|

市場調查報告書

商品編碼

1521831

IP 攝影機:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029 年)IP Camera - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

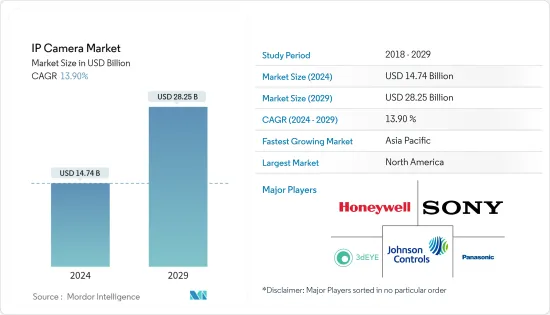

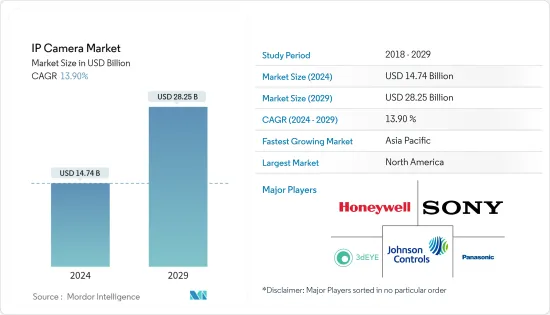

IP攝影機市場規模預計2024年為147.4億美元,預計到2029年將達到282.5億美元,在市場估計和預測期間(2024-2029年)複合年成長率預計為13.90%。

*IP 攝影機(網際網路通訊協定攝影機)是一種透過 IP 網路傳輸和接收視訊影像的數位安全攝影機。與類比閉路電視攝影機不同,IP攝影機不需要本地錄製設備,只需要本地網路。每個網路攝影機都配備了一個處理晶片,用於壓縮錄製的視訊影像。攝影機解析度越高,記錄的影像資料越多,需要更多的儲存空間和傳輸頻寬。

*IP 攝影機具有出色的影像質量,包括高解析度視訊和影像。數位技術的使用提高了清晰度、清晰度和色彩準確性,從而可以有效地識別和分析事件。高清 (HD) 和超高清 (UHD) 解析度可確保捕捉重要細節並提高監控能力。透過智慧型手機、平板電腦或具有網路連線的電腦,隨時隨地查看即時影像。遠端存取有助於即時回應緊急情況,允許使用者採取適當的行動或在必要時通知當局。

*對高清視訊監控的需求不斷成長是 IP 攝影機的顯著市場驅動力。隨著組織和個人優先考慮安全和保障,越來越需要捕捉清晰、詳細的影像以提高情境察覺。可以提供高解析度視訊影像的網路攝影機可以滿足這一需求,因為它們可以更準確地識別個人、物體和事件。這對於機場、銀行和政府機構等需要準確識別的關鍵應用尤其有利。

*與需要複雜接線的類比攝影機不同,IP 攝影機利用現有的網路基礎設施,安裝既簡單又經濟高效。乙太網路供電 (PoE) 技術允許使用單一電纜傳輸電力和資料,從而無需單獨的電源。此外,IP 攝影機具有可擴展性,可讓您根據需求的變化輕鬆擴展監控系統。

*然而,高昂的初始實施成本為精打細算的消費者和企業帶來了挑戰。此外,不同相機品牌和軟體平台之間的互通性問題限制了無縫整合和相容性。

*此外,俄羅斯和烏克蘭之間的衝突預計將對電子和半導體產業產生重大影響。這場衝突已經加劇了電子和半導體領域的供應鏈問題,晶片短缺已經對該行業產生了影響。這種干擾可能導致鎳、鈀、銅、鈦和鋁等關鍵原料的價格波動,進而導致材料短缺。這可能反過來影響網路攝影機的生產。

IP攝影機市場趨勢

商業領域預計將推動市場成長

*網路攝影機已成為零售企業的必備工具。由於其先進的功能和連接性,IP 攝影機具有廣泛的應用,包括增強安全性、改善營運和增加銷售。在安全方面,IP攝影機提供即時監控,使零售商能夠防止盜竊、檢測可疑活動並維護安全的環境。此外,這些攝影機可以與視訊分析軟體整合,以識別入店行竊、分析客戶行為並最佳化商店佈局。此外,IP 攝影機還支援遠端監控,讓零售商同時監控多個商店。

*零售市場的擴張可能會推動所研究市場的成長。例如,根據美國人口普查局的數據,到2023年終,美國零售總額將達到約7.24兆美元,比上年增加約15億美元。

*IP 攝影機製造商正在引入寬動態範圍 (WDR) 技術和低照度性能功能,以克服惡劣的照明條件。 WDR 讓您即使在亮度變化極大的場景(例如明亮的陽光或深陰影)中也能捕捉清晰的影像。低照度性能使您即使在光線不足的環境中也能製作可用的影像。

*IP 攝影機在 BFSI(銀行、金融服務和保險)領域有多種應用。用於監控和安全目的,銀行和金融機構可以監控和記錄即時活動,阻止潛在犯罪並確保客戶安全。它還用於預防和調查詐欺,並在發生詐欺時提供清晰的影片影像。

*此外,這些攝影機還用於存取控制、員工行為監控和行業監管合規性。此外,IP 攝影機還可以幫助進行風險管理,因為它們可以與分析軟體整合以檢測可疑活動和潛在威脅。

*此外,受訪市場的商業部門對雲端基礎的解決方案的採用顯著增加。雲端儲存和遠端存取使用戶可以從任何地方方便地儲存和存取監視影像,從而提高可擴展性並降低基礎設施成本。

*隨著即時影像分析需求的增加,邊緣運算預計將在商務用IP 攝影機的未來中發揮關鍵作用。邊緣運算透過在攝影機本身上本地處理資料來減少延遲、頻寬要求和對雲端基礎設施的依賴,從而縮短回應時間並改善隱私。

*例如,2024 年 4 月,Ajax Systems Inc. 推出了最新的有線安全 IP 攝影機系列,可提供高解析度監控和強大的隱私保護。型號包括TurretCam、BulletCam和DomeCamMini,每種型號都有不同的規格。這些攝影機用途廣泛,適合室內和室外使用,防護等級為 IP65。這些攝影機具有無密碼安全身份驗證功能,可實現平穩、安全的設定。

*這些攝影機可以透過不同的矩陣類型和鏡頭滿足不同的視訊監控要求。其他功能包括長達 35m 的紅外線範圍、可自訂的運動偵測區域、與系統事件的存檔同步以及內建數位麥克風。預計此類技術創新將為所研究市場的成長提供有利可圖的機會。

預計亞太地區市場成長率較高

*由於快速都市化、日益嚴重的安全問題以及對先進監控系統的需求等因素,亞太地區正在成為利潤豐厚的 IP 攝影機市場。中國、韓國、日本和印度等國家處於採用 IP 攝影機技術的前沿,並正在推動市場成長。

*亞太地區的 IP 攝影機與人工智慧 (AI) 和分析技術的整合日益增多。這種整合可實現進階影像分析、臉部辨識、物體偵測和行為分析,從而提高監控系統的有效性。

*由於犯罪活動和安全威脅的增加,對強大監控系統的需求不斷增加。例如,根據日本警察廳的數據,日本警方已知的暴力犯罪總數將從2021年的49,720起增加到2022年的52,700起。到2023年,日本警方已知的暴力犯罪總數將達到約58,470起。 IP攝影機具有即時監控、遠端存取、預警等先進功能,適合增加安全措施。

*此外,亞太地區各國政府正大力投資智慧城市計劃,包括實施先進的監控系統。 IP 攝影機在這些計劃中發揮著重要作用,並為市場成長做出了貢獻。 IP 攝影機技術的不斷進步,例如更高解析度、改進的低照度性能和增強的視訊分析功能,正在推動市場成長。這些進步是為了滿足企業和組織不斷變化的需求。

*建設活動的增加導致研究市場的需求激增。例如,中國的「十四五」規劃重點在於交通、水系統、能源、新型都市化等新型基礎建設計劃。據計算,「十四五」期間(2021-2025年)新型基礎設施投資總額將達到近27兆元。新規劃突顯了節能和綠色建築發展的九個重點。

*此外,根據中國國家統計局的數據,2022年中國建築業產值突破31兆元人民幣,較10年前成長近100%。 2020年及2021年,中國建築業產值分別為26.39兆元及29.31兆元。此外,預計到2025年中國建築業收入將達到約41,590.3億美元。

網路攝影機產業概況

IP 攝影機市場由江森自控國際公司、霍尼韋爾國際公司、3dEYE 公司、索尼公司、松下公司和 Matrix Comsec Pvt Ltd 等知名市場參與企業細分。市場參與企業努力透過在研發、聯盟和合併方面的大量投資來創新新產品,以滿足消費者不斷變化的需求。

*2024 年 1 月 - 基於 IP 的創新視訊監控解決方案的著名供應商 Milesight 和雲端基礎的視訊管理、人工智慧分析和自動化參與企業3dEYE 宣佈建立策略合作夥伴關係,為安全和監控行業的客戶提供改進。 3dEYE 和Milesight 之間的合作夥伴關係將Milesight 先進的IP 攝影機技術和3dEYE 先進的純雲端視訊AI 平台結合在一起,實現可擴展的集中監控、增強的AI 分析以減少誤報並易於部署,為客戶提供了降低總成本等關鍵優勢。

*2023 年 11 月 - 領先的安全和通訊解決方案公司 Matrix 宣布推出用於交通監控的 Matrix Ruggedized 系列 IP 攝影機。該攝影機配備了 STARVIS 系列背照式CMOS 感測器,即使在極低照度條件下也能確保穩定的視訊品質。堅固的設計可承受衝擊、振動、灰塵、衝擊和潮濕,使其適合惡劣的運輸環境。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 技術進步

- COVID-19 和宏觀經濟趨勢對產業的影響

第5章市場動態

- 市場促進因素

- IP攝影機與智慧家居科技的進一步融合,智慧城市的擴展

- 安防監控需求不斷成長

- 對高解析度相機的需求不斷成長

- 市場限制因素

- 資料隱私和安全問題

- 安裝和維護成本高

- 市場機會

- 透過整合人工智慧(AI)和機器學習(ML)等先進技術實現影像分析

第6章 市場細分

- 按類型

- 固定的

- 平移傾斜變焦 (PTZ)

- 變焦

- 按最終用戶產業

- 住宅

- 商業(BFSI、教育、醫療、房地產、零售等)

- 工業的

- 政府和執法部門

- 按地區*

- 北美洲

- 歐洲

- 亞洲

- 拉丁美洲

- 中東/非洲

- 澳洲和紐西蘭

第7章 競爭格局

- 公司簡介

- Johnson Controls International plc.

- Honeywell International Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd

- 3dEYE Inc.

- Sony Corporation

- Panasonic Corporation

- Matrix Comsec Pvt. Ltd.

- Ajax Systems Inc.

- D-Link Limited

- Cisco Systems, Inc.

- Motorola Solutions, Inc.

第8章投資分析

第9章 市場的未來

The IP Camera Market size is estimated at USD 14.74 billion in 2024, and is expected to reach USD 28.25 billion by 2029, growing at a CAGR of 13.90% during the forecast period (2024-2029).

* An IP camera, or internet protocol camera, is a digital security camera that receives and sends video footage via an IP network. Unlike analog closed-circuit television cameras, IP cameras do not need a local recording device, only a local network. Each IP camera is equipped with a processing chip that compresses the video footage as it is recorded. The higher the resolution of the camera, the more data each video recording contains, which requires more storage space and bandwidth for transmission.

* IP cameras boast superior image quality, offering high-resolution videos and images. The use of digital technology allows for better clarity, sharpness, and color accuracy, enabling effective identification and analysis of events. High-definition (HD) and ultra-high-definition (UHD) resolutions ensure that crucial details are captured, enhancing surveillance capabilities. By connecting to the internet, users can view real-time footage from any location using a smartphone, tablet, or computer. Remote access facilitates immediate response to emergencies, allowing users to take appropriate action or notify authorities when necessary.

* The increasing demand for high-resolution video surveillance is a prominent market driver for IP cameras. As organizations and individuals prioritize safety and security, there is a growing need to capture clear and detailed images to enhance situational awareness. IP cameras, with their ability to provide high-resolution video footage, satisfy this demand by enabling better identification of individuals, objects, and events. This is particularly beneficial in critical applications such as airports, banks, and government institutions where accurate identification is vital.

* Unlike analog cameras that require complex wiring, IP cameras utilize existing network infrastructure, making installation simpler and more cost-effective. With Power over Ethernet (PoE) technology, a single cable can transmit both power and data, eliminating the need for separate power supplies. Additionally, IP cameras offer scalability, allowing for easy expansion of the surveillance system as needs evolve.

* However, high initial installation costs pose a challenge for budget-conscious consumers and businesses. Additionally, interoperability issues between different camera brands and software platforms limit seamless integration and compatibility.

* Further, the conflict between Russia and Ukraine will significantly impact the electronics and semiconductor industry. The conflict has already exacerbated the electronics and semiconductor supply chain issues and chip shortages that have affected the industry for some time. The disruption may result in volatile pricing for critical raw materials such as nickel, palladium, copper, titanium, and aluminum, resulting in material shortages. This, in turn, could impact the manufacturing of IP cameras.

IP Camera Market Trends

The Commercial Segment is Expected to Drive the Market's Growth

* IP cameras have become an essential tool for the retail sector. With their advanced features and connectivity, IP cameras offer a range of applications that enhance security, improve operations, and boost sales. In terms of security, IP cameras provide real-time monitoring, enabling retailers to prevent theft, detect suspicious activities, and maintain a safe environment. Additionally, these cameras can be integrated with video analytics software to identify shoplifting, analyze customer behavior, and optimize store layouts. Moreover, IP cameras enable remote monitoring, allowing retailers to monitor multiple locations simultaneously.

* The expansion of the retail market is likely to boost the growth of the studied market. For instance, according to the US Census Bureau, by the end of 2023, total retail sales in the United States reached approximately USD 7.24 trillion, an increase of around USD 1.5 billion from the year before.

* IP camera manufacturers have introduced wide dynamic range (WDR) technology and low-light performance capabilities to overcome challenging lighting conditions. WDR allows cameras to capture clear images in scenes with extreme variations in brightness, such as areas with bright sunlight and deep shadows. Low-light performance enables cameras to produce usable footage even in poorly lit environments.

* IP cameras have diverse applications in the BFSI (Banking, Financial Services, and Insurance) sector. They are used for surveillance and security purposes, allowing banks and financial institutions to monitor and record real-time activities, deter potential crimes, and ensure customer safety. They are also utilized for fraud prevention and investigation, providing clear video evidence in case of any fraudulent activities.

* Additionally, these cameras are employed for access control, monitoring employee behavior, and ensuring compliance with industry regulations. Moreover, IP cameras aid in risk management, as they can be integrated with analytics software to detect suspicious activities and potential threats.

* Further, the adoption of cloud-based solutions in the commercial sector in the studied market has increased significantly. Cloud storage and remote access allow users to conveniently store and access surveillance footage from anywhere, improving scalability and reducing infrastructure costs.

* With the increasing demand for real-time video analytics, edge computing is expected to play an important role in the future of commercial IP cameras. By processing data locally on the camera itself, edge computing reduces latency, bandwidth requirements, and reliance on cloud infrastructure, enabling faster response times and improved privacy.

* For instance, in April 2024, Ajax Systems launched its latest line of wired security IP cameras, offering high-definition surveillance and robust privacy protections. The models include the TurretCam, BulletCam, andDomeCamMini, each with different specifications. These cameras are claimed to be versatile, suitable for both indoor & outdoor use, and carry an IP65 rating. They offer secure, password-less authentication for a smooth and secure setup.

* These cameras can cater to various video surveillance requirements with various matrix types and lenses. Other features include an IR illumination range of up to 35 m, a customizable motion detection area, archive synchronization with system events, and a built-in digital microphone. Such innovations are anticipated to offer lucrative opportunities for the growth of the studied market.

Asia-Pacific is Expected to Witness a High Market Growth Rate

* Asia-Pacific has emerged as a lucrative IP camera market due to factors such as rapid urbanization, increasing security concerns, and the need for advanced surveillance systems. Countries like China, South Korea, Japan, and India have been at the forefront of adopting IP camera technology, driving the market's growth.

* In Asia-Pacific, IP cameras are increasingly being integrated with artificial intelligence (AI) and analytics technologies. This integration allows for advanced video analytics, facial recognition, object detection, and behavior analysis, enhancing the effectiveness of surveillance systems.

* The demand for robust surveillance systems has increased with the rise in criminal activities and security threats. For instance, according to the National Police Agency (Japan), the total number of violent offenses known to the police in Japan increased from 49.72 thousand in 2021 to 52.7 thousand in 2022. In 2023, the total number of violent offenses known to the police in Japan amounted to approximately 58.47 thousand. IP cameras offer advanced features like real-time monitoring, remote access, and proactive alerts, making them suitable for enhancing security measures.

* Further, governments in Asia-Pacific are investing heavily in smart city projects, including deploying advanced surveillance systems. IP cameras play a crucial role in these projects, contributing to the growth of the market. The continuous advancements in IP camera technology, such as higher resolutions, improved low-light performance, and enhanced video analytics, are driving the market's growth. These advancements cater to the evolving requirements of businesses and organizations.

* The increasing construction activities have led to a surge in the demand for the studied market. For instance, China's 14th Five-Year Plan emphasizes new infrastructure projects in transportation, water systems, energy, and new urbanization. According to estimates, overall investment in new infrastructure during the 14th Five-Year Plan period (2021-2025) will reach nearly CNY 27 trillion. The new plan accentuated nine key items for energy efficiency and green building development.

* Further, according to the National Bureau of Statistics of China, in 2022, the construction industry in China generated an output of over CNY 31 trillion, representing an increase of almost 100% from a decade ago. In 2020 and 2021, the construction industry in China generated an output of CNY 26.39 trillion and CNY 29.31 trillion, respectively. Further, it is projected that the construction revenue in China will amount to approximately USD 4,159.03 billion by 2025.

IP Camera Industry Overview

The IP camera market is fragmented, with several prominent market players like Johnson Controls International PLC, Honeywell International Inc., 3dEYE Inc., Sony Corporation, Panasonic Corporation, Matrix Comsec Pvt. Ltd, etc. The market players are striving to innovate new products by way of extensive investments in R&D, collaborations, and mergers to cater to the evolving demands of consumers.

* January 2024 - Milesight, a prominent provider of innovative IP-based video surveillance solutions, and 3dEYE, a player in cloud-based video management, AI analytics, and automation, announced their strategic collaboration to deliver improved cloud video solutions to their security and monitoring industry customers. The partnership between 3dEYE and Milesightbrings together Milesight's advanced IP camera technology with 3dEYE's advanced pure cloud video AI platform, providing their customers with key advantages like scalable centralized monitoring, enhanced AI analytics to reduce false alarms, ease of deployment, and low total cost of ownership (TCO), etc.

* November 2023 - Matrix, a prominent player in security and telecommunications solutions, announced the launch of its Matrix Ruggedized Series IP Cameras, which are catered towards transportation surveillance. The cameras boast a back-illuminated CMOS sensor from the STARVIS Series, ensuring robust video quality even in extremely low-light conditions. Their rugged design is made to withstand shocks, vibrations, dust, impacts, and moisture, making them suitable for the challenging transportation environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Technological Advancements

- 4.5 Impact of COVID-19 and Macro Economic Trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing integration of IP cameras with smart home technologies and expansion of smart cities

- 5.1.2 Rising demand for security surveillance

- 5.1.3 Growing demand for high-resolution cameras

- 5.2 Market Restraints

- 5.2.1 Data privacy and security concerns

- 5.2.2 High installation and maintenance costs

- 5.3 Market Opportunities

- 5.3.1 Integration of advanced technologies like artificial intelligence (AI), and machine learning (ML), enabling video analytics

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Fixed

- 6.1.2 Pan-Tilt-Zoom (PTZ)

- 6.1.3 Varifocal

- 6.2 By End-User Industry

- 6.2.1 Residential

- 6.2.2 Commercial (BFSI, Education, Healthcare, Real Estate, Retail, and others)

- 6.2.3 Industrial

- 6.2.4 Government and law enforcement

- 6.3 By Geography***

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.6 Australia and New Zealand

7 COMPETITIVE LANSDCAPE

- 7.1 Company Profiles*

- 7.1.1 Johnson Controls International plc.

- 7.1.2 Honeywell International Inc.

- 7.1.3 Hangzhou Hikvision Digital Technology Co., Ltd

- 7.1.4 3dEYE Inc.

- 7.1.5 Sony Corporation

- 7.1.6 Panasonic Corporation

- 7.1.7 Matrix Comsec Pvt. Ltd.

- 7.1.8 Ajax Systems Inc.

- 7.1.9 D-Link Limited.

- 7.1.10 Cisco Systems, Inc.

- 7.1.11 Motorola Solutions, Inc.