|

市場調查報告書

商品編碼

1445945

紅外線攝影機 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)IR Camera - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

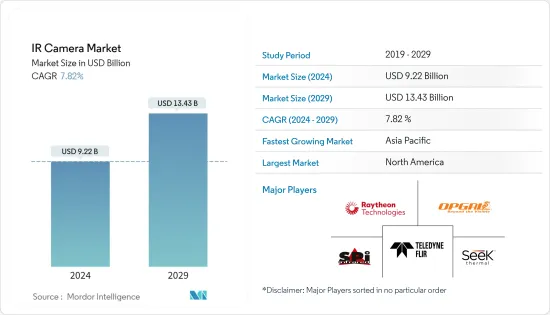

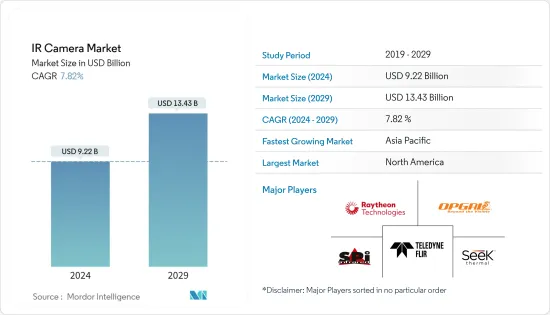

紅外線攝影機市場規模預計到 2024 年為 92.2 億美元,預計到 2029 年將達到 134.3 億美元,在預測期內(2024-2029 年)CAGR為 7.82%。

主要亮點

- 隨著未來對先進駕駛輔助系統(ADAS) 的需求不斷成長以及對自動駕駛汽車的投資,紅外線攝影機預計將在車輛中廣泛採用。各種應用對監視的需求越來越大,包括與軍事和國防、能源和商業空間相關的應用。太陽能越來越受歡迎,能源使用在全球自然資源管理策略中發揮至關重要的作用。良好的安全性至關重要,因為太陽能越來越受歡迎,而且太陽能板是一種昂貴而脆弱的商品。

- 軍隊對持續嚴格監控的需求日益成長,可能為政府使用這些解決方案提供機會。世界各國政府已大量部署無人機鏡頭,覆蓋約 100 公里的區域。

- 工業4.0推動了機器人等技術的發展,在工業自動化中發揮著至關重要的作用,工業中的許多核心操作都由機器人管理。 InGaAs 相機提供了新的應用,例如視覺引導機器人和自動屠宰。這些視覺引導機器人是紅外線成像儀的組合,可以發現並拾取箱子中的隨機零件,然後攝影機分析每個零件的方向並將它們放在傳送帶上。

- 短波長紅外線(SWIR)在消費和汽車等終端用戶領域越來越受歡迎,但它需要更多的技術進步才能使其價格合理。 ADAS 和 AV 將使用利用紅外線波長的不同技術。這些技術提供了免費的資訊類型,以提供冗餘並提高系統可靠性。對基於攝影機的便利功能的需求不斷成長,尤其是在一些車輛中,預計將推動汽車行業對紅外線攝影機的需求。

- COVID-19 對市場產生了重大影響。由於 COVID-19 被宣佈為大流行病,供應鏈經歷了相當大的中斷。由於製造業活動低迷,公司傾向於取消維護,從而導致價格上漲。大流行後,大多數最終用戶行業擴大採用紅外線攝影機,對市場的成長產生了積極影響。

紅外線攝影機市場趨勢

冷卻探測器將佔據重要市場佔有率

- 最靈敏的紅外線攝影機使用冷卻探測器,場景溫度變化很小。由於黑體物理學,它們提供具有高熱對比度的圖像,特別是在光譜的中波紅外線 (MWIR) 部分。與非製冷紅外線攝影機相比,增強的熱差使其更容易識別目標。

- 冷卻紅外線熱像儀能夠有效地執行光譜過濾以揭示特徵並進行測量,這是影響其採用的關鍵因素之一,而這是非冷卻熱像儀無法實現的。具有冷卻探測器的紅外線攝影機可提供更好的影像品質。與具有非冷卻偵測器類型的熱像儀相比,具有冷卻偵測器類型的紅外線熱像儀具有許多優勢。

- 製冷紅外線探測器技術的先進發展促使了各種紅外線遙感儀器的快速成長,例如高光譜遙感、空間成像和監視以及環境應用。由於低溫冷卻偵測器的高靈敏度,紅外線系統已被開發用於對波長高達 25 μm 的各種光譜帶進行成像。 2022會計年度,印度國防設備出口額達到1,282億印度盧比,創同期最高水平,因而帶動了軍事和國防工業對紅外線攝影機的需求。

- 隨著技術的進步,該公司一直在開發新的創新方法來推出新型紅外線攝影機。例如,2022 年 4 月,Teledyne FLIR 推出了 RS6780 遠端輻射紅外線攝影機,專為所有條件下的距離追蹤、目標特徵、戶外測試和科學應用而設計。 RS6780 透過將全功能輻射紅外線攝影機密封在 IP65 等級外殼內以保護其免受惡劣天氣的影響,實現精確的遠端測量和追蹤應用。重要參與者的此類開發和創新正在推動對紅外線攝影機的需求。

北美將見證顯著成長

- 紅外線成像對武裝部隊(主要是陸軍、海軍和空軍)來說是一個福音,因為它具有晝夜工作能力和在所有天氣條件下都能良好執行的能力。陸軍和海軍使用紅外線攝影機進行邊境監視和執法。它們也用於海軍部門的船舶防撞和導引系統。

- 在航空業,它們大大降低了在低光源和夜間條件下飛行的風險。航空業也利用它們來識別、定位和瞄準敵軍。最近,它也被納入民航,用於飛機健康監測。

- 政府舉措,例如先進製造合作夥伴關係,旨在促使產業、各大學和聯邦政府投資新興自動化技術,將增加機器視覺系統的產量。

- 例如,2022 年 5 月,Teledyne FLIR Defense 向美國陸軍交付了熱成像系統。 FWS-I 系統是一種電池供電的熱成像系統,可安裝在不同的單兵武器系統上,以便在各種天氣和照明條件下為士兵提供紅外線影像。該系統還將使士兵能夠透過霧、灰塵和煙霧看到東西。該公司將在馬薩諸塞州比爾里卡和加州戈利塔的工廠生產 FWS-I 裝置。

紅外線攝影機產業概況

紅外線攝影機市場本質上競爭非常激烈。高額的研發費用、合作夥伴關係和收購是該地區公司為維持激烈競爭而採取的主要成長策略。市場主要參與者包括 FLIR Systems Inc.、SPI Infrared、Opgal Optronics Industries Ltd.、Raytheon Company、Seek Thermal, Inc.、Fluke Corporation、Testo AG、HGH-Infrared、Teledyne Dalsa、DRS Technologies Inc.、InfraTec GmbH、還有很多。

2022 年 11 月,Teledyne Flir 宣布與位於華盛頓州溫哥華的輔助實境穿戴解決方案開發商 RealWear 建立合作夥伴關係,成為其最新的 Thermal by Flir 合作夥伴。合作夥伴推出了首款完全免持、語音控制的熱像儀模組。 Thermal by FLIR 是一項合作產品開發和行銷計劃,支援 OEM 製造基於 FLIR 熱感攝影機模組的創新產品。

2022年9月,雷神公司與諾斯羅普格魯曼公司合作。兩家公司正在進行 DARPA 項目,以創建神經形態紅外線攝影機技術。 DARPA 選擇了兩家公司來開展一項計劃,生產新的基於事件的紅外線攝影機技術,在視覺環境中傳輸重要資料。雷神公司和諾斯羅普·格魯曼公司分別獲得了 FENCE(基於快速事件的神經形態相機和電子設備)項目第二階段的契約,契約金額分別為 1627 萬美元和 871 萬美元。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭激烈程度

- COVID-19 對紅外線攝影機市場的影響

第 5 章:市場動態

- 市場促進因素

- 各個垂直領域的監控需求不斷成長

- 熱像儀成本逐漸降低

- 市場課題

- 相機功能缺乏準確性和嚴格的進出口法規

第 6 章:市場區隔

- 透過探測器

- 冷卻

- 非製冷

- 依材質

- 鎗

- 矽

- 藍寶石

- 其他材料

- 依類型

- 短波長紅外線

- 中波紅外線

- 長波紅外線

- 依最終用戶垂直領域

- 軍事與國防

- 汽車

- 工業的

- 商業及公共

- 住宅

- 其他最終用戶垂直領域

- 依地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 亞太地區其他地區

- 世界其他地區

- 北美洲

第 7 章:競爭格局

- 公司簡介

- Teledyne FLIR Systems Inc.

- SPI Infrared

- Opgal Optronics Industries Ltd.

- Raytheon Company

- Seek Thermal, Inc.

- Fluke Corporation

- Testo AG

- HGH-Infrared

- Teledyne Dalsa

- DRS Technologies Inc.

- InfraTec GmbH

第 8 章:投資分析

第 9 章:市場的未來

The IR Camera Market size is estimated at USD 9.22 billion in 2024, and is expected to reach USD 13.43 billion by 2029, growing at a CAGR of 7.82% during the forecast period (2024-2029).

Key Highlights

- With the increasing demand for advanced driver assistance systems (ADAS) in the future and investments in autonomous cars, IR cameras are expected to witness significant adoption in vehicles. There is a greater need for surveillance across various applications, including those related to the military and defense, energy, and commercial spaces. Solar energy is becoming increasingly popular, with energy use playing a critical role in the worldwide strategy to manage natural resources. Good security is essential because solar power is gaining popularity and because solar panels are an expensive and delicate commodity.

- An increasing need for continual and rigorous surveillance in the military is likely to provide an opportunity through these solutions for the use of the government. Governments worldwide have already deployed drone cameras in large numbers, covering around 100 kilometers of area.

- Industry 4.0 fueled the development of technologies like robots playing a crucial role in industrial automation, with many core operations in industries being managed by robots. InGaAs cameras offer new applications, such as vision-guided robotics and automated butchering. These vision-guided robots are a combination of IR imagers that finds and picks random parts in a bin, and then a camera analyses the orientation of each part and places them on the conveyor belt.

- Short wavelength infrared, or SWIR, is gaining popularity in end-user sectors like consumer and automotive, but it will need more technological advancement to become reasonably priced. ADAS and AV will use different technologies utilizing infrared wavelengths. These technologies offer complimentary information types to provide redundancy and boost system reliability. The increasing demand for camera-based convenience features, especially in several vehicles, is expected to fuel the demand for IR cameras in the automotive industry.

- COVID-19 impacted the market significantly. The supply chain experienced a considerable disruption owing to COVID-19 being declared a pandemic. Since manufacturing activity was low, companies were tempted to eliminate maintenance, resulting in high prices. Post-pandemic, the increasing adoption of IR cameras by most end-user industries positively impacted the markets' growth.

IR Camera Market Trends

Cooled Detectors to Hold Significant Market Share

- The most sensitive IR cameras, with only tiny variations in scene temperature, use cooled detectors. Due to blackbody physics, they provide images with high thermal contrast, especially in the spectrum's mid-wave infrared (MWIR) portion. Compared to uncooled IR cameras, the enhanced thermal difference makes it easier to identify targets.

- The ability of cooled IR cameras to effectively perform spectrum filtering to reveal features and take measurements that would otherwise be impossible with an uncooled thermal camera is one of the key factors influencing their adoption. IR cameras with cooled detectors offer better image quality. IR cameras with cooled detector types have many advantages over thermal imaging cameras with uncooled detector types.

- Advanced developments in cooled IR detector technology have led to the rapid growth of various IR remote sensing instruments like hyperspectral remote sensing, space imaging & surveillance, and environmental applications. Due to the high sensitivity of cryogenically cooled detectors, IR systems have been developed for imaging various spectral bands with wavelengths up to 25 μm. In the financial year 2022, the export value of defense equipment from India reached 128.2 billion Indian rupees, the highest during the presented period, thus driving the demand for IR cameras in the military and defense industry.

- With the advancing technologies, companies have been developing new and innovative ways to launch new IR cameras. For instance, in April 2022, Teledyne FLIR introduced the RS6780 long-range radiometric IR camera, designed for range tracking, target signature, outdoor testing, and science applications in all conditions. The RS6780 enables precision long-range measurement and tracking applications by combining a full-feature, radiometric IR camera sealed within an IP65-rated enclosure to protect it from the elements. Such developments and innovations by significant players are driving the demand for IR cameras.

North America to Witness Significant Growth

- IR imaging is a boon to the armed forces, primarily the army, navy, and air force, because of its day-night working capability and ability to perform well in all weather conditions. The army and navy use IR cameras for border surveillance and law enforcement. They are also used in ship collision avoidance and guidance systems in the naval sector.

- In the aviation industry, they have significantly mitigated the risks of flying in low light and night conditions. Aviation also uses them to identify, locate, and target enemy forces. Recently, it has also been incorporated into civil aviation for aircraft health monitoring.

- Government initiatives, such as Advanced Manufacturing Partnership, which has been undertaken to make the industry, various universities, and the federal government invest in emerging automation technologies, will increase the production of machine vision systems.

- For instance, in May 2022, Teledyne FLIR Defense delivered thermal imaging systems to US Army. The FWS-I system is a battery-operated thermal imaging system that can be mounted on different individual weapon systems to offer soldiers infrared imagery in all weather and lighting conditions. The system will also enable the soldiers to see through fog, dust, and smoke. The company will manufacture the FWS-I units at facilities in Billerica, Massachusetts, and Goleta, California.

IR Camera Industry Overview

The IR camera market is highly competitive in nature. The high expense on research and development, partnerships, and acquisitions are the prime growth strategies adopted by the companies in the region to sustain the intense competition. Key players in the market are FLIR Systems Inc., SPI Infrared, Opgal Optronics Industries Ltd., Raytheon Company, Seek Thermal, Inc., Fluke Corporation, Testo AG, HGH-Infrared, Teledyne Dalsa, DRS Technologies Inc., InfraTec GmbH, and many more.

In November 2022, Teledyne Flir announced a partnership with RealWear, Vancouver, WA, a developer of assisted reality wearable solutions, as its latest Thermal by Flir collaborator. The partners launched the first fully hands-free, voice-controlled thermal camera module. Thermal by FLIR is a cooperative product development and marketing program that supports OEMs to create innovative products based on Flir's thermal camera modules.

In September 2022, Raytheon Company collaborated with Northrop Grumman. The companies are working on a DARPA program to create neuromorphic IR camera technologies. DARPA has selected two companies to work on a program to produce new event-based IR camera technologies that transmit essential data in visual environments. Raytheon and Northrop Grumman each received contracts for Phase 2 of the FENCE (Fast Event-based Neuromorphic Camera and Electronics) program, with USD 16.27 million and USD 8.71 million awards, respectively.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the IR Camera Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Surveillance Across Various Verticals

- 5.1.2 Gradually Decreasing Costs of Thermal Cameras

- 5.2 Market Challenges

- 5.2.1 Lack of Accuracy in Camera Functionality and Stringent Import/Export Regulations

6 MARKET SEGMENTATION

- 6.1 By Detector

- 6.1.1 Cooled

- 6.1.2 Uncooled

- 6.2 By Material

- 6.2.1 Germanium

- 6.2.2 Silicon

- 6.2.3 Sapphire

- 6.2.4 Other Materials

- 6.3 By Type

- 6.3.1 Short-wavelength IR

- 6.3.2 Medium-wavelength IR

- 6.3.3 Long-wavelength IR

- 6.4 By End-user Vertical

- 6.4.1 Military and Defense

- 6.4.2 Automotive

- 6.4.3 Industrial

- 6.4.4 Commercial & Public

- 6.4.5 Residential

- 6.4.6 Other End-user Vertical

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Rest of Europe

- 6.5.3 Asia Pacific

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 Rest of Asia Pacific

- 6.5.4 Rest of the World

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Teledyne FLIR Systems Inc.

- 7.1.2 SPI Infrared

- 7.1.3 Opgal Optronics Industries Ltd.

- 7.1.4 Raytheon Company

- 7.1.5 Seek Thermal, Inc.

- 7.1.6 Fluke Corporation

- 7.1.7 Testo AG

- 7.1.8 HGH-Infrared

- 7.1.9 Teledyne Dalsa

- 7.1.10 DRS Technologies Inc.

- 7.1.11 InfraTec GmbH