|

市場調查報告書

商品編碼

1445453

智慧食品物流 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Smart Food Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

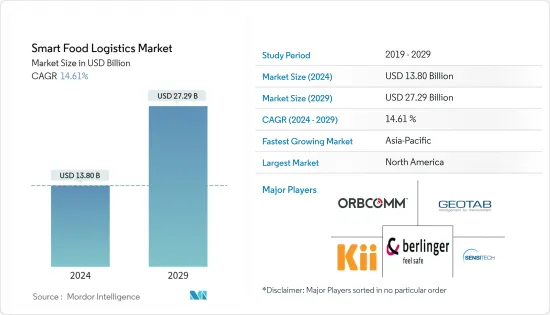

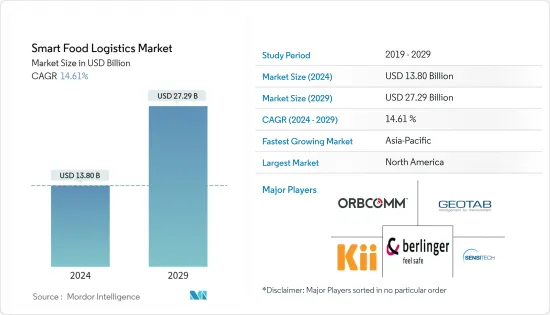

智慧食品物流市場規模預計到2024年為138億美元,預計到2029年將達到272.9億美元,在預測期內(2024-2029年)CAGR為14.61%。

智慧食品物流公司利用冷鏈監控技術的趨勢日益明顯,特別是幫助食品製造商管理溫控產品的運輸、儲存和分銷。交通堵塞、機械故障和其他原因引起的溫度變化可能會破壞並產生未保存的不安全食品,這也是市場成長如此迅速的一個重要原因。

主要亮點

- 隨著數位經濟的擴展,物聯網技術已經從一個未來的想法發展成為物流公司在供應鏈中使用的實用工具。感測器和物聯網工具正在將傳統的資產追蹤轉變為智慧供應鏈,為物流公司帶來更高的投資報酬率。這些支援物聯網的感測器提供有關資產或車隊位置、車隊移動速度、溫度條件以及食品行業其他關鍵資料集的即時資訊。

- 此外,物流和技術以及延伸至整個供應鏈的基於雲端的協作解決方案使整個供應鏈的倉庫、運輸和最終消費者資訊的緊密整合和透明度成為可能。反過來,這也被認為是所研究市場成長的關鍵驅動力。此外,不同領域的不同食品法規,例如《食品藥品安全法》,給供應鏈帶來了極大的壓力,要求記錄更多資訊並更加開放,這也是市場整體成長率的一個重要原因。

- 此外,市場上主要參與者正在進行各種策略合併、收購和投資,作為其改善業務和影響力以接觸客戶並滿足他們對各種應用的要求的策略的一部分。例如,2022 年 8 月 20 日,反飢餓和營養不良區域卓越中心 (CERFAM) 與 HELP Logistics 簽署了一份合作備忘錄。主要目標是建立一個新的技術、科學和教育研究領域合作的平台。該平台的活動旨在加強農業食品價值鏈和非洲社區應對社會經濟衝擊的整體抵禦能力。

- 但整個安裝過程的不同複雜程度可能會減緩未來幾年市場的成長。

- COVID-19 大流行嚴重擾亂了全球幾乎所有最終用戶行業,由於遠端工作環境或全面封鎖,擾亂了公司的供應鏈管理,導致營運停止。為了度過這場大流行並保持營運平穩運行,這種破壞促使企業更多地使用技術和數位化。因此,預計未來幾年市場將有許多成長機會。

智慧食品物流市場趨勢

冷鏈監控將佔據重要佔有率

冷鏈監控解決方案可協助食品製造商管理溫控物品的儲存、運輸和分銷。由於機械故障、交通延誤和其他原因導致的不完整的冷卻鏈會促使溫度變化,從而影響易腐爛食品的腐敗和安全。此外,缺乏對貨物位置的即時可見性可能會導致操作流程效率低下。

- 因此,冷鏈監控的採用確保了貨物運輸和儲存溫度的穩定性。具有溫度感測器的藍牙低功耗 (BLE) 信標等技術可以追蹤相關檢查點的貨物位置,並在運輸過程中或整個供應鏈中連續、無縫地追蹤溫度資料。然而,在整個交付過程中維持冷鏈的需要給許多易腐爛商品生產商、手工食品生產商以及自己很少或沒有物流能力的農民帶來了重大障礙。

- 此外,快速變化的飲食習慣增加了對包裝食品的需求,嚴格的包裝和儲存法規促使權力從製造商轉移到商人。推動食品和飲料物流自動化和技術採用的主要原因包括注重零污染、精確儲存以及高速儲存和檢索作業的流程。

- 沃爾瑪等公司在自動化雜貨選擇機器人方面進行了大量投資。 Alphabot 在倉庫內挑選訂單,利用自動推車挑選常溫下儲存的冷凍冷藏雜貨。機器人識別物品、拾取物品並將其運送到工作站以供工作人員檢查。此類產業自動化進步預計將為冷鏈監控解決方案的採用帶來巨大的前景。

- 根據印度醫藥協會統計,2019年,印度冷鏈產業總規模約為3,300億盧比(398,730.75萬美元),預計2022年將達到4,200億盧比(5076288,000美元)。2020年,預計印度將擁有約3740萬噸冷鏈倉儲能力。由於冷鏈產業的崛起,預計市場在整個預測期內將出現顯著的成長機會。

北美佔主要佔有率

由於眾多供應商的存在以及對消除浪費和最佳化資源的日益關注,預計北美地區將擁有智慧物流採用的最大佔有率。此外,由於該地區的強大影響力,北美是一個重要的資產追蹤市場製造業、運輸業和物流業以及各種技術進步。此外,不同最終用戶領域的政府措施和政策可能會促進區域市場的擴張。

- 政府致力於採用技術來減少供應鏈中的浪費,這正在推動該地區的市場成長。例如,美國國家公路和運輸官員協會、聯邦公路協會和地方交通部門都支持在運輸和物流行業中採用資產追蹤。

- 此外,市場上主要參與者正在進行各種重大收購、合併和投資,作為其關鍵成長策略的一部分,以改善業務和整體影響力,以接觸客戶並滿足他們對各種關鍵應用的要求。預計這將為智慧食品物流市場在預測期內擴大和改善帶來大量機會。

- 例如,2022 年2 月,美國農業部(USDA) 部長湯姆·維爾薩克(Tom Vilsack) 宣布,美國農業部將提供高達約2.15 億美元的贈款和其他支持,以擴大家禽和肉類加工選擇,加強整體食品供應鏈,創造就業和經濟機會,特別是在農村地區。因此,美國農業部非常注重採取措施提高加工能力並促進家禽和肉類加工產業的競爭。這將使美國的農產品市場對牧場主和農民來說更具競爭性、公平性、可近性和穩定性。

- 此外,美國農業部 (USDA) 部長 Tom Vilsack 於 2022 年 10 月宣布,該部將主要透過食品供應鏈擔保貸款計畫投資約 1,110 萬美元,以協助 Crystal Freeze Dry LLC 擴大其冷凍乾燥產品的生產能力。乾蛋產品並在愛荷華州農村創造就業機會。拜登-哈里斯政府致力於加強關鍵的食品供應鏈基礎設施,為美國人民建立更繁榮的社區,這筆資金是其承諾的重要組成部分。

智慧食品物流產業概況

智慧食品物流市場適度分散。擁有顯著市場佔有率的主要參與者都非常注重在國外擴展其客戶群。這些公司正在利用多項關鍵的策略合作計劃來最大限度地提高市場佔有率並提高盈利能力。市場的一些主要發展是:

2022年12月,全球智慧端對端供應鏈物流供應商DP World與溫控倉儲物流供應商Americold簽署策略合作協議,將投資數百萬美元建置更有彈性、高效率且永續的全球食品供應鏈。該組織希望透過制定從農場到餐桌的全球食品分銷新標準來幫助世界上最大的食品公司。

2022 年 3 月,中西部著名的卡車運輸和物流提供商 Hill Brothers, Inc. 將選擇 ORBCOMM Inc. 提供其用於整個車隊管理的整合乾燥和冷藏拖車監控解決方案。 ORBCOMM 的一體化解決方案包括業界領先的無線連接硬體和統一的基於雲端的分析平台,以簡化跨多個資產類別的營運。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 市場定義與研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場動態

- 市場促進因素

- 為了更好地控制資產而對有效監控和追蹤的需求不斷增加

- 市場限制

- 安裝複雜性

第 6 章:COVID-19 對食品和飲料產業物流業的影響

第 7 章:市場區隔

- 成分

- 硬體(感測器、遠端資訊處理、網路設備等)

- 軟體和服務

- 科技

- 車隊的管理

- 資產追蹤

- 冷鏈監控

- 地理

- 北美洲

- 歐洲

- 亞太

- 拉丁美洲

- 中東和非洲

第 8 章:競爭格局

- 公司簡介

- Orbcomm

- Sensitech (Carrier Global Corporation)

- Berlinger & Co. AG

- Geotab Inc.

- Kii Corporation

- Verizon Connect

- Teletrac Navman

- Monnit Corporation

- Controlant

- Samsara Inc.

- Seaos

- Nippon Express co. Ltd.

- YUSEN LOGISTICS CO. LTD (Nippon Yusen Kabushiki Kaisha(NYK)

- Hacobu Co. Ltd (MOVO)

- Kouei system ltd.

- LYNA LOGICS, Inc.

第 9 章:投資分析

第 10 章:市場的未來

The Smart Food Logistics Market size is estimated at USD 13.80 billion in 2024, and is expected to reach USD 27.29 billion by 2029, growing at a CAGR of 14.61% during the forecast period (2024-2029).

There is a rising trend of utilizing cold chain monitoring technologies by smart food logistics companies, especially to assist food makers in managing the transport, storage, and distribution of temperature-controlled products. Temperature changes caused by traffic jams, mechanical problems, and other things can ruin and make unsafe food that hasn't been preserved, which is a big reason why the market is growing so quickly.

Key Highlights

- As the digital economy expands, IoT technology has evolved from a futuristic idea to a practical tool for logistics companies to use in their supply chains. Sensors and IoT tools are changing traditional asset tracking toward intelligent supply chains that can generate a higher ROI for logistics firms. These IoT-enabled sensors provide real-time information on asset or fleet location, fleet mobility speed, temperature conditions, and other critical data sets for the food industry.

- Also, the tight integration of warehouse, transport, and end-consumer information and transparency through the supply chain has been made possible by logistics and technology, along with cloud-based collaborative solutions that extend through the entire supply chain. This, in turn, has been recognized as a key driver of the growth of the market under study. Also, different food laws and regulations in different areas, like the Food and Drug Safety Act, put a lot of pressure on supply chains to record more information and be more open, which is a big reason for the market's overall growth rate.

- Moreover, the market is witnessing various strategic mergers, acquisitions, and investments by key players as part of its strategy to improve business and their presence to reach customers and meet their requirements for various applications. For example, on August 20, 2022, the Regional Centre of Excellence against Hunger and Malnutrition (CERFAM) and HELP Logistics signed a Memorandum of Understanding. The main goal was to set up a new platform for collaboration in different areas of technical, scientific, and educational research. The activities of this platform would be aimed at strengthening agri-food value chains and the overall resilience of communities in Africa to socio-economic shocks.

- But different levels of complexity in the overall installation processes could slow the market's growth over the next few years.

- The COVID-19 pandemic significantly interrupted practically all end-user industries worldwide, disrupting company supply chain management owing to remote working circumstances or total lockdown, resulting in the halt of operations. In order to survive the pandemic and keep their operations running smoothly, the disruption caused companies to use technology and digitalization more. As a result, the market is expected to have many growth opportunities over the next few years.

Smart Food Logistics Market Trends

Cold Chain Monitoring to Hold a Significant Share

A cold chain monitoring solution helps food manufacturers manage temperature-controlled items' storage, shipment, and distribution. Incomplete cooling chains caused by mechanical breakdowns, traffic delays, and other reasons result in shifting temperatures, which can influence the spoilage and safety of perishable foods. In addition, a lack of real-time visibility of goods' locations might contribute to an inefficient operating process.

- As a result, the adoption of cold chain monitoring ensures stable temperatures for transporting and storing goods. Technologies like Bluetooth Low Energy (BLE) beacons with temperature sensors enable tracking goods' locations at relevant checkpoints and tracing temperature data continuously and seamlessly during shipment or throughout the supply chain. However, the need to maintain the cold chain throughout the delivery process raised a significant barrier for many producers of perishable goods, artisanal food producers, and farmers with little or no logistical capacities of their own.

- Moreover, rapidly changing food habits have boosted demand for packaged food, and stringent packing and storage regulations have resulted in a power transfer from manufacturers to merchants. The primary reasons propelling automation and technology adoption in food and beverage logistics include processes focusing on zero contamination, precise storage, and high-speed storage and retrieval operations.

- Companies such as Walmart have made considerable investments in automated grocery selection robots. Alphabot picks orders within the warehouse, utilizing autonomous carts to pick frozen and refrigerated groceries stored at ambient temperature. The robot identifies an item, picks it up, and carries it to a workstation for inspection by a staff person. Such industry automation advancements are projected to generate considerable prospects for cold chain monitoring solution adoption.

- As per the Indian Pharmaceutical Association, in 2019, the total size of the cold chain industry in India was around 330 billion rupees (USD 3987307500), and it was estimated to reach 420 billion rupees (USD 5076288000) in 2022. In 2020, it was predicted that India would have approximately 37.4 million metric tons of cold chain storage capacity. Due to the rise in the cold chain industry, the market is expected to witness significant growth opportunities throughout the forecast period.

North America Holds Major Share

Because of the presence of many vendors and the growing concern to eliminate waste and optimize resources, the North American region is expected to have the largest share of smart logistics adoption.Moreover, North America is a significant asset tracking market due to the region's strong presence in the manufacturing, transportation, and logistics industries and various technological advancements. Furthermore, government initiatives and policies in different end-user sectors will likely boost regional market expansion.

- The government's drive to adopt technology to reduce waste in the supply chain is fueling the region's market growth. For example, the American Association of State Highway and Transportation Officials, the Federal Highway Association, and local departments of transportation have all supported the adoption of asset tracking in the transportation and logistics industry.

- Moreover, the market is witnessing various significant acquisitions, mergers, and investments by key players as part of their crucial growth strategy to improve business and their overall presence to reach customers and meet their requirements for various key applications. This is expected to open up a plethora of opportunities for the smart food logistics market to expand and improve over the forecast period.

- For instance, in February 2022, U.S. Department of Agriculture (USDA) Secretary Tom Vilsack declared that USDA is making available up to a sum of around USD 215 million in grants and other support to extend poultry and meat processing options, strengthen the overall food supply chain, and create jobs and economic opportunities, especially in rural areas. So, the USDA is very focused on taking steps to increase processing capacity and boost competition in the poultry and meat processing industries. This will make agricultural markets in the United States more competitive, fair, accessible, and stable for ranchers and farmers.

- Furthermore, U.S. Department of Agriculture (USDA) Secretary Tom Vilsack announced in October 2022 that the Department is investing approximately USD 11.1 million, primarily through the Food Supply Chain Guaranteed Loan Program, to assist Crystal Freeze Dry LLC in expanding its capacity to manufacture freeze-dried egg products and creating job opportunities in rural Iowa. The funding is a crucial part of the Biden-Harris Administration's commitment to strengthening the critical food supply chain infrastructure to build more thriving communities for the American people.

Smart Food Logistics Industry Overview

The market for smart food logistics is moderately fragmented. The major players with a prominent share of the market are greatly focusing on extending their customer base across various foreign countries. These companies are leveraging several key strategic collaborative initiatives to maximize their market share and increase their profitability. Some of the key developments in the market are:

In December 2022, DP World, the provider of worldwide smart end-to-end supply chain logistics, and Americold, the provider of temperature-controlled warehousing and logistics, signed a strategic partnership agreement that would enable multi-million dollar investment in a more resilient, efficient, and sustainable global food supply chain. This group wants to help the biggest food companies in the world by setting a new standard for global food distribution, from the farm to the table.

In March 2022, Hill Brothers, Inc., a prominent trucking and logistics provider in the Midwest, will choose ORBCOMM Inc. to supply its integrated dry and refrigerated trailer monitoring solutions for fleet-wide management. ORBCOMM's all-in-one solutions include industry-leading hardware for wireless connectivity and a unified cloud-based analytics platform to streamline operations across multiple asset classes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Efficient Monitoring and Tracking for Better Control of Assets

- 5.2 Market Restraints

- 5.2.1 Installation Complexities

6 IMPACT OF COVID-19 ON THE LOGISTICS INDUSTRY IN THE FOOD AND BEVERAGE SECTOR

7 MARKET SEGMENTATION

- 7.1 Component

- 7.1.1 Hardware (Sensors, Telematics, Networking Devices, etc.)

- 7.1.2 Software and Services

- 7.2 Technology

- 7.2.1 Fleet Management

- 7.2.2 Asset Tracking

- 7.2.3 Cold Chain Monitoring

- 7.3 Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia-Pacific

- 7.3.4 Latin America

- 7.3.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Orbcomm

- 8.1.2 Sensitech (Carrier Global Corporation)

- 8.1.3 Berlinger & Co. AG

- 8.1.4 Geotab Inc.

- 8.1.5 Kii Corporation

- 8.1.6 Verizon Connect

- 8.1.7 Teletrac Navman

- 8.1.8 Monnit Corporation

- 8.1.9 Controlant

- 8.1.10 Samsara Inc.

- 8.1.11 Seaos

- 8.1.12 Nippon Express co. Ltd.

- 8.1.13 YUSEN LOGISTICS CO. LTD (Nippon Yusen Kabushiki Kaisha(NYK)

- 8.1.14 Hacobu Co. Ltd (MOVO)

- 8.1.15 Kouei system ltd.

- 8.1.16 LYNA LOGICS, Inc.