|

市場調查報告書

商品編碼

1445404

自動曳引機:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Autonomous Tractors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

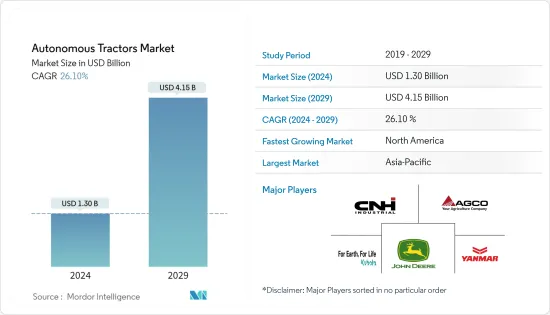

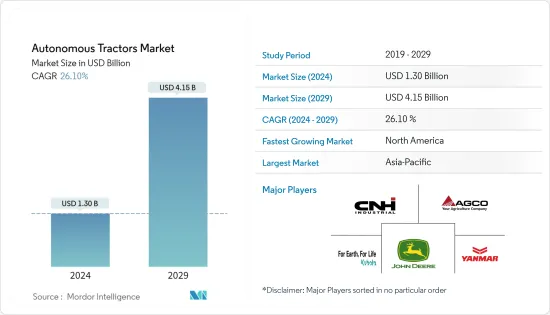

預計2024年自動曳引機市場規模為13億美元,預計到2029年將達到41.5億美元,在預測期內(2024-2029年)年複合成長率為26.10%。

主要亮點

- 由於農業勞動成本上升,農業勞動力不斷減少。農民擴大採用農業機械化來取代體力勞動,提供更具成本效益、更容易取得和更有效率的農業作業。曳引機是驅動農業機械的主要動力來源。據觀察,從長遠來看,這有助於市場的成長。

- 半自動系統比完全自主系統更可行,因為它們在合理的距離內獨立運行,允許農民在出現問題時進行干涉。由於農業車輛搭載操作員,因此這種半自動系統的安全性可以輕鬆保證,無需涵蓋昂貴的感測器或複雜的感測器融合演算法,使其成為農民最負擔得起的系統,尤其是在新興國家。

自主曳引機市場趨勢

農業勞動力短缺和耕地減少

- 由於農業勞動力的減少,農業勞動力的價格不斷上漲。考慮簡單的供需經濟學,農業勞動成本與一個國家從事農業的總人口比例直接相關,進而影響農用曳引機市場。

- 平均而言,新興經濟體依賴農業的人口比例較高。然而,隨著每年越來越多的人遷移到都市區,這一比例正在下降。根據世界銀行資料庫,農業就業佔全球就業總量的比重從2014年的29.43%大幅下降至2019年的26.75%。

- 技術輔助農業需要技術純熟勞工,但技術勞動力嚴重短缺,因此鑑於當前的挑戰,農民正在採用高產自主曳引機等技術。這種情況是推動市場前進的主要因素之一。

- 據印度食品和農業委員會(ICFA)稱,到2050年,印度農業工人的比例預計將下降25.7%。農業需要技術純熟勞工,而且短缺嚴重,因此農民正在部署自動曳引機等技術。鑑於當前的挑戰,它可能會富有成效。這種情況是推動市場前進的主要因素之一。

預計北美將成為成長最快的市場

- 北美將在 2022 年佔據最大的市場佔有率,同時在預測期(2023-2028 年)市場將快速成長。農民可支配收入的增加、訓練有素的農業勞動力的稀缺性以及發達的技術預計將成為北美自主曳引機市場未來擴張的主要原因。

- 由於北美是一個已開發地區,農場通常很大,客戶忠誠度也很高。美國對高性能曳引機的需求開始增加。美國是北美地區最大的自動曳引機市場。

- 政府對永續生產技術的支持,例如與物聯網 (IoT)、人工智慧 (AI) 和機器學習 (ML) 相結合的精密農業,正在推動對自動化技術的需求。因此,這可能會導致美國自動曳引機市場在預測期內出現顯著成長。

- 此外,加拿大農民也對自動曳引機表現出興趣,因為它們可以節省時間並降低營運成本。因此,這可能預示著未來幾年市場成長的正面徵兆。

自主曳引機產業概述

自動曳引機市場相當整合。該市場的主要企業專注於全球創新和新產品發布。由於該市場剛剛興起,因此被認為是一個整合市場,少數參與者佔據了大部分市場佔有率。市場的主要企業包括迪爾公司、凱斯紐荷蘭工業公司、愛科公司、久保田公司和洋馬公司。兩家公司都從事各種策略活動,包括產品創新、擴張、合作夥伴關係以及併購。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 馬力

- 低於 30 匹馬力

- 31HP~100HP

- 100HP以上

- 自動化

- 全自動

- 半自動

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 西班牙

- 法國

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 其他非洲

- 北美洲

第6章 競爭形勢

- 最採用的策略

- 市場佔有率分析

- 公司簡介

- AGCO

- John Deere

- Mahindra and Mahindra Ltd

- Autonomous Tractor Corporation

- CNH Industrial

- Kubota Corporation

- Dutch Power Company

- Yanmar Co. Ltd

- Zimeno Inc.(DBA Monarch Tractor)

- AutoNext Automation

第7章市場機會與未來趨勢

The Autonomous Tractors Market size is estimated at USD 1.30 billion in 2024, and is expected to reach USD 4.15 billion by 2029, growing at a CAGR of 26.10% during the forecast period (2024-2029).

Key Highlights

- Agricultural labor is decreasing due to the cost of farm labor rising. Farmers are increasingly adopting agricultural mechanization as a substitute for manual labor and offering more cost-effective, easily available, and efficient agricultural operations. Tractors are the primary source of power for driving agricultural machinery. This is observed to contribute to market growth over the long term.

- The semi-autonomous systems operate independently enough within reasonable distances that the farmer can intervene if any problems occur, and therefore, they are more viable than fully autonomous equipment. Because of the operator's presence in agricultural vehicles, the safety of such a semi-autonomous system can be easily ensured without the incorporation of costly sensors and complicated sensor fusion algorithms, making them the most feasible for farmers to purchase, especially in developing countries.

Autonomous Tractors Market Trends

Shortage of Farm Labor and Declining Arable Land

- Due to decreasing agricultural labor, the prices of farm labor are rising. The cost of farm labor directly relates to the percentage of a country's total population employed in agriculture, considering simple demand-supply economics, thereby affecting the agricultural tractors market.

- On average, developing economies have larger percentages of the population dependent on agriculture. However, the percentages have decreased as many people migrate yearly to urban areas. According to the World Bank's database, agricultural employment out of total employment fell drastically from 29.43% in 2014 to 26.75% in 2019 globally.

- As technologically assisted agriculture needs skilled labor, of which there is an acute shortage, farmers are adopting technologies such as autonomous tractors that can be productive, considering the current challenge. This scenario is one of the major factors that drive the market forward.

- According to the Indian Council of Food and Agriculture (ICFA), the percentage of agriculture workers in India is estimated to decline by 25.7% in 2050. As agriculture needs skilled laborers with an acute shortage of availability, farmers are adopting technologies such as autonomous tractors that can be productive, considering the current challenge. This scenario is one of the major factors that drive the market forward.

North America Projected to be Fastest-Growing Market

- North America accounted for the largest market share in 2022 while also rapidly advancing in the market growth over the forecast period(2023-2028). The higher disposable incomes of farmers, lack of trained farm labor, and well-developed technology are expected to be the primary reasons for the future expansion of the North American autonomous tractors market.

- Since North America is a developed region, farms are usually large, and customer loyalty is high. The demand for high-powered tractors in the US is starting to gain traction. The US is the largest market for autonomous tractors in the North American region.

- The government's support for sustainable production techniques, such as precision farming, involving the integration of the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML) is boosting the demand for automated technologies. Therefore, this may result in the significant growth of the autonomous tractors market in the US during the forecast period.

- Further, Canadian farmers are also showing interest in adopting autonomous tractors as they would save time and decrease operating costs. Therefore, this may indicate a positive sign for market growth over the coming years.

Autonomous Tractors Industry Overview

The autonomous tractors market is fairly consolidated. The major players in this market are focused on innovation and launching new products globally. Since the market's inception is very recent, it is considered a consolidated market with a few players holding most of the market share. The top players in the market are Deere and Co, CNH Industrial, AGCO Corporation, Kubota, and Yanmar. The companies were involved in various strategic activities such as product innovations, expansions, partnerships, and mergers and acquisitions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Horsepower

- 5.1.1 Up to 30 HP

- 5.1.2 31 HP to 100 HP

- 5.1.3 Above 100 HP

- 5.2 Automation

- 5.2.1 Fully Automated

- 5.2.2 Semi-automated

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 US

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Spain

- 5.3.2.4 France

- 5.3.2.5 Russia

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 AGCO

- 6.3.2 John Deere

- 6.3.3 Mahindra and Mahindra Ltd

- 6.3.4 Autonomous Tractor Corporation

- 6.3.5 CNH Industrial

- 6.3.6 Kubota Corporation

- 6.3.7 Dutch Power Company

- 6.3.8 Yanmar Co. Ltd

- 6.3.9 Zimeno Inc. (DBA Monarch Tractor)

- 6.3.10 AutoNext Automation