|

市場調查報告書

商品編碼

1445564

工業滾筒:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Industrial Drums - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

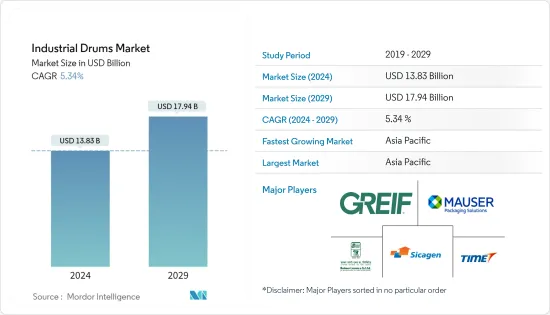

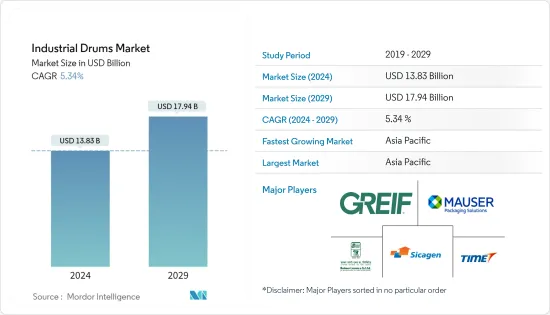

2024年工業滾筒市場規模預計為138.3億美元,預計到2029年將達到179.4億美元,在預測期內(2024-2029年)成長5.34%,以年複合成長率成長。

主要亮點

- 工業滾筒市場對具有高強度、阻氣性和良好加工性等理想性能的化學和石化潤滑劑的需求,推動了預測期內該行業的產品需求。據巴西化學工業協會稱,巴西是化學產品進口國。 2021年,該國進口產品價值592億美元。 2021年巴西化學品出口額達142億美元。此類化學品的進出口預計將為工業滾筒市場創造巨大需求。

- 不斷發展的石化產業需要安全的包裝解決方案來保護其產品。此外,新興市場油漆、染料和油墨產量的增加以及對安全供應鏈和產品運輸的需求不斷成長預計將推動需求。增加對不斷成長的生產設備的投資預計將為工業滾筒市場的成長提供重大的成長機會。

- 工業桶的需求預計將主要集中在亞太地區,但中東和東歐等其他地區的發展也預計將對全球需求產生重大影響。例如,Moser 正在投資先進的塑膠桶機械,旨在擴大中東和東歐市場,而中東石油產量的增加預計將推動對工業桶的需求。

- 此外,紙板桶在化學和肥料行業中越來越受到關注,以提高生產力並降低成本。不同國家之間化肥和化學品分銷的擴大預計將加速各種工業桶的成長。

- 有各種法規反映了工業桶價格的上漲,影響了產品的消費並進一步阻礙了所研究市場的成長。總體而言,製造商現在正在使用其他具有環保特性的包裝材料。由於纖維和紙板的環保性和高可回收性,工業桶市場中纖維和紙板的消耗在各個地區都表現出很高的採用率。

- COVID-19 的爆發大大增加了對包裝食品和必需品的需求,而包裝和加工食品食品在其供應鏈中面臨著維持生產線的巨大壓力。預計將增加對原料的供應和包裝的需求,進而增加市場需求。

工業滾筒市場趨勢

化工、化肥和石油潤滑油產業需求增加推動市場

- 工業桶經常用於運輸和儲存危險和非危險材料。工業桶最常用於化工、化肥、石油、石油等產業。支持工業桶市場成長的因素之一是這些產業的持續擴張以及過去十年國際貿易活動的增加。

- 據聯盟商工部長稱,2021-22年印度化學品出口預計將增加106%。相較於2013-14年印度化學品出口額為142.1億美元,預計2021-22年將達到292.96億美元的新高。預計這將增加對化學品桶的需求。

- 此外,化學工業中紙板桶的採用正在推動市場成長。紙板桶用於儲存和運輸各種產品,如黏劑、染料、著色劑、危險化學物質等。紙板桶是可回收的,這使得它們環保並且是塑膠桶和鋼桶的更實惠的替代品。

- 印度斯坦石油公司表示,其國際貿易部門為其位於孟買和維沙卡帕特南的煉油廠採購原油,總吞吐量為1,800萬噸。該部門也進出口石油產品,2020-2021年石油產品進出口量為7.18 MMT。此類活動增加了市場對工業桶的需求。

- 此外,紙板桶在化學和肥料行業中越來越受到關注,以提高生產力並降低成本。不同國家之間化肥和化學品分銷的擴大預計將加速各種工業桶的成長。

- 國際貿易活動的不斷增加以及對提高生產力的需求不斷成長正在推動化學、化肥和石油潤滑油行業的市場成長。

亞太地區佔最大市場佔有率佔有率

- 在亞太地區快速發展的工業和製造業中,隨著製造商繼續將製造地擴大到中國、印度和印尼等新興經濟體,工業滾筒的使用預計將會增加。中國紙板桶產量呈現樂觀成長。就金額而言,它令馬來西亞和新加坡等其他國家相形見絀。

- 更高品質的紙板桶反映了當地知名公司對複雜產品包裝解決方案日益成長的興趣。零售業的成長以及對可回收紙板桶等輕質散裝容器的日益偏好是影響紙板桶市場的關鍵因素。使用紙板桶的主要優點是它們是可回收的。因此,亞太地區紙板桶市場的前景預計是光明的。

- 由於該地區葡萄酒和植物油出口的增加,預計該地區的工業桶市場將繼續擴大。亞洲國家的石油出口商使用工業桶代替其他散裝包裝材料。中國和印度的大規模棕櫚油出口可能會顯著增加該地區對工業桶的需求。

- 中國和印度等亞太地區的農產品生產國正在透過實施有效的儲存、運輸和包裝解決方案來增加出口量。根據歐盟統計局和歐盟委員會統計,2021年歐盟對華機械和運輸設備出口額約1,160億歐元(約1,244.7億美元),成為對華出口最多的項目,其次是化學品及相關產品。 328.9 億歐元(約 353 億美元)。

- 2021年,歐盟從中國進口了約2,640億歐元(約2,832.3億美元)的機械和運輸設備。據印度投資促進機構印度投資局稱,印度是世界領先的香辛料、腰果、豆類和黃麻生產國之一。該國也是世界上最大的水果和蔬菜生產國之一。該國農業部門的成長預計將對該地區的化學品和化肥最終用途市場產生對鋼桶的巨大需求。

工業滾筒產業概況

- 工業滾筒市場的特點是差異化、產品普及不斷提高以及競爭激烈。透過設計、容量和應用方面的創新可以獲得永續的競爭優勢。由於化學品和化肥等最終用戶的採用率不斷提高,這些產品的普及正在提高,預計在預測期內將進一步普及。該市場的主要企業包括 Greif Inc.、Schutz GmbH &Co. KGaA 和 Mauser Group BV。

- 2023 年 2 月 - Mauser Packaging Solutions 透過投資最先進的塑膠桶製造設備,擴大了在南非的產品供應。這條新生產線總部位於南非德班,生產尺寸為 210 L、232 L 和 250 L 的聯合國認證緊頭聚乙烯桶。塑膠桶有單層或多層形式,是化學品的理想選擇。 、食品、油品、潤滑劑應用。

- 2022 年 10 月 - Schutz 的綠色生命週期管理透過 Green Layer 系列得到改進。在該計劃中,包裝專家幫助客戶實現其永續性目標。此外,它還有助於減少整體包裝二氧化碳排放。我們的目標是提供最豐富、最經濟的環保包裝材料供應。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵意強度

- 替代品的威脅

- 產業價值鏈分析

- 評估 COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 化肥和石油潤滑油產業對工業桶的需求不斷增加

- 更加重視加強最終用戶供應鏈能力

- 市場挑戰

- 環境惡化

- 原物料價格波動

第6章市場區隔

- 依產品類型

- 鋼桶

- 塑膠桶

- 紙板桶

- 按最終用戶產業

- 食品和飲料

- 化學品和肥料

- 藥品

- 石油和潤滑油

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭形勢

- 公司簡介

- Greif Inc.

- Sicagen India Ltd

- Balmer Lawre &Co. Ltd

- Time Technoplast Ltd

- Schutz GmbH &Co. KGaa

- Mauser Packaging Solutions

- TPL Plastech Limited

- Peninsula Drums

- Eagle Manufacturing Company

- US Coexcell Inc.

第8章投資分析

第9章市場機會與未來趨勢

簡介目錄

Product Code: 69047

The Industrial Drums Market size is estimated at USD 13.83 billion in 2024, and is expected to reach USD 17.94 billion by 2029, growing at a CAGR of 5.34% during the forecast period (2024-2029).

Key Highlights

- The industrial drum market is witnessing demand for chemical and petrochemical lubricants for the ideal properties they offer, such as high strength, gas barrier properties, and superior workability driving the product demand in the industry over the forecast period. According to the Brazilian Chemical Industrial Association, Brazil is an importer of chemical products. The value of products imported into the country in 2021 was USD 59.2 billion. Brazil exported USD 14.2 billion worth of chemicals in 2021. Such imports and exports of chemicals are expected to create significant demand for the industrial drum market.

- The growing petrochemical industry demands safe packaging solutions to protect its products. Also, the rising production of paints, dyes, and inks in emerging markets and the ever-increasing need for a secure supply chain and transportation of products is expected to drive the demand. Increased investment in growing production equipment is expected to provide significant growth opportunities for the industrial drums market growth.

- Although the demand for industrial drums is expected to be mainly concentrated in the APAC area, other regions, such as the Middle East and Eastern Europe, are also expected to impact global demand due to advancements in Eastern Europe significantly. For instance, Mauser invested in advancing its machinery for plastic drums to expand its market in the Middle East and Eastern Europe, and the increasing oil production in the Middle East is expected to drive the demand for industrial drums.

- Moreover, fiber drums are becoming more prominent in the chemical and fertilizers industry because they improve productivity and reduce expenses. The expansion of fertilizer and chemical traffic between various countries is predicted to accelerate the growth of different industrial drums.

- Various regulations reflect on the increase in the price of the industrial drums, which affects the consumption of the product and further hinders the growth of the market studied. Overall, manufacturers are now using other packaging materials which offer environment-friendly properties. The consumption of fiber and paperboard in the industrial drum market is witnessing high adoption rates in the regions, owing to its eco-friendly nature and high recyclability.

- Due to the COVID-19 outbreak, the packaging demand for food and essentials rose significantly, while packaged and processed food manufacturers experienced significant supply chain pressure to maintain production lines. This is expected to drive the demand for raw material supply and packaging, in turn driving the market demand.

Industrial Drums Market Trends

Increasing Demand from the Chemical and Fertilizers and Petroleum Lubricant Industry to Drive the Market

- Industrial drums are frequently used for transporting and storing hazardous and non-hazardous commodities. Industrial drums are most commonly used in the chemical, fertilizer, oil, and petroleum industries. One of the factors supporting the growth of the industrial drum market is the continued expansion of these sectors, together with rising international trade activities over the past ten years.

- According to the Union Minister for Commerce and Industry, Indian chemical exports were expected to expand by 106% in 2021-22. Compared to 2013-14, when India's chemical exports were USD 14210 million, they will reach a new high of USD 29296 million in 2021-22. This is expected to drive the demand for chemical drums.

- Further, the fiber drums adoption in the chemical industry is driving the market growth. Fiber drums are utilized for storing and transporting various goods, including adhesives, dyes and colorants, and hazardous chemicals. Fiber drums offer eco-friendliness due to their recyclability and can be a more affordable alternative to plastic and steel drums.

- According to the Hindustan Petroleum Corporation Limited, the International Trade department procures crude oil for the refineries in Mumbai and Visakhapatnam with a united crude throughput of 18 million metric tons. The department also undertakes the import and export of petroleum products, and the volume of import and export of petroleum products for FY 2020-2021 was 7.18 MMT. Such activities drive the demand for industrial drums in the market.

- Moreover, fiber drums are becoming more prominent in the chemical and fertilizers industry because they improve productivity and reduce expenses. The expansion of fertilizer and chemical traffic between various countries is predicted to accelerate the growth of different industrial drums.

- Such rising international trade activities and the growing need to increase productivity drive the market growth for the chemical and fertilizers and petroleum lubricant industry.

Asia Pacific Accounts for the Largest Market Share

- The rapidly evolving industry and manufacturing sector in the Asia-Pacific region is expected to increase the usage of industrial drums as manufacturers continue expanding their manufacturing bases to emerging economies like China, India, and Indonesia. China has shown optimistic growth in the production of fiber drums. In terms of value, it has a strong hold over other countries such as Malaysia and Singapore.

- The rising concerns for sophisticated packaging solutions for products by local and renowned players have translated into better quality fiber drums. The growing retail sector and the increasing preference for lightweight bulk containers such as recyclable fiber drums are key factors affecting the fiber drums market. The main advantage of using fiber drums is that they are recyclable. Therefore, the fiber drums market outlook is expected to be positive in the Asia-Pacific region.

- The region's industrial drums market is expected to continue to expand due to the region's growing exports of wines and vegetable oil. Asian nations' oil exporters use industrial drums over other bulk packaging materials. Large-scale palm oil exports from China and India may significantly increase demand for industrial drums in the region.

- Countries in Asia-Pacific, such as China and India, with robust agricultural produce, are improving their export volumes by implementing effective storage, transport, and packaging solutions. According to Eurostat and the European Commission, in 2021, the EU machinery and transport equipment exports to China accounted for about EUR 116 billion (~USD 124.47 billion), making it the most exported commodity to China, followed by chemicals and related products, accounting for EUR 32.89 billion (~USD 35.3 billion).

- In 2021, the European Union imported nearly EUR 264 billion (~USD 283.23 billion) of machinery and transport equipment from China. According to Invest India, a national investment and facilitation agency, India is one of the world's top producers of spices, cashews, pulses, and jute. The country is also one of the world's largest producers of fruits and vegetables. The country's growing agriculture sector is expected to create significant demand for steel drums in the market's chemical and fertilizer end-use in the region.

Industrial Drums Industry Overview

- The Industrial Drums Market is characterized by differentiation, growing levels of product penetration, and high levels of competition. Sustainable competitive advantage can be gained through innovation in design, capacity, and application. The penetration rates of these products grow due to their increasing adoption by end-users, including chemicals and fertilizers, and the rates are expected to grow further during the forecast period. Some of the key players in the market include Greif Inc., Schutz GmbH & Co. KGaA, and Mauser Group BV.

- February 2023 - Mauser Packaging Solutions expanded its product offering in South Africa by investing in state-of-the-art plastic drum manufacturing equipment. Based in Durban, South Africa, the new line manufactures UN-certified, tight-head polyethylene barrels in sizes 210 L, 232 L, and 250 L. Plastic barrels are available in mono-layer or multi-layer formats and are ideal for chemical, food, oil, and lubricant use.

- October 2022 - Schutz's Green Lifecycle Management is improved with the Green Layer series. With this program, the packaging expert helps clients achieve sustainability objectives. In addition, it helps them cut the overall CO2 footprint of their packaging. The goal is to provide the most abundant and economical supply of environmentally friendly packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Industrial Drum from the Chemical and Fertilizers and Petroleum Lubricant Industry

- 5.1.2 Increasing Focus on Strengthening Supply Chain Capabilities Among End Users

- 5.2 Market Challenges

- 5.2.1 Environmental Degradation

- 5.2.2 Fluctuating Raw Material Price

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Steel Drum

- 6.1.2 Plastic Drum

- 6.1.3 Fiber Drum

- 6.2 By End-user Industry

- 6.2.1 Food and Beverage

- 6.2.2 Chemicals and Fertilizers

- 6.2.3 Pharmaceuticals

- 6.2.4 Petroleum and Lubricants

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Greif Inc.

- 7.1.2 Sicagen India Ltd

- 7.1.3 Balmer Lawre & Co. Ltd

- 7.1.4 Time Technoplast Ltd

- 7.1.5 Schutz GmbH & Co. KGaa

- 7.1.6 Mauser Packaging Solutions

- 7.1.7 TPL Plastech Limited

- 7.1.8 Peninsula Drums

- 7.1.9 Eagle Manufacturing Company

- 7.1.10 U.S. Coexcell Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219