|

市場調查報告書

商品編碼

1445566

區塊鏈物聯網 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Blockchain IoT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

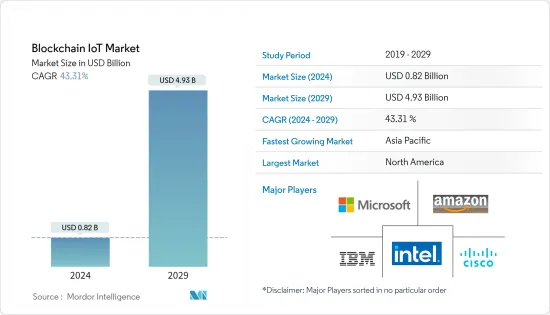

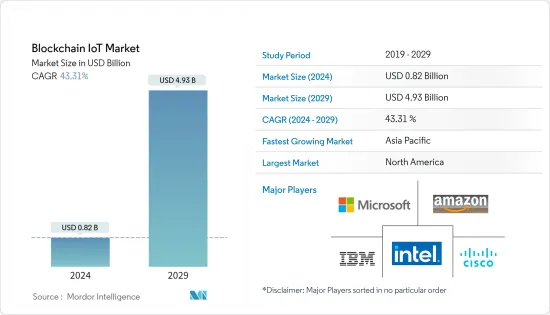

2024年區塊鏈物聯網市場規模預計為8.2億美元,預計到2029年將達到49.3億美元,在預測期內(2024-2029年)CAGR為43.31%。

物聯網(IoT)是一種透過網際網路連接所有設備的先進技術,而區塊鏈是一種分散式金融技術。將區塊鏈用於物聯網的主要優勢包括降低共謀和操縱的可能性以及降低交易結算和成本。

主要亮點

- 隨著通訊技術的快速發展,物聯網(IoT)的研究和工業正在經歷指數級成長。隨著產生、傳輸和處理的資料量的增加,它正在從起步階段進入成熟階段。

- 傳統的物聯網系統由集中式拓撲提供支持,其中資料從實體設備傳輸到雲端,並在雲端使用分析來處理資料。輸出被接收回 IoT 設備。儘管如此,網路設備頻率的增加限制了物聯網平台的可擴展性,並使其面臨漏洞的風險,最終會損害用戶的網路安全和隱私。

- 由去中心化架構和加密技術支援的區塊鏈透過確保點對點網路中的隱私和安全來利用物聯網平台。然而,它需要較高的運算能力,從而導致較高的頻寬開銷和延遲。

- 物聯網生態系統相當多元化。創建與區塊鏈技術相容的物聯網設備涉及許多課題。可擴展性涉及處理廣泛的感測器網路產生的大量資料,是物聯網面臨的主要課題之一。在基於區塊鏈的生態系統中加密所有物聯網設備所需的處理能力和時間未達預期。將帳本保留在邊緣節點的區塊鏈系統的另一個關鍵課題是儲存。邊緣的物聯網智慧型設備目前無法儲存大量資料或處理大量運算能力。

- COVID-19 大流行影響了許多部門,包括個人和企業。網際網路生態系統在全球範圍內發揮著至關重要的作用。由於COVID-19疫情,對網路企業的依賴急劇增加。 BFSI、醫療保健和生命科學、製造、汽車、零售、運輸和物流正在利用網際網路為客戶提供所需的服務。供應商注意到對區塊鏈物聯網解決方案的需求下降。全球停工影響了區塊鏈物聯網所需的特定硬體組件的需求和可用性。未來,醫療保健和政府垂直產業預計將適度採用物聯網感測器和區塊鏈,以在流行病期間保護醫院、政府建築和人口。

- 在新冠肺炎 (COVID-19) 疫情之後,政府也一直在研究實施多種智慧城市技術的潛力,以提高城市在危機時期的復原能力,這可能會推動市場的成長。

區塊鏈物聯網市場趨勢

智慧城市最終用戶區隔市場預計將佔據重要市場佔有率

- 在過去的幾十年裡,世界經歷了前所未有的城市成長,這主要是由於人口增加、資源稀缺和氣候變遷。根據聯合國統計,約有54% 的人口居住在城市,預計到2050 年這一比例將達到66%。政府機構專注於物聯網、無線通訊和區塊鏈等現代技術,以應對城市成長、降低成本並最佳化城市資源。

- 提供永續的環境是智慧城市的關鍵特徵之一。鑑於快速的工業和城市化趨勢,追蹤環境指標至關重要。環境監測的主要課題是使用可靠且精確的監測工具進行即時資料收集。智慧城市平台的主要角色可能有利於預測期內市場的擴張。

- 資料安全是大都市中部署的設備和服務的重要約束之一,借助區塊鏈的去中心化平台,確保公眾的信任並促進市場的成長。

- 根據《經濟學人》智慧城市指數評級,哥本哈根是 2022 年全球領先的數位城市之一,得分為 80.3。首爾、北京、阿姆斯特丹和新加坡則名列最佳數位城市前五名。

- 此外,世界各地的政府措施也開始認知到區塊鏈的潛力,因為它提供了交易管理所需的基礎設施,同時確保透明度和安全性,而這將是智慧城市實施的關鍵要素。

- 在全球範圍內,許多智慧城市計畫和努力正在實施,鼓勵城市化帶來的全球投資。經合組織估計,2010 年至 2030 年間,全球所有大都會基礎設施項目對智慧城市計畫的投資總額將達到約 1.8 兆美元。

亞太地區預計將成為成長最快的市場

- 由於該地區科技公司不斷湧入,以及對物聯網技術、智慧城市部署、政府舉措和城市發展的投資不斷增加,預計亞太地區在預測期內將以最高的速度成長。人口。

- 快速的城市化和地方政府措施促進了對智慧城市的需求。智慧城市必然存在資料中心營運成本高、物聯網安全性差、設備維護等問題。然而,區塊鏈物聯網等技術將為交易管理、資產追蹤和智慧合約提供必要的基礎設施,同時確保安全性和透明度,從而提高營運效率。

- 2023年2月,Conflux Network與中國電信合作開發以區塊鏈為基礎的SIM卡。區塊鏈協議 Conflux Network 將與中國電信合作開發基於區塊鏈的 SIM 卡。中國電信是中國最大的無線供應商之一,估計擁有 3.9 億用戶。

- 2022 年11 月,中國國家區塊鏈基礎設施星火區塊鏈基礎設施與設施與馬來西亞數位服務供應商MY EG Services Berhad (MyEG) 簽署協議,在北京擴大其國際區塊鏈發展之際,擁有並營運一個「國際超級節點」。

區塊鏈物聯網產業概況

區塊鏈物聯網市場高度分散,主要參與者包括IBM公司、英特爾公司、微軟公司、思科系統公司和亞馬遜公司。市場參與者正在採取合作、創新、併購等策略來增強他們的產品供應並獲得永續的競爭優勢。

- 2022 年 5 月 - IBM 與 Web3 合作創建數位原生體驗,加速和發展企業區塊鏈的未來。混合企業區塊鏈解決方案可以幫助企業實現新的業務成果,例如細粒度的安全性、隱私性、可審計的監管合規性和競爭優勢保護。適應市場可能有助於公司獲得競爭優勢。隨著摩擦的減少、成本的降低和效率的提高,所有參與成員都可以近乎即時地看到單一事實來源。

- 2022 年 4 月 - 英特爾發布了有關其新型英特爾 Blockscale ASIC 的資訊。基於英特爾多年的研發,其專用積體電路(ASIC)將為客戶提供工作量證明共識網路的節能運算。圍繞區塊鏈技術的討論日益增多。它支援去中心化和分散式計算,為新的商業模式鋪平道路。英特爾正在開發能夠獨立於客戶營運環境提供運算吞吐量和能源效率的適當組合的技術,以實現這個新的運算時代。英特爾在加密、雜湊演算法和超低電壓電路方面數十年的研究和開發使區塊鏈應用程式能夠在不影響永續性的情況下提高其運算能力。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

- 價值鏈/供應鏈分析

- COVID-19 對產業影響的評估

第 5 章:市場洞察

- 市場促進因素

- 對物聯網安全的需求不斷成長

- 市場限制

- 可擴展性、處理能力和儲存問題

第 6 章:市場區隔

- 透過提供

- 硬體

- 軟體

- 基礎設施

- 依應用

- 資料安全

- 智慧合約

- 數據通訊

- 資產追蹤和管理

- 其他應用

- 依最終用戶

- 製造業

- 能源公用事業

- 運輸與物流

- 大樓管理

- 零售

- 智慧城市

- 依地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太

- 印度

- 中國

- 日本

- 亞太其他地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第 7 章:競爭格局

- 公司簡介

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Cisco Systems Inc.

- Amazon Inc.

- Robert Bosch GmbH

- The Linux Foundation

- KrypC Technologies

- Ethereum Foundation

- R3 LLC

- IoTA

- Waltonchain

第 8 章:市場機會與未來趨勢

The Blockchain IoT Market size is estimated at USD 0.82 billion in 2024, and is expected to reach USD 4.93 billion by 2029, growing at a CAGR of 43.31% during the forecast period (2024-2029).

The Internet of Things (IoT) is an advanced technology that connects all devices over the Internet, and blockchain is a kind of distributed financial technology. The main advantages of using blockchain for IoT include lower chances of collusion and manipulation and lower transaction settlement and costs.

Key Highlights

- With the rapid development of communication technologies, IoT ( Internet of Things) is experiencing exponential growth in research and industry. It is getting out of its infancy to a maturity phase with the volume of data generated, transmitted, and processed.

- The traditional IoT systems are powered by centralized topology, where data is transmitted from physical devices to the cloud, where the data is processed using analytics. Output is received back to the IoT device. Still, the increase in the frequency of network devices limits the scalability of the IoT platforms and risks them with vulnerabilities that would eventually compromise users' network security and privacy.

- The blockchain powered by decentralized architecture and cryptographic encryptions leverages the IoT platform by ensuring privacy and security in a peer-to-peer network. However, it requires high computational power, resulting in higher bandwidth overhead and delay.

- The Internet of Things ecosystem is quite diversified. Creating IoT devices that are compatible with blockchain technology involves many challenges. Scalability, which involves processing a huge volume of data generated by a wide network of sensors, is one of the primary challenges IoT faces. The processing power and time necessary to encrypt all IoT devices in a blockchain-based ecosystem are not as anticipated. Another key challenge in blockchain systems that keep the ledger on edge nodes is storage. IoT smart devices at the edge are currently incapable of storing large amounts of data or processing large amounts of computational power.

- The COVID-19 pandemic has impacted many sectors, including individuals and corporations. The internet ecosystem has played a critical role worldwide. The reliance on internet enterprises has grown dramatically due to the COVID-19 epidemic. BFSI, healthcare and life sciences, manufacturing, automotive, retail, transportation, and logistics are embracing the Internet to offer customers the required services. Suppliers have noticed a decrease in demand for a blockchain IoT solution. The global shutdown impacts the demand and availability of specific hardware components necessary for blockchain IoT. In the future, the healthcare and government verticals are expected to see moderate adoption of IoT sensors and blockchain to protect hospitals, government buildings, and populations during epidemics.

- Post-COVID-19, the government has also been investigating the potential for implementing a number of smart city technologies to increase urban resilience in times of crisis, which may propel the market's growth.

Blockchain IoT Market Trends

Smart City End Users Segment is Expected to Hold Significant Market Share

- Over the last few decades, the world has experienced unparalleled urban growth, majorly due to increased population, scarcity of resources, and climate changes. According to the United Nations, about 54% of people dwell in cities, which is expected to reach 66% by 2050. Government bodies focus on modern technologies like IoT, wireless communication, and blockchain to cope with urban growth, reduce costs, and optimize resources.

- Providing a sustainable environment is one of the key characteristics of smart cities. Keeping track of the environmental indicators in light of the rapid industrial and urbanization trends is critical. The primary challenge in environmental monitoring is real-time data collection using reliable and precise monitoring tools. The major role of smart city platforms may benefit the market's expansion during the forecast period.

- Data security is one of the vital constraints for devices and services deployed in a metropolitan city, which, leveraged with the blockchain's decentralized platform, ensures the public's trust and fosters the market's growth.

- According to The Economist's smart city index rating, Copenhagen was one of the leading global digital cities in 2022, with a score of 80.3. Seoul, Beijing, Amsterdam, and Singapore completed the top five list of finest digital cities.

- Also, government initiatives across the world are starting to appreciate the potential of blockchain as it provides the infrastructure necessary for transaction management while ensuring transparency and security, which stand to be critical elements in smart city implementation.

- Globally, many smart city projects and efforts are being implemented, encouraging global investments due to urbanization. The OECD estimates that between 2010 and 2030, worldwide investments in smart city initiatives would total around USD 1.8 trillion for all metropolitan city infrastructure projects.

Asia-Pacific is Expected to Be the Fastest-growing Market

- The Asia-Pacific region is expected to grow at the highest rate over the forecast period, owing to the rising influx of technology companies in the area and the increasing investments in IoT technology, smart city deployments, government initiative, and the growth of the urban population.

- Rapid urbanization and regional government initiatives foster the demand for smart cities. Smart cities are entitled to problems, such as high data center operation costs, poor IoT security, and equipment maintenance. However, technologies like blockchain IoT would provide the necessary infrastructure for transaction management, asset tracking, and smart contracts while ensuring security and transparency, thereby increasing operational efficiency.

- In February 2023, Conflux Network collaborated with China Telecom to develop blockchain-based SIM cards. Conflux Network, a blockchain protocol, will develop blockchain-based SIM cards in collaboration with China Telecom, one of the country's largest wireless providers with an estimated 390 million users.

- In November 2022, China's state blockchain infrastructure, Xinghuo Blockchain Infrastructure and Facility, signed an agreement with Malaysian digital service provider MY EG, Services Berhad (MyEG), to own and run an "international supernode," as Beijing expands its international blockchain push.

Blockchain IoT Industry Overview

The blockchain IoT market is highly fragmented, with the presence of major players like IBM Corporation, Intel Corporation, Microsoft Corporation, Cisco Systems Inc., and Amazon Inc. Players in the market are adopting strategies such as partnerships, innovations, mergers, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2022 - IBM collaborated with Web3 to create a digital native experience, accelerating and evolving the future of enterprise blockchain. A hybrid enterprise blockchain solution may assist enterprises in achieving new business outcomes, such as fine-grained security, privacy, auditable regulatory compliance, and competitive advantage protection. Adaptability to the market may help the company gain a competitive edge. With decreased friction, cost reductions, and efficiency, a single source of truth is visible to all participating members in near real-time.

- April 2022 - Intel released information on its new Intel Blockscale ASIC. Its application-specific integrated circuit (ASIC) would provide customers with energy-efficient computing for proof-of-work consensus networks, based on years of Intel R&D. The buzz surrounding blockchain technology is growing. It enables decentralized and distributed computing, paving the path for new business models. Intel is developing technologies that can offer an appropriate mix of computing throughput and energy efficiency independent of a customer's operating environment to enable this new era of computing. Intel's decades of research and development in encryption, hashing algorithms, and ultra-low voltage circuits enable blockchain applications to increase their computational capacity without affecting sustainability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Defnition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET INSIGHTS

- 5.1 Market Drivers

- 5.1.1 Growing Need for IoT Security

- 5.2 Market Restraints

- 5.2.1 Scalability, Processing Power, and Storage Issues

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Infrastructure

- 6.2 By Application

- 6.2.1 Data Security

- 6.2.2 Smart Contracts

- 6.2.3 Data Communication

- 6.2.4 Asset Tracking and Management

- 6.2.5 Other Applications

- 6.3 By End User

- 6.3.1 Manufacturing

- 6.3.2 Energy Utility

- 6.3.3 Transportation and Logistics

- 6.3.4 Building Management

- 6.3.5 Retail

- 6.3.6 Smart City

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 India

- 6.4.3.2 China

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Intel Corporation

- 7.1.3 Microsoft Corporation

- 7.1.4 Cisco Systems Inc.

- 7.1.5 Amazon Inc.

- 7.1.6 Robert Bosch GmbH

- 7.1.7 The Linux Foundation

- 7.1.8 KrypC Technologies

- 7.1.9 Ethereum Foundation

- 7.1.10 R3 LLC

- 7.1.11 IoTA

- 7.1.12 Waltonchain