|

市場調查報告書

商品編碼

1445940

檸檬酸鈣 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Calcium Citrate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

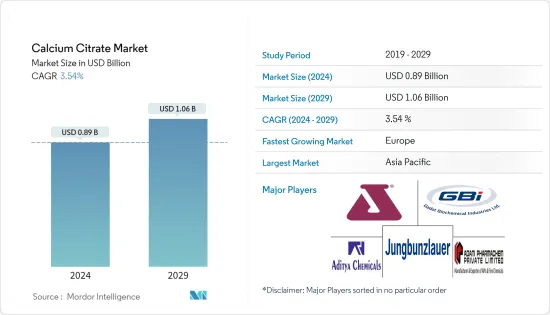

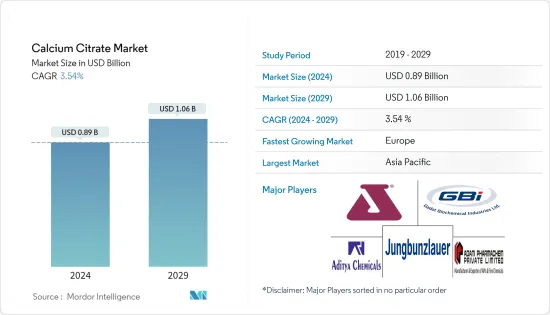

2024年檸檬酸鈣市場規模預計為8.9億美元,預計到2029年將達到10.6億美元,在預測期內(2024-2029年)CAGR為3.54%。

該市場是由其在多個最終用戶行業的不同應用推動的,從其在食品和飲料中作為酸度調節劑、乳化劑和防腐劑的作用,到在藥品中作為利尿劑和化痰劑的作用。檸檬酸鈣工業應用廣泛,大部分地區都有使用。越來越多的千禧世代選擇鈣補充劑。對補充劑和營養素的需求的成長,特別是嬰兒潮一代人群的需求,預計將擴大檸檬酸鈣的市場。檸檬酸鈣主要以粉末形式存在。然而,由於其特性,微粉化粉末出現了顯著的成長。

在已開發國家和發展中國家,消費者購買力的上升和快節奏的生活方式推動了包裝食品的銷售。 《商業標準》的一篇文章稱,人口紅利、電子商務繁榮和經濟成長都可能促使印度包裝食品產業在未來 5-10 年內規模翻倍。在許多包裝食品中,檸檬酸鈣是一種常見的食品添加物。由於健康飲食習慣的趨勢,使用檸檬酸鈣去除包裝中的水分並延長食品保存期限的包裝食品也越來越受歡迎。這可能會推動預測期內檸檬酸鈣市場的成長。

生活方式疾病發病率的不斷上升促使製藥業顯著成長。例如,根據國家投資促進和便利化局發布的報告,到2022年,印度製藥業預計將達到3,720億美元,CAGR為39%。癌症、愛滋病毒或愛滋病以及結核病等疾病的出現激增了開發高效藥物的研發活動,其中檸檬酸鈣被用作藥物製劑開發的利尿劑和化痰劑。預計這些因素將在預測期內促進市場需求。

檸檬酸鈣市場趨勢

對補充劑的需求增加

檸檬酸鈣市場主要依賴極易發生骨損傷和骨折的老化人口。老化或老年人口是全球骨關節保健品製造商最重要的目標群體之一。維持健康的生活方式和預防與年齡相關的骨骼疾病,尤其是老年骨骼疾病,使得消費者為這些補充劑支付高價,因為它們具有健康益處,針對人體特定部位的治療。根據世界銀行資料,2021年,17.04%的人口年齡在65歲以上,而64.72%的人口年齡在15歲至64歲之間。根據世界衛生組織(WHO)的數據,2021年,近2,200萬人處於老年狀態。歐洲和美國有 1400 萬人患有骨質疏鬆症。根據國家醫學圖書館的數據,2021 年,超過 10.33 億人患有骨質疏鬆症。這些令人震驚的數字為所研究的市場帶來了巨大的動力。

越來越多的千禧世代選擇鈣補充劑。女性,尤其是 30 多歲的女性,對維持骨骼健康的鈣補充劑表現出更大的興趣,進一步推動了檸檬酸鈣市場的發展。以檸檬酸鈣為基礎的補充劑的主要技術優勢是其高吸收效率 - 檸檬酸鈣不需要任何額外的膽汁酸(在消化過程中分泌)即可吸收。近年來,市面上出現了各種形式的檸檬酸鈣補充劑,包括片劑、膠囊、咀嚼片、液體和粉末,以應對骨骼退化和骨質疏鬆等疾病,骨關節保健品的需求,如圖所示,將見證可觀的成長率。眾所周知,鈣對骨骼和關節健康有益,是主要的生長促進因子。

亞太地區仍是最大市場

由於中國和印度等主要經濟體,亞太地區是重要的市場。中國仍然是該地區最大的檸檬酸鈣消費國和出口國,國內幾家小型企業以具有競爭力的價格提供多個等級的檸檬酸鈣。多年來,該國生產檸檬酸鈣的新進者數量一直在增加,這反映出市場對該化合物的需求不斷成長。檸檬酸鈣在食品和飲料、製藥和動物飼料等各行業的廣泛應用正在推動該國檸檬酸鈣市場的發展。這些化合物有粉末、固體、液體和顆粒形式,非常適合每個最終用戶產業,促使市場多年來不斷成長。該地區對該化合物作為食品和飲料行業的添加劑和防腐劑有著巨大的潛在需求。對化妝品和個人護理產品的需求不斷成長可能會推動該地區對檸檬酸鈣的需求。

檸檬酸鈣產業概況

檸檬酸鈣市場高度活躍且分散。市場上一些知名的參與者包括 Adani Pharmachem Private Limited、Aditya Chemicals Limited、Gadot Biochemical Industries Ltd、Jungbunzlauer、Jost Chemical 和 Dr. Paul Lohmann GmbH KG。市場上有許多自有品牌,它們共同促進了檸檬酸鈣的生產繁榮,這是促使該行業分散的主要因素之一。產品創新採用高階技術,使產品在吸收和儲存穩定性方面實現高效率,一直是該行業的主要驅動力,並被 Jungbunzlauer 和 Jost Chemical 等主要企業所採用。合作夥伴關係是參與者為獲得市場佔有率而採取的第二常見策略。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場區隔

- 形式

- 微粉

- 粉末

- 顆粒狀

- 應用

- 農業

- 食品與飲品

- 衛生保健

- 其他應用

- 地理

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 義大利

- 英國

- 法國

- 俄羅斯

- 西班牙

- 歐洲其他地區

- 亞太

- 印度

- 中國

- 澳洲

- 日本

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 中東和非洲其他地區

- 北美洲

第 6 章:競爭格局

- 市佔率分析

- 最常用的策略

- 公司簡介

- Adani Pharmachem Private Limited

- Aditya Chemicals Limited

- Dr. Paul Lohmann GmbH KG

- Daffodil Pharmachem Private Limited

- Jungbunzlauer Suisse AG

- Jost Chemical Co.

- Gadot Biochemical Industries Ltd

- Sucroal SA

- Nantong Feiyu Food Technology Co. Ltd

- Panvo Organics Pvt. Ltd

第 7 章:市場機會與未來趨勢

The Calcium Citrate Market size is estimated at USD 0.89 billion in 2024, and is expected to reach USD 1.06 billion by 2029, growing at a CAGR of 3.54% during the forecast period (2024-2029).

The market is driven by its varied application in several end-user industries, ranging from its role as an acidity regulator, emulsifier, and preservative in food and beverage to its role as a diuretic and phlegm agent in pharmaceuticals. Calcium citrate has wide industry applications, and it is being used in most regions. An increasing number of millennials are opting for calcium-based supplements. The growth in the demand for supplements and nutrients, particularly among the baby boomer population, is expected to augment the market for calcium citrate. Calcium citrate is mostly found in powder. However, micronized powder witnessed significant growth due to its properties.

In established and developing countries, the rise in consumer purchasing power and fast-paced lifestyles drive the sales of packaged food products. According to a Business Standard article, the demographic dividend, e-commerce boom, and economic growth may all contribute to India's packed food industry doubling in size over the next 5-10 years. In many packaged food items, calcium citrate is a ubiquitous food additive. The popularity of packaged foods, which use calcium citrate to remove moisture from the packaging and extend the shelf life of food products, has also increased due to trends toward healthier eating habits. This may propel the growth of the calcium citrate market during the forecast period.

The growing incidence of lifestyle diseases has led the pharmaceutical sector to witness significant growth. For instance, according to a report published by the National Investment Promotion & Facilitation Agency, the Indian pharmaceutical sector was expected to reach USD 372 billion by 2022, at a CAGR of 39%. The emergence of diseases such as cancer, HIV or AIDS, and tuberculosis have surged the R&D activities for developing highly efficient drugs where calcium citrate is used as a diuretic and phlegm agent for pharmaceutical formulation development. Such factors are anticipated to foster the demand for the market during the forecast period.

Calcium Citrate Market Trends

Increased Demand for Supplements

The calcium citrate market primarily depends on the aging population that is highly susceptible to bone injuries and fractures. The aging or geriatric population is one of the most significant target segments for global bone and joint health supplement manufacturers. Maintaining a healthy lifestyle and preventing age-related bone diseases, particularly at an older age, is making consumers pay premium prices for these supplements, as they impart health benefits, targeting treatment of a specific segment of the human body. According to World Bank data, in 2021, 17.04% of the population was over 65 years old, while 64.72% were between the ages of 15 and 64. According to the World Health Organization (WHO), in 2021, almost 22 million individuals in Europe and 14 million in the United States had osteoporosis. According to the National Library of Medicine, in 2021, it was observed that more than 1033 million people had osteoporosis. These alarming figures have given significant momentum to the market studied.

An increasing number of millennials are opting for calcium-based supplements. Women, especially in their mid-30s, have shown greater interest in calcium-based supplements to maintain their bone health, further fueling the calcium citrate market. The major technological advantage in favor of calcium citrate-based supplements is their high absorption efficiency - calcium citrate does not require any extra bile acids (secreted during digestion) for its absorption. The market has recently witnessed the emergence of calcium citrate supplements in various forms, including tablets, capsules, chews, liquids, and powders due the diseases such as bone deterioration and osteoporosis, The demand for bone and joint health supplements, as evident from the graph, is set to witness a decent growth rate. As it is well-known for bone and joint health, calcium is a main growth-promoting factor.

Asia-Pacific Remains the Largest Market

The Asia-Pacific region is a prominent market due to major economies such as China and India. China remains the largest consumer and exporter of calcium citrate in the region, with several small domestic players offering calcium citrate in multiple grades at competitive pricing. The number of new entrants producing calcium citrate in the country has been increasing over the years, which reflects the growing demand for the compound in the market. The broad spectrum of applications of calcium citrate in various industries, such as food and beverages, pharmaceutical, and animal feed, is driving the market for calcium citrate in the country. The compounds' availability in powder, solid, liquid, and granular forms suits well with every end-user industry, leading to market growth over the years. The region offers huge potential demand for the compound as an additive and preservative in the food and beverage industry. The increasing demand for cosmetics and personal care products is likely to propel the demand for calcium citrate in the region.

Calcium Citrate Industry Overview

The calcium citrate market is highly dynamic and fragmented. Some of the prominent players in the market include Adani Pharmachem Private Limited, Aditya Chemicals Limited, Gadot Biochemical Industries Ltd, Jungbunzlauer, Jost Chemical, and Dr. Paul Lohmann GmbH KG. The market exhibits many private-label brands that collectively contribute to the production boom of calcium citrate, which is one of the major contributing factors to the fragmented nature of the industry. Product innovation, using high-end technology that results in high efficiency of the product in terms of absorption and storage stability, has been the major driving force for the industry, adopted by key players like Jungbunzlauer and Jost Chemical. Partnership is the second-most common strategy players are adopting to gain market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Form

- 5.1.1 Micronized Powder

- 5.1.2 Powder

- 5.1.3 Granular

- 5.2 Application

- 5.2.1 Agriculture

- 5.2.2 Food and Beverage

- 5.2.3 Healthcare

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 Italy

- 5.3.2.3 United Kingdom

- 5.3.2.4 France

- 5.3.2.5 Russia

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Most Adopted Strategies

- 6.3 Company Profiles

- 6.3.1 Adani Pharmachem Private Limited

- 6.3.2 Aditya Chemicals Limited

- 6.3.3 Dr. Paul Lohmann GmbH KG

- 6.3.4 Daffodil Pharmachem Private Limited

- 6.3.5 Jungbunzlauer Suisse AG

- 6.3.6 Jost Chemical Co.

- 6.3.7 Gadot Biochemical Industries Ltd

- 6.3.8 Sucroal SA

- 6.3.9 Nantong Feiyu Food Technology Co. Ltd

- 6.3.10 Panvo Organics Pvt. Ltd