|

市場調查報告書

商品編碼

1445573

消費者物聯網:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Consumer IoT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

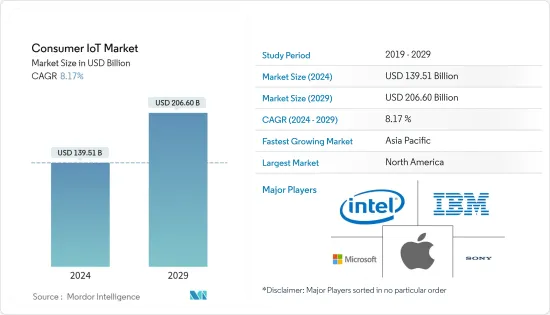

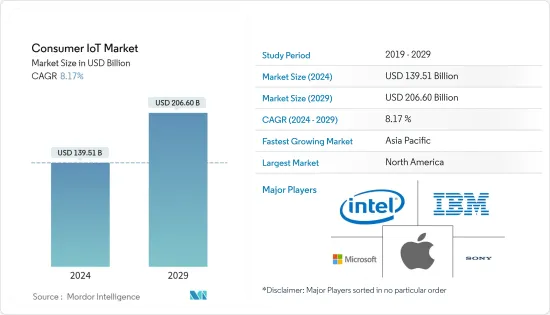

消費者物聯網市場規模預計到 2024 年為 1,395.1 億美元,預計到 2029 年將達到 2066 億美元,在預測期內(2024-2029 年)年複合成長率為 8.17%。

主要亮點

- 物聯網是全球數位轉型的基礎,有助於改變許多消費者、工業、政府和國防應用。 IT 支出在 2022 年有所下降,但預計在 2023 年會有所增加。如物聯網分析報告所述,物聯網將推動 IT 支出,預計 2023 年將成長約 19%。採用物聯網有助於克服勞動力短缺並加速數位轉型。

- 整合 5G 和物聯網可以促進各個行業的許多永續性用例。 83% 的組織透過實施物聯網技術提高了效率。例如,水產業中的物聯網應用使電力公司能夠有效地了解、監控、管理受缺水影響的地區的供水並從中收益。智慧水務解決方案

- 物聯網正在透過機器人外科醫生和智慧醫院等創新來改變醫療保健產業,將患者照護提升到一個新的水平。使用感測器資料的物聯網設備可以幫助健康監測、早期診斷、醫院治療等。例如,由物聯網平台支援的蘋果智慧型手錶整合了跌倒偵測系統和緊急呼叫服務,可以幫助及時挽救生命。

- COVID-19 的爆發改變了消費者看待物聯網的方式。介紹物聯網機器人,這些機器人在家庭、零售、製造和醫療保健等領域需求量大。例如,潔淨科技公司 Skillancer Solar 開發了一種無水機器人,用於清潔家庭屋頂上的小型太陽能發電廠。這些機器人可以根據您的要求幫助清潔面板,無需任何人工干涉。

- 儘管物聯網有潛力為日常業務帶來便利並提高生產力,但由於實施該技術所需的成本高昂,該技術的採用進展緩慢。開發和維護這些物聯網設備的高昂成本限制了市場的成長。

消費性物聯網市場趨勢

家庭自動化預計將佔據最大的市場佔有率

- 隨著智慧型手機使用的增加和高速網路的引入,人們現在能夠在日常業務中採用物聯網技術。隨著5G的加速普及,預計2029年全球物聯網市場將達到24,652.6億美元。

- 城市數位化是全球各國政府關注的重點領域之一。物聯網是這些智慧城市計劃背後的關鍵組成部分。總部位於香港的 GLy Capital Investment 已為德國 Volocopter 的 Neom計劃提供資金。該計劃包括開發用於運輸乘客和貨物的 Velocity 空中計程車,從而適應實體和數位基礎設施。

- 2023年2月,來自新加坡的企業家團隊計劃投資智慧城市計劃,特別是在UP,在印度擁有綜合交通管理系統、固態廢棄物管理系統、健康ATM機等設施。我們參觀了智慧城市指揮控制中心。

- 2022 年 10 月 - 科技公司 ABB 發布用於智慧家庭自動化的 SmartTouch 10。這對於室內通訊非常有用,並且無需額外的室內視訊站。該設備可以管理整個建築安裝,從 IP 攝影機到照明、遮陽、場景和溫度控制。通知中心通知使用者所有操作和錯過的訪問。

北美佔最大市場佔有率

- 北美引領了大多數技術創新和進步,物聯網的採用重塑了全部區域各個工業和消費領域。該地區的 5G普及很高,到 2022 年第三季度,5G 連接總合已安裝 1.08 億個。自主 5G 的持續部署將推動整個物聯網市場。

- 2023 年 2 月 加拿大物聯網公司 Elevenx 為北美的市政停車場提供智慧停車系統,可監控停車位並提供即時可用資料。這將減少該地區的堵塞,最佳化停車法規並進一步改善城市交通。

- 2022年8月北美最大的IOT Pay平台被GrubMarket收購。此次收購將使 GrubMarket 能夠利用 IOT Pay 的技術和付款基礎設施來簡化食品供應鏈產業。 IOT Pay 也期待為中小型企業 (SMB) 推出數位銀行業務解決方案。

消費性物聯網產業概述

消費者物聯網市場高度分散,潛力巨大,隨著對人工智慧、機器學習、巨量資料和5G技術的大量投資,正在邁向新的水平。物聯網簡化了生活,人們購買小工具來調節和監控他們的生活方式。提供該領域服務的主要企業包括微軟公司、蘋果、索尼、IBM、英特爾等。這些物聯網領導者正在投資新產品開發和協作,以擴大其在各個行業和地區的足跡。

2023 年 2 月,Taoglas 與物聯網經銷商 Westbase.io 合作,為歐洲地區的客戶提供創新的 4G/5G 和物聯網解決方案。此次合作將為客戶提供可靠、高效的解決方案,涵蓋建築、物流、緊急服務、智慧城市、連線健診和其他要求嚴格的應用。 Taiglas 高度精密的天線利用 Westbase 的網路為工業客戶提供尖端的射頻和天線技術。

2022 年 11 月,瑞士物聯網公司 Loriot 與阿拉伯聯合大公國物聯網平台 Disrupt-X 簽署協議,以加速歐洲和世界其他地區的物聯網普及。兩家公司將投資開發智慧解決方案,為工業、商業和住宅領域提供創新的物聯網產品和服務。我們也計劃為歐洲地區的客戶提供本地網路伺服器。此外,Disrupt-X 引入了一個儀表板,用於從物聯網平台直接存取 LORIOT 網路伺服器。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- 產業價值鏈分析

- 消費者物聯網市場中的 COVID-19 評估

第5章市場動態

- 市場促進因素

- 消費者對連網型設備的採用率和技術普及有所提高

- 5G 的影響和行動電話網路的興起

- 由於家庭自動化的增加,市場預計將蓬勃發展

- 市場挑戰

- 政府法規、資料安全和隱私以及互通性問題

第6章市場區隔

- 按類型

- 硬體(處理器、感測器、閘道、控制器、交換器等組件)

- 解決方案(獨立軟體和整合平台)

- 服務(設備生命週期管理、遠端監控、部署服務)

- 按用途

- 家庭自動化(智慧恆溫器、儀表、鎖等)

- 消費性穿戴裝置(智慧型手錶、眼鏡、健身追蹤器等)

- 消費性電器產品(智慧電視和其他連網白色家電)

- 醫療保健(醫療級設備和穿戴式裝置、平台等)

- 汽車(資訊娛樂系統、聯網汽車等)

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 亞太地區其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- MEA 的其餘部分

- 北美洲

第7章 競爭形勢

- 公司簡介

- AT&T Inc.

- Microsoft Corporation

- Sony Corporation

- Apple Inc.

- LG Electronics

- Alphabet Inc.

- Hewlett Packard Enterprise(HPE)

- Honeywell International Inc.

- Cisco Systems Inc.

- Intel Corporation

- IBM Corporation

- Schneider Electric SE

- Symantec Corporation

- Qorvo Inc.

第8章投資分析

第9章 全球消費性物聯網市場的未來

The Consumer IoT Market size is estimated at USD 139.51 billion in 2024, and is expected to reach USD 206.60 billion by 2029, growing at a CAGR of 8.17% during the forecast period (2024-2029).

Key Highlights

- Iot is the base of digital transformation worldwide, helping to transform many consumer, industrial, government, and defense applications. Even though IT spending fell in 2022, it is expected to grow in 2023. IoT will drive this IT expenditure with approximately 19% growth in 2023, as mentioned in a report by IoT Analytics. IoT deployment helps overcome labor shortages and could speed up digital transformation initiatives.

- Integrating 5G and IoT can promote many sustainability use cases in various industries. 83% of organizations have improved their efficiency by introducing IoT technology. For instance, with IoT applications in Water Industry, the utility company can recognize, monitor, manage, and monetize water distribution effectively in regions impacted by water scarcity. Smart Water solutions

- IoT is changing the healthcare industry with innovations like robot surgeons and smart hospitals, which take patient care to the next level. IoT devices that use sensor data help in health condition monitoring, early diagnosis, in-patient treatment, and more. For instance, Apple Smartwatch, which works on an IoT platform, is integrated with Fall Detection System and Emergency Call services that help save lives on time.

- The COVID-19 outbreak changed the perspective of consumers toward IoT. The introduction of IoT robots is catching demand in sectors like household, retail, manufacturing, healthcare, and others. For instance, Skilancer Solar, a clean-tech firm, developed a waterless robot for cleaning small-scale solar power plants on household rooftops. These robots will help to clean the panels as per requirement, without any human involvement.

- IoT may bring convenience and improve the productive time of daily tasks, but the implementation of it is pretty expensive, so there is slow adoption of this technology. The high cost involved in developing and maintaining these IoT devices restrains the market growth.

Consumer Internet of Things (IoT) Market Trends

Home Automation is Expected to Account for Maximum Market Share

- The increasing use of smartphones and the introduction of high-speed networks have enabled people to adopt IoT technologies in their routine tasks. As 5G adoption accelerates, the global IoT market is expected to reach 2,465.26 billion USD by 2029.

- The digitization of cities is one area that Governments are focussing globally. IoT is the major building block behind these smart city projects. Hong Kong-based GLy Capital Investment provided funds to German-based Volocopter for project Neom. The project will involve the development of Velocity air taxis to transport passengers and goods, enabling the physical and digital infrastructure to match.

- Feb 2023 - A team of Singapore entrepreneurs visited the Smart City Command Control Centre in India as they plan to invest in Smart City projects, particularly in UP state, with facilities like the integrated traffic management system, the solid waste management system, and health ATMs.

- October 2022 - The technology company ABB released SmartTouch 10 for smart home automation. This will help indoor communication, replacing the need for an additional indoor video station. The device can manage entire building installation, from IP cameras to lighting, shading, scene, and temperature control. A notification center informs users about all actions and missed visits.

North America Occupies the Largest Market Share

- North America is a pioneer in adopting most technological innovations and advancements, and the adoption of IoT is reshaping various industrial and consumer sectors throughout the region. The 5G adoption in the region is high, and a total of 108 million 5G connections have been laid by Q3 2022. The autonomous 5G deployments that are underway will drive the market for IoT as a whole.

- February 2023 - Canadian-based IoT company, Eleven-x, will help North America municipal parking with the smart parking system that will monitor parking spots and provide real-time data on availability. This will reduce congestion in the area and optimize parking enforcement, further improving urban mobility.

- August 2022 - North America's biggest IOT Pay platform was acquired by GrubMarket. This acquisition will help GrubMarket to use IOT Pay's technology and payments infrastructure to streamline the food supply chain industry. IOT Pay is also looking forward to rolling out a digital banking solution for small and medium-sized businesses (SMBs).

Consumer Internet of Things (IoT) Industry Overview

The Consumer IoT market is highly fragmented with huge potential and is turning to the next level with significant investments in AI, machine learning, big data, and 5G technology. IoT simplifies lives, and people buy gadgets to regulate and monitor their way of living. Some significant players offering their services in this sector include Microsoft Corporation, Apple Inc, Sony Corporation, IBM, Intel, and so on. These IoT leaders invest in new product developments and collaborations to expand their footprints across different industries and geographies.

In February 2023, Taoglas and Westbase.io, the IoT distributor, collaborated to provide innovative 4G/5G and IoT solutions to its customers in European Region. The partnership will offer clients reliable and high-performance solutions across construction, logistics, emergency services, smart cities, connected health, and other demanding applications. The highly-sophisticated antennas from Taoglas will deliver the most advanced RF and antenna technologies to the industrial clients with Westbase's network.

In November 2022, Switzerland-based IoT company, Loriot, signed a contract with Disrupt-X, a UAE-based IoT platform, to promote IoT dissemination in Europe and other geographies. The companies will invest in developing smart solutions that deliver innovative IoT products and services designed for the industrial, commercial, and residential sectors. They also plan to offer local Network Servers for their clients in the European region. Further, Disrupt-X will introduce a dashboard to access LORIOT Network Servers directly from its IoT Platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 on the Consumer IoT Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Connected Devices and Technology Proliferation Among Consumers

- 5.1.2 Impact of 5G and Increased Cellular Networks

- 5.1.3 Increasing home automation is expected to flourish the market

- 5.2 Market Challenges

- 5.2.1 Government Regulations, Security and Privacy of Data and Interoperability Concerns

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware (Components, such as Processors, Sensors, Gateways, Controllers, and Switches)

- 6.1.2 Solutions (Independent Software and Integrated Platforms)

- 6.1.3 Services (Device Lifecycle Management, Remote Monitoring, and implementation Services)

- 6.2 By Application

- 6.2.1 Home Automation (Smart Thermostats, Meters, Locks, etc.)

- 6.2.2 Consumer Wearables (Smart Watches, Glasses, Fitness Trackers, etc.)

- 6.2.3 Consumer Electronics (Smart TV and Other Connected White Goods)

- 6.2.4 Healthcare (Medical-grade Devices and Wearables, Platforms, etc.)

- 6.2.5 Automotive (Infotainment System, Connected Cars, etc.)

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 UK

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Australia

- 6.3.3.5 Rest of Aisa-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Argentina

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 UAE

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of MEA

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 AT&T Inc.

- 7.1.2 Microsoft Corporation

- 7.1.3 Sony Corporation

- 7.1.4 Apple Inc.

- 7.1.5 LG Electronics

- 7.1.6 Alphabet Inc.

- 7.1.7 Hewlett Packard Enterprise (HPE)

- 7.1.8 Honeywell International Inc.

- 7.1.9 Cisco Systems Inc.

- 7.1.10 Intel Corporation

- 7.1.11 IBM Corporation

- 7.1.12 Schneider Electric SE

- 7.1.13 Symantec Corporation

- 7.1.14 Qorvo Inc.