|

市場調查報告書

商品編碼

1519943

混凝土表面緩凝劑:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Concrete Surface Retarders - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

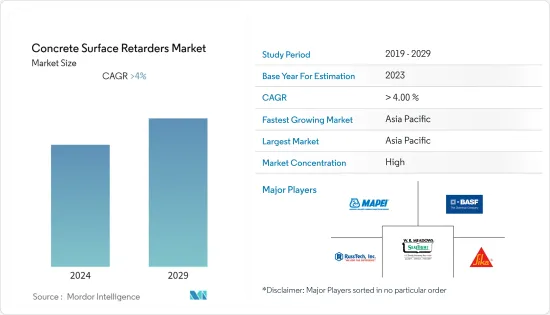

混凝土表面緩凝劑市場規模預計2024年為39.7億美元,預計2029年將達到51.9億美元,在預測期內(2024-2029年)複合年成長率預計將超過5.5%。

主要亮點

- 2020 年,市場受到 COVID-19 爆發的負面影響。然而,隨著關鍵終端用戶產業恢復營運,2021年和2022年顯著復甦。此外,由於全球建築業的成長,預計市場將在預測期內穩定成長。

- 不斷增加的基礎設施開發計劃和不斷增加的商業建築正在推動對混凝土表面緩凝劑的需求。

- 另一方面,原料成本上漲可能會阻礙市場成長。

- 預計水基混凝土表面緩凝劑將在預測期內主導市場。

- 亞太地區是最大的市場,由於中國、印度和日本等國家的消費量不斷增加,預計亞太地區將成為預測期內成長最快的市場。

混凝土表面緩凝劑的市場趨勢

住宅和商業建築的成長

- 環保、無毒、低味、無味的混凝土表面緩凝劑廣泛應用於建築領域。

- 由於揮發性有機化合物 (VOC) 含量低,隨著人們對揮發性有機化合物 (VOC)排放增加和法規日益嚴格的擔憂,與溶劑型替代品相比,水性混凝土表面緩凝劑越來越受歡迎。

- 此外,混凝土表面緩凝劑也用於面朝上和麵下預製混凝土生產中的裸露骨材混凝土飾面的生產。

- 此外,表面緩凝劑是水基的,因此可以安全地塗布室外或通風不良的區域。

- 其他優點包括經濟且易於使用,在熱固化和熱混凝土澆注中顯示出良好的效果,並且能夠用於鋼、玻璃纖維或木模板。

- 新興國家住宅建設和重建活動的增加增加了對混凝土表面緩凝劑的需求。

- 中國政府正在推出一項大規模建設計畫,其中包括在未來 10 年內將 2.5 億人遷移到新的特大城市。

- 由於多戶住宅的增加和向城市移民的增加,美國人口普查局正在增加新住宅建設的許可。

- 根據美國人口普查局的數據,商業竣工面積將反彈至經濟景氣衰退前的水平,並於 2022 年達到 1,150 億美元。美國最常見的商業建築是倉庫和私人辦公室。

- 此外,2023年1-8月建築支出達12,847億美元,比2022年同期的12,334億美元成長4.2%。

- 此外,根據歐盟統計局的數據,由於歐盟復甦基金的新投資,歐洲建築業在 2022 年成長了 2.5%。 2022年的主要建設計劃將是非住宅(辦公室、醫院、飯店、學校、工業建築),佔總活動的31.3%。

- 德國是歐洲最大的建築國。德國政府已撥款約 3,750 億歐元(約 4,091.7 億美元)用於未來幾年的建設活動。此外,該市還宣布計劃建造 25 萬至 40 萬套住宅,使該計劃成為城市、私人開發人員和公共住宅當局的絕佳投資機會。

- 因此,混凝土表面緩凝劑的這些優點正在推動其在全球建設產業的需求。

亞太地區主導市場

- 由於該地區住宅、商業和基礎設施建設計劃的增加,亞太地區預計將成為混凝土表面緩凝劑最大且成長最快的地區。

- 亞太地區擁有最大的低成本住宅建築市場,其中以中國、印度和東南亞國家為首。因此,這些國家的住宅建築市場正在擴大,進一步推動了對混凝土的需求。

- 中國、印度、印尼和馬來西亞等國家有許多購物中心處於規劃或開發階段。

- 中國的成長主要是由商業建築業的快速擴張所推動的。根據中國國家統計局的數據,由於快速的都市化,中國的建築業一直在穩步成長,到 2022 年總產值將達到約 27.6 兆元(3.9 兆美元)。

- 此外,中國的建築產值將於 2022 年達到約 31.2 兆元(4.39 兆美元)的高峰。因此,這些因素往往會推動建築業對建築化學品的需求。

- 此外,未來七年印度將投資約1.3兆美元建造住宅,預計在此期間將建造6,000萬套住宅。到2024年,經濟適用住宅的供應量預計將增加70%左右。

- 在2023-2024年預算中,財政部長宣布撥款2.7兆瑞典克朗(33.9億美元)來促進住宅建設。這一分配比上年度增加了近10%。這將大大加快住宅建設。

- 此外,日本還有多個建設計劃正在進行中。例如,2021年10月,宣布了濱松町芝浦1丁目再開發計劃。該計劃涉及在東京港區佔地4公頃的土地上建造一座由兩座232.55米高的建築組成的55萬平方公尺的綜合體。建設工程預計將於 2021 年第三季開始,並於 2030 年第四季完工。

- 因此,所有此類計劃和投資計畫預計將導致預測期內對混凝土和混凝土生產中使用的表面緩凝劑的需求增加。

混凝土表面緩凝劑產業概況

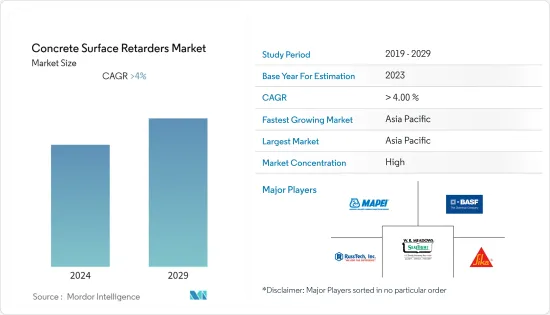

混凝土表面緩凝劑市場具有綜合性。市場上的主要企業(排名不分先後)包括 Sika AG、Focroc Inc、Mapei SpA、RussTech, Inc. 和 WR Meadows。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 住宅和商業建築的成長

- 政府加大對基礎建設計劃的投資

- 其他司機

- 抑制因素

- 原料成本上漲

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 原料

- 有機的

- 無機的

- 產品類別

- 水性的

- 溶劑型

- 目的

- 住宅

- 商業的

- 基礎設施

- 其他(設施、工業等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- Adomast Manufacturing Ltd

- CEMEX SAB de CV

- CHRYSO(Saint Gobain)

- Fosroc Inc.

- GCP Applied Technologies

- Mapei SpA

- MC-Bauchemie

- RECKLI

- RussTech Inc.

- Sika AG

- The Euclid Chemical Company

- WR Meadows Inc.

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 69109

The Concrete Surface Retarders Market size is estimated at USD 3.97 billion in 2024, and is expected to reach USD 5.19 billion by 2029, growing at a CAGR of greater than 5.5% during the forecast period (2024-2029).

Key Highlights

- The market was affected negatively by the COVID-19 outbreak in 2020. However, with the resumption of operations in major end-user industries, it recovered significantly in 2021 and 2022. Furthermore, the market is projected to grow steadily in the forecast period owing to global growth in the construction sector.

- The increasing infrastructure development projects and growing commercial construction are driving the demand for concrete surface retarders.

- On the flip side, high raw material costs are likely to hinder the growth of the market.

- Water-based concrete surface retarders are forecasted to dominate the market studied over the forecast period.

- The Asia-Pacific region is the largest market, and it is also expected to be the fastest-growing market over the forecast period, owing to the increasing consumption from countries such as China, India, and Japan.

Concrete Surface Retarders Market Trends

Growing Residential and Commercial Construction

- Eco-friendly, non-hazardous, and low/no odor concrete surface retarders are widely popular for use in the construction sector.

- The lower VOC content in water-based concrete surface retarders is making them more popular as compared to solvent-based ones, with growing concerns and stringent regulations related to VOC emissions.

- Furthermore, concrete surface retarders are used for producing exposed aggregate concrete finish in face-up and face-down precast concrete manufacture.

- Additionally, surface retardants, being water-based, can be safely applied outdoors and in areas with low ventilation.

- Other advantages include, being economical, easy to use, showing good results with heat curing and high-temperature concreting, and can be used on steel, glass fiber, or timber formwork.

- The increasing residential construction and renovation activities in developing countries are increasing the demand for concrete surface retarders.

- The Chinese government has rolled out massive construction plans, including making provisions for the movement of 250 million people to its new megacities over the next ten years.

- The US Census Bureau has been providing more permits for constructing new residential buildings due to the current trend of multi-family buildings and a rise in migration to cities.

- According to the US Census Bureau, the value of completed commercial construction has rebounded to pre-recession levels, reaching USD 115 billion in 2022. The most popular types of commercial development started in the United States were warehouses and private offices.

- Additionally, during the first eight months of 2023, construction spending amounted to USD 1,284.7 billion, which increased by 4.2% to USD 1,233.4 billion for the same period in 2022.

- Furthermore, according to Eurostat, the European construction sector grew by 2.5% in 2022 due to new investments from the EU Recovery Fund. The major construction projects in 2022 accounted for non-residential construction (offices, hospitals, hotels, schools, and industrial buildings), accounting for 31.3% of total activity.

- Germany has the largest construction industry in Europe. The German government has allocated around EUR 375 billion (~USD 409.17 billion) in construction activities in the coming years. In addition, it also revealed plans to build 250,000 to 400,000 housing units, making this project a great investment opportunity for the city, private developers, and public housing authorities.

- Hence, such benefits of concrete surface retarders have been driving their demand in the construction industry across the world.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is projected to be the largest and the fastest-growing region for concrete surface retarders, owing to the growing number of residential, commercial, and infrastructure construction projects in the region.

- Asia-Pacific has the largest low-cost housing construction segment, led by China, India, and various Southeast Asian countries. With this, the housing construction market has been expanding in these countries, and thus, this is further fueling the demand for concrete.

- Countries such as China, India, Indonesia, and Malaysia, have numerous malls under the planning or development phase.

- China's growth is fueled mainly by rapid expansion in the commercial building sectors. According to the National Bureau of Statistics of China, the country's construction work sector was growing steadily owing to rapid urbanization, which amounted to a total output value of around CNY 27.6 trillion (USD 3.9 trillion) in 2022.

- Also, China's construction output peaked in 2022 at a value of about CNY 31.2 trillion (USD 4.39 trillion). As a result, these factors tend to drive the demand for construction chemicals in the construction sector.

- Furthermore, India is likely to witness an investment of around USD 1.3 trillion in housing over the next seven years, during which it is likely to witness the construction of 60 million new homes. The rate of availability of affordable housing is expected to rise by around 70% in 2024.

- In the budget 2023-2024, the finance minister announced an allocation of 2.7 lakh crore (USD 3.39 billion) for boosting housing construction. This allocation increased by nearly 10% as compared to the previous year. This will provide a significant boost to housing construction.

- Furthermore, several construction projects are being carried out in Japan. For instance, in October 2021, the Hamamatsucho Shibaura 1 Chome Redevelopment project was announced. The project is to construct a 550,000 sq m complex of two 232.55-meter-high buildings on 4 hectares of land in Minato Ward, Tokyo. The construction work started in Q3 2021 and is expected to be completed in Q4 2030.

- Hence, all such projects and planned investments are expected to provide growth in the demand for concrete as well as surface retarders used in the production of concrete over the forecast period.

Concrete Surface Retarders Industry Overview

The concrete surface retarders market is consolidated in nature. Some of the major players (not in any particular order) in the market include Sika AG, Focroc Inc, Mapei SpA, RussTech, Inc., and W. R. Meadows, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Residential and Commercial Construction

- 4.1.2 Increasing Government Investment in Infrastructure Development Projects

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Raw Material Cost

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Raw Materials

- 5.1.1 Organic

- 5.1.2 Inorganic

- 5.2 Product Type

- 5.2.1 Water-based

- 5.2.2 Solvent-based

- 5.3 Application

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Infrastructure

- 5.3.4 Other Applications (Institutional, industrial, etc)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Adomast Manufacturing Ltd

- 6.4.2 CEMEX SAB de CV

- 6.4.3 CHRYSO (Saint Gobain)

- 6.4.4 Fosroc Inc.

- 6.4.5 GCP Applied Technologies

- 6.4.6 Mapei SpA

- 6.4.7 MC-Bauchemie

- 6.4.8 RECKLI

- 6.4.9 RussTech Inc.

- 6.4.10 Sika AG

- 6.4.11 The Euclid Chemical Company

- 6.4.12 W. R. Meadows Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rise in Inclination TowardsEsthetically Pleasing Concrete Structures

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219