|

市場調查報告書

商品編碼

1689976

乙太網路控制器:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Ethernet Controller - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

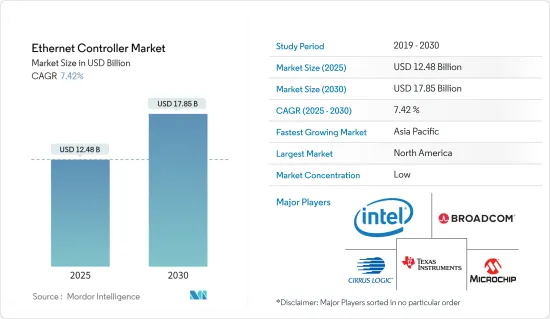

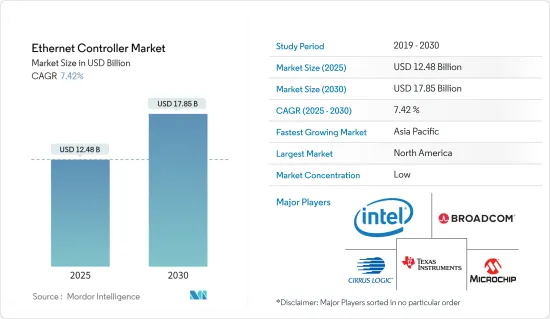

乙太網路控制器市場規模預計在 2025 年為 124.8 億美元,預計到 2030 年將達到 178.5 億美元,預測期內(2025-2030 年)的複合年成長率為 7.42%。

現代數位經濟中資料中心和雲端運算的日益普及推動了市場的發展。從科學發現到人工智慧 (AI),現代資料中心對於解決世界上最大的挑戰至關重要。這些現代資料中心正在進行轉型,以增加網路頻寬並最佳化人工智慧等工作負載。

資料量的增加推動了對乙太網路控制器的需求,從而促進了市場成長。根據愛立信行動報告,資料封包價格的下降和智慧型手機使用量的增加正在加速印度的資料流量。報告預測到2025年,行動資料流量將達到每月Exabyte以上。

控制自動化技術乙太網路(EtherCAT)基於 CANopen通訊協定和乙太網路。但與網際網路或網路通訊不同的是,它針對工業自動化控制進行了最佳化。利用 OSI 網路模型,乙太網路和 EtherCAT 依賴相同的實體層和資料鏈結層。不僅如此,這兩個網路針對不同的任務進行了最佳化,因此在設計上有所不同。

USB 轉乙太網路轉換器在多種情況下都很有用。例如,您可能會發現使用者筆記型電腦上的 Wi-Fi 選項遇到技術問題,或者使用者需要存取網際網路,但發現出於安全原因某些位置已停用 Wi-Fi。在這些情況下,一個乙太網路連接埠和一個簡單的適配器就足夠了。

此類長期延期合約預計會使市場飽和並影響成長,從而為市場快速實施技術更新帶來障礙。產業趨勢要求解決方案和服務供應商應該使用乙太網路控制器等新興技術,而長期合約可能會對市場產生反效果。此外,市場競爭加劇將影響現有供應商的利潤率和成長。供應商之間的競爭水平非常激烈,乙太網路控制器產品在全球範圍內正變得商品化。

由於需求出現意外波動,加上供應減少,一些零件製造商已加大產量,但仍不夠。成長的主要動力是對全球經濟數位化的持續投資、5G技術的推出以及對資料中心和雲端服務的大力投資。隨著 5G 智慧型手機的快速普及和雲端運算的持續增強對高速連接的需求不斷增加,預計未來幾年市場將會成長。愛立信預計,2019 年至 2028 年間,全球整體5G 用戶數將大幅成長,從 1,200 多萬增至 45 億多。

乙太網路控制器市場趨勢

伺服器佔最大市場佔有率

- 大多數企業需要儲存資料,例如電子郵件、網站、線上交易等,而這通常在伺服器上完成。伺服器是連接到公司本地網路或在大多數情況下連接到網際網路的專用電腦。如果您的公司規模較小,您甚至可以將伺服器保留在公司內部並自行操作。但隨著組織及其需求的成長,會產生更多的資料,需要更多的伺服器和儲存空間。典型的資料中心基礎設施包含許多伺服器,它們是功能強大的電腦。

- 伺服器為資料中心提供動力並支援雲端環境,使伺服器產業成為無數關鍵任務企業和客戶端運算業務的支柱。隨著企業努力滿足巨量資料和進階工作負載要求,對更強大伺服器的需求持續成長。隨著雲端處理、人工智慧、巨量資料和資料中心的興起,伺服器的需求也將大幅增加。隨著伺服器需求的增加,乙太網路控制器的數量也隨之增加。

- 基板管理控制器 (BMC) 監控大多數現代伺服器中的溫度、電壓和風扇。如果系統中某些事情需要管理員注意(例如 CPU 過熱),BMC 通常會設定為傳送通知(以電子郵件和/或 SNMP 警報的形式)。

- 英特爾乙太網路 800 系列控制器包括應用裝置佇列 (ADQ)、動態裝置個人化 (DDP) 以及對 iWARP 和 RoCEv2 遠端直接記憶體存取 (RDMA) 的支援。它提供工作負載最佳化的效能和靈活性,以滿足不斷變化的網路需求。對於 NFV、儲存、HPC-AI 和混合雲端等高效能伺服器應用,800 系列控制器可提供高達 100GbE 的速度。

- 此外,NetXtreme-E系列BCM57414 50G PCIe 3.0乙太網路控制器基於Broadcom的可擴充10/25/50/100/200G乙太網路控制器架構。該架構旨在為企業和雲端規模的網路和儲存應用程式在伺服器中建構高度擴充性、功能豐富的網路解決方案,包括高效能運算、通訊、機器學習、儲存分解和資料分析。

- 愛立信表示,到2030年,資料流量預計將成長兩倍。到2023年,全球智慧型手機每月平均使用的行動資料將達到20.37千兆字節,高於前一年的15.93千兆位元組。預計這一數字將在 2024 年達到 25.17 GB,並在 2028 年達到 47.27 GB。因此,分散式雲端將變得實用化,並提供輕鬆實現這種規模連接所需的低延遲和高頻寬。一些科技巨頭在管理其伺服器和運算需求時面臨重大挑戰。密集化的關鍵促進因素是人工智慧資料分析的普及。

北美佔有最大市場佔有率

- 為了充分發揮5G的潛力,它需要靈活的網路和傳輸基礎設施。隨著乙太網路成為最有效的傳輸技術,通訊業者路由器和交換器被要求透過共用基礎設施來支援各種使用案例,從而導致乙太網路設備的部署增加。

- 據愛立信稱,預計2019年至2028年間,北美5G用戶數將從107萬多大幅成長至4.054億多。隨著美國5G產業的快速發展,市場對乙太網路控制器的需求也有望增加。

- 乙太網路控制器允許有線連接到電腦網路,因此任何需要高速網際網路連接的設備都必須使用乙太網路控制器來實現高速網際網路連接。雲端基礎設施網路就是一個例子。隨著雲端功能的發展和企業將業務轉移到雲端,美國對雲端應用程式的需求正在迅速成長。

- 低成本、減少維護、資料安全和幾乎無限的擴充性可能會導致未來幾年更多企業選擇雲端儲存解決方案。因此,雲端運算和儲存的成長也可能引發乙太網路控制器市場的激增。

- 加拿大先進的通訊研究中心通訊研究中心(CRC)致力於採用5G技術,讓加拿大人能夠使用尖端的通訊系統、技術和應用。根據 GSMA 預測,到 2030 年,5G 連線將佔加拿大所有行動連線的 95%。

乙太網路控制器產業概覽

乙太網路控制器市場高度分散,既有全球參與者,也有中小型企業。主要參與企業包括英特爾公司、博通公司、微晶片科技公司、Cirrus Logic 公司和德州儀器公司。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

2024 年 4 月,Microchip 收購 ADAS 和數位駕駛座連接領域的先驅 VSI,擴大了其車載網路足跡。此次市場收購將為 Microchip 廣泛的乙太網路和 PCIe 車載網路產品系列添加 ASA Motion Link 技術,從而支援下一代軟體定義汽車。

2024年3月,Marvell Technology Inc.與台積電合作推出業界領先的2奈米半導體技術平台,以滿足高速基礎設施需求。 Marvell 2 nm 平台提供了廣泛的 IP 套件來滿足許多基礎設施需求。這包括超過 200Gbps 的高速長距離 SerDes、處理器子系統、加密引擎、系統晶片到晶片互連以及用於計算、記憶體、網路和儲存的高頻寬物理層介面。這些進步為開發客製化的雲端最佳化運算加速器、乙太網路交換器、用於光學和銅互連的數位訊號處理器以及對人工智慧叢集、雲端資料中心和類似高效能基礎設施至關重要的其他設備奠定了基礎。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估主要宏觀經濟趨勢的影響

第5章 市場動態

- 市場促進因素

- 採用EtherCat即時網路進行機器控制

- 採用USB乙太網路控制器

- 市場限制

- 受新冠疫情影響,需求下降

- 由於定價競爭激烈,利潤空間較小

第6章 市場細分

- 頻寬類型

- 快速以太網

- Gigabit乙太網

- 交換器以太網

- 按功能

- PHY(物理層)

- 一體化

- 按最終用戶

- 伺服器

- 路由器/交換機

- 消費性電子應用

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 亞洲

- 印度

- 中國

- 日本

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Intel Corporation

- Broadcom Inc.

- Microchip Technology Inc.

- Cirrus Logic Inc.

- Texas Instruments Incorporated

- Silicon Laboratories Inc.

- Marvell Technology Group

- Realtek Semiconductor Corp.

- Cadence Design Systems Inc.

- Futurlec Inc.

第8章投資分析

第9章 市場機會與未來趨勢

The Ethernet Controller Market size is estimated at USD 12.48 billion in 2025, and is expected to reach USD 17.85 billion by 2030, at a CAGR of 7.42% during the forecast period (2025-2030).

The increasing adoption of data centers and cloud computing in the modern digital economy drives the market. From scientific discoveries to artificial intelligence (AI), modern data centers are crucial to solving some of the world's most important challenges. These modern data centers are transforming to increase networking bandwidth and optimize workloads, like AI.

The increasing data volume heightened the need for Ethernet controllers, thereby driving the market's growth. According to the Ericsson Mobility Report, the decline in data packet charges and increased smartphone usage accelerated data traffic across India. The report estimates that the volume of mobile data traffic is expected to reach over 21 exabytes per month by 2025.

Ethernet for Control Automation Technology (EtherCAT) is based on the CANopen protocol and Ethernet. However, it differs from Internet or network communications in that it is specifically optimized for industrial automation control. Utilizing the OSI network model, Ethernet and EtherCAT rely on the same physical and data link layers. Beyond that, the two networks diverge by design as they are optimized for different tasks.

A USB-to-ethernet converter is useful in various circumstances. For example, a user's laptop's Wi-Fi option may be experiencing technical difficulties, or the user may discover that the Wi-Fi is disabled for security reasons in specific locations despite users requiring internet access. An Ethernet port and a simple adapter should suffice in such circumstances, as a cable will provide a faster and more consistent connection.

The market is expected to create a roadblock for itself to update faster on technology, as such long-duration contracts with extensions saturate the market, thus impacting its growth. When the industry trends indicate that the solution and service providers should use new and emerging technology, such as Ethernet controllers, long-term contracts can be counterproductive in the market. Moreover, the growing competition in the market impacts the profit margins and growth of the existing vendors. The level of competition between suppliers is so high that Ethernet controller products are transitioning to be commoditized in the world.

The unanticipated swing in demand with reduced supply led to the ramping of production by several component manufacturers, which still fell short. The primary drivers behind the growth are the continued investments in digitizing global economies, the deployment of 5G technologies, and the robust investments in data centers and cloud services. The market is expected to witness growth in the coming years, owing to the increase in the demand for high-speed connectivity, driven by the ongoing 5G smartphone ramp-up and the continued strength of the cloud. According to Ericsson, 5G subscriptions are forecast to increase drastically from 2019 to 2028 globally, from over 12 million to over 4.5 billion subscriptions, respectively.

Ethernet Controller Market Trends

Servers to Hold the Largest Market Share

- Most businesses require data storage, whether for their email, website, or online transactions, and this may be done on a server. Servers are specialized computers linked to a company's local network and, in most cases, the Internet. If a company is small enough, it may keep its servers in-house and run them independently. However, as organizations and their demands expand, more servers and storage space are required as more data is generated. A typical data center infrastructure includes many servers, which are powerful computers.

- As servers power data centers and support cloud environments, the server industry is the backbone of innumerable mission-critical and client-side corporate computing operations. As businesses seek to power big data and advanced workload requirements, demand for higher-performing servers continues to climb. With the increasing cloud computation, AI, big data, and data centers, the need for servers will also grow significantly. With this growing demand for servers, Ethernet controllers will also increase.

- A baseboard management controller (BMC) monitors most modern servers' temperature, voltages, and fans. When something in the system requires an administrator's attention (such as the CPU overheating), the BMC may generally be set to send out notifications (in the form of emails and SNMP alerts).

- Application device queues (ADQ), dynamic device personalization (DDP), and support for both iWARP and RoCEv2 Remote Direct Memory Access (RDMA) are included in Intel Ethernet 800 Series controllers. It provides workload-optimized performance and the flexibility to meet changing network requirements. For high-performance server applications, including NFV, storage, HPC-AI, and hybrid cloud, the 800 Series controllers provide speeds up to 100GbE.

- Further, the NetXtreme-E Series BCM57414 50G PCIe 3.0 Ethernet controller is based on Broadcom's scalable 10/25/50/100/200G Ethernet controller architecture. This architecture is designed to build highly scalable, feature-rich networking solutions in servers for enterprise and cloud-scale networking and storage applications, such as high-performance computing, telco, machine learning, storage disaggregation, and data analytics.

- According to Ericsson, the data traffic is expected to triple by 2030. In 2023, smartphones across the globe used an average of 20.37 gigabytes of mobile data per month, up from 15.93 gigabytes the previous year. This figure is expected to reach 25.17 gigabytes in 2024 and 47.27 gigabytes by 2028. Thus, the distributed cloud that can secure the low latency and high bandwidth required to connect such scale easily is coming into action. Several technology giants are addressing the critical challenges while managing their servers and computational needs. A major factor responsible for the rising densities is the rapid rise of data-crunching for AI.

North America Holds Largest Market Share

- 5G requires a flexible networking and transportation infrastructure to reach its full potential. As Ethernet becomes the most efficient transport technology, carrier routers and switches are being charged with supporting a range of use cases over shared infrastructure, increasing Ethernet gear installations.

- According to Ericsson, 5G subscriptions are predicted to increase drastically in North America from 2019 to 2028, from over 1.07 million to over 405.4 million. With such massive growth in the 5G industry in the United States, the market will also see demand for Ethernet controllers.

- As an Ethernet controller allows wired connections to a computer network, any device requiring a high-speed internet connection has to use Ethernet controllers for fast internet connections. Such is the case with cloud infrastructure networks. With developing cloud capabilities and enterprises shifting their work to the cloud, the demand for cloud applications is increasing rapidly in the United States.

- Due to low costs, less maintenance, data security, and almost unlimited scalability, more businesses will opt for cloud storage solutions in the coming years. Therefore, this rise in cloud computing and storage will also surge in the ethernet controller market.

- The Communications Research Centre (CRC), Canada's leading advanced telecommunications research center, is dedicated to bringing 5G technology to Canadians to ensure they can use state-of-the-art telecommunications systems, technologies, and applications. According to GSMA, by 2030, 5G connections are predicted to account for 95% of all mobile connections in Canada.

Ethernet Controller Industry Overview

The ethernet controller market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Intel Corporation, Broadcom Inc., Microchip Technology Inc., Cirrus Logic Inc., and Texas Instruments Incorporated. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In April 2024, Microchip acquired ADAS and Digital Cockpit Connectivity Pioneer VSI Co. Ltd to extend automotive networking. The market acquisition adds ASA Motion Link technology to Microchip's broad Ethernet and PCIe automotive networking portfolio to enable next-generation software-defined vehicles.

In March 2024, Marvell Technology Inc., in partnership with TSMC, unveiled the industry's pioneering 2 nm semiconductor technology platform, tailored for high-speed infrastructure demands. The Marvell 2 nm platform, an extensive IP suite, addresses many infrastructure needs. It includes high-speed long-reach SerDes exceeding 200 Gbps, processor subsystems, encryption engines, system-on-chip fabrics, chip-to-chip interconnects, and high-bandwidth physical layer interfaces for computing, memory, networking, and storage. These advancements form the cornerstone for developing bespoke cloud-optimized compute accelerators, Ethernet switches, digital signal processors for optical and copper interconnects, and other devices crucial for fueling AI clusters, cloud data centers, and similar high-performance infrastructure.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 An Assessment of the Impact of Key Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Adoption of EtherCat for Realtime Network for Machine Control

- 5.1.2 Adoption of USB Ethernet Controllers

- 5.2 Market Restraints

- 5.2.1 Low Demand Due to Impact of COVID-19

- 5.2.2 Competitive Prices Led to Stiff Profit Margins

6 MARKET SEGMENTATION

- 6.1 By Bandwidth Type

- 6.1.1 Fast Ethernet

- 6.1.2 Gigabit Ethernet

- 6.1.3 Switch Ethernet

- 6.2 By Function

- 6.2.1 PHY (Physical Layer)

- 6.2.2 Integrated

- 6.3 By End Users

- 6.3.1 Servers

- 6.3.2 Routers and Switches

- 6.3.3 Consumer Applications

- 6.3.4 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 India

- 6.4.3.2 China

- 6.4.3.3 Japan

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Broadcom Inc.

- 7.1.3 Microchip Technology Inc.

- 7.1.4 Cirrus Logic Inc.

- 7.1.5 Texas Instruments Incorporated

- 7.1.6 Silicon Laboratories Inc.

- 7.1.7 Marvell Technology Group

- 7.1.8 Realtek Semiconductor Corp.

- 7.1.9 Cadence Design Systems Inc.

- 7.1.10 Futurlec Inc.