|

市場調查報告書

商品編碼

1445495

滲透壓計:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Osmometers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

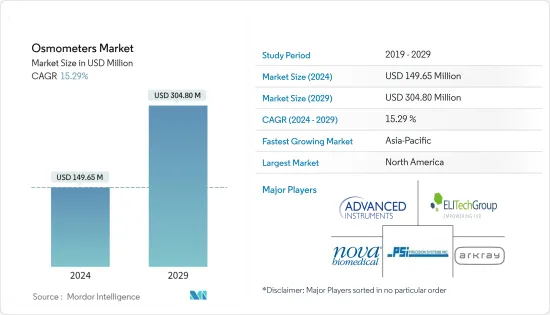

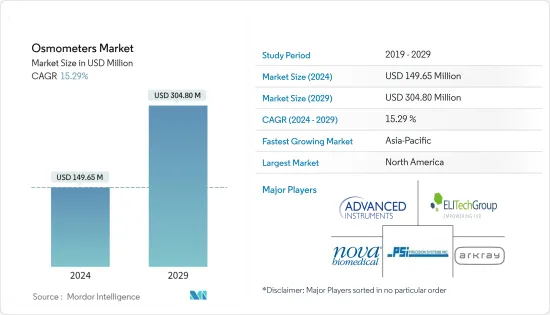

滲透壓計市場規模預計到 2024 年為 1.4965 億美元,預計到 2029 年將達到 3.048 億美元,在預測期內(2024-2029 年)成長 15.29%,年複合成長率成長。

近期,受疫情影響,各國面臨巨大挑戰。 COVID-19 大流行對所研究的市場產生了重大影響。根據美國國立衛生研究院 2020 年 3 月發布的資料,COVID-19 與電解質失衡(包括低鈉血症)有關。低鈉血症患者的早期診斷和病因識別對於確保適當的治療並避免對患者造成潛在傷害非常重要。由於滲透壓計有助於診斷低鈉血症,市場正在出現積極成長。然而,COVID-19感染疾病導致臨床研究停止,對市場產生了一定程度的負面影響。

滲透壓計需求的增加主要是由於研發活動的增加以及臨床和生物製藥實驗室數量的增加。全球疾病負擔的增加以及對先進和設備齊全的臨床實驗室的需求不斷增加,以獲得更好的臨床結果是推動市場成長的一些因素。例如,根據國際癌症研究機構 2021 年的數據,全世界五分之一的人會在一生中罹患癌症,八分之一的男性和十分之一的女性將死於癌症。隨著世界各地癌症患者數量的增加,對臨床實驗室的需求不斷增加,從而促進了市場的成長。

此外,醫療保健支出的增加以及對先進測試設備的需求,以進行準確的分析和結果以獲得更好的臨床結果,是對市場成長產生積極影響的其他因素。例如,根據經合組織2022年11月公佈的資料,經合組織國家2021年醫療保健支出佔GDP的比例約為9.6%,高於前一年。隨著醫療保健成本的不斷上升,相信滲透壓計領域的研發將會增加。因此,高昂的醫療成本正在推動所研究市場的成長。

然而,各種滲透壓測量檢測法的局限性和缺乏熟練的專業人員可能會減緩市場的成長。

滲透壓計市場趨勢

冰點滲透壓計預計將有健康的成長速度

冰點滲透壓計是一種用於確定溶液滲透壓強度的滲透壓計,因為溶液的滲透活性方面會降低冰點。冰點滲透壓計測量溶劑冰點隨溶質總數的變化。冰點滲透壓計的獨特性能非常重要,因為溶液的滲透壓與其冰點之間存在精確的線性相關性。由於易於控制和校準等原因,冰點滲透壓計是最優選的滲透壓計。

此外,主要市場參與者都專注於研發活動,以將可靠的新產品推向市場,並專注於產品發布。例如,2022 年 7 月,Advanced Instruments 推出了其臨床冰點滲透壓計系列的最新產品-OsmoPRO MAX 自動滲透壓計。 Advanced Instruments 是滲透壓測量領域的領導者,為希望透過自動化提高生產力的各種規模的臨床實驗室設計了 OsmoPRO MAX。因此,由於上述因素,預計所研究的市場將顯著成長。

此外,全球蒸氣壓滲透壓計技術製造商 ELITechGroup 於 2021 年 7 月收購了冰點滲透壓計技術市場領導者 GONOTEC,幫助醫生快速、準確地診斷疾病並正確治療患者。治療政策。隨著主要企業採取此類策略步驟,該行業可能在未來幾年快速成長。

北美預計將以顯著的速度成長

預計北美地區在預測期內將出現顯著的市場成長。高昂的醫療成本、臨床實驗室和醫院擴大使用自動化醫療設備以及該地區的技術進步都可能推動該地區的成長。

隨著時間的推移,研發支出不斷增加,根據美國國家科技統計中心2021年12月發表的報導,美國42個聯邦資助的研發中心(FFRDC)本會計年度將增加235個2021年,公司研發支出10億美元,年均成長3.4%。支出的增加主要是由於我們專注於比競爭對手擁有競爭優勢並從新開發的產品中獲得更高的利潤。

此外,腹瀉病導致的死亡人數顯著增加。根據 2022 年 6 月出版的《美國家庭醫生》日誌報道,美國每年大約發生 1.79 億例急性腹瀉病例,滲透壓計對於準確、正確地診斷腹瀉的根本原因至關重要,使用需求可能會增加。

美國擁有主要企業,北美擁有完善的醫療設備產業,這兩者都對該地區研究市場的成長產生正面影響。

滲透壓計產業概況

滲透壓計市場競爭適度,由本地或區域參與者主導。市場相關人員專注於創新產品的發布和地理擴張。活躍的市場參與者包括 Advanced Instruments LLC、Precision Systems Inc.、ELITechGroup 和 ARKRAY Inc.。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 滲透壓計的技術進步和對自動化的高需求

- 加大研發投入,多種疾病負擔加重

- 市場限制因素

- 滲透壓計的局限性

- 缺乏熟練的專業人員

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 依產品類型

- 冰點滲透壓計

- 蒸氣壓滲透壓計

- 薄膜滲透壓計

- 按採樣能力

- 單樣品滲透壓計

- 多樣品滲透壓計

- 按用途

- 臨床

- 製藥和生物技術

- 其他用途

- 按最終用戶

- 醫院

- 檢測診斷中心

- 其他最終用戶

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 世界其他地區

- 北美洲

第6章 競爭形勢

- 公司簡介

- Advanced Instruments LLC

- Precision Systems Inc.

- ELITechGroup

- ARKRAY Inc.

- Nova Biomedical

- ASTORI TECNICA

- KNAUER Wissenschaftliche Gerete GmbH

- Loser Messtechnik

第7章市場機會與未來趨勢

The Osmometers Market size is estimated at USD 149.65 million in 2024, and is expected to reach USD 304.80 million by 2029, growing at a CAGR of 15.29% during the forecast period (2024-2029).

In recent times, countries have faced a huge setback due to the pandemic. The COVID-19 pandemic had a significant impact on the market studied. According to the data from the National Institute of Health published in March 2020, COVID-19 was associated with electrolyte disorders, including hyponatremia. Early diagnosis and etiologic determination in any hyponatremic patient are critical to ensuring proper treatment and avoiding potential harm to the patient. As osmometers are useful in the diagnosis of hyponatremia, there has been positive growth in the market. However, the COVID-19 pandemic halted clinical studies, which negatively impacted the market to some extent.

The rise in demand for osmometers is primarily due to the increase in research and development activities and the number of clinical and biopharmaceutical labs. Growing disease burdens all over the world and increasing demand for advanced and well-equipped clinical laboratories for better clinical outcomes are some of the factors that are accelerating the market's growth. For instance, according to the International Agency for Research on Cancer 2021, globally 1 in 5 people develop cancer during their lifetime, and 1 in 8 men and 1 in 11 women die from the disease. As the number of people with cancer rises around the world, there is more demand for clinical laboratories, which is helping the market grow.

In addition, growing healthcare spending and demand for advanced laboratory equipment for accurate analysis and results for better clinical outcomes are a few other factors that are positively impacting market growth. For instance, as per the OECD data published in November 2022, healthcare spending as a percent of GDP during the year 2021 was around 9.6% in OECD countries, which was higher than that of previous years. With the high expenditure on healthcare, it is believed that there will be growing research and development in the field of osmometers. Hence, high healthcare spending is augmenting the growth of the market studied.

But the growth of the market is likely to be slowed by the limitations of different osmometry methods and the lack of skilled professionals.

Osmometers Market Trends

Freezing Point Osmometers are Expected to have Healthy Growth Rate

The freezing point osmometer is a type of osmometer used to determine the osmotic strength of a solution as its osmotically active aspects depress its freezing point. A freezing point osmometer measures changes in a solvent's freezing point as a function of the total number of solutes. The distinct nature of freezing point osmometers is very important, as there is a precise linear correlation between osmolality and the freezing point of a solution. Freezing point osmometers are the most preferred osmometers due to factors such as ease of control and simple calibration.

Furthermore, the major market players are focusing on R&D activities to bring new and reliable products to the market, and they are also focusing on product launches. For instance, in July 2022, Advanced Instruments announced the newest addition to its clinical line of freezing point osmometers, the OsmoPRO MAX Automated Osmometer. As the leading authority in osmometry, Advanced Instruments designed the OsmoPRO MAX for clinical laboratories of all sizes seeking higher productivity through automation. Thus, owing to the aforementioned factors, the market studied is expected to grow significantly.

Additionally, in July 2021, ELITechGroup, a manufacturer of global vapor pressure osmometer technology, acquired GONOTEC, a leading market player in freezing point osmometer technology, to help physicians rapidly and accurately diagnose disease and determine the proper course of patient treatment. With the key companies taking such strategic steps, the segment is likely to grow quickly in the coming years.

North America is Projected to Grow at a Significant Rate

The North American region is expected to have significant market growth over the forecast period. High healthcare costs, the growing use of automated medical equipment in clinical labs and hospitals, and technological advances in the region are all things that are likely to help the region grow.

Spending on research and development has increased over time. According to an article by the National Center for Science and Engineering Statistics published in December 2021, the 42 federally funded research and development centers (FFRDCs) in the United States spent USD 23.5 billion on research and development in FY 2021, an annual increase of 3.4%. This increase in expenditure is largely driven by the focus on having a competitive edge over their competitors and high returns on the newly developed product.

Additionally, the number of deaths attributed to diarrheal diseases has increased substantially as well. According to the journal American Family Physician published in June 2022, approximately 179 million acute diarrhea cases occur each year in the United States, which is likely to increase the demand for osmometer usage in the accurate and proper diagnosis of the underlying causes of diarrhea.

There are also key players in the United States and a well-established medical device industry in North America, both of which are good for the growth of the market that was studied in the region.

Osmometers Industry Overview

The osmometer market is moderately competitive, with a majority of local or regional players. Market players are focusing on innovative product launches and geographical expansions. The market players operating are Advanced Instruments LLC, Precision Systems Inc., ELITechGroup, and ARKRAY Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological Advancements in Osmometers and High Demand for Automation

- 4.2.2 Growing R&D Investments and Increase in Burden of Various Diseases

- 4.3 Market Restraints

- 4.3.1 Limitations of Osmometers

- 4.3.2 Dearth of Skilled Professionals

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product Type

- 5.1.1 Freezing Point Osmometers

- 5.1.2 Vapor Pressure Osmometers

- 5.1.3 Membrane Osmometers

- 5.2 By Sampling Capacity

- 5.2.1 Single-sample Osmometers

- 5.2.2 Multi-sample Osmometers

- 5.3 By Application

- 5.3.1 Clinical

- 5.3.2 Pharmaceutical and Biotech

- 5.3.3 Other Applications

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Laboratory and Diagnostic Centers

- 5.4.3 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Advanced Instruments LLC

- 6.1.2 Precision Systems Inc.

- 6.1.3 ELITechGroup

- 6.1.4 ARKRAY Inc.

- 6.1.5 Nova Biomedical

- 6.1.6 ASTORI TECNICA

- 6.1.7 KNAUER Wissenschaftliche Gerete GmbH

- 6.1.8 Loser Messtechnik