|

市場調查報告書

商品編碼

1445874

BYOD - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)BYOD - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

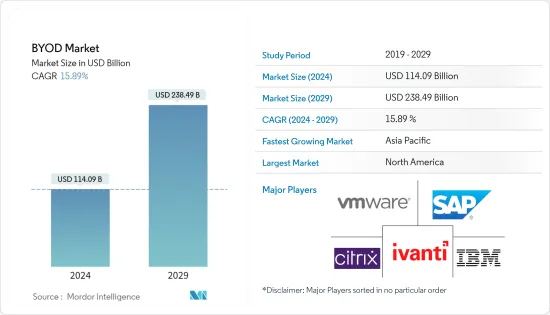

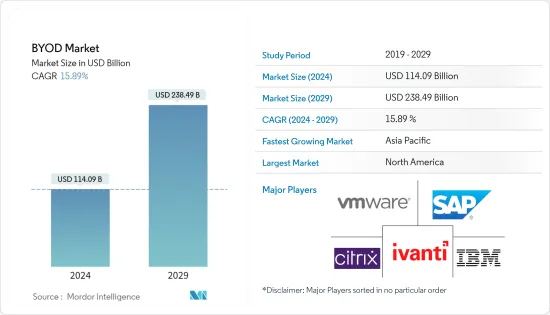

BYOD市場規模預計到2024年將達到1,140.9億美元,預計到2029年將達到2,384.9億美元,在預測期內(2024-2029年)CAGR為15.89%。

主要亮點

- BYOD 市場的主要驅動力之一是為組織節省成本。 BYOD 消除了公司為員工購買和維護設備的需要,從而降低了硬體成本和相關費用。相反,員工需要承擔自己設備的費用。

- 發展中經濟體的 BYOD 產業是由電信公司提供的 4G 和 5G 等高速服務所推動的。由於智慧型手機需求的成長,BYOD 文化得到了擴展。愛立信預計,從 2019 年到 2027 年,全球 5G 用戶數量預計將分別從超過 1,200 萬增加到超過 40 億。

- 智慧型裝置的日益普及和普及極大地推動了 BYOD 市場的發展。 BYOD 是指允許員工使用其個人裝置(例如智慧型手機、平板電腦和筆記型電腦)執行與工作相關的任務和存取公司網路的策略。智慧型設備不斷發展,功能、處理能力、儲存容量和連接選項均已改進。

- BYOD 政策使員工能夠靈活地選擇工作方式和地點。員工可以在傳統辦公時間之外或使用個人設備在遠端位置完成工作任務。這種靈活性有助於更好地平衡工作與生活並提高員工滿意度。

- 安全問題和政府合規要求可能會限制 BYOD 市場。當員工從個人裝置存取公司資料和網路時,BYOD 會帶來潛在的安全風險。組織需要實施強大的安全措施來保護敏感資訊,例如客戶資料、智慧財產權和機密業務資料。未能充分保護資料可能會導致資料外洩、聲譽損失和法律後果。

- 這場大流行迫使全球許多組織突然轉向遠距工作。隨著員工在家工作,對 BYOD 政策的需求激增。員工需要存取公司資源並遠端協作,使用個人設備成為實用的解決方案。這加速了 BYOD 的採用,以實現遠端工作並保持業務連續性。 Bitglass 的一項研究表明,由於 COVID-19 大流行,近 85% 的組織已經允許合作夥伴和員工使用 BYOD 環境。

自帶設備 (BYOD) 市場趨勢

智慧型設備滲透率的提高預計將推動市場成長

- 智慧型設備普及率的不斷提高預計將推動 BYOD 市場的發展。連網設備的成長擴大了員工可以帶入工作場所的設備範圍。除了智慧型手機和平板電腦之外,員工還可能攜帶支援物聯網 (IoT) 的設備,例如智慧型手錶、健身追蹤器和其他穿戴式裝置。這種設備多樣性為員工使用設備執行與工作相關的任務創造了新的機會,進一步推動了 BYOD 市場的發展。這種對個人設備的偏好推動了對 BYOD 策略的需求。

- 據思科系統公司稱,到 2022 年,北美地區透過穿戴式裝置採用的 5G 連接數量最多。在北美,4.39 億連接數比 2017 年連接到 4G 網路的人數增加了 2.22 億。在北美和亞太地區,2022 年穿戴式設備約佔全球穿戴式 5G 連接數的 70%。

- BYOD 對於組織而言具有成本效益,因為它減少了購買和維護公司發放的員工設備的需求。相反,員工使用自己的設備,從而降低了組織的硬體和維護成本。這種節省成本的方式鼓勵組織採用 BYOD 政策。

- 此外,中國、印度和巴西等新興國家不斷成長的行動用戶群推動了BYOD政策的採用,提高了工作效率和營運靈活性。根據思科的報告,採用 BYOD 政策的企業平均每年為每位員工節省 350 美元。此外,反應性計畫可以將每位員工每年節省的成本提高到 1,300 美元。

- 員工經常發現使用個人設備執行與工作相關的任務更方便。他們可以在個人活動和工作活動之間無縫過渡,從而提高生產力。員工還可以靈活地使用自己喜歡的設備在任何地方工作,從而增強工作與生活的平衡。

- 允許員工使用設備進行工作可以提高工作滿意度。員工欣賞 BYOD 政策提供的靈活性和自主權,這可以提高員工士氣和留任率。

- 智慧型設備的不斷進步,例如處理能力的提高、儲存容量的增加和連接性的增強,使它們更有能力處理與工作相關的任務。隨著智慧型裝置變得更加強大和功能豐富,員工可以完成許多工作功能,進一步推動 BYOD 市場的發展。

預計北美將佔據重要的市場佔有率

- 北美 BYOD 市場多年來經歷了顯著成長。該地區擁有大量精通技術的個人和強大的企業影響力,因此很快就接受了 BYOD 政策。

- 北美擁有強大的技術基礎設施,包括高速網路連接和廣泛的蜂窩網路覆蓋範圍。這些因素有助於將個人設備無縫整合到工作環境中,使員工能夠從自己的裝置存取公司網路和應用程式。

- 北美的許多組織都實施了 BYOD 政策,以充分利用員工自有設備的優勢。這種趨勢在 IT、金融、醫療保健和專業服務領域尤其普遍。企業越來越認知到 BYOD 的潛在好處,包括提高生產力、降低成本和提高員工滿意度。

- 隨著向虛擬化和基於雲端的環境的轉變,BYOD 設備使機構能夠移動監控和追蹤線上登入、活動和交互,這有助於保持合規性並確保員工遵守公司政策。這些服務也使機構能夠透過 BYOD 部署簡化員工互動並提高績效。此外,BYOD 設備還提供了多重身份驗證的機會。

- 該地區高度流動的勞動力促進了北美 BYOD 市場的成長。隨著遠距工作和靈活的工作安排變得越來越普遍,員工需要靈活地使用自己的設備來執行與工作相關的任務。 BYOD 使員工能夠在行動中保持聯繫並提高工作效率。

- 美國政府組織(包括國防部門)的員工擴大採用 BYOD 方法。 2022 年,陸軍在試點計畫中觀察到顯著的作戰優勢後,擴大了 BYOD 政策。該試點計劃由國民警衛隊領導,包括徹底的安全測試。陸軍實施的技術滿足了功能要求。它接受了作戰測試和評估總監以及陸軍威脅系統管理辦公室的廣泛網路安全紅隊和測試。

自帶設備 (BYOD) 產業概述

BYOD 市場高度分散,主要參與者包括 VMware Inc.、Citrix Systems Inc.、IBM Corporation、MobileIron Inc.(Ivanti.) 和 SAP SE。市場參與者正在採取合作夥伴關係和收購等策略來增強其產品供應並獲得永續的競爭優勢。

2022 年5 月,Citrix 宣布與Microsoft 合作推出即將推出的產品,該產品將Citrix 的高清用戶體驗(HDX) 技術、強大的IT 策略控制和生態系統靈活性與全球首款雲端PC Windows 365 相結合,為IT 管理員提供簡化 Citrix 使用者授權和員工,透過 Microsoft Endpoint Manager 和 windows365.microsoft.com 無縫過渡到 Citrix 用戶端。

2022年5月,埃森哲和SAP推出了一項新的協作服務,以協助主要組織遷移到雲端並提供持續創新。新的協作產品將 RISE 與 SAP 解決方案以及安全編排、自動化和回應 (SOAR) 與 Accenture 服務結合,並透過其他功能進一步增強。這些功能包括埃森哲廣泛的轉型服務套件,包括客製化的雲端解決方案和專有的智慧工具。這些服務透過整合即服務模式提供,提供全面且客製化的方法來滿足客戶的獨特需求。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

- 評估 COVID-19 對市場的影響

第 5 章:市場動態

- 市場促進因素

- 提高智慧型設備的滲透率

- 提高員工生產力和滿意度

- 市場限制

- 安全問題和政府合規性

第 6 章:市場區隔

- 依部署

- 本地部署

- 雲

- 依最終用戶垂直領域

- 零售

- 衛生保健

- 政府

- 能源和公用事業

- 汽車

- 其他最終用戶垂直領域

- 依地理

- 北美洲

- 歐洲

- 亞太

- 拉丁美洲

- 中東和非洲

第 7 章:競爭格局

- 公司簡介

- VMware Inc.

- Citrix Systems Inc.

- IBM Corporation

- MobileIron Inc.(Ivanti.)

- SAP SE

- BlueBOX IT (Lookout)

- Cisco Systems Inc.

- Divide (Google LLC)

- Hewlett-Packard Company

- Alcatel-Lucent Enterprise SA ( Nokia)

- Oracle Corporation

- BlackBerry Limited

- Tata Consultancy Services Limited

- Verizon Communicatiomns

第 8 章:投資分析

第 9 章:市場機會與未來趨勢

The BYOD Market size is estimated at USD 114.09 billion in 2024, and is expected to reach USD 238.49 billion by 2029, growing at a CAGR of 15.89% during the forecast period (2024-2029).

Key Highlights

- One of the primary drivers of the BYOD market is cost savings for organizations. BYOD eliminates the need for companies to purchase and maintain devices for employees, reducing hardware costs and associated expenses. Instead, employees bear the cost of their own devices.

- The BYOD industry in developing economies is driven by high-speed services like 4G and 5G provided by telecom firms. BYOD culture has expanded due to the rise in smartphone demand. According to Ericsson, 5G subscriptions are forecast to increase globally from 2019 to 2027, from over 12 million to over 4 billion respectively.

- The increasing adoption and penetration of smart devices have significantly driven the BYOD market. BYOD refers to a policy that allows employees to use their personal devices, such as smartphones, tablets, and laptops, for work-related tasks and accessing corporate networks. Smart devices continue to evolve with improved features, processing power, storage capacity, and connectivity options.

- BYOD policies enable employees to have flexibility in how and where they work. Employees can complete work tasks outside of traditional office hours or from remote locations with their personal devices. This flexibility can contribute to better work-life balance and employee satisfaction.

- Security concerns and government compliance requirements can restrain the BYOD market. BYOD introduces potential security risks as employees access corporate data and networks from their personal devices. Organizations need to implement robust security measures to protect sensitive information, such as client data, intellectual property, and confidential business data. Failure to adequately secure data can lead to data breaches, loss of reputation, and legal consequences.

- The pandemic necessitated a sudden shift to remote work for many organizations worldwide. With employees working from home, the demand for BYOD policies surged. Employees needed to access corporate resources and collaborate remotely, and using personal devices became a practical solution. This accelerated the adoption of BYOD to enable remote work and maintain business continuity. According to a Bitglass study, due to the COVID-19 pandemic, almost 85% of organizations already permit BYOD environments for partners and workers.

Bring Your Own Device (BYOD) Market Trends

Increasing Smart Devices Penetration is Expected to Drive the Market Growth

- The increasing smart device penetration is expected to drive the BYOD market. The growth of connected devices expands the range of devices employees can bring into the workplace. In addition to smartphones and tablets, employees may bring the Internet of Things (IoT)-enabled devices such as smartwatches, fitness trackers, and other wearable devices. This device diversity creates new opportunities for employees to use their devices for work-related tasks, further driving the BYOD market. This preference for personal devices drives the demand for BYOD policies.

- According to Cisco Systems, In 2022, North America had the most 5G connections adopted through wearable devices. In North America, the 439 million connections represented an increase of 222 million compared to the number of individuals connected to 4G networks in 2017. In North America and Asia Pacific, wearables accounted for around 70% of global wearable 5G connectivity in 2022.

- BYOD can be cost-effective for organizations as it reduces the need to purchase and maintain company-issued employee devices. Instead, employees use their own devices, reducing hardware and maintenance costs for the organization. This cost-saving aspect encourages organizations to adopt BYOD policies.

- Furthermore, the growing mobile subscriber base in emerging countries, such as China, India, and Brazil, has been propelling the adoption of BYOD policies, enhancing work efficiency and flexibility in operations. According to a Cisco report, enterprises with a BYOD policy save, on average, USD 350 per year per employee. Moreover, reactive programs can boost these savings to USD 1,300 per year per employee.

- Employees often find using their personal devices for work-related tasks more convenient. They can seamlessly transition between personal and work activities, increasing productivity. Employees also have the flexibility to work from anywhere using their preferred devices, enhancing work-life balance.

- Allowing employees to use their devices for work can increase job satisfaction. Employees appreciate the flexibility and autonomy that BYOD policies offer, which can lead to improved employee morale and retention.

- The constant advancements in smart devices, such as improved processing power, increased storage capacity, and enhanced connectivity, make them more capable of handling work-related tasks. As smart devices become more powerful and feature-rich, employees can accomplish many work functions, further driving the BYOD market.

North America is Expected to Hold Significant Market Share

- The North America BYOD market has experienced significant growth over the years. With a large population of tech-savvy individuals and a strong corporate presence, the region has quickly embraced BYOD policies.

- North America has a robust technological infrastructure, including high-speed Internet connectivity and widespread cellular coverage. These factors contribute to the seamless integration of personal devices into work environments, enabling employees to access corporate networks and applications from their own devices.

- Many organizations in North America have implemented BYOD policies to leverage the benefits of employee-owned devices. This trend is particularly prevalent in the IT, finance, healthcare, and professional services sectors. Enterprises are increasingly recognizing the potential benefits of BYOD, including enhanced productivity, reduced costs, and improved employee satisfaction.

- With the shift to virtualized and cloud-based environments, BYOD devices have enabled institutions to mobile monitor and track online logins, activities, and interactions, which helps maintain compliance and ensure that employees adhere to corporate policies. These services have also enabled institutions to streamline workforce interactions and improve performance through BYOD deployment. Additionally, BYOD devices have provided the opportunity for multiple authentications.

- The region's highly mobile workforce contributes to the growth of the BYOD market in North America. With remote work and flexible work arrangements becoming more prevalent, employees require the flexibility to use their own devices for work-related tasks. BYOD enables employees to stay connected and productive while on the move.

- Government organizations in the United States, including the defense sector, have witnessed growing adoption of the BYOD approach among their employees. In 2022, the Army expanded its BYOD policy after observing significant operational advantages during a pilot program. Led by the National Guard, the pilot program included thorough security testing. The technology implemented by the Army met functional requirements. It underwent extensive cybersecurity red teaming and testing by the Director of Operational Test and Evaluation and the Army's threat systems management office.

Bring Your Own Device (BYOD) Industry Overview

The BYOD market is highly fragmented, with the presence of major players like VMware Inc., Citrix Systems Inc., IBM Corporation, MobileIron Inc.(Ivanti.), and SAP SE. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In May 2022, Citrix announced that it is collaborating with Microsoft on an upcoming offering that combines Citrix's high-definition user experience (HDX) technology, robust IT policy control, and ecosystem flexibility with Windows 365, the world's first Cloud PC, providing IT administrators with streamlined Citrix user licensing and employees with a seamless transition to Citrix clients through Microsoft Endpoint Manager and windows365.microsoft.com.

In May 2022, Accenture and SAP launched a new collaborative service to assist major organizations in migrating to the cloud and delivering continuous innovation. The new collaborative offering combines the RISE with SAP solution and security orchestration, automation, and response (SOAR) with Accenture services and has been further enhanced with additional features. These features include Accenture's extensive suite of transformation services, including customized cloud solutions and proprietary intelligent tools. These services are delivered through an integrated-as-a-service model, providing a comprehensive and tailored approach to meet clients' unique needs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Smart Devices Penetration

- 5.1.2 Enhanced Employee Productivity and Satisfaction

- 5.2 Market Restraints

- 5.2.1 Security Concerns and Government Compliance

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-Premise

- 6.1.2 Cloud

- 6.2 By End-User Vertical

- 6.2.1 Retail

- 6.2.2 Healthcare

- 6.2.3 Government

- 6.2.4 Energy and Utility

- 6.2.5 Automotive

- 6.2.6 Other End-User Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 VMware Inc.

- 7.1.2 Citrix Systems Inc.

- 7.1.3 IBM Corporation

- 7.1.4 MobileIron Inc.(Ivanti.)

- 7.1.5 SAP SE

- 7.1.6 BlueBOX IT (Lookout)

- 7.1.7 Cisco Systems Inc.

- 7.1.8 Divide (Google LLC)

- 7.1.9 Hewlett-Packard Company

- 7.1.10 Alcatel-Lucent Enterprise SA ( Nokia)

- 7.1.11 Oracle Corporation

- 7.1.12 BlackBerry Limited

- 7.1.13 Tata Consultancy Services Limited

- 7.1.14 Verizon Communicatiomns