|

市場調查報告書

商品編碼

1445967

壁紙 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Wallpaper - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

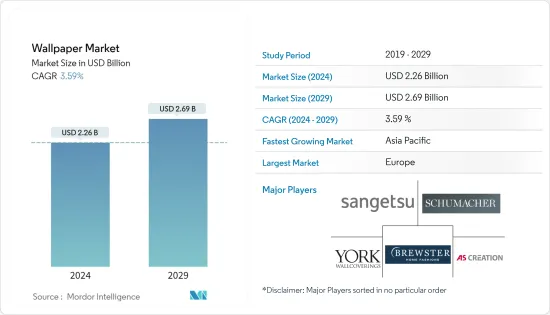

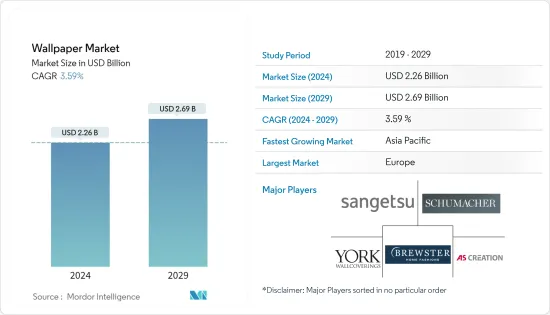

壁紙市場規模預計到 2024 年為 22.6 億美元,預計到 2029 年將達到 26.9 億美元,在預測期內(2024-2029 年)CAGR為 3.59%。

壁紙具有成本效益,因此擴大採用傳統的壁畫做法。

主要亮點

- 可支配收入的增加和城市化的迅速崛起已經壓倒性地取代了鄉村文化,並推動了全球範圍內人類社會根源的歷史性變革。因此,許多牆面覆蓋物和其他現代產品,如傳熱極低的窗框、電纜和管道、易於清潔的地板和反光屋頂,正在不斷成長。

- 如今隨著科技的進步,壁紙有助於提升房間或生活空間的檔次,並且壁紙種類繁多,推動了市場需求,同時允許消費者選擇他們想要的東西。此外,根據 Housing.com 報導,到 2022 年 2 月,壁紙可用於天花板表面、壁櫥、門板和框架藝術品,以照亮房屋。壁紙也適用於線條簡潔和有一些曲線的區域,例如桌面、鏡框、相框、凳子、抽屜櫃和開放式牆櫃。

- 對環保壁紙的偏好是推動乙烯基產品需求的另一個因素。製造乙烯基壁紙所需的能源消耗僅為紙質壁紙的一半。另一方面,世界各地越來越多的餐廳、俱樂部、酒吧和咖啡館也推動了對商業壁紙的需求,壁紙在吸引顧客並給他們帶來幸福和放鬆的感覺方面發揮著重要作用。

- 而且,隨著平面設計和新的複製方法的出現,壁紙已成為設計和裝飾的下一個突破。布魯克林的 Calico 等主要設計公司已經讓壁紙進入了家庭。

- 根據 Nagai 2021 年 10 月報道,氯乙烯中添加了大量塑化劑,以使其在壁紙加工過程中具有柔韌性。除塑化劑外,還使用各種化學品,例如殺菌劑、阻燃劑和染料。隨著時間的推移,這些化學物質會以揮發性有機化合物 (VOC) 的形式釋放到房間中。這些揮發性有機化合物會引起各種症狀,包括頭痛、頭暈和眨眼。這些因素可能對市場構成課題。

- 隨著COVID-19的爆發,由於世界各地廣告的減少,牆布市場沒有顯著成長。由於全球封鎖,建築業以及貿易都受到了打擊。由於這些因素的直接影響,壁紙市場受到了影響。此外,由於疫情導致經濟放緩,消費者支出也可能減少。

壁紙市場趨勢

無紡壁紙類型區隔市場預計將佔據重要的市場佔有率

- 非織物壁紙因其多功能性和易用性而在市場上廣受歡迎。與由紙或乙烯基製成的傳統壁紙不同,不織布壁紙由合成纖維和天然纖維製成,例如聚酯和纖維素。

- 非織物壁紙以其方便用戶使用的安裝過程而聞名。它不需要任何浸泡時間或貼上壁紙本身。相反,黏合劑直接塗在牆上,使懸掛更容易、更快捷。

- 非織物壁紙非常耐用且耐磨損。它可以防潮,適合在濕度高的區域使用,例如浴室和廚房。在安裝或拆卸過程中也不太可能撕裂。

- 非織物壁紙可以讓牆壁透氣,防止黴菌生長。此功能使其成為需要通風的空間的選擇。

- 非織物壁紙提供各種設計、圖案和紋理,可滿足各種室內設計偏好。它可以模仿織物、紋理表面甚至壁畫的外觀,為屋主和設計師提供多功能且具有視覺吸引力的選擇。

- 根據英國國家統計局的數據,英國壁紙製造的收入預測已經更新。目前預計到 2024 年將達到約 1.0673 億美元。請注意,該預測可能會發生變化,應被視為基於現有資料的估計。

歐洲地區預計將佔據重要市場佔有率

- 歐洲壁紙市場是全球壁紙產業的重要組成部分。歐洲以其豐富的歷史、建築遺產和設計文化而聞名,這增加了該地區對壁紙的需求。

- 公司正在採用壁紙產品的數位印刷來增強永續性。壁紙數位印刷是一種永續的牆面裝飾方法,因為它可以減少設計過程中產生的浪費。數位印刷過程不需要創建印版,並且使用的墨水少四倍。

- 環境意識和永續發展在歐洲市場變得越來越重要。消費者擴大尋求環保和永續的壁紙選擇。這促使了由回收材料、水性油墨和環保生產流程製成的壁紙的出現。

- 據義大利 Ambientha 稱,近年來,用於裝飾辦公室和商店(例如商店)牆壁的壁紙選擇再次成為熱門話題。與傳統壁紙相比,新基材、不同材料的開發以及數位技術的進步使得創造耐用、個人化且美觀的裝飾品成為可能。壁紙是適合各種環境的室內設計。

- 歐洲消費者偏愛高品質、奢華的壁紙。人們需要優質材料、複雜的設計和獨特的圖案。這種需求促使市場上出現了各種各樣的壁紙選擇。

- 此外,歐盟委員會預計,到2050年,歐洲城市化程度預計將提高到83.7%左右。農村人口占總人口的比例平穩成長,而城鎮人口的比例則平穩成長。到 2050 年,歐洲城市功能區 (FUA) 的總人口預計將平均增加 4%。城市化進程的加速將帶動整個地區的壁紙市場。

壁紙產業概況

壁紙市場高度分散,主要參與者包括 York Wall Coverings Inc.、Brewster Home Fashion LLC、F. Schumacher & Co、AS Creation Tapeten AG 和 Sangetsu Corporation。市場參與者正在採取合作夥伴關係和收購等策略來增強其產品供應並獲得永續的競爭優勢。

2023 年 5 月,Asian Paints 宣佈在欽奈推出家居工作室和 2023 年家居裝飾系列。工作室提供花園精選的織物、壁紙、寢具和地毯。

2022 年 8 月,豪華室內設計和家具公司之一桑德森設計集團宣布與迪士尼建立新的合作關係。根據許可安排的條款,該集團的 Sanderson 品牌將被允許生產基於各種迪士尼經典財產的壁紙和紡織品。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭激烈程度

- 產業價值鏈分析

- COVID-19 對產業影響的評估

第 5 章:市場動態

- 市場促進因素

- 美學的發展趨勢

- 非織物壁紙需求旺盛

- 市場課題

- 監管嚴格、成本高

第 6 章:市場區隔

- 依壁紙類型

- 乙烯基壁紙

- 非織物壁紙

- 紙質壁紙

- 布藝桌布

- 其他壁紙類型

- 依應用

- 商業的

- 非商業用途

- 依地理

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第 7 章:競爭格局

- 公司簡介

- York Wall Coverings Inc.

- Brewster Home Fashion LLC

- F. Schumacher & Co

- AS Creation Tapeten AG

- Sangetsu Corporation

- Erismann & Cie. GmbH

- Laura Ashley Holdings PLC

- Grandeco Wallfashion Group

- Sanderson Design Group PLC

- Tapetenfabrik Gebr. Rasch GmbH & Co. KG

- LEN-TEX Corporation

- Asian Paints Ltd

- Gratex Industries Ltd

第 8 章:投資分析

第 9 章:市場的未來

The Wallpaper Market size is estimated at USD 2.26 billion in 2024, and is expected to reach USD 2.69 billion by 2029, growing at a CAGR of 3.59% during the forecast period (2024-2029).

Wallpapers are cost-effective, hence are increasingly being adopted over traditional wall painting practices.

Key Highlights

- Rising disposable incomes and the rapid rise of urbanization have overwhelmingly replaced rural cultures and have helped drive historical changes in human social roots on a global scale. As a result, many wall coverings and other modern products, such as very low heat transfer window frames, electrical cables and pipes, easy-to-clean floors, and light-reflecting roofs, are growing.

- Wallpapers available today with technological advancements help elevate rooms or living spaces and are available in wide varieties, driving the market demand while allowing consumers to choose what they want. Moreover, according to Housing.com, in February 2022, wallpapers can be used for ceiling surfaces, closets, door panels, and framed art to brighten the home. Wallpaper is also suitable for areas with clean lines and a few curves, such as table tops, mirror frames, picture frames, stools, chests of drawers, and open wall units.

- The preference for eco-friendly wallpaper is another factor driving the demand for vinyl-based products. The energy consumption required to manufacture vinyl wallpaper is only half that of paper wallpaper. On the other hand, the need for commercial wallpaper is also fueled by an increasing number of restaurants, clubs, bars, and cafes around the world, where wallpaper plays an important role in attracting customers and giving them a feeling of well-being and relaxation.

- Moreover, with the advent of graphic design and new reproduction methods, wallpaper has become the next breakthrough in design and decoration. Major design firms such as Brooklyn's Calico have enabled wallpaper to enter homes.

- Acording to Nagai Co., Ltd in October 2021, a large amount of plasticizer is added to vinyl chloride to give it flexibility during wallpaper processing. In addition to plasticizers, various chemicals are used, such as fungicides, flame retardants, and dyes. Over time, these chemicals are released into the room as volatile organic compounds (VOCs). These VOCs cause various symptoms, including headaches, dizziness, and blinking eyes. Such factors can be challenging for the market.

- With the outbreak of COVID-19, the wall covering market did not grow significantly due to a decrease in advertising across the various part of the world. Because of the global lockdown, the construction industry, as well as the trade, has taken a hit. Due to the direct impact of these factors, the wallpaper market was affected. Moreover, consumer spending is also likely to decrease due to the pandemic's economic slowdown.

Wallpaper Market Trends

Non-Woven Wallpaper Type Segment is Expected to Hold Significant Market Share

- Non-woven wallpaper is popular in the market due to its versatility and ease of use. Unlike traditional wallpaper, made from paper or vinyl, non-woven wallpaper is made from synthetic and natural fibers, such as polyester and cellulose.

- Non-woven wallpaper is known for its user-friendly installation process. It does not require any soaking time or pasting of the wallpaper itself. Instead, the adhesive is applied directly to the wall, making hanging easier and quicker.

- Non-woven wallpaper is highly durable and resistant to wear and tear. It can withstand moisture, making it suitable for use in areas with high humidity, such as bathrooms and kitchens. It is also less likely to tear during installation or removal.

- Non-woven wallpaper allows the walls to breathe, preventing mold or mildew growth. This feature makes it a choice for spaces where ventilation is a concern.

- Non-woven wallpaper offers various designs, patterns, and textures, catering to various interior design preferences. It can mimic the appearance of fabric, textured surfaces, or even murals, providing a versatile and visually appealing option for homeowners and designers.

- According to the Office for National Statistics (United Kingdom), the revenue projection for the manufacture of wallpaper in the United Kingdom has been updated. It is now anticipated to reach approximately USD 106.73 million by 2024. Please note that this projection is subject to change and should be considered an estimate based on the available data.

Europe Region is Expected to Hold Significant Market Share

- The European wallpaper market is a significant segment of the global wallpaper industry. Europe is known for its rich history, architectural heritage, and design culture, which contributes to the demand for wallpapers in the region.

- Companies are incorporating digital printing of wallpaper products to enhance sustainability. Digital printing of wallpapers is a sustainable method for creating wall decor because it reduces the waste produced during the design process. The digital printing process does not require the creation of plates, and it uses four times less ink.

- Environmental consciousness and sustainability are gaining importance in the European market. Consumers are increasingly seeking eco-friendly and sustainable wallpaper options. This has led to the availability of wallpapers made from recycled materials, water-based inks, and environmentally friendly production processes.

- In recent years, according to Ambientha, Italy, the choice of wallpaper to decorate walls in offices and houses such as shops is back at the forefront. Compared to traditional wallpaper, the development of new backings, different materials, and advances in digital technology have made it possible to create durable, personalized, and aesthetically pleasing decorations. Wallpaper is an interior design suitable for all types of environments.

- European consumers have a preference for high-quality and luxurious wallpapers. There is a demand for premium materials, intricate designs, and unique patterns. This demand has led to the availability of a wide range of wallpaper options in the market.

- Moreover, according to European Commission, the degree of urbanization in Europe is expected to increase to around 83.7% by 2050. The share of the total population living in rural areas, while cities and towns experienced a smooth and steady increase. The total population of functional urban areas (FUAs) in Europe is projected to grow by an average of 4% by 2050. An increase in urbanization will leverage the wallpaper market across the region.

Wallpaper Industry Overview

The wallpaper market is highly fragmented with the precence of major players like York Wall Coverings Inc., Brewster Home Fashion LLC, F. Schumacher & Co, AS Creation Tapeten AG, and Sangetsu Corporation. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In May 2023, Asian Paints announced the launch of the homes studio in Chennai and the 2023 collection for home decor. The studio offers a garden selection of fabrics, wallpapers, bedding, and rugs.

In August 2022, Sanderson Design Group, one of the luxury interior designs and furnishings firms, announced a new partnership with Disney. The Group's Sanderson brand will be permitted to manufacture wallpapers and textiles based on a wide range of Disney Classic properties under the terms of the licensing arrangement.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Trends of Aesthetics

- 5.1.2 High Demand for Non-woven Wallpapers

- 5.2 Market Challenges

- 5.2.1 Stringent Regulations and High Costs

6 MARKET SEGMENTATION

- 6.1 By Wallpaper Type

- 6.1.1 Vinyl Wallpaper

- 6.1.2 Non-woven Wallpaper

- 6.1.3 Paper-based Wallpaper

- 6.1.4 Fabric Wallpaper

- 6.1.5 Other Wallpaper Types

- 6.2 By Appliaction

- 6.2.1 Commercial

- 6.2.2 Non-commercial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 York Wall Coverings Inc.

- 7.1.2 Brewster Home Fashion LLC

- 7.1.3 F. Schumacher & Co

- 7.1.4 AS Creation Tapeten AG

- 7.1.5 Sangetsu Corporation

- 7.1.6 Erismann & Cie. GmbH

- 7.1.7 Laura Ashley Holdings PLC

- 7.1.8 Grandeco Wallfashion Group

- 7.1.9 Sanderson Design Group PLC

- 7.1.10 Tapetenfabrik Gebr. Rasch GmbH & Co. KG

- 7.1.11 LEN-TEX Corporation

- 7.1.12 Asian Paints Ltd

- 7.1.13 Gratex Industries Ltd