has been a wave of consolidation in the market as smaller players seek to scale up their production to compete, and big companies are focusing on product innovation and launches to maintain their market position. For instance,

In April 2023, Schneider Electric launched a new service offer, EcoCare for Modular Data Centers. Members of this innovative service plan benefit from specialized expertise to maximize modular data centers' uptime with 24/7 proactive remote monitoring and condition-based maintenance. Members benefit from exclusive support, which includes a dedicated customer success management team, who become their go-to coach, orchestrating remote and on-site services teams and addressing infrastructure and maintenance needs at a system level, rather than a fragmented approach for each asset only when problems arise.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Data Traffic and Need for Secured Connectivity is Promoting the Growth of the Data Center Physical Security Market

- 4.2.2 Rise in Cyber Threats is Causing the Data Center Physical Security Market to Grow

- 4.3 Market Restraints

- 4.3.1 Limited IT Budgets, Availability of Low-Cost Substitutes, and Piracy is Discouraging the Potential Growth of Data Center Physical Security Market

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 By Solution Type

- 5.1.1 Video Surveillance

- 5.1.2 Access Control Solutions

- 5.1.3 Others (Mantraps and Fences and Monitoring Solutions)

- 5.2 By Service Type

- 5.2.1 Consulting Services

- 5.2.2 Professional Services

- 5.2.3 Others (System Integration Services)

- 5.3 End-User

- 5.3.1 IT and Telecommunication

- 5.3.2 BFSI

- 5.3.3 Government

- 5.3.4 Healthcare

- 5.3.5 Other End User

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Axis Communications AB

- 6.1.2 ABB Ltd

- 6.1.3 Bosch Sicherheitssysteme GmbH

- 6.1.4 Honeywell International Inc.

- 6.1.5 Johnson Controls

- 6.1.6 Schneider Electric

- 6.1.7 ASSA ABLOY

- 6.1.8 Cisco Systems Inc.

- 6.1.9 Boon Edam

- 6.1.10 Dahua Technology