|

市場調查報告書

商品編碼

1521319

新戊四醇:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Pentaerythritol - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

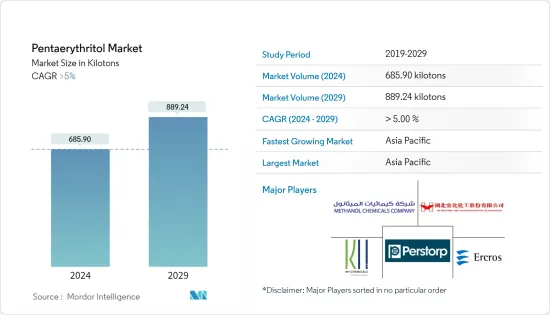

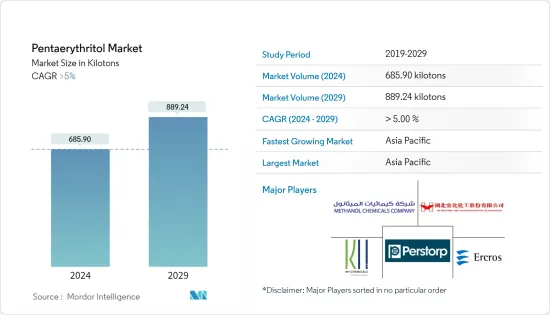

新戊四醇市場規模預計到2024年為685.90 Kt,預計到2029年將達到889.24 Kt,在預測期內(2024-2029年)複合年成長率超過5%。

COVID-19大流行對新戊四醇市場產生了負面影響。多個國家實施了全國範圍的封鎖,封鎖造成的勞動力短缺對油漆和被覆劑、潤滑劑和塑化劑生產設施的關閉產生了不利影響,從而影響了新戊四醇市場。然而,在COVID-19爆發後,由於油漆和塗料、農業和潤滑油行業的需求增加,新戊四醇市場一直在穩步復甦。

主要亮點

- 油漆和塗料應用對新戊四醇的需求不斷增加,以及汽車工業中新戊四醇的使用量不斷增加,預計將推動新戊四醇市場的發展。

- 原料價格的波動以及有關新戊四醇使用的嚴格法規和政策預計將阻礙市場成長。

- 環保油漆和被覆劑對新戊四醇的需求不斷增加,預計將在預測期內創造市場機會。

- 預計亞太地區將主導市場。由於油漆和被覆劑、潤滑劑和農業應用中對新戊四醇的需求不斷增加,預計在預測期內複合年成長率將達到最高。

新戊四醇市場趨勢

油漆和塗料應用領域佔據市場主導地位

- 新戊四醇用於生產醇酸樹脂,並用作油漆和被覆劑生產中的樹脂。醇酸樹脂用作大多數商業油性塗料中的主要樹脂。

- 油性塗料用於各種住宅用途,包括住宅和建築物的外牆、廚房、浴室、門和室內裝飾。因此,住宅建設活動的增加將提振對油性塗料的需求並帶動新戊四醇市場。

- 亞太地區的建築業是世界上最大的。由於人口成長、中等收入階層的壯大和都市化,它正在以健康的速度成長。在中國和印度不斷擴大的住宅建築市場的推動下,亞太地區預計將出現最高的成長。

- 在中國,許多住宅建設將於2022年動工。香港住宅委員會推出多項措施推動保障住宅建設。當局的目標是在截至 2030 年的十年內交付 301,000 套公共住宅。

- 同樣,印度政府也積極推動住宅建設,為約13億人提供住宅。預計未來六到七年,該國將在住宅投資約 1.3 兆美元。該國預計將新建6,000萬套住宅。

- 同樣,在北美,隨著住宅建設的增加,對油基塗料的需求也增加。美國是全國最大的住宅市場。根據美國人口普查局的數據,2022 年美國住宅建築年產值為 9,080 億美元,而 2021 年為 8,020 億美元。因此,住宅建設活動的活性化預計將推動油基塗料需求並推動當前的研究市場。

- 因此,由於上述因素,油漆和塗料應用領域可能在預測期內主導新戊四醇。

亞太地區主導市場

- 預計亞太地區將在預測期內主導新戊四醇市場。中國、日本和印度等國家的塑化劑和住宅黏劑對新戊四醇的需求被覆劑增加,預計將推動該地區對新戊四醇的需求。

- 中國是全球最大的汽車生產和銷售市場。根據國際汽車製造組織(OICA)統計,2022年中國汽車產量總合2,702萬輛,較2021年同期成長3%。因此,汽車產量的增加預計將帶動潤滑油市場並增加對新戊四醇的需求。

- 同樣,印度汽車和工業部門對潤滑油的需求也在增加。因此,各個製造商都在國內擴大潤滑油生產。例如,埃克森美孚於2023年3月宣布,將投資近1.1億美元,在馬哈拉斯特拉邦工業發展公司位於萊加德的伊桑貝工業區建造潤滑油製造廠。因此,潤滑油產量的增加預計將推動該國季戊四醇新戊四醇的發展。

- 中國是亞太地區最大的建築市場。根據中國國家統計局的數據,建築業產值將從2021年的29.3兆元(4.2兆美元)增加至2022年的31.2兆元(4.5兆美元)。預計到 2030 年,中國將在建築方面花費約 13 兆美元。因此,建設活動的增加預計將帶動油漆和被覆劑、黏劑和密封劑的需求,從而推動新戊四醇市場。

- 由於上述因素,亞太地區新戊四醇市場預計在預測期內將顯著成長。

新戊四醇產業概況

新戊四醇市場因其性質而部分整合。市場主要企業(排名不分先後)包括Chemanol、Ercros SA、湖北宜化化工、KH Chemicals、Perstorp等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 油漆和被覆劑中新戊四醇的需求增加

- 汽車工業中新戊四醇的使用量增加

- 其他司機

- 抑制因素

- 原物料價格波動

- 關於新戊四醇使用的嚴格法規和政策

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔:市場規模(基於數量)

- 種類

- 新戊四醇

- 雙異戊四醇

- 新戊四醇

- 目的

- 畫

- 潤滑劑

- 塑化劑

- 火藥

- 農業

- 其他用途(黏劑、密封劑、化妝品等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 土耳其

- 俄羅斯

- 北歐國家

- 西班牙

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Chemanol

- Chifeng Ruiyang Chemical Co.,Ltd.

- Ercros SA

- Henan Pengcheng Group

- HUBEI YIHUA CHEMICAL INDUSTRY CO., LTD.

- KH Chemicals

- Merck KGaA

- Perstorp

- Samyang Chemical Corporation

- Solventis

- U-JIN Chemical Co., Ltd

- Yuntianhua Group Co., Ltd.

第7章 市場機會及未來趨勢

- 環保油漆和被覆劑對新戊四醇的需求不斷成長

- 其他機會

The Pentaerythritol Market size is estimated at 685.90 kilotons in 2024, and is expected to reach 889.24 kilotons by 2029, growing at a CAGR of greater than 5% during the forecast period (2024-2029).

The COVID-19 pandemic has negatively affected the market for pentaerythritol. The nationwide lockdowns in several countries and the labor shortage due to social distancing measures had negatively resulted in the closure of manufacturing facilities of paints and coatings, lubricants, and plasticizers, thereby affecting the market for pentaerythritol. However, post-COVID pandemic, the market for pentaerythritol recovered well due to increasing demand from the paints and coatings, agriculture, and lubricants application segments.

Key Highlights

- The growing demand for pentaerythritol from paints and coatings applications and the increasing usage of pentaerythritol in the automotive industry is expected to drive the market for pentaerythritol.

- The volatility In the prices of raw materials and the stringent regulations and policies on the use of pentaerythritol are expected to hinder the market's growth.

- The growing demand for pentaerythritol from eco-friendly paints and coatings is expected to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market. It is also expected to register the highest CAGR during the forecast period due to rising demand for pentaerythritol from paints and coatings, lubricants, and agriculture applications.

Pentaerythritol Market Trends

Paints and Coatings Application Segment to Dominate the Market

- Pentaerythritol is used to manufacture Alkyd resins, used as resins in manufacturing paints and coatings. Alkyd resins are used as the dominant resin in most commercial oil-based coatings.

- The oil-based paints and coatings are used in various residential coating applications such as home or building exterior trim, kitchens and baths, doors, and interior decoration. Thus, the increasing residential building construction activities will drive the demand for oil-based coatings, thereby driving the market for Pentaerythritol.

- The construction sector in the Asia-Pacific region is the largest in the world. It is increasing at a healthy rate, owing to the rising population, increase in middle-class income and urbanization. The highest growth for housing is expected to be registered in the Asia-Pacific region, owing to the expanding housing construction markets in China and India.

- In China, many residential constructions kick-started in the year 2022. The housing authorities of Hong Kong launched several measures to push the construction of low-cost housing. The officials aim to provide 301,000 public housing units in 10 years till 2030.

- Similarly, the Indian government has been actively boosting housing construction to provide homes to about 1.3 billion people. The country will likely witness around USD 1.3 trillion of investment in housing over the next six to seven years. It is likely to witness the construction of 60 million new homes in the country.

- Similarly, in the North American region, the demand for oil-based coatings is increasing with the increasing residential construction activities. The United States is the largest residential construction market in the country. According to the United States Census Bureau, the annual value of residential construction output in the United States was valued at USD 908 billion in 2022, compared to USD 802 billion in 2021. Thus, the rising residential construction activities are expected to drive the demand for oil-based coatings, thereby driving the current studied market.

- Hence, owing to the above-mentioned factors, the paints and coatings application segment is likely to dominate the market for Pentaerythritol during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for pentaerythritol during the forecast period. The rising demand for pentaerythritol from plasticizers, adhesives and sealants, lubricants, paints, and coatings in the automotive and residential construction sectors in countries like China, Japan, and India is expected to drive the demand for pentaerythritol in this region.

- China is the world's biggest automobile market in production and sales. According to OICA (The Organisation Internationale des Constructeurs d'Automobiles), vehicle production in China reached a total of 27.02 million units in 2022, which is an increase of 3% over 2021 for the same period. Thus, the increasing production of automotive vehicles is anticipated to drive the lubricant market, thereby driving the demand for pentaerythritol.

- Similarly, in India, the demand for lubricants is increasing from the automotive and industrial sectors. Thus, various manufacturers are expanding lubricant production in the country. For instance, in March 2023, ExxonMobil announced to invest nearly USD 110 million to build a lubricant manufacturing plant at the Maharashtra Industrial Development Corporation's IsambeIndustrial Area in Raigad. Thus, the increase in the production volume of lubricants is expected to drive the market for pentaerythritol in the country.

- China is the largest construction market in the Asia-Pacific region. According to the National Bureau of Statistics of China, The value of construction output accounted for CNY 31.2 trillion (USD 4.5 trillion) in 2022, up from CNY 29.3 trillion (USD 4.2 trillion) in 2021. China is expected to spend nearly USD 13 trillion on buildings by 2030. Thus, the increasing construction activities are expected to drive the demand for paints and coatings, adhesives, and sealants, thereby driving the market for pentaerythritol.

- Owing to the above-mentioned factors, the market for pentaerythritol in the Asia-Pacific region is projected to grow significantly during the forecast period.

Pentaerythritol Industry Overview

The Pentaerythritol Market is partially consolidated in nature. Some of the major players in the market (not in any particular order) include Chemanol, Ercros SA, HUBEI YIHUA CHEMICAL INDUSTRY CO., LTD., KH Chemicals, and Perstorp, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand of Pentaerythritol from Paints and Coatings

- 4.1.2 The Increasing Usage of Pentaerythitol in Automotive Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Volatility in the Prices of Raw Materials

- 4.2.2 The stringent regulations and policies on the use of Pentaerythritol

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Mono Pentaerythritol

- 5.1.2 Di-Pentaerythritol

- 5.1.3 Tri-Pentaerythritol

- 5.2 Application

- 5.2.1 Paints and Coatings

- 5.2.2 Lubricants

- 5.2.3 Plasticizer

- 5.2.4 Explosives

- 5.2.5 Agriculture

- 5.2.6 Other Applications (Adhesives and Sealants, Cosmetics, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Turkey

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Spain

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chemanol

- 6.4.2 Chifeng Ruiyang Chemical Co.,Ltd.

- 6.4.3 Ercros SA

- 6.4.4 Henan Pengcheng Group

- 6.4.5 HUBEI YIHUA CHEMICAL INDUSTRY CO., LTD.

- 6.4.6 KH Chemicals

- 6.4.7 Merck KGaA

- 6.4.8 Perstorp

- 6.4.9 Samyang Chemical Corporation

- 6.4.10 Solventis

- 6.4.11 U-JIN Chemical Co., Ltd

- 6.4.12 Yuntianhua Group Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growind Demand of Pentaerythritol from Eco-Friendly Paints and Coatings

- 7.2 Other Opportunities