|

市場調查報告書

商品編碼

1445623

列印和應用標籤和標籤設備 - 市場佔有率分析、行業趨勢與統計、成長預測(2024 - 2029)Print and Apply Labeling and Labeling Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

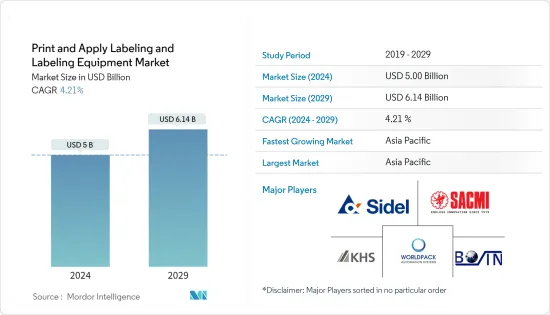

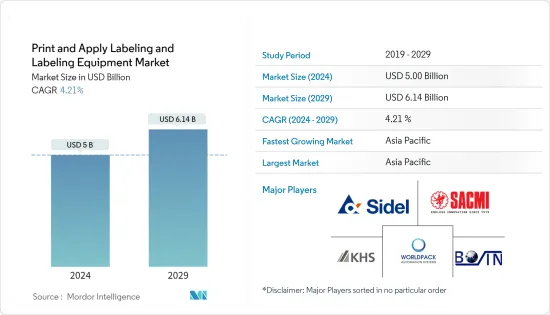

列印和貼上標籤及標籤設備市場規模預計到2024年將達到 50 億美元,預計到2029年將達到 61.4 億美元,在預測期內(2024-2029年)CAGR為 4.21%。

主要亮點

- 這個市場主要是由食品和飲料行業包裝領域對高速、準確的標籤解決方案和自動化不斷成長的需求所推動的。由於自動化技術的使用和技術發展不斷增加,列印和貼上標籤以及標籤設備的全球市場不斷擴大。該行業競爭激烈,必須列印高品質的標籤,以避免供應鏈延誤。在預測期內,標籤的追蹤和防偽功能使產品製造商可以輕鬆追蹤出貨情況。標籤還可以確保產品不間斷地交付給客戶,防止篡改。預計進一步增加對該設備的需求的是對防止詐欺和盜竊的安全標籤的需求不斷成長。

- 近年來,尤其是疫情過後,人們的健康意識日益增強。生活方式和飲食計劃的變化導致了食品和飲料行業對標籤的需求。資訊標籤可幫助正確了解產品的成分和比例。此外,有些標籤還帶有彩色邊界,可以將產品與其他產品區分開來。根據聯邦食品和農業部 - BMEL 發布的研究,在2017年至2022年 6月期間,使用有機標籤的公司數量從 5,044 家增加到 6,649 家。標籤使用量的成長趨勢意味著市場對貼標機的需求不斷成長。

- 對印刷和標籤應用的要求也顯著增加,因為它直接影響產品在最終用戶心目中的形象。由於對精確、快速、簡單的貼標機的需求不斷成長,預計市場將繼續擴大。預計貼標機市場也將受到預測期內電子商務強勁成長的推動。在電子商務行業中,貼標機用於在各種紙箱和包裝上貼上標籤和條碼。電子商務的成長將直接意味著對複雜貼標機的需求激增。

- 貼標機在包裝產業中發揮著非常重要的作用。許多機器可供購買,有助於提高任何企業的生產力和效率。包裝印刷產業的發展、對美觀的需求、產品差異化和技術進步是數位印刷包裝市場的一些促進因素。安裝貼標設備需要大量初始投資。建立工廠或購買印刷機需要較高的投資。對經濟、永續和創新印刷技術的需求不斷成長。趨勢和印刷技術的變化將迫使製造商重新經歷這個過程。這對市場的成長提出了挑戰。

- COVID-19大流行的出現促進了市場成長,特別是食品和飲料包裝以及藥品包裝機械。這是由於線上和線下通路對各種食品和藥品的需求增加。

列印及貼上標籤及標籤設備市場趨勢

食品和飲料產業將佔據主要市場佔有率

- 消費者和品牌對食品和飲料標籤興趣的增加以及嚴格的食品和飲料標籤法規促進了列印貼標和標籤設備的市場成長。人們對產品標籤日益濃厚的興趣給政府官員帶來了問題,他們必須保證食品和飲料包裝上的資訊有用、可信且清晰,以免消費者被誤導。

- 隨著全球食品貿易的擴大,更加需要標準化食品標籤,以使產品資訊易於理解並為不同國家的消費者提供協助。此外,隨著包裝食品和即飲飲料消費量的激增,對準確的產品和品牌訊息的需求也不斷增加,刺激了對列印貼標和標籤設備的需求。

- 考慮到全球監管要求,標籤是一個高度複雜的過程,對產品來說比以往任何時候都更重要。美國農業部(USDA)、食品藥物管理局(FDA)和歐洲食品標準局(EFSA)等監管機構對食品安全和包裝實施了嚴格的規定。

- FDA 的食品安全機構加強了《食品安全現代化法案》(FSMA)的授權,以保障大眾的健康和消費者的健康。這些監管機構不斷致力於改善製造和分銷中的食品安全流程,並增強供應鏈中的產品可追溯性。這推動了全球列印貼標和標籤設備的銷售。

- 此外,食品和飲料行業對自動化的需求推動市場研究。隨著當今消費者更加關注產品細節,標籤在提供產品資訊和促進銷售方面發揮著非常重要的作用。製造商現在轉向自動化標籤系統,以滿足食品和飲料行業不斷成長的需求。

亞太地區預計成長最快

- 由於包裝食品需求的增加、聚合物薄膜的簡單獲取以及相對廉價的勞動力資源,不斷成長的城市人口主要推動亞太地區的發展。收縮和拉伸套管是裝飾複雜設計容器的經濟選擇,預計將在價格敏感的東南亞市場大幅擴張。此外,隨著食品和飲料產品以及個人護理用品的需求、高速和高品質標籤解決方案的必要性以及食品行業對包裝的需求,快速消費品產品的消費預計也會增加。

- 由於中國政府對產品進出口的嚴格規定。根據《中華人民共和國食品標籤標準》(GB7718-2011),進口食品應有明顯的標識,標明原產國以及在該國註冊的總經銷商的名稱和地址。推動中國貼標機需求的主要驅動力之一是食品和飲料、製藥、化學和技術發展等行業對生產力提高的渴望不斷成長。中國法規要求,在貨物進出口之前,必須驗證進出口(但不是國內)食品的標籤,包括糖果、葡萄酒、堅果、罐頭食品和起司,並且必須檢查產品的品質。

- 該國多個行業包裝領域的不斷擴張、支出和產品創新推動了對貼標機的需求。例如,2022年 8月,古吉拉特邦柔印機製造商 AKO Flexo 在蒙德拉海港設立了生產部門,面向印度和海外銷售。該公司已經在中國擁有一家製造工廠,預計將繼續運作以滿足當地需求。新的印度工廠可能將於2023年 3月投入營運。AKO Flexo 是一家柔印機和標籤印後設備製造商。印度、中國和加拿大的三個合作夥伴共同擁有這項業務。

- 印度的貼標機市場是進口驅動型的,因為它從歐洲進口產品。可支配收入的增加和人口的成長是推動貼標機市場收入的關鍵因素;由於包裝食品支出增加,民眾的個人照護支出也增加。此外,2022年 6月,總部位於孟買的 Printgraph Converting Machinery 與 Macrt 和 Perfect Printgraph Engineers 在第15 屆 Printpack India 上推出了數位標籤印表機。這款名為 TruWo 的機器將滿足印刷和包裝行業的需求,這些行業尋找補充技術來增強其現有的印刷能力。

列印及貼上標籤及標籤設備產業概述

印刷貼標和標籤設備市場呈現碎片化,主要參與者包括SIDEL (Tetra Laval Group), Sacmi Imola SC, Krones AG, Kunshan Bojin Trading等。市場參與者採取合作夥伴關係、合併和收購等策略來增強其產品供應並獲得永續的競爭優勢。

2023年 4月,ProMach 產品品牌 Axon 將展示其最近發布的技術 HE-500 蒸汽收縮機,該技術為精釀啤酒商提供了卓越性能的專利設計。

2023年10月,Sidel推出了最新的拉伸薄膜技術EvoFilm Stretch,目的是為飲料、食品、家居和個人護理(FHPC)市場提供全新的永續二次包裝解決方案。隨著永續發展和 SKU 激增等消費趨勢繼續影響分銷和生產需求,客戶需要替代的二次包裝解決方案,以更具成本效益的方式滿足這些需求。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭激烈程度

- COVID-19 對產業影響的評估

第5章 市場動態

- 市場促進因素

- 數位印刷技術與自動貼標機的演變

- 食品和飲料包裝對自動化的需求不斷增加

- 市場挑戰

- 貼標機的高成本與因應趨勢

- 缺乏能夠承受惡劣氣候條件的產品

第6章 市場細分

- 依技術

- 自動

- 半自動

- 手動

- 依類型

- 壓敏/自黏標籤

- 收縮套標

- 膠基標籤

- 模內標籤及其他類型

- 依最終用戶垂直領域

- 製藥

- 食品和飲料

- 個人護理和家庭護理

- 其他最終用戶垂直領域

- 按地理

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- SIDEL(Tetra Laval Group)

- Sacmi Imola SC

- KHS GmbH

- Kunshan Bojin Trading Co., Ltd

- Worldpack Automation Systems

- Etiquette Labels Ltd.

- Novexx Solutions GmbH

- Axon LLC

- PDC International Corporation

- Heuft Systemtechnik GmbH

- HERMA GmbH

- Weber Marking Systems GmbH

- Quadrel Labeling Systems

- CECLE Machine

- Wuxi Sici Auto Co. Ltd.

- Marchesini Group SpA

第8章 投資分析

第9章 市場的未來

The Print and Apply Labeling and Labeling Equipment Market size is estimated at USD 5 billion in 2024, and is expected to reach USD 6.14 billion by 2029, growing at a CAGR of 4.21% during the forecast period (2024-2029).

Key Highlights

- The market is primarily driven by the growing demand for high-speed and accurate labeling solutions and automation in the packaging sector in the food and beverage industry. The global market for print & apply labels and labeling equipment is expanding owing to rising automation techniques usage and technical developments. The industry is highly competitive, and quality printing of labels becomes necessary to avoid delays in the supply chain. During the forecast period, labels' tracking and anti-counterfeiting functions make it simple for product manufacturers to keep track of shipments. Labels also protect against tampering by guaranteeing that the products are delivered to the clients without disruption. Further anticipated to increase demand for this equipment is the rising demand for security labeling to prevent fraud and theft.

- Over the past few years, especially during the period after the pandemic, people have become extremely health conscious. The change in lifestyle and dietary plans has resulted in the demand for labels across the food and beverages sectors. The help of informative labeling gives the proper understanding of the product's ingredients and proportions. Also, some label comes with colorful demarcation that differentiates the products from others. According to research published by the Federal Ministry of Food and Agriculture - BMEL, in the time frame between 2017 to June 2022, the number of companies using organic labels increased from 5,044 to 6,649. This increasing trend in the usage of labels signifies the rising demand for labeling machines in the market.

- The requirement for printing and labeling application has also increased significantly because it immediately impacts the product's image in end-users' minds. The market is projected to continue to expand due to rising demand for precise, quick, and uncomplicated labeling machines. The market for labeling machines is also anticipated to be driven by robust e-commerce growth during the forecast period. In the e-commerce industry, labeling machines are used to apply labels and barcodes on various cartons and packages. The uptick in e-commerce would directly signify a spike in demand for sophisticated labeling machines.

- Labelling machines play an essential role in the packaging industry. Numerous machines are available to buy that can help improve productivity and efficiency in any business. Development in the packaging printing industry, demand for aesthetics, product differentiation, and technological advancements are some digitally printed packaging market drivers. A significant initial investment is required to install labeling equipment. Setting up a factory or purchasing a printing press requires higher investments. There is a growing demand for economical, sustainable, and innovative printing technologies. Changes in trends and printing technology will force manufacturers to go through the process all over again. This poses a challenge to the market's growth.

- The emergence of the COVID-19 pandemic has boosted market growth, particularly for food and beverage packaging and pharmaceutical packaging machinery. This is due to increased demand for various foods and medicines through online and offline channels.

Print & Apply Labeling & Labeling Equipment Market Trends

Food and Beverages Sector to Hold Major Market Share

- The increased consumer and brand interest in food and beverage labels and strict food and beverage labeling regulations boost the market growth for print-and-apply labeling and labeling equipment. The increased interest in product labels poses issues for government officials, who must guarantee that the information on food and beverage packages is helpful, credible, and presented clearly so that the consumer is not misled.

- With the expansion of the global food trade, there is a greater need to standardize food labeling so that product information is easily understood and helpful to consumers in diverse countries. Also, with the surge in consumption of packaged food and ready-to-drink beverages, the need for accurate product and brand information has been propelled, which fuels the demand for print-and-apply labeling and labeling equipment.

- Considering global regulatory demands, labeling is a highly intricate process that is even more vital to products than ever before. Regulatory authorities such as the US Department of Agriculture (USDA), the Food and Drug Administration (FDA), and the European Food Standards Agency (EFSA) have imposed strict regulations on food safety and packaging.

- The FDA's food safety authority has strengthened the Food Safety Modernization Act (FSMA) mandates in order to safeguard the public's health and consumers. These regulatory bodies continually aim to improve food safety processes in manufacturing and distribution and enhance product traceability in the supply chain. This drives the sales of print-and-apply labeling and labeling equipment globally.

- Furthermore, the demand for automation in the food and beverage industry is driving the market study. As consumers today are more conscious of product details, labels play a crucial role in providing information about the product and boosting sales. Manufacturers are now shifting to automated labeling systems to meet the growing demand in the food and beverage industry.

Asia Pacific is Expected to Register Fastest Growth

- The growing urban population primarily drives the Asia-Pacific region due to increased packaged food demand, simple access to polymer films, and a relatively inexpensive labor pool. Shrink and stretch sleeves, economical options for adorning containers with complicated designs, are projected to see significant expansion in Southeast Asia, a price-sensitive market. Also, the consumption of FMCG products is anticipated to rise along with the demand for food and beverage products and personal care items, the necessity for high-speed and high-quality labeling solutions, and the need for packaging in the food business.

- Due to the stringent regulations of the Chinese government on product import and export. According to the Food Labeling Standards of China (GB7718-2011), imported foods shall have clear markings that indicate the country of origin and the name and address of the general distributor registered in the country. One of the primary drivers boosting labeling machine demand in China is the rising desire for productivity gains across industries, including food and beverage, pharmaceutical, chemical, and technical developments. Chinese regulations demand that before goods can be imported or exported, labels for imported and exported (but not domestic) food items, including sweets, wine, nuts, canned food, and cheese, must be validated, and the products must be checked for quality.

- Growing expansion, spending, and product innovation in the packaging area across multiple industries in the country have boosted the demand for labeling machines. For instance, in August 2022, Gujarat-based flexo press manufacturer AKO Flexo set up its production unit in Mundra Seaport for sales in India and overseas. The company already had a manufacturing plant in China that is expected to continue to operate to meet local demand. The new India plant will likely be operational by March 2023. AKO Flexo is a flexo press and label finishing equipment manufacturer. Three partners in India, China, and Canada jointly own the business.

- The labeling machine market in India is import-driven, as it imports its product from Europe. The rising disposable income and growing population are key factors driving the labeling machine market revenue; owing to the increased spending on packaged food, personal care spending among the populace has also increased. Additionally, in June 2022, Printgraph Converting Machinery, a Mumbai-based company, along with Macrt and Perfect Printgraph Engineers, launched a digital label printer at the 15th Printpack India. The machine known as TruWo will meet the demands of the printing and packaging industries, which are looking for complementary technology to add to their existing print capabilities.

Print & Apply Labeling & Labeling Equipment Industry Overview

The print and apply labeling and labeling equipment market is fragmented with the presence of major players like SIDEL (Tetra Laval Group), Sacmi Imola SC, Krones AG, Kunshan Bojin Trading Co. Ltd., and others. Players in the market are adopting strategies such as partnerships, mergers, and acquisitions to enhance their product offerings and gain a sustainable competitive advantage.

In April 2023, Axon, a ProMach product brand, will showcase their recently released technology HE-500 steam shrink tunnel, which offers craft brewers a patented design for superior performance.

In October 2023, Sidel launched the latest stretch film technology, EvoFilm Stretch, which is designed to offer the beverage, food, home, and personal care (FHPC) markets a new sustainable solution for secondary packaging. As consumer trends, such as sustainability and SKU proliferation, continue to affect distribution and production needs, customers require alternative secondary packaging solutions that can address these demands in a more cost-effective way.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolution of Digital Printing technology and Automatic Labeling Machine

- 5.1.2 Increasing Demand for Automation in Food and Beverage Packaging

- 5.2 Market Challenges

- 5.2.1 High Cost Associated with Labeling Machines and Coping with Trends

- 5.2.2 Lack of Products with Ability to Withstand Harsh Climatic Conditions

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Automatic

- 6.1.2 Semi-automatic

- 6.1.3 Manual

- 6.2 By Type

- 6.2.1 Pressure Sensitive/Self-Adhesive Label

- 6.2.2 Shrink Sleeve Label

- 6.2.3 Glue Based Label

- 6.2.4 In-Mold Label and Other Types

- 6.3 By End-user Vertical

- 6.3.1 Pharmaceutical

- 6.3.2 Food and Beverages

- 6.3.3 Personal Care and Household Care

- 6.3.4 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SIDEL (Tetra Laval Group)

- 7.1.2 Sacmi Imola S.C.

- 7.1.3 KHS GmbH

- 7.1.4 Kunshan Bojin Trading Co., Ltd

- 7.1.5 Worldpack Automation Systems

- 7.1.6 Etiquette Labels Ltd.

- 7.1.7 Novexx Solutions GmbH

- 7.1.8 Axon LLC

- 7.1.9 PDC International Corporation

- 7.1.10 Heuft Systemtechnik GmbH

- 7.1.11 HERMA GmbH

- 7.1.12 Weber Marking Systems GmbH

- 7.1.13 Quadrel Labeling Systems

- 7.1.14 CECLE Machine

- 7.1.15 Wuxi Sici Auto Co. Ltd.

- 7.1.16 Marchesini Group S.p.A.