|

市場調查報告書

商品編碼

1521328

混凝土:市場佔有率分析、產業趨勢、成長預測( 噴混凝土 )Sprayed Concrete (Shotcrete) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

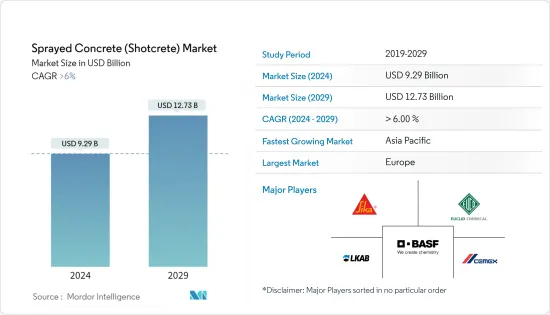

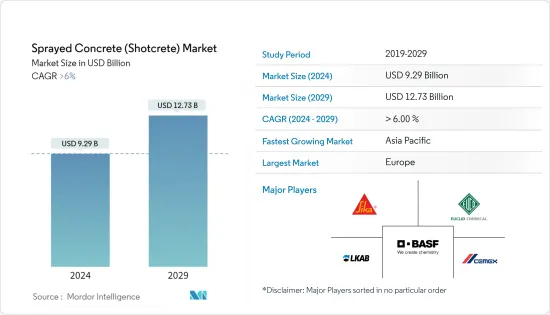

混凝土市場規模預計2024年為92.9億美元,預計2029年將達到127.3億美元,預測期內(2024-2029年)複合年成長率將超過6%,成長率將發生變化。

COVID-19 對混凝土市場的影響因地區、計劃類型和經濟狀況而異。儘管最初遇到了干擾和挑戰,但市場在某些地區顯示出復甦甚至成長的跡象。隨著疫情影響持續緩解,混凝土市場在其固有優勢以及技術和應用不斷進步的推動下,長期前景依然樂觀。

主要亮點

- 混凝土市場由於其多功能性、強度、速度、效率、環境效益以及與全球基礎設施趨勢的結合,正經歷建築業不斷成長的需求。

- 然而,乾混凝土製程中排放的粉塵造成的環境問題對所調查的市場成長構成了挑戰。

- 活性化的研發活動可能會在未來五年為噴混凝土混凝土提供機會。

- 歐洲預計將主導全球市場,亞太地區預計將成為預測期內成長最快的地區。

混凝土市場趨勢

建築業的需求增加

- 混凝土應用於各種基礎設施計劃。例如,它被用來沿著海岸線建造堅固的防波堤和屏障,以防止侵蝕和風暴潮。在交通領域,我們也參與跑道、航站等機場功能的建造與修復。此外,也用於建設和改善地鐵、停車場等地下設施。

- 根據美國地質調查局(USGS)預測,2022年美國水泥公司將生產9,500萬噸水泥,與前一年同期比較2021年的9,300萬噸增加2.2%。

- 此外,美國人口普查局強調,美國建築業產值激增,達到17,920億美元,與前一年同期比較超過1,660億美元。水泥產量的增加顯示了混凝土市場的廣闊前景,並暗示著潛在成長和機會的擴大。

- 根據中國國家統計局數據,2022年中國水泥產量近21.3億噸,2021年為23.3億噸,下降9%。政府宣布減產,以解決水泥產業產能過剩問題。儘管發生這種轉變,持續的建築需求以及對建築效率和永續性的重視可能仍會推動混凝土市場的成長。

- 日本財務省公佈的2022會計年度日本建設產業銷售額約為149.8兆日圓(1.15兆美元),較上年度成長9.6%。隨著建設活動的擴大,對混凝土等多功能、高效材料的需求不斷成長,特別是基礎設施、隧道和橋樑。

- 據印度財政部稱,2023 會計年度建設業的實際附加價值毛額(GVA) 飆升超過 9%。另一方面,2021 會計年度成長-8.6%,2022 會計年度成長 10.7%。疫情對2021年的建設業產生了影響。然而,復甦的跡像很明顯,預計將在預測期內推動混凝土市場。

- 混凝土的地下應用包括補充或更換傳統支撐,例如滯後和鋼架、密封岩石表面、引導水以及安裝臨時支撐或永久襯砌。交通運輸、用水和污水領域擴張計畫的大幅增加預計將推動地下建設活動。

- 所有上述因素預計將在預測期內推動混凝土(噴混凝土)市場。

亞太地區主導市場

- 根據美國地質調查局預測,2022年中國水泥產量將達21億噸,位居世界第一,印度緊追在後,為3.7億噸,越南則為1.2億噸。三個主要生產國均位於亞太地區,凸顯了水泥產業在全球的主導地位。

- 採礦和採石業通常需要基礎設施開發,例如隧道、豎井和地下結構的建設。混凝土因其強度、耐用性和對惡劣環境的適應性而對於這些應用至關重要。

- 根據越南統計總局的數據,2022年,採礦業為GDP貢獻了約268.1兆越南盾(11.65兆美元),佔全國GDP總量的2.82%。這比 2021 年的 206.2 兆越南盾(8.96 兆美元)大幅成長,佔 GDP 的 2.42%,成長了 30%。隨著採礦和採石業的擴張,地面支撐、隧道襯砌和礦井等應用對混凝土的需求不斷增加。

- 印度工業和內貿促進部報告稱,到 2022 年,印度採礦業將成長約 12%。

- 此外,工業和貿易促進部表示,印度水泥產量2022會計年度年成長率為20.8%,2021會計年度為10.8%,2020會計年度為0.9%,反映了從疫情影響中的復甦。為正值。這種復甦趨勢預計將對混凝土市場產生正面影響。

- 根據中國國家統計局預測,2022年中國建築業產值將超過31兆元(4.61兆美元),與前一年同期比較成長10%,達到29.31兆元人民幣(4.36兆美元)。與前一年同期比較穩定成長,比10年前成長了近100%。不斷成長的建築業正在將混凝土的應用範圍從住宅和商業結構擴展到專業基礎設施,從而推動了需求和市場範圍。

- 據國土交通省稱,2022會計年度日本民間建築投資將達到約37.1兆日圓(2,600億),將對混凝土市場產生重大影響。此外,預計 2023 年私人建築投資將保持在這一水平,這表明對混凝土的需求持續成長。

- 因此,所有這些市場趨勢預計將在預測期內推動亞太地區混凝土(噴混凝土)市場的需求。

混凝土產業概述

全球混凝土市場因其性質而部分整合。主要參與者(排名不分先後)包括 Sika、 BASF SE、Euclid Chemical Company、Cemex 和 LKAB Berg & Betong。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 建築業的需求增加

- 採礦和隧道開挖的增加

- 其他司機

- 抑制因素

- 混凝土的成本高於傳統混凝土或預製混凝土

- 乾燥過程中產生的粉塵所造成的環境問題

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 流程

- 濕噴

- 乾噴

- 最終用戶產業

- 基礎設施

- 採礦和隧道挖掘

- 維修和維修

- 其他最終用戶(航太/國防、住宅/商業建築、環境應用)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- Cemex

- Custom Crete

- Ductal

- HeidelbergCement

- JE Tomes & Associates Inc.

- LKAB Berg & Betong

- Sika

- Target Products Ltd

- The Euclid Chemical Company

- The QUIKRETE Companies

第7章 市場機會及未來趨勢

- 活性化研發活動

- 其他機會

The Sprayed Concrete Market size is estimated at USD 9.29 billion in 2024, and is expected to reach USD 12.73 billion by 2029, growing at a CAGR of greater than 6% during the forecast period (2024-2029).

The COVID-19 impact on the sprayed concrete market varied depending on the region, project type, and economic conditions. While initial disruptions and challenges were significant, the market showed signs of resilience and even experienced some growth in specific areas. As the pandemic's effects continue to moderate, the long-term outlook for the sprayed concrete market remains positive, driven by its inherent advantages and continued advancements in technology and applications.

Key Highlights

- The sprayed concrete market is driven by increasing demand from the construction sector by the combination of its versatility, strength, speed, efficiency, environmental benefits, and alignment with global infrastructure development trends.

- However, the environmental issues arising from the dust released in the dry-sprayed concrete process pose challenges to the studied market growth.

- Increasing research and development activities are likely to provide opportunities for the sprayed concrete (shotcrete) market over the next five years.

- Europe dominated the market across the globe and Asia-Pacific is expected to be the fastest-growing region over the forecast period.

Sprayed Concrete Market Trends

Increasing Demand From Construction Sector

- Sprayed concrete finds applications in a range of infrastructure projects. For instance, it's used to create strong seawalls and barriers along coastlines to protect against erosion and storm surges. Additionally, in the realm of transportation, it plays a role in constructing and fixing airport features like runways and terminals. Moreover, it's employed in the construction and improvement of underground facilities such as metro systems and parking garages.

- US cement companies produced 95Mt of cement in 2022, up by 2.2% year-on-year from 93Mt in 2021, according to the United States Geological Survey (USGS).

- Additionally, the US Census Bureau highlighted a surge in U.S. construction output, reaching USD 1,792 billion, up by over USD 166 billion from the previous year. This uptick in cement production signals promising prospects for the sprayed concrete market, suggesting potential growth and expanded opportunities.

- As per the National Bureau of Statistics of China, in 2022, the production volume of cement in China amounted to almost 2.13 billion metric tons and 2.33 billion metric tons in 2021 a 9% decline. The government announced to reduce the output, in order to address the production overcapacity in the cement sector. Despite this shift might still stimulate growth in the sprayed concrete market due to ongoing construction demands and an emphasis on construction efficiency and sustainability.

- In fiscal year 2022, Japan's construction industry, as per the Ministry of Finance, saw sales of about JPY 149.8 trillion (USD 1.15 trillion), a 9.6% rise from the previous year. With growing construction activities, there's heightened demand for versatile and efficient materials like sprayed concrete, especially for infrastructure, tunnels, and bridges.

- According to the Ministry of Finance (India), the real gross value added (GVA) in the construction industry in FY2023 surged by over 9%. In contrast, there were contractions of -8.6% in FY2021 and a growth of 10.7% in FY2022. The pandemic impacted the construction sector in 2021. However, signs of recovery are evident and expected to drive the sprayed concrete market during the forecast period.

- Underground applications of shotcrete include supplementing or replacing conventional support materials, such as lagging and steel sets, sealing rock surfaces, channeling water flows, and installing temporary support and permanent linings. Significantly growing expansion programs within the transportation and water/wastewater sectors are expected to provide a boost to the underground construction activities.

- All the aforementioned factors are expected to drive the sprayed concrete (shotcrete) market during the forecast period.

Asia-Pacific Region to Dominate the Market

- In 2022, According to the US Geological Survey, global cement production showed China as the leading producer with 2,100 million metric tons, followed by India at 370 million metric tons, and Vietnam at 120 million metric tons. All three leading producers are from the Asia-Pacific region, highlighting its dominance in the cement industry on a global scale.

- The mining and quarrying sector often requires infrastructure development for operations such as building tunnels, shafts, and underground structures. Sprayed concrete is essential in these applications due to its strength, durability, and adaptability to challenging environments.

- According to the General Statistics Office of Vietnam, in 2022, the mining and quarrying sector contributed approximately VND 268.1 trillion (USD 11.65 trillion) to the GDP, making up 2.82% of the nation's total GDP. This marks a significant rise from VND 206.2 trillion (USD 8.96 trillion), or 2.42% of the GDP, in 2021, indicating a 30% increase. With the expansion of the mining and quarrying sector, there is an increased demand for sprayed concrete in applications such as ground support, tunnel linings, and mine shafts.

- India's mining industry witnessed a growth of approximately 12% in FY2022, as reported by the Department for Promotion of Industry and Internal Trade (India).

- Additionally, as indicated by the Department for Promotion of Industry and Internal Trade (India), the annual growth rate for cement production in India saw positive shifts: 20.8% in FY2022, -10.8% in FY2021, and -0.9% in FY2020, reflecting a rebound from the pandemic's effects. This recovery trajectory is expected to have a positive impact on the Sprayed Concrete Market.

- As per the National Bureau of Statistics of China, the construction industry in China generated an output of over CNY 31 trillion (USD 4.61 trillion) in 2022, representing an increase of 10% of CNY 29.31 trillion (USD 4.36 trillion) compared to the previous year and there is an increase of almost 100% from a decade ago with a steady growth y-o-y. The growing construction sector broadens sprayed concrete's applications, from residential and commercial structures to specialized infrastructure, boosting its market demand and reach.

- According to MLIT (Japan), private sector building construction investment in Japan reached approximately JPY 37.1 trillion (USD 0.26 trillion) in fiscal year 2022, significantly influencing the sprayed concrete market. Additionally, projections suggest that private investment in building construction will maintain this level into fiscal 2023, indicating a sustained demand for sprayed concrete.

- Hence, all such market trends are expected to drive the demand for the sprayed Concrete (shotcrete) market in the Asia-Pacfic region during the forecast period.

Sprayed Concrete Industry Overview

The global sprayed concrete market is partially consolidated in nature. The major players (not in any particular order) include Sika, BASF SE, The Euclid Chemical Company, Cemex, and LKAB Berg & Betong among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Construction Sector

- 4.1.2 Growing Mining and Tunnel Activities

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Sprayed Concrete is Costlier than Traditional and Precast Concrete Types.

- 4.2.2 Environmental Issues Arising from the Dust Released in Dry Process

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Process

- 5.1.1 Wet Spraying

- 5.1.2 Dry Spraying

- 5.2 End-User Industry

- 5.2.1 Infrastructure

- 5.2.2 Mining and Tunneling

- 5.2.3 Repair and Rehabilitation

- 5.2.4 Other End Users (Aerospace And Defense, Residential and Commercial Construction, and Environmental Applications)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Cemex

- 6.4.3 Custom Crete

- 6.4.4 Ductal

- 6.4.5 HeidelbergCement

- 6.4.6 JE Tomes & Associates Inc.

- 6.4.7 LKAB Berg & Betong

- 6.4.8 Sika

- 6.4.9 Target Products Ltd

- 6.4.10 The Euclid Chemical Company

- 6.4.11 The QUIKRETE Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing R&D activities

- 7.2 Other Opportunities