|

市場調查報告書

商品編碼

1687971

建築機器人-市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Construction Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

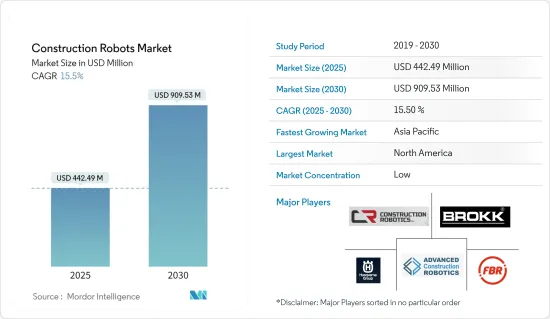

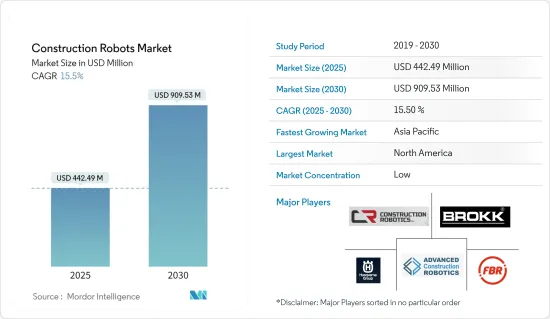

預計 2025 年建築機器人市場規模為 4.4249 億美元,到 2030 年將達到 9.0953 億美元,預測期內(2025-2030 年)的複合年成長率為 15.5%。

都市化加快、工業化深入、建築和拆除活動日益複雜等因素正在推動市場收益成長。

關鍵亮點

- 建築組織越來越注重減少建材資源和施工過程中的材料廢棄物,這推動了建築機器人市場的採用。 Autodesk 進一步指出,雖然很難確定典型建築工地產生的廢棄物量的確切數字,但一些建築組織認為,運送到建築工地的建材總重量的近 30% 被浪費了。

- 此外,更短的計劃時程正在推動建築機器人的發展。 PrintStones 是一家總部位於奧地利的建築移動 3D 列印機器人製造商,推出了其最新的製造機器人。 Baubot 的模組化設計讓第三方可以輕鬆進行客戶修改。這種類似探測車的設備被描述為“多功能建築機器人”,它的功能混凝土3D 列印混凝土。它合格於許多靈活的製造程序,例如材料處理、焊接、銑削、擰螺絲、切割、噴漆甚至砌磚。

- 此外,2022 年 5 月,Dusty Robotics 籌集了 4,500 萬美元,並宣布推出業界首個硬體、軟體和服務解決方案,透過先進的機器人技術消除施工錯誤。 FieldPrinter 結合硬體、軟體和服務,在建築工地上以真人大小的地板應用列印和自動化數位地板技術。

- 隨著新基礎設施建設需求的不斷增加,自動化施工解決方案預計將在未來幾年獲得發展動力,對市場產生正面影響。根據 Redshift 的數據,從現在到 2050 年,工業界每天需要建造 13,000 棟建築,以支援 70 億都市區。

- 此外,引入建築機器人的挑戰之一是獲取和維護該技術的成本高昂。技術的引進也伴隨著成本的增加。因此,只有銷售和市場競爭對手才能實施這些技術。除此之外,自動化技術需要更新和維護,其中大多數都是昂貴的。由於需要熟練的技術人員,新機器人設備的維護成本將會很高。

- 先前爆發的新冠肺炎疫情對建築業產生了負面影響,在封鎖的最初幾個月裡,建築工作陷入停頓。然而,由於該技術提供的安全優勢,產品需求已顯示業界對採用該產品的興趣日益濃厚。

建築機器人市場趨勢

商業建築和住宅將是建築機器人最大的應用領域

- 隨著新商業和住宅建築基礎設施建設需求的不斷增加,自動化施工解決方案預計將在未來幾年獲得發展動力,對市場產生積極影響。根據 Redshift 的數據,到 2050 年,每天需要建造 13,000 座建築物,以支援預計的 70 億都市區。

- 都市化進程快速推進。根據世界銀行的資料,全球約有55%的人口,即42億人居住在都市區,預計這一趨勢將持續。到2050年,世界城市人口預計將增加一倍,幾乎每10人中就有7人居住在城市。這將帶來自動化和人工智慧等技術變革,我們期待看到包括機器人技術在內的各種技術的快速部署,以應對多重城市挑戰。

- 根據人口問題實驗室發布的《2021年世界人口資料表》,北美洲是世界上都市化最高的大陸,82%的人口居住在城市。拉丁美洲和加勒比地區都市化程度為79%。預計到2050年,全球居住在都市區的人口比例將從2020年的56%增加到70%。

- 都市化的需求和規模對滿足日益成長的經濟適用住宅、交通網路和其他基礎設施的需求提出了挑戰。根據世界銀行統計,近十億城市貧困階級生活在非正規居住,其中60%的人因靠近引發衝突的機會都市區被迫流離失所。

- 世界主要經濟體都在尋求建造更多的住宅都市區住宅,使低收入者更負擔得起住宅。北美和歐洲主要經濟體的城市規劃部門正在考慮為市場建造住宅,這將對房價起到一定緩解作用。因此,可大幅縮短施工時間的永續 3D 列印解決方案預計將在未來幾年推動需求。主要位於亞太地區的成長型經濟體正在推動對基礎設施和住宅解決方案的需求,預計這將推動對建築技術的投資。

- 預計預測期內,住宅和公寓等住宅的興起將推動對建築機器人的需求。

亞太地區佔市場主導地位

- 亞太地區是建築機器人市場的關鍵地區之一,其中三個主要國家是印度、中國和日本。該地區 3D 列印住宅的持續發展預計將推動市場成長。

- 此外,由於對 3D 列印的需求很高,各種國際公司都在尋求擴大在該地區的業務。例如,2022年6月,丹麥3D建築列印技術開發商COBOD International與澳洲Fortex公司簽署了一項新的分銷協議,這是該公司將尖端混凝土3D列印技術引入澳洲並加強亞太地區3D建築列印策略的一部分。

- 在疫情爆發之前,亞洲已經全面接受了機器人技術和工業自動化。在後疫情時代,我們可能會繼續看到這些技術以及整合這些技術的產業(例如製造業、物流業和建築業)的採用率不斷提高。

- 預計都市化的加速將進一步創造市場成長的需求。根據中國國家統計局的數據,到2022年,中國約有65.2%的人口居住在城鎮。近幾十年來,都市化大幅提高。

- 建築業前景樂觀,勞動力需求強勁。面對持續大量的建築工程,業界需要提高施工效率,確保工人和工地的安全,以提高整體生產力和成本效益。預計此類趨勢將在預測期內推動所研究市場的積極成長。

建築機器人產業概況

建築機器人市場較為分散,主要參與者包括 Brokk AB(Lifco Public AB)、Husqvarna AB、Construction Robotics LLC、FBR Ltd. 和 Advanced Construction Robotics Inc.。該市場的參與企業正在採用合作、創新和收購等策略來增強其產品供應並獲得永續的競爭優勢。

2022 年 12 月,醫療和工業外骨骼技術產業領導者 Ekso Bionics 宣布已收購運動和控制技術全球領導者派克漢尼汾公司(「派克」)的人體運動和控制(「HMC」)業務部門。此次收購包括Indegolower肢體外骨骼產品線,並計畫矯正器具機器人輔助矯正器具和義肢。

2022 年 10 月,全球大型公司的遙控拆除機器人製造商 Brokk 宣布增加 BROKK SURFACE GRINDER 530 (BSG 530) 附件,用於在翻新和修復應用中對牆壁、地板和天花板進行附件去除、表面處理和拋光,以去除維修、石棉和其他材料。

2022 年 8 月,Husqvarna Construction 與該地區領先的工業工具和設備供應商 AAB Tools 建立了戰略夥伴關係。 Husqvarna Construction 的有機產品將由 AABTools 分銷,其中包括 20 多種重型和高頻混凝土取芯機、專為磚塊和鋼筋混凝土設計的牆鋸、遙控拆除機器人、手持式動力切割機、除塵器和地板鋸。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響

第5章市場動態

- 市場促進因素

- 快速都市化

- 政府對工人安全的嚴格規定

- 市場限制

- 高資本投資和設置成本

第6章市場區隔

- 按類型

- 拆解

- 磚砌體

- 3D列印

- 其他

- 按應用

- 公共基礎設施

- 商業和住宅建築

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章競爭格局

- 公司簡介

- BROKK AB(Lifco publ AB)

- Husqvarna AB

- Construction Robotics LLC

- FBR Ltd.

- Advanced Construction Robotics Inc.

- Dusty Robotics

- Apis Cor

- COBOD International AS

- Ekso Bionics

第8章投資分析

第9章:市場的未來

The Construction Robots Market size is estimated at USD 442.49 million in 2025, and is expected to reach USD 909.53 million by 2030, at a CAGR of 15.5% during the forecast period (2025-2030).

The growing urbanization, industrialization penetration, and advanced construction & demolition operation factors are driving market revenue growth.

Key Highlights

- The increasing focus of construction organizations on reducing building materials' resources and material waste during construction will drive the adoption of the construction robot market. Further, Autodesk identifies that while it is difficult to get exact figures of the waste produced on a typical construction site, several construction organizations have thought that nearly 30% of the total weight of building materials transported to a building site gets wasted.

- Further, reducing the construction time of the projects is aiding the growth of construction robots. Printstones, an Austria-based manufacturer of mobile 3D printing robots for construction, has launched its latest manufacturing robot. A modular design indicates the Baubot, which easily allows third-party customer modifications. Described as a 'multi-functional construction robot,' the rover-Esque device goes beyond concrete 3D printing. It qualifies for many flexible manufacturing processes such as material transportation, welding, milling, screwdriver, cutting, painting, and even bricklaying.

- Further, in May 2022, Dusty Robotics raised USD 45 million to announce the Industry's First Hardware, Software, and Services Solution to Destroy Construction Errors Through Advanced Robotics. FieldPrinter automates digital floor techniques on construction sites by printing them full-size on the floor through a mixture of hardware, software, and services.

- With the growing need for new infrastructure, automated construction solutions are expected to gain momentum over the coming years and impact the market positively. According to Redshift, the industry must build 13,000 buildings daily from now to 2050 to support an expected population of seven billion living in urban areas.

- Furthermore, high costs associated with acquiring and maintaining the technologies are one of the challenges in implementing construction robotics. The purchase, along with the implementation of the technologies, is costly. Therefore, only firms with a good turnover and market competition can afford these technologies. In addition to this, automation technologies need to be updated and maintained, and most of them are expensive to do it. The maintenance cost for the new robotics equipment is higher because of the exceptional technician's needs.

- The past outbreak of COVID-19 adversely affected the construction industry, with construction work coming to a standstill in the initial months of the lockdown. However, the product demand witnessed an increased interest in adoption from the industry owing to the safety benefits offered by the technology.

Construction Robots Market Trends

Commercial and Residential Buildings to be the Largest Application for Construction Robots

- With the growing need for new commercial and residential infrastructure, automated construction solutions are expected to gain momentum over the coming years and impact the market positively. According to Redshift, the industry must build 13,000 buildings daily from now to 2050 to support an expected population of seven billion in urban areas.

- Urbanization is rising at an exponential rate. According to World Bank data, about 55% of the world's population, or 4.2 billion people, live in cities, and the trend is expected to continue over the coming years. By 2050, the urban population worldwide is expected to double, with nearly seven out of 10 people living in cities. This is expected to bring about technological changes such as automation and artificial intelligence and rapidly deploy various technologies, including robotics, to address multiple urban challenges.

- According to the World Population Data Sheet 2021, published by the Population Reference Bureau, North America was the most urbanized continent worldwide, with 82% of the population living in cities. In Latin America and the Caribbean, the degree of urbanization stood at 79%. It is projected that the share of people living in urban areas globally will increase from 56% in 2020 to 70% in 2050.

- The need and scale of urbanization are bringing challenges that include meeting accelerated demand for affordable housing, well-connected transport systems, and other basic infrastructure for living. According to the World Bank, nearly one billion urban poor who live in informal settlements are near opportunities that result in conflicts, which is leading to 60% of them being forcibly displaced in urban areas.

- Major economies worldwide are considering building more housing solutions to control the price of homes in urban areas so that lower-income citizens can afford them. Urban planning departments across major economies in North America and Europe are looking to build more housing for the market, which will somewhat moderate some prices. This is where 3D printing solutions that consume significantly less time to build and are sustainable are expected to gain traction in demand over the coming years. The demand for infrastructure and housing solutions in growing economies, mainly situated in the Asia-Pacific region, is expected to accelerate their investment in construction technologies.

- The growing construction of residential places like homes and apartments is expected to propel the demand for construction robots over the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is one of the significant regions for the construction robotics market, with the three major countries being India, China, and Japan. The increasing development of 3D-printed houses in the region is expected to boost market growth.

- Additionally, various international companies are looking to expand their regional offerings due to the high demand for 3D printing. For instance, in June 2022, COBOD International, a Danish developer of 3D construction printing technology, signed a new distribution agreement with Fortex, an Australian company, as part of the company's strategy to bring cutting-edge concrete 3D printing technology to Australia and strengthen 3D construction printing in the Asia-Pacific region.

- Asia was already fully embracing robotics and industrial automation before the pandemic. In a post-COVID world, the adoption of these technologies and industries that integrate them, like manufacturing, logistics, and construction, will continue to rise.

- The increasing urbanization is further expected to create demand for market growth. As per the National Bureau of Statistics of China, in 2022, approximately 65.2% of the population in China lived in cities. The urbanization rate has increased significantly in the country over the last few decades.

- The prospect of the construction industry is optimistic, with a strong demand for manpower. Nevertheless, in the face of a continuous and huge amount of construction work, the industry needs to improve construction efficiency and ensure worker and site safety, thereby enhancing overall productivity and cost-effectiveness. Such trends are expected to create positive growth for the market studied over the forecast period.

Construction Robots Industry Overview

The construction robots market is fragmented with the presence of major players like Brokk AB (Lifco Public AB), Husqvarna AB, Construction Robotics LLC, FBR Ltd., and Advanced Construction Robotics Inc. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain a sustainable competitive advantage.

In December 2022, Ekso Bionics, an industry leader in exoskeleton technology for medical and industrial use, announced the acquisition of the Human Motion and Control ("HMC") Business Unit from Parker Hannifin Corporation ("Parker"), a global leader in motion and control technologies. The acquisition included the Indegolower limb exoskeleton line of products as well as the planned development of robotic-assisted orthotic and prosthetic devices.

In October 2022, Brokk, the world's leading manufacturer of remote-controlled demolition robots, announced the addition of the BROKK SURFACE GRINDER 530 (BSG 530) attachment for material removal, such as paint and asbestos, surface preparation, and polishing on walls, floors, and ceilings in renovation and restoration applications.

In August 2022, Husqvarna Construction entered into a strategic partnership with AABTools, the region's leading industrial tools and equipment supplier. Husqvarna Construction's organic products were to be distributed by AABTools, including heavy-duty and high-frequency concrete coring machines, wall saws designed for brick and reinforced concrete, remote-controlled demolition robots, and twenty-plus models of handheld power cutters, dust extractors, and floor saws.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Urbanization

- 5.1.2 Stringent Government Regulations for Worker's Safety

- 5.2 Market Restraints

- 5.2.1 High Equipment and Setup Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Demolition

- 6.1.2 Bricklaying

- 6.1.3 3D Printing

- 6.1.4 Other Types

- 6.2 By Application

- 6.2.1 Public Infrastructure

- 6.2.2 Commercial and Residential Buildings

- 6.2.3 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 BROKK AB (Lifco publ AB)

- 7.1.2 Husqvarna AB

- 7.1.3 Construction Robotics LLC

- 7.1.4 FBR Ltd.

- 7.1.5 Advanced Construction Robotics Inc.

- 7.1.6 Dusty Robotics

- 7.1.7 Apis Cor

- 7.1.8 COBOD International AS

- 7.1.9 Ekso Bionics