|

市場調查報告書

商品編碼

1644292

變更和配置管理-市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Change and Configuration Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

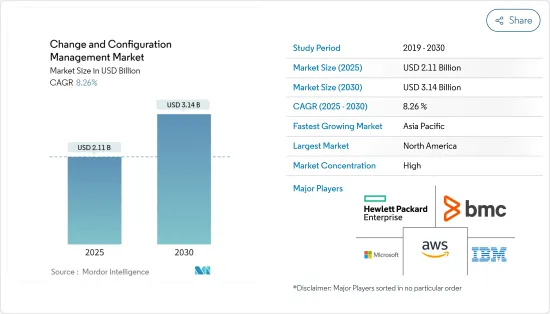

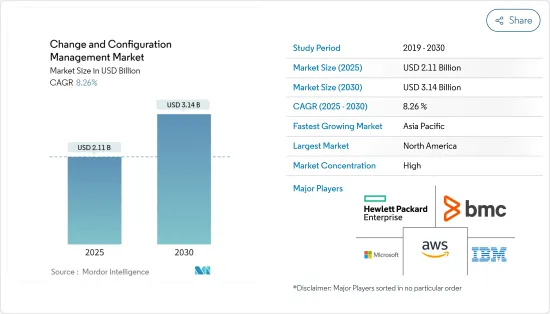

變更和配置管理市場規模預計在 2025 年為 21.1 億美元,預計到 2030 年將達到 31.4 億美元,預測期內(2025-2030 年)的複合年成長率為 8.26%。

變更和配置管理市場正在各種最終用戶行業中迅速成長。配置管理的使用日益廣泛是由一系列好處推動的,包括透過減少冗餘來大幅節省成本,以及透過更快地解決問題來提高服務品質。我們為大型企業、雲端服務供應商和中型市場客戶提供強大的開發。

關鍵亮點

- 隨著組織的全球擴張,網路規模和複雜性不斷增加,預計全球網路變更和配置管理市場將在預測期內快速成長。隨著採用新設備和新技術來滿足業務需求,網路規模呈指數級成長。企業 IT 經理必須解決對效能下降和網路停機的擔憂。需要更有效的配置管理,因為許多網路中斷和應用程式效能不佳都是由錯誤的手動配置變更引起的。

- 將 CI 儲存在 CMDB 中會建立一個統一的系統資訊儲存庫。這使得 IT 管理員能夠更輕鬆地調整系統元件的狀態,監控基礎設施和個人層面的變化需求,並即時診斷系統故障以確保系統可用性。透過建立有效的基本規則來減少系統停機時間、提高對指南的遵守程度、提高基礎設施的靈活性、在一定程度上實現流程自動化,從而使組織能夠專注於其核心功能,這些都是使用變更和配置管理的一些主要動機。

- 自動化的網路配置和變更控制系統有助於減少手動配置變更而導致的人為錯誤,從而減少網路中斷和劣化。這些解決方案持續監控設備配置,並在配置變更時提供即時通知和警報,使您能夠更好地管理多供應商網路環境中的設定檔。預測期內,網路變更和配置管理 (NCCM) 市場將受到傳統配置管理自動化帶來的成本降低的推動。網路功能虛擬化 (NFV) 和軟體定義網路 (SDN) 等網路技術的採用正在推動這些解決方案的採用。

- 此外,來自多個組織的客戶要求他們存放在公司的文件符合 HIPAA 和/或 FINRA 規定。這就是為什麼您的文件管理系統必須包含完全符合所有適用隱私法的功能並採取額外措施來保護您的企業及其客戶的資訊。在數位時代,保護線上文件對於防止資料外洩和駭客的惡意攻擊至關重要。安全性已成為許多部署 DMS 的公司關注的主要議題。除了財務影響之外,資料外洩還可能導致客戶流失、品牌聲譽受損、商業機密曝光、合規和法律問題。

- 與 COVID-19 疫情相關的諸多障礙包括全國和地區醫療設備、個人防護工具(PPE) 和醫院用品短缺。通常的策略是盡快填補客戶空缺。

- 如果快速將產品推向市場的決定是基於適當的風險/收益計算,那麼即使在危機中也可以保持產品的完整性、通訊協定和客戶福祉。在全國性災難期間,將急需的物品送到客戶手中可能需要走捷徑,而這其中的風險相當大。類似這樣的案例在疫情期間提振了市場。

變更和配置管理市場趨勢

中小企業佔主要市場佔有率

- 根據美國小型企業管理局宣傳辦公室的數據,2022年美國小型企業數量將達到3,320萬家,佔全國企業總數的近99.9%。 2022年美國小型企業數量的成長反映穩定成長,與前一年同期比較成長2.2%,較2017-2022年成長12.2%。

- 2022 年 3 月,印度政府為中小微型企業績效改善與加速計畫撥款 606.245 億印度盧比(8.08 億美元)。該計劃旨在擴大市場和信貸管道,在聯邦和州兩級建立機構和管治,加強聯邦與州的協調與合作,解決付款延遲和綠色中小微型企業問題。根據中小微型企業部的資料,截至 2022 年 11 月 25 日,Udyam 註冊平台已註冊 12,201,448 家中小微型企業,取代了先前透過 Udyog Aadhaar 備忘錄進行註冊的方式。

- 顧客現在可以選擇如何花錢。因此,消費者對符合他們現有價值觀的有意義的活動越來越感興趣。購買表示消費者認同該品牌的理念。為了吸引消費者和員工,小型企業必須透過新的和現有的接觸點有效地表達其品牌價值。隨著社區從疫情中復甦,人們越來越意識到本地購物和支持小型企業。此外,消費者也表現出願意將自己的購買力擴展到高階品牌和快速消費經營模式之外,以參與有助於當地經濟復甦的明智購買行為。

- 資金籌措在小型企業的發展和創建中發揮著至關重要的作用。疫情的影響促使小型企業尋求透過創造性的解決方案來更具創新性的方式資金籌措。因此,去中心化金融(DeFi)已成為新興經濟體中小企業的工具,尤其是匯款和小額貸款。比特幣和以太坊等加密貨幣正越來越廣泛地用作付款手段。此外,加密貨幣所依賴的區塊鏈技術以及支援加密貨幣的金融基礎設施也在不斷發展,以提供金融服務系統。

- 中小微型企業領域的技術部署表明,企業會根據事實做出適當且明智的決策。在這些情況下,資料和分析很容易揭示對做出更好的商業決策至關重要的見解。因此,我們預計從 2022 年起,大多數考慮和計劃的商業活動中技術的使用將會增加。科技比以往任何時候都更容易獲得,趨勢表明我們正在進入一個中小企業從根本上改變其經營方式的時代。

預測期內亞太地區將實現最高成長

- 由於政府推出各種數位化舉措,預計亞太地區將在預測期內呈現最高成長。此外,該地區數位化的快速發展預計將極大地推動雲端基礎的ITSM 解決方案的發展。例如,「數位印度」旨在透過改善IT基礎設施和增強網路連接,以電子方式向公民提供政府服務。

- 此外,該計劃還旨在將舊有系統轉變為雲端基礎的整合模型。該雲端平台預計將為公民提供電子服務。中國、印度、日本和韓國等國家投資者對 IT 服務管理的興趣日益濃厚。中國正在經歷快速發展,並在邊緣運算、人工智慧和物聯網等新興IT技術領域處於全球領先地位。因此,我們預計對改進 IT 服務的需求將激增。

- 東亞銀行(中國)有限公司(東亞中國)採用BMC Software 的業務服務管理平台來提供全面的 IT 管理平台並建立資料中心,以滿足其快速成長的銀行業務的需求。該供應商為BEA中國提供了BSM解決方案,建立了安全、可靠、自動化的IT配置管理流程,降低了人工干預的風險,並保障了業務的穩定性。

- 根據印度儲備銀行的資料,截至2020-21年,印度IT和IT支援服務出口穩定成長至1,337億美元。印度 IT 和 IT 支援服務公司已在 80 個國家建立了 1,000 多個全球交付中心。此外,業務流程管理部門貢獻了印度IT市場32%的收益。

- 配置管理解決方案可以減少生產變化對公司業務營運的影響。配置管理還可以透過深入了解現有 IT 環境的整體擁有成本來幫助降低營運成本。由於組態管理是在軟體開發和部署過程中使用的,因此它也被稱為軟體配置管理或整合組態管理。軟體開發人員使用組態管理來追蹤原始碼、修訂和文件。

變更和配置管理行業概覽

變更和配置管理市場的主要企業是 IBM 公司、微軟公司、惠普公司、亞馬遜網路服務和 BMC 軟體。市場由這些主要企業主導,因此比較鞏固。因此,預計市場集中度將會較高。

2023 年 1 月,配置和生命週期管理 (CLM) 技術領域的市場參與企業Configit Ace 表示,它將作為雲端服務提供。我們雲端基礎的配置和生命週期管理 (CLM) 平台與供應商無關,旨在與任何 IT 系統互動。 Configit Ace Cloud 為複雜產品、系統和服務提供全面的企業範圍的配置流程,支援其設計、開發、生產、銷售和支援。

2022 年 9 月,Microsoft Endpoint Configuration Manager 版本 2103-2207 收到安全性升級以修復漏洞。攻擊者可以利用此漏洞來獲取敏感資訊。根據網路安全和基礎設施安全局 (CISA) 的說法,鼓勵使用者和管理員查看 Microsoft 針對 CVE-2022-37972 的安全公告並應用任何必要的更新。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 市場影響

第5章 市場動態

- 市場促進因素

- 企業正迅速採用數位轉型

- 自動化 IT 資源管理

- 市場限制

- 企業應用需求多樣化

第6章 市場細分

- 按組件

- 軟體

- 服務

- 按組織類型

- 小型至中型

- 大規模

- 最終用戶

- BFSI

- 零售

- 醫療

- 通訊和 IT

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- Amazon Web Services

- Ansible(Red Hat, Inc.)

- BMC Software Inc.

- CA Technologies(Broadcom Inc.)

- Chef Software, Inc.

- Codenvy, Inc.

- Hewlett-Packard Enterprise Company

- IBM Corporation

- Microsoft Corporation

- Puppet

- Servicenow Inc.

第8章投資分析

第9章:市場的未來

The Change and Configuration Management Market size is estimated at USD 2.11 billion in 2025, and is expected to reach USD 3.14 billion by 2030, at a CAGR of 8.26% during the forecast period (2025-2030).

The change and configuration management market is gaining pace in various end-user industries. The rising usage of configuration management can be ascribed to various benefits, including significant cost savings due to less redundant duplication and faster problem resolution, resulting in higher service quality. It offers strong development for large organizations, cloud service providers, and midmarket customers.

Key Highlights

- The global network configuration and change management market is predicted to grow rapidly during the forecast period due to increased network size and complexity due to the organization's global expansion. Including new devices and technology to meet corporate demands has greatly increased the network's size. IT managers in firms must deal with the concerns of performance degradation and network downtime prevention. Most network outages and application performance deterioration are caused by incorrect manual configuration changes, necessitating more effective configuration management.

- The storage of CIs in CMDB results in the construction of a unified repository for the system's information. This allows IT managers to more easily regulate the state of system components, monitor requirement changes at both the infrastructure and individual levels, and assure system availability by diagnosing system faults in real-time. Establishing effective ground rules with which they can reduce system downtimes, improve compliance with guidelines, improve the flexibility of the infrastructure, and automation of the process to a certain extent, allowing them to focus on their core business functions, are some of the major motivators for organizations to use change and configuration management.

- Automated network configuration and change management systems help to reduce human errors caused by manual configuration changes, resulting in fewer network outages and degradation. These solutions continuously monitor device configurations and offer real-time notifications and warnings whenever a configuration change occurs, allowing for better configuration file management in a multi-vendor network environment. Over the projection period, the NCCM (network configuration and change management) market would be driven by cost savings from the automation of traditional configuration management. The introduction of networking technologies like Network Function Virtualization (NFV) and Software-defined Networking (SDN) has aided in adopting these solutions.

- Moreover, multiple organizations' clients would require HIPAA or FINRA compliance for the documents they entrust to the company. Therefore, document management systems must incorporate features that take extra steps to fully comply with all applicable privacy laws to protect the company's and its client's information.In the digital era, protecting online documents is essential to prevent data breaches and malicious attacks from hackers. Security is becoming a significant concern for many companies that have deployed DMS. Besides the financial consequences, a data breach can cause customer loss, brand reputation damage, company secrets leaking, compliance, and legal issues.

- Numerous obstacles related to the COVID-19 pandemic included national and local shortages of medical devices, personal protective equipment (PPE), and hospital supplies. The normal strategy was to fill client shortages as soon as possible.

- When decisions to rush items to market are based on appropriate risk/benefit calculations, the product's integrity, protocols, and customer happiness can be maintained even during a crisis. During a national disaster, getting desperately required products out the door and into customers' hands may need shortcuts that carry more than their fair share of dangers. Such instances pushed the market during a pandemic.

Change & Configuration Management Market Trends

Small and Medium Scale Enterprise Segment Holds Significant Share of the Market

- According to the US Small Business Administration Office of Advocacy, in 2022, the number of small enterprises in the United States reached 33.2 million, accounting for nearly all (99.9%) firms in the country. The increase in the number of small firms in the United States in 2022 reflects steady growth, with a 2.2% increase from the previous year and a 12.2% increase from 2017 to 2022.

- In March 2022, The Indian government allotted INR 6,062.45 crore (USD 808 million) for the Raising and Accelerating MSME Performance initiative. The program aims to increase market and credit access, build institutions and governance at the federal and state levels, strengthen federal-state links and cooperation, handle late payment issues, and green MSMEs. According to Ministry of Micro, Small, and Medium Enterprises data, as of November 25, 2022, the Udyam Registration platform had registered 12,201,448 MSMEs, replacing the previous method of registering for a Udyog Aadhaar Memorandum.

- Customers can now choose how they want to spend their money. As a result, there is a strong alignment towards meaningful events, which corresponds with their existing values. A purchase represents the consumer's alignment with the brand's ideals. To engage their consumer base and staff, SMEs must successfully express their brand values through new and existing touchpoints. There has been a conscious shift towards shopping locally and supporting small businesses throughout communities recovering from the pandemic. Furthermore, consumers have demonstrated a level of thought to expand their purchasing power beyond high-end brands and fast-consumption business models to engage in wise purchase behavior that supports reconstructing their local economies.

- Financing plays an essential role in the advancement and creation of SMEs. Due to the pandemic's effects, SMEs seek more innovative funding via creative solutions. As a result, decentralized finance (DeFi) arises as a tool for smaller enterprises in developing economies, notably for remittances and small loans. Cryptocurrencies such as Bitcoin and Ethereum are becoming more frequently recognized as payment methods. Furthermore, the blockchain technology that underpins cryptocurrencies and its supporting financial infrastructure is evolving to provide a financial services system.

- Technology deployment in the MSME sector has demonstrated that firms make appropriate and intelligent judgments based on facts. In their situation, data and analytics readily reveal the insights critical to making great business decisions. As a result, 2022 and beyond will see increased tech usage for the most thought-out and planned corporate activities. Technology is more accessible than ever, and trends show that SMEs are here to transform how they do business fundamentally.

Asia-Pacific to Witness the Highest Growth Over the Forecast Period

- The Asia-Pacific region is expected to witness the highest growth during the forecast period, owing to various government digitization initiatives. Additionally, the rapid increase in digitization in this region is expected to drive cloud-based ITSM solutions significantly. For instance, Digital India aims to electronically provide government services to citizens by improving the IT infrastructure and increasing internet connectivity.

- Moreover, the initiative aims to move legacy and on-premise systems to a cloud-based or integrated model. The cloud platform is expected to host the delivery of e-services to the citizens. Economies such as China, India, Japan, and South Korea are witnessing increasing investor interest in IT service management. China is going through rapid development and is the global leader in new, emerging IT technologies, such as edge computing, AI, and IoT. As a result, a surge in demand for improved IT services is expected.

- The Bank of East Asia (China) Limited (BEA China) has selected BMC Software's business service management platform to provide a comprehensive IT management platform and build a data center that meets the rapidly growing banking business. The vendor is offering BEA China a BSM solution that reduces the risks of manual interference and ensures business stability by establishing a secure and reliable automated IT configuration management process.

- According to the Reserve Bank of India data, India's IT and IT-enabled services exports have steadily risen to USD 133.7 billion as of 2020-21. The Indian IT and IT-enabled service companies have set up over 1,000 global delivery centers in 80 countries. Also, the business process management sectors account for 32% of the revenue in the Indian IT market.

- A configuration management solution can reduce the impact of changes in production on the enterprise's business operations. Configuration management also contributes to lower operational costs by giving businesses a better grasp of the total cost of ownership of their existing IT environment. Because configuration management is utilized during the software development and deployment processes, it is also known as software or unified configuration management. Software developers use configuration management to track source code, revisions, and documentation.

Change & Configuration Management Industry Overview

The major players in the change and configuration management market are IBM Corporation, Microsoft Corporation, Hewlett-Packard Company, Amazon Web Services, and BMC Software. The market is consolidated, as it is dominated by these major players. Hence, market concentration is expected to be high.

In January 2023, Configit Ace, the market's player in Configuration Lifecycle Management (CLM) technology, is now accessible as a cloud service, according to the company. The cloud-based Configuration Lifecycle Management (CLM) platform is vendor-agnostic and designed to interface with any IT system. Configit Ace Cloud allows a comprehensive, enterprise-wide configuration process for complex products, systems, and services that support design, development, production, sales, and support.

In September 2022, Microsoft Endpoint Configuration Manager versions 2103-2207 received a security upgrade to fix a vulnerability. An attacker could take advantage of this flaw to access sensitive information. Users and administrators are encouraged to review Microsoft's Security Advisory for CVE-2022-37972 and apply the necessary updates, according to the Cybersecurity and Infrastructure Security Agency (CISA).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 COVID-19 Impact on the Market

5 Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Rapid Increase in Adoption of Digital Transformation by Organizations

- 5.1.2 Automated Management of IT Resources

- 5.2 Market Restraints

- 5.2.1 Diverse Requirements in an Enterprise Application

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Organization Type

- 6.2.1 Small and Medium Scale

- 6.2.2 Large Scale

- 6.3 End-user

- 6.3.1 BFSI

- 6.3.2 Retail

- 6.3.3 Healthcare

- 6.3.4 Telecom and IT

- 6.3.5 Other End-User Industry

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services

- 7.1.2 Ansible (Red Hat, Inc.)

- 7.1.3 BMC Software Inc.

- 7.1.4 CA Technologies (Broadcom Inc.)

- 7.1.5 Chef Software, Inc.

- 7.1.6 Codenvy, Inc.

- 7.1.7 Hewlett-Packard Enterprise Company

- 7.1.8 IBM Corporation

- 7.1.9 Microsoft Corporation

- 7.1.10 Puppet

- 7.1.11 Servicenow Inc.