|

市場調查報告書

商品編碼

1689935

鎂金屬:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Metal Magnesium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

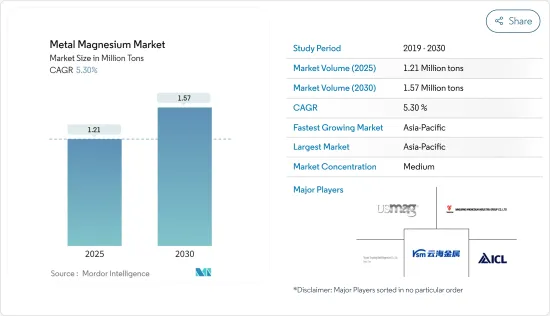

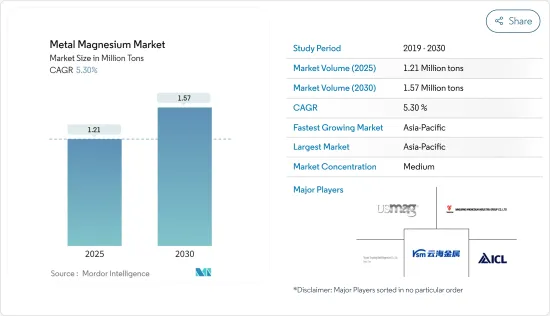

預計2025年鎂金屬市場規模為121萬噸,2030年將達157萬噸,預測期間(2025-2030年)複合年成長率為5.3%。

2020 年,新冠疫情對市場產生了負面影響。然而,由於汽車和電子等各終端用戶領域的消費增加,2021 年需求增加。此外,在電子領域,鎂也用於散熱系統以及電視和電腦機殼。因此,市場在疫情後實現了穩定成長,預計在預測期內仍將以同樣的速度成長。

主要亮點

- 短期內,與其他金屬合金化的需求增加以及航太和汽車工業對輕量材料的需求不斷成長是刺激市場需求的一些促進因素。

- 另一方面,金屬價格的波動預計會阻礙市場成長。

- 未來幾年,隨著越來越多的人購買電動車,市場可能會獲得更多機會。

- 預計亞太地區將主導市場,並可能在預測期內呈現最高的複合年成長率。

鎂金屬市場趨勢

鋁合金在生產上的使用日益增多

- 鎂為金屬(尤其是鋁合金)提供了中等、高強度的性能,同時又不影響延展性。添加鎂的鋁合金被歸類為 5000 系列,以板材和片材形式在市場上銷售。

- 鋁合金主要應用領域包括航太零件製造、汽車零件製造、工業零件、工具、機械等。

- 根據國際汽車製造商組織(OICA)的數據,2022年OICA成員國的新車銷售和註冊量將接近6,900萬輛。也就是說,汽車銷售和生產數量的增加將導致鋁合金市場需求的增加。

- 此外,2022 年前三個季度全球乘用車產量約為 5,000 萬輛,較 2021 年同期成長近 9%。不過,根據歐洲汽車工業協會 (ACEA) 的報告,這仍比 2019 年疫情前的水平低約 500 萬輛。

- 然而,電動車領域的需求可能會增加對鋁合金的需求。預計多種應用對輕量級組件的需求不斷成長將推動市場的發展。

- 根據世界經濟論壇(WEF)統計,2022年上半年全球售出近430萬輛新型電池驅動電動車(BEV)和插電式混合動力車(PHEV)。此外,BEV的銷量較去年同期成長約75%,而PHEV的銷量則成長了37%。此外,2022年1-8月全球電動車銷量突破570萬輛大關,插電式電動車的市場佔有率上升至近15%。

- 減輕飛機的重量有助於節省能源和燃料。

- 由於航空客運量和貿易航空業務的增加,對民航機的需求上升,引發了生產。重點是能夠高效運載重物的堅固、輕型飛機。

- 根據波音公司2022-2041年的商業展望,預計北美地區將在預測期結束時(2041年)覆蓋全球約22%的飛機機隊。未來20年預計總合9,310架飛機交付,其中單通道交付量佔該地區飛機總數的近70%。

- 由於所有這些因素,預測期內全球鎂金屬市場可能會成長。

亞太地區佔市場主導地位

- 亞太地區是全球市場上最大的金屬鎂消費地區。中國、印度和日本等國使用大量的金屬鎂。

- 金屬鎂主要用於鋁合金、壓鑄、鋼材、金屬還原等。此外,鋁合金和壓鑄件在汽車零件、航太零件和設備製造以及其他終端用戶產業的應用也越來越多。亞太地區在全球汽車、航太和電子市場佔有重要佔有率。

- 中國是汽車業最大的製造國,預計該國的鎂市場將呈指數級成長。根據中國工業協會(CAAM)預測,2022年中國汽車產量預計將年增與前一年同期比較%左右。 2022 年汽車產量將達到約 2,700 萬輛,而 2021 年的產量為 2,608 萬輛。

- 此外,印度品牌股權基金會(IBEF)預測,到2026年,印度汽車產業規模將達到3,000億美元。報告顯示,印度22會計年度的汽車年產量約2,300萬輛。

- 預測期內,中國對電動車的需求也預計將大幅成長。隨著政府舉措不斷增多,電動車生產企業數量不斷增加,充電站數量不斷增加,國家也正在發生快速的變化。

- 根據中國工業協會預測,2022年中國新能源汽車總產量將達700萬輛左右。與 2021 年的產量(354 萬輛)相比,這一數字成長了近 97%,令人震驚。

- 日本也計劃在2035年實現汽車銷售100%轉型為電動車,目前該國電動車市場正在成長。美國公司可能會在與電動車相關的各個領域找到商機。因此,預計該國電動車市場的擴大將對市場成長產生積極影響。

因此,以上所有因素均有可能對未來亞太地區對鎂金屬的需求產生重大影響。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 與其他金屬合金化的需求不斷增加

- 航太和汽車工業對輕量材料的需求不斷增加

- 限制因素

- 金屬價格波動

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 最終用戶產業

- 鋁合金

- 壓鑄

- 鋼

- 金屬還原

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)分析

- 主要企業策略

- 公司簡介

- American Magnesium

- Dead Sea Magnesium(ICL Group)

- Fu Gu Yi De Magnesium Alloy Co. Ltd.

- Nanjing Yunhai Special Metals Co. Ltd.

- Regal Metal

- Rima Industrial

- Shanxi Bada Magnesium Co. Ltd.

- Solikamsk Magnesium Works

- Southern Magnesium & Chemicals Limited(SMCL)

- Taiyuan Tongxiang Metal Magnesium Co. Ltd.

- US Magnesium LLC

- Wenxi Yinguang Magnesium Industry(group)Co. Ltd.

- Western Magnesium Corporation

第7章 市場機會與未來趨勢

- 電動車日益普及

The Metal Magnesium Market size is estimated at 1.21 million tons in 2025, and is expected to reach 1.57 million tons by 2030, at a CAGR of 5.3% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market in 2020. However, the demand increased in 2021 due to the rise in consumption from various growing end-user sectors, such as automotive and electronics. Moreover, in electronics, magnesium is used in heat dissipation systems, television and computer casings, and others. This resulted in the steady growth of the market in the post-pandemic era and is expected to continue at the same pace during the forecast period.

Key Highlights

- Over the short term, the growing demand for alloying with other metals and the increasing demand for lightweight materials in the aerospace and automotive industries are some driving factors stimulating market demand.

- On the flip side, fluctuations in the prices of metals are expected to hinder market growth.

- In the coming years, the market is likely to have more opportunities as more people buy electric cars.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Metal Magnesium Market Trends

Increasing Usage in the Production of Aluminum Alloys

- Magnesium offers moderate and high strength characteristics to metals, especially aluminum alloys, without impacting the ductility. Aluminum alloys with magnesium added are placed in the 5000 series and are commercially available in plates and sheets.

- Major applications of aluminum alloys include aerospace parts manufacturing, automotive component manufacturing, industrial components, tools and machinery, and others.

- As more people want electric cars, the way cars are made is changing.According to the Organization Internationale des Constructeurs d'Automobiles (OICA), the total number of new automobile sales and registrations in OICA member countries was close to 69 million units in 2022. So, a rise in the number of vehicles sold or made would lead to a rise in the market demand for aluminum alloys.

- Moreover, in the first three quarters of 2022, around 50 million passenger cars were manufactured worldwide, an increase of nearly 9% compared to the same quarters in 2021. However, this was still around 5 million units less than pre-pandemic levels in 2019, as per the report of the European Automobile Manufacturers' Association (ACEA).

- However, the demand for the electric vehicle segment may likely increase the demand for aluminum alloys. The growing demand for lightweight components across several applications is anticipated to drive the market.

- As per the World Economic Forum (WEF), nearly 4.3 million new battery-powered EVs (BEVs) and plug-in hybrid electric vehicles (PHEVs) were sold globally in the first half of 2022. Additionally, BEV sales grew by around 75% on the year and PHEVs by 37%. Moreover, global electric car sales crossed the 5.7 million unit mark in the first eight months of 2022, and the market share of plug-in electric cars has increased to nearly 15%.

- Aluminum alloys are also used in airplanes because they are strong and don't weigh much.Reducing the weight of an airplane is a good way to save energy and cut down on fuel use, since a lighter plane needs less lift force and thrust to fly.

- The growing demand for commercial aircraft due to an increase in air passengers and air transport for trade operations has triggered manufacturing. It covers high-strength and lightweight aircraft that can carry heavy loads with efficient performance.

- According to Boeing's commercial outlook for 2022-2041, the North American region is predicted to cover around 22% of the global fleet at the end of the forecast period (2041). It is also anticipated that a total of 9,310 fleet deliveries will be made over the next two decades, with single-aisle accounting for almost 70% of the total deliveries in the region.

- Owing to all these factors, the market for metal magnesium is likely to grow globally during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is the biggest consumer of magnesium metal on the global market. Countries like China, India, and Japan use a lot of magnesium metal.

- Metal magnesium is mainly used in aluminum alloys, die-casting, iron and steel, metal reduction, and others. Moreover, aluminum alloys and die-casting have been increasingly used in the manufacturing of automotive parts, aerospace parts and equipment, and other end-user industries. The Asia-Pacific region has a significant global automotive, aerospace, and electronics market share.

- China being the largest manufacturer in the automotive industry, the market for magnesium in the country is predicted to rise at an exponential rate. According to the Chinese Association of Automotive Manufacturers (CAAM), China's automotive production increased by roughly 3.4% in 2022 compared to the previous year. In 2022, approximately 27 million automobiles will be produced, compared to 26.08 million units in 2021.

- The India Brand Equity Foundation (IBEF), in addition, forecasts that the Indian automotive industry will reach USD 300 billion by 2026.The report also stated that India's annual production of automobiles in FY22 was approximately 23 million units.

- During the forecast period, there is also likely to be strong growth in the demand for electric vehicles in China. This is because the country is changing quickly due to more government initiatives, more companies making electric cars, and more charging stations.

- China has been the biggest maker and buyer of electric cars, accounting for about half of the market around the world.According to the China Association of Automobile Manufacturers, the total production of new energy vehicles in China in 2022 was estimated to be about 7 million units. This saw a whooping increase of close to 97% when compared with the production of vehicles in 2021 (3.54 million units).

- Japan is also planning to transition to 100% electric car sales by 2035, and the Japanese electric vehicle market is growing. The United States companies may find business opportunities in various areas related to electric vehicles. Expansion of the electric vehicle market in the country is therefore projected to benefit market growth.

So, it's likely that all of the above factors will have a big effect on the demand for magnesium metal in the Asia-Pacific region in the future.

Metal Magnesium Industry Overview

The metal magnesium market is partially consolidated in nature. Some of the key players in the studied market include Nanjing Yunhai Special Metals Co. Ltd., Taiyuan Tongxiang Metal Magnesium Co. Ltd., Dead Sea Magnesium (ICL Group), Wenxi YinGuang Magnesium Industry (Group) Co. Ltd., and US Magnesium LLC, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Alloying with Other Metals

- 4.1.2 Increasing Demand for Lightweight Materials in the Aerospace and Automotive Industry

- 4.2 Restraints

- 4.2.1 Fluctuation in Prices of Metal

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 End-user Industry

- 5.1.1 Aluminum Alloys

- 5.1.2 Die-casting

- 5.1.3 Iron and Steel

- 5.1.4 Metal Reduction

- 5.1.5 Other End-user Industries

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 American Magnesium

- 6.4.2 Dead Sea Magnesium (ICL Group)

- 6.4.3 Fu Gu Yi De Magnesium Alloy Co. Ltd.

- 6.4.4 Nanjing Yunhai Special Metals Co. Ltd.

- 6.4.5 Regal Metal

- 6.4.6 Rima Industrial

- 6.4.7 Shanxi Bada Magnesium Co. Ltd.

- 6.4.8 Solikamsk Magnesium Works

- 6.4.9 Southern Magnesium & Chemicals Limited (SMCL)

- 6.4.10 Taiyuan Tongxiang Metal Magnesium Co. Ltd.

- 6.4.11 US Magnesium LLC

- 6.4.12 Wenxi Yinguang Magnesium Industry (group) Co. Ltd.

- 6.4.13 Western Magnesium Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Adoption of Electric Vehicles