|

市場調查報告書

商品編碼

1445483

託管應用服務:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Managed Application Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

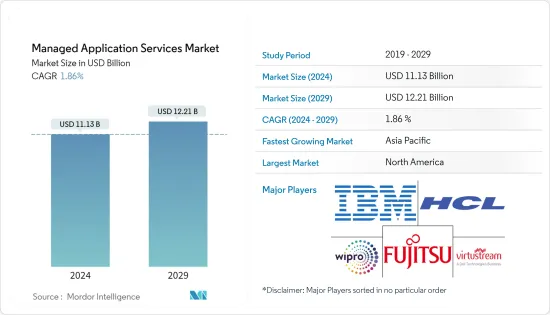

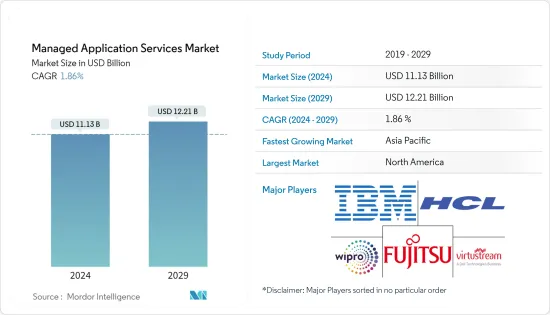

託管應用服務市場規模預計到 2024 年為 111.3 億美元,預計到 2029 年將達到 122.1 億美元,預測期內(2024-2029 年)年複合成長率為 1.86%。

預計在預測期內,對端到端應用程式託管服務的需求將會增加。託管應用程式服務允許組織將特定的 IT 需求外包給第三方服務供應商。企業可以降低成本、提高生產力並提高應用程式效能,而無需花費時間實施、維護或升級 IT 相關應用程式。智慧型手機設備的日益普及和組織內物聯網服務的實施預計將在預測期內推動市場發展。自 COVID-19 爆發以來,隨著企業採用遠距工作模式,對雲端基礎的解決方案的需求顯著增加。然而,過去幾年,零售、製造業和 BFSI 等各行業的收益都出現了大幅下降。

主要亮點

- 隨著客戶將工作負載轉移到雲端,雲端原生架構(尤其是微服務)的使用正在增加。基於微服務的架構有助於提高可擴展性和速度,但實施它們可能會帶來挑戰。對於許多 Java 開發人員來說,Spring Boot 和 Spring Cloud 協助解決了這些挑戰,提供了一個強大的平台,具有用於開發和操作微服務服務應用的既定模式。去年,為了簡化 Spring Cloud 應用程式的部署和管理,微軟與 Pivotal 合作創建了 Azure Spring Cloud。

- 最近,VSHN 發布了 Project Syn,這是一個新一代開放原始碼託管服務框架,適用於基於 Kubernetes 的任何基礎架構上的 DevOps 和應用程式操作。 Project Syn 是一組預先整合工具,用於在雲端上對 Kubernetes 和生產應用程式進行設定、更新備份、監控、回應或發出警報。使用容器、Kubernetes 和 GitOps 透過完整的自助服務和自動化來支援 DevOps。 Syn 專案即將成為一個開放原始碼計劃。它充當生產框架,由多個組件組成,提供在 Kubernetes 上運行生產中的應用程式所需的功能。

- 去年,AWS 推出了 Amazon Managed Apache Cassandra Service,這是一項可擴展、高度可用、託管且與 Apache Cassandra 相容的資料庫服務。這允許使用者利用相同的 Cassandra 應用程式程式碼(由 Apache 2.0 授權)在 AWS 雲端上執行 Cassandra 工作負載。使用協助者、工具等。託管 Cassandra 服務無需配置、修補和管理伺服器以及安裝、維護和操作軟體。表可以根據請求流量自動擴展和縮小,吞吐量和儲存幾乎不受限制。使用者可以使用 AWS Identity and Access Management (IAM) 管理對其表的訪問,並透過整合日誌記錄和監控保持應用程式平穩運行。

- 近年來,由於 COVID-19感染疾病導致經濟放緩,組織減少了技術投資,資訊技術支出可能會下降。不過,企業和政府機構持續投資軟體和IT服務,市場預計將穩定下來。儘管短期計劃被叫停,但為服務供應商帶來可觀收益的託管應用服務產業並未受到疫情影響。最近,作為其COVID-19 響應計劃計劃的一部分,XenonStack 向直接參與救援工作的任何人(包括醫療保健、非政府組織和政府機構)提供三個月的免費託管IT 支援、應用程式管理和雲端支持。到。

託管應用服務市場趨勢

IT和通訊預計將佔據很大佔有率

- 由於各種技術的高採用率、BYOD 策略檢查頻率的增加以及組織之間資料的快速成長對高階安全性的需求不斷增加,IT 和通訊行業已成為託管應用程式服務的重要市場。過去幾年,通訊業經歷了顯著成長。電信業者始終面臨以低成本提供創新服務的壓力,以便在競爭激烈的市場中留住客戶。

- 根據最近對 SD-WAN 託管服務的調查,64% 的受訪網路和 IT 管理員計劃在未來幾年內添加 SD-WAN 託管服務。這是因為我們相信最終用戶將享受增強的安全性、改進的雲端應用程式效能和靈活的管理。這種需求正在推動 IT 和通訊服務供應商從第三方購買硬體、軟體和日常網路管理。許多 SD-WAN 託管服務供應商透過各種安全產品脫穎而出。

- 根據與英特爾合作製作的 Hazlecast Infinity Data 報告,IT 決策者認為雲端應用效能 (40%) 是利潤的最大驅動力,此外還有金融服務 (49%)、電訊(42%) 和電子服務。-商業。我們認為這是一個機會。 (40%) 在受訪產業中排名最高。然而,遷移到雲端時最大的挑戰是安全性 (97%) 和效能 (90%)。

- 去年,Hazelcast 宣佈在 Amazon Web Services (AWS) 上推出 Hazelcast Cloud Enterprise。這是 Hazelcast 軟體的低延遲部署,作為託管服務,旨在提高雲端基礎的應用程式的效能、安全性和可管理性。憑藉內建保護和與雲端無關的架構,Hazelcast Cloud Enterprise 為大規模企業部署提供了超越現有商品化雲端資料儲存服務的速度、規模、安全性和高可用性功能。

預計北美將佔據主要佔有率

- 由於IT基礎設施形勢不斷變化,尤其是中小型企業 (SME),北美託管應用服務市場正在不斷成長,並持續關注外包網路安全解決方案。例如,美國新興的 IT 用品製造商和分銷商之一 Kpaul Properties LLC 部署了富士通,以虛擬環境取代實體伺服器。這使公司的成本降低了 15%,運作了 95%。隨著現代技術的快速發展以及對簡化 IT 功能的需求,該地區越來越多的企業正在尋找跟上 MSP 的最佳方式。

- 此外,加拿大多重雲端環境中的應用程式正在激增,自動化的採用也不斷增加。在該地區,雲端、行動和社交技術迫使企業採取主動的IT安全方法,從而導致對跨所有安全管理層提供的強大託管服務實施的需求不斷增加。整合通訊即服務和相關的客服中心即服務市場為託管服務供應商提供了機會。這是因為新興企業提供了雲端基礎的創新解決方案,這些解決方案易於以最少的投資進行部署。

- 近日,美國控股雲端運算公司Rackspace宣布,已同意收購亞馬遜網路服務(AWS)合作夥伴網路(APN)首要諮詢合作夥伴及AWS託管服務供應商Onica。此次收購將 Onica 的創新專業服務能力(包括策略諮詢、架構、工程和應用開發)添加到 Rackspace 產品組合中,並補充了其現有的託管雲端服務能力。 Rackspace 的混合雲端產品組合使企業能夠利用從IT安全到軟體開發的各種技術增強功能。

- 去年,Infosys 在亞利桑那州鳳凰城推出了 Infosys Live Enterprise Suite,這是一套全面的平台、解決方案和數位服務,可協助企業加速數位創新。用戶可以採用雲端提供者的最佳創新,並透過 Infosys Polycloud 平台建立與雲端無關的應用程式堆疊。該平台提供了一個公共雲端雲和私有雲端的背板,可讓您透過標準介面和目錄在整個企業中選擇、配置、移動和管理平台和應用程式服務工作負載。

託管應用服務產業概述

託管應用服務市場內的市場參與者之間的競爭非常激烈,沒有特定的主導參與者存在。競賽結果基於公司最重要的特點:高品質和價格合理的服務。該市場的一些主要參與者包括 IBM 公司、HCL Technologies Limited、WIPRO Limited 和 Fujitsu Limited。市場的最新發展包括:

- 2022 年 5 月 - Microsoft 推出了一個新的託管服務類別,稱為 Microsoft 安全專家。該服務為組織提供外部安全專家的協助,他們可以執行威脅搜尋以及託管偵測和回應任務。對於企業而言,該服務允許現場安全團隊在異地Microsoft 專家的幫助下補充其能力。

- 2022 年 2 月 - IBM 與 SAP(NYSE:SAP)合作,提供技術幫助客戶採用混合雲端方法,並將關鍵任務工作負載從SAP 解決方案轉移到受監管和不受監管行業的雲中,並諮詢了專家。 IBM 是第一個提供雲端基礎架構和技術管理服務(作為 RISE with SAP 產品的一部分)的合作夥伴。

- 此外,當客戶考慮混合雲端策略時,他們將需要一個安全可靠的雲端環境來移動作為企業營運支柱的工作負載和應用程式。隨著針對 RISE with SAP 的 IBM 供應商選項的推出,客戶現在擁有了加速將本機 SAP 軟體工作負載遷移到 IBM Cloud 的工具,並得到了業界領先的安全功能的支援。

- 此外,IBM 還推出了一項名為 BREAKTHROUGH with IBM for RISE with SAP 的新計畫。它包括一系列解決方案和諮詢服務,可加速和擴展您向 SAP S/4HANA Cloud 的遷移。建構在靈活、可擴展平台上的解決方案和服務使用智慧工作流程來簡化營運。它們提供了一個參與模型來幫助規劃、執行和支持全面的業務轉型。它還為客戶提供了利用深厚的行業專業知識將 SAP 解決方案工作負載遷移到公共雲端的選擇和彈性。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 對端到端應用程式託管的需求不斷成長

- 改進和保護關鍵業務應用程式的要求

- 提高應用基礎設施水平

- 市場限制因素

- 與應用程式資料相關的安全風險

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

- PESTLE分析

第5章市場區隔

- 組織規模

- 中小企業

- 主要企業

- 最終用戶產業

- BFSI

- 零售與電子商務

- 資訊科技與電信

- 製造業

- 衛生保健

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東地區

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 併購

- 公司簡介

- Fujitsu Limited

- IBM Corporation

- HCL Technologies Limited

- Wipro Limited

- VIRTUSTREAM INC.

- RACKSPACE INC.

- CenturyLink, Inc.

- DXC Technology Company

- BMC Software, INC.

- Mindtree Limited

- Unisys Corporation

第7章市場機會與未來趨勢

The Managed Application Services Market size is estimated at USD 11.13 billion in 2024, and is expected to reach USD 12.21 billion by 2029, growing at a CAGR of 1.86% during the forecast period (2024-2029).

Demand for end-to-end application hosting services will increase in the forecast period. The managed application services allow the organization to outsource specific IT requirements to a third-party service provider. The companies can reduce costs, boost productivity, and enhance application performance without spending time on implementation, maintenance, and upgradation of their IT-related application. The increase in the adoption of smartphone devices and the implementation of IoT services in the organization will drive the market in the forecast period. Since the outbreak of COVID-19, the demand for cloud-based solutions has seen significant growth owing to remote working models being adopted by enterprises; however, various industries such as retail, manufacturing, BFSI, and others have seen a significant slump in their revenues in the past years.

Key Highlights

- As customers have moved their workloads to the cloud, there is a growth in the usage of cloud-native architectures, particularly microservices. Microservice-based architectures help improve scalability and velocity, but implementing them can pose challenges. For many Java developers, Spring Boot and Spring Cloud have helped address these challenges, providing a robust platform with well-established patterns for developing and operating microservice applications. In the previous year, to help make it simpler to deploy and manage Spring Cloud applications, together with Pivotal, Microsoft created Azure Spring Cloud.

- Recently, VSHN announced Project Syn, the next generation Open Source managed services framework for DevOps and application operations on any infrastructure based on Kubernetes. Project Syn is a pre-integrated set of tools to provision, update backup, observe, and react or alert production applications on Kubernetes and in the cloud. It supports DevOps through complete self-service and automation with the help of containers, Kubernetes, and GitOps. Project Syn is about to become an Open Source project shortly. It consists of several components that bring the necessary features for running applications in production on Kubernetes, acting as an operations framework.

- During the previous year, AWS launched Amazon Managed Apache Cassandra Service, a scalable, highly available, and managed Apache Cassandra-compatible database service that enables the user to run the Cassandra workloads in the AWS Cloud utilizing the same Cassandra application code, Apache 2.0 licensed drivers, and tools that are used. With Managed Cassandra Service, there is no need to provision, patch, or manage servers and install, maintain, or operate the software. Tables could scale up and down automatically based on request traffic, with virtually unlimited throughput and storage. The user can manage access to the tables using AWS Identity and Access Management (IAM) and keep the applications running smoothly with integrated logging and monitoring.

- Information Technology spending in recent years is likely to fall as organizations trim investments in technology in the wake of the COVID-19 pandemic-led slowdown. However, enterprises and government agencies continue to invest in software and IT services, which is expected to stabilize the market. While short-term projects are getting stopped, the managed application services segment, which fetches significant revenue for service providers, has not been impacted by the outbreak. Recently, XenonStack offered a free 3-month Managed IT Support, Application Management, and Migration to the Cloud as part of their COVID-19 response plan program to anyone directly involved in relief initiatives like Healthcare, NGOs, and government bodies.

Managed Application Services Market Trends

IT and Telecom is Expected to Hold Major Share

- The IT and telecom sector is a significant market for managed application services due to the high rate of various technological adoptions, increased frequency of confirmation of the BYOD policy, and an increased need for high-end security due to the rapidly growing data among organizations. The telecom industry has observed extensive growth during the past few years. Telecommunication companies are constantly pressured to deliver innovative services at lower costs to retain their customers in the competitive market.

- According to the SD-WAN Managed Services recent survey, 64% of the surveyed network and IT managers plan to add an SD-WAN managed service in the upcoming years. This is because the end-users believe it will deliver better security, improved cloud application performance, and flexible management. This demand is encouraging IT and Telcom service providers to purchase hardware, software, and regular administration of their networks from a third party. Many SD-WAN-managed service providers are differentiating themselves with a wide range of security offerings.

- According to Hazlecast Infinity Data report in collaboration with Intel, IT decision-makers identified cloud application performance (40%) as the number one opportunity to unlock profits, with financial services (49%), telecommunications (42%), and e-commerce (40%) ranking it the highest among verticals surveyed. However, security (97%) and performance (90%) were the top challenges when migrating to the cloud.

- In the previous year, Hazelcast announced the availability of Hazelcast Cloud Enterprise on Amazon Web Services (AWS), a low-latency deployment of Hazelcast software as a managed service designed to improve the performance, security, and ease of management of cloud-based applications. Featuring built-in protection and a cloud-agnostic architecture, Hazelcast Cloud Enterprise exceeds the speed, scale, safety, and high availability capabilities of existing commoditized cloud data storage services for large-scale enterprise deployments.

North America is Expected to Hold Major Share

- The North American Managed Application Services market is growing due to the changing IT infrastructure landscape, especially in small and medium enterprises (SMEs), continually focusing on outsourcing cybersecurity solutions. For instance, Kpaul Properties LLC, one of the emerging manufacturers and distributors of IT supplies in the United States, onboarded FUJITSU to replace physical servers with a virtualized environment. This has reduced the company's cost by 15% and delivered 95% uptime. With the speedy acceleration of modern technology and the need for streamlined IT functions, an increasing number of businesses in the region find the best way to keep pace with MSP.

- Besides, Canada is witnessing a high rise in the application of multi-Cloud environments and increased adoption of automation. In the region, Cloud, mobile, and social technologies demand that businesses take a proactive approach toward IT security, thus boosting the demand for deploying robust managed services that would deliver in all security management layers. Unified Communications as a Service and related Contact Center as a Service market represent a business opportunity for managed service providers. This is because emerging players offer innovative cloud-based solutions, which require a minimum investment and are easy to deploy.

- Recently, Rackspace, an American-managed Cloud computing company, announced that it has agreed to acquire Onica, an Amazon Web Services (AWS) Partner Network (APN) Premier Consulting Partner and AWS Managed Service Provider. This acquisition brings Onica's innovative professional services capabilities, including strategic advisory, architecture, engineering, and application development, to the Rackspace portfolio, complementing its existing managed cloud services capabilities. Rackspace's hybrid cloud portfolio enables enterprises to leverage various technical enhancements, from IT security to software development.

- In the previous year, Infosys unveiled the Infosys Live Enterprise Suite in Phoenix, Arizona, a comprehensive set of platforms, solutions, and digital services that helps enterprises to accelerate their digital innovation journey. The user can embrace the best innovations across cloud providers and build a cloud-agnostic application stack through the Infosys Polycloud Platform. The platform provides a backplane that abstracts the public and private clouds, enabling a standard interface and catalog to select, provision, move and manage platform and application services workloads across the enterprise.

Managed Application Services Industry Overview

The competition within the managed application services market is high among the market players without any specific dominating player. The competition results are based on the enterprise's best features of high quality and services at a reasonable price. Some significant players in the market are IBM Corporation, HCL Technologies Limited, WIPRO Limited, Fujitsu Ltd., and others. Some of the recent trends in the market are as follows:

- May 2022 - Microsoft launched a new managed service category known as Microsoft Security Experts. The service provides organizations with assistance from external security experts who can perform threat hunting and managed detection and response tasks. For businesses, the service enables on-site security teams to supplement their capabilities with assistance from off-site Microsoft experts.

- February 2022 - IBM partnered with SAP (NYSE: SAP) to provide technology and consult experts to help clients embrace a hybrid cloud approach and migrate mission-critical workloads from SAP solutions to the cloud in regulated and non-regulated industries. As part of the RISE with an SAP offering, IBM is the first partner to provide cloud infrastructure and technical managed services.

- Moreover, as clients consider hybrid cloud strategies, moving the workloads and applications that are the backbone of their enterprise operations necessitates a highly secure and reliable cloud environment. With the launch of the IBM supplier option for RISE with SAP, clients have the tools to help accelerate the migration of their on-premise SAP software workloads to IBM Cloud, backed by industry-leading security capabilities.

- In addition, IBM is launching a new program called BREAKTHROUGH with IBM for RISE with SAP, which includes a portfolio of solutions and consulting services to help accelerate and amplify the journey to SAP S/4HANA Cloud. The solutions and services, built on a flexible and scalable platform, use intelligent workflows to streamline operations. They offer an engagement model that aids in the planning, execution, and support of holistic business transformation. Clients are also given the option and flexibility to migrate SAP solution workloads to the public cloud with the help of deep industry expertise.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased demand for end-to-end application hosting

- 4.2.2 The requirement to improve and secure critical business applications

- 4.2.3 Increase in the level of application infrastructure

- 4.3 Market Restraints

- 4.3.1 Security risks associated with application data

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porters 5 Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Organization Size

- 5.1.1 Small & Medium-scale Enterprises

- 5.1.2 Large Enterprises

- 5.2 End-user Verticals

- 5.2.1 BFSI

- 5.2.2 Retail & E-Commerce

- 5.2.3 IT & Telecom

- 5.2.4 Manufacturing

- 5.2.5 Healthcare

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.5 Middle East

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 Fujitsu Limited

- 6.3.2 IBM Corporation

- 6.3.3 HCL Technologies Limited

- 6.3.4 Wipro Limited

- 6.3.5 VIRTUSTREAM INC.

- 6.3.6 RACKSPACE INC.

- 6.3.7 CenturyLink, Inc.

- 6.3.8 DXC Technology Company

- 6.3.9 BMC Software, INC.

- 6.3.10 Mindtree Limited

- 6.3.11 Unisys Corporation