|

市場調查報告書

商品編碼

1445406

乙炔:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Acetylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

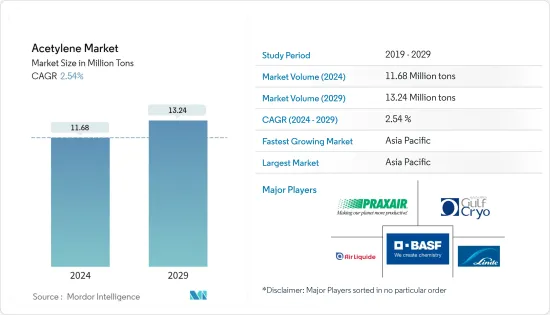

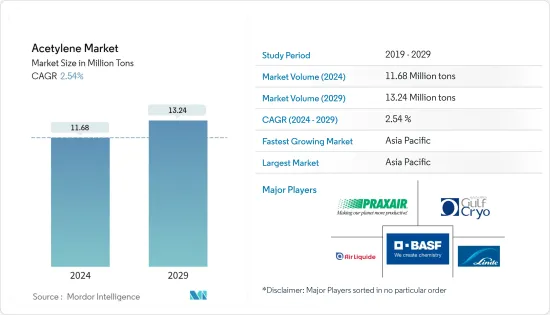

預計2024年乙炔市場規模為1,168萬噸,預計2029年將達到1,324萬噸,在預測期間(2024-2029年)年複合成長率為2.54%。

COVID-19感染疾病對乙炔需求產生了負面影響。各國的封鎖對供應鏈造成了限制,並嚴重阻礙了產業擴張。然而,市場去年復甦,預計在預測期內將大幅成長。

主要亮點

- 推動研究市場的關鍵因素包括全球金屬加工產業的持續需求和化學品生產需求的增加。

- 然而,嚴格的環境法規和高濃度乙炔的不利影響預計將阻礙市場成長。

- 此外,乙炔氣在各種科學研究中的應用可能成為預測期間內需要研究的市場機會。

- 亞太地區主導全球市場,最大的消費來自中國和印度等國家。

乙炔市場趨勢

金屬加工產業可望主導市場

- 乙炔主要用於氧乙炔切割、熱處理和焊接。散裝乙炔也用作化學加工工業的原料,生產乙醛、乙酸和醋酐等有機化合物。

- 乙炔由於其三鍵結構而具有最高的火焰溫度。當乙炔與氧氣燃燒時,火焰溫度達到 3090 度C(5594 °F),並釋放 54.8 kJ/公升的能量。這種最高的火焰溫度允許乙炔用於金屬加工應用,例如切割、焊接、釬焊和硬焊。

- 乙炔的上述應用廣泛用於許多最終用戶產業,例如汽車、航太、金屬加工、製藥和玻璃。

- 根據世界鋼鐵協會統計,2022年全球鋼鐵需求與前一年同期比較下降2.3%。不過,預計 2023 年將恢復 1%。通貨膨脹、美國貨幣緊縮、中國經濟放緩、俄羅斯入侵烏克蘭都是促成因素。對該行業產生了負面影響,由於能源價格上漲、利率上升和信心下降,需求預測被下調,導致鋼鐵製造業放緩。

- 此外,根據世界鋼鐵協會的數據,2023年1月全球鋼鐵產量為1.453億噸,年減3.3%。 2023年1月非洲產量為120萬噸,年減4.9%。亞洲和大洋洲產量1.075億噸,下降0.2%。歐盟(27個國家)產量1,030萬噸,下降15.2%。中東產量380萬噸,成長19.7%。北美產量為 910 萬噸,下降 5.6%。俄羅斯及獨立國協國家及烏克蘭剩餘產量為650萬噸,下降24.9%。同時,南美產量為360萬噸,年減0.6%。

- 此外,根據國際鋁協會的數據,2022 年全球原生鋁總產量為 68,461,000 噸,而 2021 年為 67,092,000 噸。此外,2022年北美鋁需求成長4.8%。

- 美國是世界第五大銅生產國,擁有4,800萬噸銅蘊藏量。此外,根據美國地質調查局的數據,2022 年美國的銅礦產量約為 130 萬噸。

- 由於金屬加工應用的擴大,預計乙炔市場在預測期內將會成長。

亞太地區預計將主導市場

- 亞太地區主導了全球市場佔有率。由於中國和日本等國家運輸活動的增加,該地區乙炔(金屬加工)的使用正在增加。

- 乙炔也用於生產許多重要化學品,包括氯乙烯單體、丙烯腈、醋酸乙烯酯、乙烯基醚、乙醛、1,2-二氯乙烷、1,4-丁炔二醇、丙烯酸酯、聚乙炔和聚二乙炔。亞太地區是化學工業最重要的市場,乙炔市場規模龐大。

- 中國是化學品加工中心,佔世界化學品產量的大部分。隨著全球對各種化學品的需求不斷增加,預計該產業對乙酸等中間體的需求在預測期內將大幅增加。

- 中國政府也致力於發展環保鋼鐵生產方式。根據中國工業2021年終發布的《推動鋼鐵工業高品質發展的指南》,電爐鋼產量佔總產量的比重預計提升至15-20%以上。未來幾年粗鋼產量將增加,廢鋼用量預計將達30%。

- 根據美國地質調查局的數據,2022 年中國銅礦產量為 190 萬噸。這結果較前一年略有下降。此外,該國還有許多正在運作的銅礦。例如,子瑪礦是中國黃金國際資源公司在西藏擁有的露天和地下礦場。 2021年,該礦預計將生產銅86,400噸。該礦很可能在 2050 年投入營運,並將成為中國建築業成長的主要推動力。

- 印度政府報告顯示,2022年該國鋼鐵出口量下降約44%,從一年前的1,850萬噸降至2022年的1,037萬噸。同樣,進口量為477萬噸,比2021年的394萬噸增加21%。印度成品鋼消費量預計將從 2022 會計年度的 8,630 萬噸增加到 2030-31 年的 230 萬噸。因此,未來一段時間粗鋼產量的增加很可能會增加國內乙炔市場的需求。

- 隨著該地區各個行業的成長,乙炔市場在預測期內可能會激增。

乙炔產業概況

乙炔市場本質上是分散的,主要參與者包括BASFSE、普萊克斯科技公司、Gulf Cryo、林德公司和液化空氣公司(排名不分先後)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 人們對乙炔作為燃氣的興趣增加

- 各種化學品產量增加

- 其他司機

- 抑制因素

- 用於焊接和切割的乙炔替代品

- 使用氧乙炔切割和焊接對健康造成的危害

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 按用途

- 金屬加工

- 化工原料

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率/排名分析

- 主要企業採取的策略

- 公司簡介

- Air Liquide

- Air Products And Chemicals Inc.

- Asia Technical Gas Co Pte Ltd.

- Axcel Gases

- BASF SE

- Butler Gas Products

- Gruppo SIAD

- Gulf Cryo

- Jinhong Gas Co. Ltd.

- Koatsu Gas Kogyo Co. Ltd.

- Linde PLC

- Nippon Sanso Holdings Corporation

- NOL Group

- Pune Air Products

- TOHO ACETYLENE Co.

第7章市場機會與未來趨勢

- 玻璃製造對乙炔的需求不斷增加

The Acetylene Market size is estimated at 11.68 Million tons in 2024, and is expected to reach 13.24 Million tons by 2029, growing at a CAGR of 2.54% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the demand for acetylene. The lockdown in various countries led to supply chain constraints that significantly obstructed the expansion of the industry. However, the market recovered last year, and it is expected to grow at a significant rate during the forecast period.

Key Highlights

- The major factors driving the market studied include the continuous demand in global metalworking industries and increasing demand in chemical production.

- However, stringent environmental regulations and the harmful effects of acetylene at higher concentrations are expected to hinder the growth of the market.

- Furthermore, the application of acetylene gas for various scientific research is likely to act as an opportunity for the market studied over the forecast period.

- The Asia-Pacific dominated the market across the world, with the largest consumption from countries like China and India.

Acetylene Market Trends

The Metalworking Industry is Expected to Dominate the Market

- Acetylene is chiefly used for oxyacetylene cutting, heat treating, and welding. Bulk acetylene is also used as a raw material in the chemical processing industry to produce organic compounds, including acetaldehyde, acetic acid, and acetic anhydride.

- Due to its triple-bond structure, acetylene has the highest flame temperature. Acetylene achieves a flame temperature of 3090°C (5594°F), releasing 54.8 kJ/liter of energy when it undergoes combustion with oxygen. This highest flame temperature allows acetylene usage in metalworking applications like cutting, welding, soldering, and brazing.

- The above mentioned applications of acetylene are used in many end-user industries like automotive, aerospace, metal fabrication, pharmaceuticals, glass, and others.

- According to the World Steel Association, global steel demand contracted by 2.3% year-on-year in 2022. However, it is expected to recover by 1% in 2023. Inflation, US monetary tightening, China's slowdown, and Russia's invasion of Ukraine all had an adverse impact on the industry, and high energy prices, rising interest rates, and waning confidence caused demand forecasts to be lower, which caused a slowdown in the steel manufacturing sector.

- Furthermore, according to the World Steel Association, global steel production in January 2023 stood at 145.3 million metric tons, a decline of 3.3% annually. Africa produced 1.2 million metric tons in January 2023, down 4.9% annually. Asia and Oceania produced 107.5 million metric tons, down 0.2%. The EU (27) produced 10.3 million tons, down 15.2%. The Middle East produced 3.8 million metric tons, up 19.7%. North America produced 9.1 million metric tons, down 5.6%. Russia and the rest of the CIS plus Ukraine produced 6.5 million metric tons, down 24.9%. Meanwhile, South America produced 3.6 million metric tons, down 0.6% during the same period.

- Moreover, according to the International Aluminum Association, in 2022, total global primary aluminum production amounted to 68.461 million metric tons, compared to 67.092 million metric tons in 2021. In addition, North American aluminum demand grew by 4.8% in 2022.

- The United States is the world's fifth-largest copper producer, with 48 million tons of copper reserves. Moreover, according to the US Geological Survey, in 2022, the United States produced some 1.3 million metric tons of copper from mines.

- With growing metalworking applications, the market for acetylene is projected to increase over the forecast period.

The Asia-Pacific Region is Expected to Dominate the Market

- The Asia-Pacific region dominated the global market share. With growing transportation activities in countries like China and Japan, the use of acetylene (metalworking) is increasing in the region.

- Acetylene is also used to produce many essential chemicals, such as vinyl chloride monomer, acrylonitrile, vinyl acetate, vinyl ether, acetaldehyde, 1,2-dichloroethane, 1,4-butynediol, acrylate esters, polyacetylene, and polydiacetylene. Asia-Pacific has the most significant market for the chemical industry, which shows enormous scope for the acetylene market.

- China is a hub for chemical processing, accounting for most of the chemical production globally. With the growing global demand for various chemicals, the demand for intermediates, such as acetic acid, from this sector is expected to increase significantly during the forecast period.

- The government of China is also focusing on developing eco-friendly means of producing steel. According to the guidance on promoting high-quality development of the iron and steel industry issued by China's Ministry of Industry and Information Technology at the end of 2021, the proportion of EAF steel output was to be increased to more than 15-20% of total crude steel output, while the scrap usage ratio will reach 30% over the coming years.

- According to the US Geological Survey, China generated 1.9 million metric tons of copper from mines in 2022. This result shows a slight reduction from the previous year. Moreover, there are many operating copper mines in the country. For instance, the Jiama Mine is a surface and underground mine in Tibet owned by China Gold International Resources. In 2021, the mine was expected to produce 86.4 thousand tons of copper. The mine will likely be in operation by 2050 and be the key driver for the growth of the construction sector in China.

- According to the Indian government report, steel exports in the country in 2022 registered a fall of around 44% and reached 10.37 MT in 2022 compared to 18.5 MT a year ago. Similarly, at 4.77 MT, the imports were 21% higher in 2022 than at 3.94 MT in 2021. India's finished steel consumption is anticipated to increase to 230 MT by 2030-31 from 86.3 MT in FY22. Thus, increased crude steel production over the coming period is likely to increase demand for the acetylene market in the country.

- With the growth of various industries in the region, the market for acetylene is likely to surge over the forecast period.

Acetylene Industry Overview

The acetylene market is fragmented in nature due to the presence of major companies, including (not in any particular order) BASF SE, Praxair Technology Inc., Gulf Cryo, Linde PLC, and Air Liquide, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Preference for Acetylene as a Fuel Gas

- 4.1.2 Rise in Various Chemicals Production

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Acetylene Alternatives for Welding and Cutting

- 4.2.2 Health Hazards Of Oxy-acetylene Cutting And Welding

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Application

- 5.1.1 Metal Working

- 5.1.2 Chemical Raw Materials

- 5.1.3 Other Applications

- 5.2 By Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Liquide

- 6.4.2 Air Products And Chemicals Inc.

- 6.4.3 Asia Technical Gas Co Pte Ltd.

- 6.4.4 Axcel Gases

- 6.4.5 BASF SE

- 6.4.6 Butler Gas Products

- 6.4.7 Gruppo SIAD

- 6.4.8 Gulf Cryo

- 6.4.9 Jinhong Gas Co. Ltd.

- 6.4.10 Koatsu Gas Kogyo Co. Ltd.

- 6.4.11 Linde PLC

- 6.4.12 Nippon Sanso Holdings Corporation

- 6.4.13 NOL Group

- 6.4.14 Pune Air Products

- 6.4.15 TOHO ACETYLENE Co.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Growing Demand For Acetylene In Glass Manufacturing