|

市場調查報告書

商品編碼

1445936

粉塵控制系統和抑制化學品 - 市場佔有率分析、行業趨勢與統計、成長預測(2024 - 2029 年)Dust Control Systems And Suppression Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

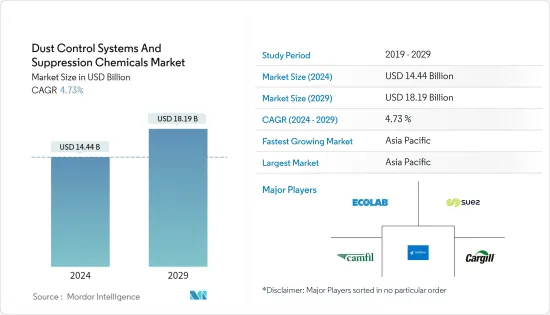

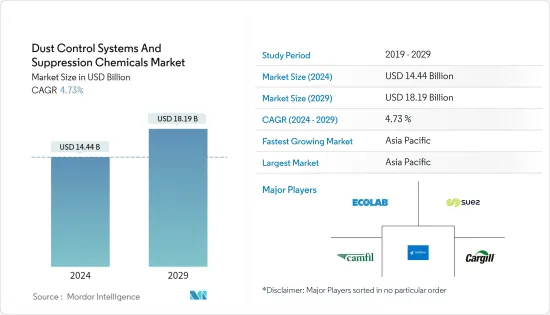

粉塵控制系統和抑塵化學品市場規模預計到 2024 年為 144.4 億美元,預計到 2029 年將達到 181.9 億美元,在預測期(2024-2029 年)CAGR為 4.73%。

COVID-19 大流行對市場產生了負面影響。然而,市場已達到疫情前的水平,預計在預測期內將穩定成長。

主要亮點

- 短期內,推動市場成長的主要因素是亞太地區建築和基礎設施的成長以及監管合規性的提高。

- 食品和製藥行業的除塵問題預計將阻礙市場的成長。

- 亞太地區主導了全球市場,最大的消費來自中國和印度。

粉塵控制系統和抑制化學品市場趨勢

建築業主導市場

- 粉塵控制措施適用於任何可能因粉塵穿過景觀或空氣而造成空氣和水污染的建築工地。

- 根據HSE統計(英國政府健康與安全執行局統計),全球每年有超過500名建築工人因接觸矽塵而死亡。因此,監管有害粉塵排放變得非常重要,在過去幾年中對粉塵控制系統和抑制化學物質產生了巨大的需求。

- 與傳統工藝相比,抑塵解決方案為建築應用提供了明顯的優勢和豐厚的效益,包括在極端氣候條件下的簡單應用和長效保護。

- 目前,最先進的粉塵控制解決方案可以解決建築工地和所有類型道路的一系列粉塵控制問題,從主要公路和高速公路到運輸、工業和農村道路、停機坪、硬地區域和防水路面。

- 氯化鈣是建築業使用的主要抑塵化學品。此外,建築業使用聚合物乳液來穩定運輸和通路。

- 美國擁有龐大的建築業,僱用了超過 760 萬名員工。根據美國人口普查局的數據,2022 年建築業價值為 17,929 億美元,比 2021 年的 16,264 億美元成長 10.2%。

- 此外,根據美國人口普查局的進一步統計,2022年美國新建建築年價值為16,575.90億美元,而2021年為14,998.22億美元。此外,美國每年的住宅建設量為2022 年,該國非住宅建築年價值為8,491.64 億美元,而2021 年為7,406.45 億美元。2022 年,該國非住宅建築年價值為8,084.27 億美元,而2021 年為7,591.77 億美元,從而減少了短期內研究市場消費情況。

- 此外,越來越多的外國公司在亞太地區存在,創造了對新辦公室、建築物、生產廠房等的需求,從而推動了該地區的建築業。

- 這些因素可能有助於建築業主導市場。

中國將主導亞太市場

- 中國建築業正經歷恆大債務危機,預計未來一段時間將會下滑。

- 過去幾年,中國一直致力於減少煤炭消耗,主要是出於環境問題和氣候目標。

- 政府採取這項措施是為了應對由於國內產量減少而導致該國煤炭進口增加的情況。

- 國家新批煤礦分佈在新疆、內蒙古、山西、陝西等地區,是國家煤炭基地建設策略的支撐。

- 這些新礦井計劃用於擴建現有煤礦。預計該國對開發和營運此類新礦山的粉塵控制系統和抑制化學品的需求將會很高。

- 該國的人口結構預計將有利於住房和商業建築活動。不斷成長的人口引發了公共和私營部門對經濟適用住宅區的投資。中國政府已主動向40個重點城市贈送650萬套政府補貼租賃住房,預計可容納約1,300萬人。

- 此外,中國政府還推出了大規模的建設計劃,其中包括為未來十年內2.5億農村人口向新的特大城市轉移作出規定,為未來建築材料在建築施工中的各種應用創造了廣闊的空間增強建築性能的活動。香港房屋當局推出多項措施推動廉租房建設。官員的目標是在 2030 年之前的 10 年內提供 301,000 套公共住宅。這些因素預計將促進該國的建築業發展,從而可能支持未來所研究的市場需求。

- 因此,各種最終用戶行業的成長正在推動各種應用的粉塵控制系統和抑制化學品的需求。

粉塵控制系統和抑制化學品行業概述

抑塵化學品市場由極少數參與者部分整合。其他一些抑塵系統市場的知名企業包括嘉吉公司、SUEZ、Ecolab、Camfil 和 Donaldson Company Inc.(排名不分先後)。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 促進要素

- 亞太地區建築和基礎設施的成長

- 提高監理合規性

- 其他司機

- 限制

- 食品醫藥產業的除塵問題

- 其他限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭激烈程度

第 5 章:市場區隔(市場價值規模)

- 化學類型

- 木質素磺酸鹽

- 氯化鈣

- 氯化鎂

- 瀝青乳液

- 油乳液

- 聚合物乳液

- 其他化學品類型

- 系統類型

- 乾採

- 濕式抑制

- 最終用戶產業

- 礦業

- 建造

- 食品與飲品

- 石油天然氣和石化

- 製藥

- 其他最終用戶產業

- 地理

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太

第 6 章:競爭格局

- 併購、合資、合作與協議

- 市佔率(%)**/排名分析

- 領先企業採取的策略

- 公司簡介

- Chemical Providers

- ADM

- Benetech Inc.

- Borregaard

- Cargill Incorporated

- Chemtex Speciality Limited

- Evonik Industries AG

- GelTech Solutions

- Hexion

- Quaker Houghton (Quaker Chemical Corporation)

- Shaw Almex Industries Ltd

- SUEZ

- Ecolab

- System Providers

- BossTek

- Camfil

- CW Machine Worx

- Donaldson Company Inc.

- DSH Systems Ltd

- Duztech AB

- Nederman Holding AB

- SLY Inc.

- The ACT Group

- Chemical Providers

第 7 章:市場機會與未來趨勢

- 增加對化工產業的投資

- 綠色粉塵治理產品的出現

The Dust Control Systems And Suppression Chemicals Market size is estimated at USD 14.44 billion in 2024, and is expected to reach USD 18.19 billion by 2029, growing at a CAGR of 4.73% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market. However, the market is reaching pre-pandemic levels and is expected to grow steadily during the forecast period.

Key Highlights

- Over the short term, the major factors driving the growth of the market are the growth in construction and infrastructure in Asia-Pacific and the increasing regulatory compliances.

- Dust collection problems in the food and pharmaceutical industry are expected to hinder the market's growth.

- Asia-Pacific dominated the market worldwide, with the largest consumption coming from China and India.

Dust Control Systems & Suppression Chemicals Market Trends

Construction Industry to Dominate the Market

- Dust control measures are applicable to any construction site with potential air and water pollution from dust traveling across the landscape or through the air.

- According to HSE statistics (the U.K. government's Health and Safety Executive statistics), every year, more than 500 construction workers die from exposure to silica dust worldwide. Hence, it became important to regulate hazardous dust emissions, creating a significant demand for dust control systems and suppression chemicals over the last few years.

- Compared to conventional processes, dust suppression solutions offer distinct advantages and lucrative benefits for construction applications, including easy application and long-life protection during extreme climatic conditions.

- Currently, there are state-of-the-art dust control solutions that can solve a range of dust control problems at construction sites and on all types of roads, from major highways and freeways to haulage, industrial, and rural roads, tarmacs, hardstand areas, and water-repellent pavements.

- Calcium chloride is the major dust control suppression chemical used in the construction industry. In addition, the construction industry uses polymer emulsions for stabilizing haul and access roads.

- The United States boasts a colossal construction sector that employs over 7.6 million employees. According to U.S. Census Bureau, in 2022, the value of construction was USD 1,792.9 billion, a 10.2% increase over the USD 1,626.4 billion spent in 2021.

- Further, as per further statistics generated by the U.S. Census Bureau, the annual value for new construction in the United States accounted for USD 1,657,590 million in 2022, compared to USD 1,499,822 million in 2021. Moreover, the annual residential construction in the United States was valued at USD 849,164 million in 2022, compared to USD 740,645 million in 2021. The annual value of non-residential construction put in place in the country was valued at USD 808,427 million in 2022, compared to USD 759,177 million in 2021, thereby decreasing the consumption of the market studied in the short term.

- Moreover, the increasing presence of foreign companies in the Asia-Pacific region has created a demand for new offices, buildings, production houses, etc., thereby driving the construction sector in the region.

- Such factors are likely to help the construction industry dominate the market.

China to Dominate the Asia-Pacific Market

- China's construction industry has been going through the Evergrande debt crisis, and it is expected to decline for a short while in the future.

- The country has been focusing on reducing coal consumption for the past few years, mainly due to environmental concerns and climate goals.

- The government took this step in accordance with the growing coal imports of the country due to the reduction in domestic production.

- The new coal mines approved in the country are located in the regions of Xinjiang, Inner Mongolia, Shanxi, and Shaanxi, supported by the national strategy toward consolidating the output at dedicated coal production bases.

- These new mines are planned for the expansion of the existing collieries. The country is expected to witness high demand for dust control systems and suppression chemicals for developing and operating such new mines.

- The country's demographics are expected to favor housing and commercial construction activities. The growing population has triggered investments in affordable residential colonies by the public and private sectors. China's government has taken the initiative to gift 40 key cities with 6.5 million government-subsidized rental homes that are supposed to accommodate around 13 million people.

- Additionally, the Chinese government has rolled out massive construction plans, which include making provisions for the movement of 250 million rural people to its new megacities over the next ten years, creating a major scope for construction materials used in the future in various applications during construction activities to enhance the building properties. The housing authorities of Hong Kong launched several measures to push start the construction of low-cost housing. The officials aim to provide 301,000 public housing units in 10 years till 2030. These factors are expected to raise the construction industry in the country and thereby are likely to support the demand for the market studied in the future.

- Thus, growth in various end-user industries is boosting the demand for dust control systems and suppression chemicals for various applications.

Dust Control Systems & Suppression Chemicals Industry Overview

The dust suppression chemicals market is partially consolidated among very few players. Some of the other prominent players in the dust suppression systems market include Cargill Incorporated, SUEZ, Ecolab, Camfil, and Donaldson Company Inc. (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growth in Construction and Infrastructure in Asia-Pacific

- 4.1.2 Increase in Regulatory Compliances

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Dust Collection Problems in Food and Pharmaceutical Industry

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Chemical Type

- 5.1.1 Lignin Sulfonate

- 5.1.2 Calcium Chloride

- 5.1.3 Magnesium Chloride

- 5.1.4 Asphalt Emulsions

- 5.1.5 Oil Emulsions

- 5.1.6 Polymeric Emulsions

- 5.1.7 Other Chemical Types

- 5.2 System Type

- 5.2.1 Dry Collection

- 5.2.2 Wet Suppression

- 5.3 End-user Industry

- 5.3.1 Mining

- 5.3.2 Construction

- 5.3.3 Food and Beverage

- 5.3.4 Oil and Gas and Petrochemical

- 5.3.5 Pharmaceutical

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chemical Providers

- 6.4.1.1 ADM

- 6.4.1.2 Benetech Inc.

- 6.4.1.3 Borregaard

- 6.4.1.4 Cargill Incorporated

- 6.4.1.5 Chemtex Speciality Limited

- 6.4.1.6 Evonik Industries AG

- 6.4.1.7 GelTech Solutions

- 6.4.1.8 Hexion

- 6.4.1.9 Quaker Houghton (Quaker Chemical Corporation)

- 6.4.1.10 Shaw Almex Industries Ltd

- 6.4.1.11 SUEZ

- 6.4.1.12 Ecolab

- 6.4.2 System Providers

- 6.4.2.1 BossTek

- 6.4.2.2 Camfil

- 6.4.2.3 CW Machine Worx

- 6.4.2.4 Donaldson Company Inc.

- 6.4.2.5 DSH Systems Ltd

- 6.4.2.6 Duztech AB

- 6.4.2.7 Nederman Holding AB

- 6.4.2.8 SLY Inc.

- 6.4.2.9 The ACT Group

- 6.4.1 Chemical Providers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Investments in the Chemical Sector

- 7.2 Emergence of Green Products for Dust Control