|

市場調查報告書

商品編碼

1444945

AIaaS(人工智慧即服務):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)AI-as-a-Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

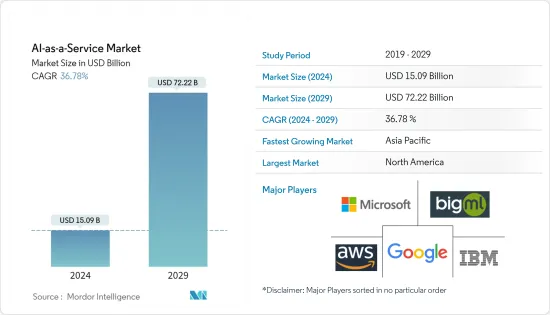

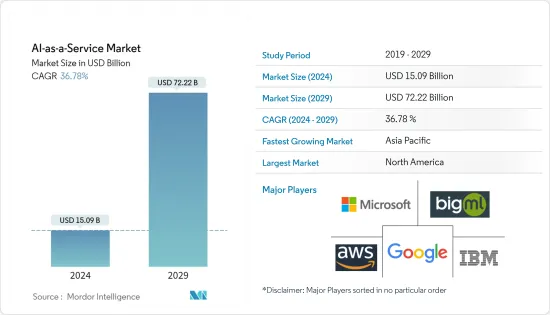

AIaaS(人工智慧即服務)的市場規模預計到 2024 年為 150.9 億美元,在預測期內(2024-2029 年)預計到 2029 年將達到 722.2 億美元,年複合成長率為 36.78 %)。

隨著公司數量和競爭的增加,公司正在努力將人工智慧 (AI) 技術整合到其應用程式、業務、分析和服務中。此外,公司正在尋求降低營運成本以提高報酬率。因此,AIaaS(AI-as-a-Service)在雲端上越來越受到關注。值得注意的是,公司對雲端基礎的機器學習越來越感興趣,以幫助試驗他們的產品。

主要亮點

- 由於多重雲端能力的成長趨勢以及雲端基礎的智慧服務的需求不斷成長,對人工智慧即服務(AIaaS)的需求也在不斷增加。據IBM稱,到2021年,98%的組織計劃採用多重雲端架構,41%的組織將制定多重雲端管理策略,並提供操作多重雲端環境的程序和工具。只有38%的組織計劃採用多雲架構。這為人工智慧服務創造了巨大的機會。

- 此外,IBM 2022 年人工智慧採用指數指出,“人工智慧 (AI) 的使用及其對商業和社會的影響已達到臨界點。全球人工智慧採用率大幅上升,達到 35%;增幅為 4%。”之前的積分。”人工智慧的使用在多個行業和國家已接近普遍,並且由於新的自動化功能、改進的可用性和可訪問性以及更全面的試驗功能,世界各地的組織擴大使用人工智慧。我們正在迅速獲得新的好處和效率人工智慧。虛擬助理和 IT 等現成的企業解決方案將人工智慧涵蓋業務中。 44% 的公司正在努力將人工智慧整合到他們目前的應用程式和流程中,這一事實支持了可訪問性很重要的論點。

- 許多政府機構,特別是新興經濟體的政府機構,也意識到人工智慧的好處和力量。因此,我們正在廣泛推動人工智慧基礎設施的發展。例如,印度的Niti Aayog推出了一項國家人工智慧計劃,包括研發,並增加了對數位印度的預算撥款,以推廣人工智慧、機器學習、3D列印和其他技術。

- 對人工智慧服務的需求不斷增加,許多雲端供應商都提供 AIaaS 和 MLaaS。因此,2020年全球醫療保健產業雲端市場錄得顯著成長。 AI 和 ML 技術被大量用於對抗 COVID-19 疾病。例如,一些研究人員正在使用機器學習來創建智慧監控系統來追蹤和檢測疑似感染疾病了 COVID-19 的人。提案的系統之一是一個新框架,它整合了機器學習、雲、霧和物聯網 (IoT) 技術,以創建 COVID-19感染疾病監測和預後系統。

- O'Reilly 的《2021 年企業人工智慧採用報告》對3,500 多名企業領導者進行了調查,發現缺乏熟練人才和招聘困難是人工智慧面臨的最大挑戰,19% 的受訪者將其列為“重大」障礙。 O'Reilly 的報告表明,人工智慧採用的第二大障礙是缺乏高品質資料,18% 的受訪者表示他們的組織沒有認知到高品質資料的重要性。我回答說我已經開始了。

AIaaS(人工智慧即服務)市場趨勢

對預測和分析解決方案的需求不斷成長預計將推動市場成長

- 對預測和分析解決方案不斷成長的需求預計將推動 AIaaS(人工智慧即服務)市場。 AIaaS是指將人工智慧(AI)運算和分析功能外包給透過網際網路提供AI解決方案和工具的第三方服務供應商。

- 人工智慧技術的進步使各行業的公司認知到將人工智慧整合到其業務中的潛在好處。人工智慧有助於提高效率、改善客戶體驗並做出資料主導的決策。然而,實施人工智慧基礎設施和內部開發人工智慧模型可能需要時間和精力。 AIaaS 透過提供預先建置的 AI 解決方案和平台,提供了經濟高效且便利的替代方案。

- AIaaS平台提供擴充性和彈性,讓企業可以根據自己的需求存取AI資源。隨著對預測和分析解決方案的需求增加,企業可以利用 AIaaS 服務輕鬆擴展其 AI 能力。這種彈性使組織能夠適應不斷變化的業務需求,而無需在基礎設施或專業知識上進行大量的前期投資。

- 借助 AIaaS,企業不再需要投資昂貴的硬體、軟體或人工智慧專業知識。 AIaaS 解決方案可讓企業以訂閱或付費使用制存取 AI 功能,從而降低前期成本,並使 AI 更容易被更廣泛的組織使用。這種成本效率特別有利。

- 在醫療保健領域實施預測分析需要強大的人工智慧功能、運算能力和專業知識。 AIaaS 平台為醫療保健組織提供了存取人工智慧和預測分析工具的便利性和可訪問性,而無需大量前期投資。隨著醫療保健提供者和付款人越來越認知到預測分析的價值,醫療保健產業對 AIaaS 解決方案的需求預計將增加並推動整個 AIaaS 市場。飛利浦表示,截至去年兩個月,新加坡接受調查的醫療保健領導者中有 92% 表示已經或正在其醫療保健組織中實施預測分析,其採用率是所有國家中最高的。中國以 79% 的採用率排名第二,其次是巴西和美國,採用率為 66%。

預計北美將佔據重要市場佔有率

- 北美人工智慧即服務 (AIaaS) 市場是 AIaaS 解決方案的最大市場之一。北美擁有矽谷等主要技術中心,促進創新並推動技術進步。該地區擁有強大的基礎設施和高技能的勞動力,有利於人工智慧技術的開發和部署。該技術生態系統為 AIaaS 供應商提供解決方案和服務創造了有利的環境。

- 美國擁有強大的創新生態系統,由聯邦政府對先進技術的戰略投資支持,吸引了來自世界各地有遠見的科學家和企業家,以及北美地區人工智慧的發展,並輔以知名研究機構的存在推動了它。

- 根據人工智慧國家安全委員會的報告,其最終報告提案國會每年將人工智慧的聯邦研發資金增加一倍,在 2026 會計年度達到 320 億美元。根據拜登政府的2023會計年度預算提案,聯邦研發預算預計將比2021會計年度授權水準增加28%,達到超過2,040億美元。國家人工智慧研究機構,無論是新成立的還是已成立的,都將獲得這些資金的一部分。這些機構將商業部門、組織、學術界以及聯邦、州和地方政府當局聚集在一起,共同應對人工智慧研究和勞動力發展的挑戰。政府的此類人工智慧發展措施將推動市場。

- 北美地區是蓬勃發展的人工智慧產業的發源地,擁有許多專注於推動人工智慧技術的新興企業、科技巨頭和研究機構。該生態系統促進創新並推動對 AIaaS 解決方案的需求。醫療、金融、零售、製造業等行業的企業正積極採用人工智慧技術來提高競爭力,進一步加速北美AIaaS市場的成長。

- 北美的許多組織正在進行數位轉型工作,以利用人工智慧技術來增強業務、最佳化流程並從資料中獲取洞察。 AIaaS 在這些努力中發揮關鍵作用,為企業提供了一種可擴展且經濟高效的方式來存取 AI 功能,而無需對基礎設施或專業知識進行大量前期投資。企業保持競爭力的需求將推動對 AIaaS 解決方案的需求。

AIaaS(人工智慧即服務)產業概述

AIaaS(人工智慧即服務)市場高度分散,主要企業包括微軟公司、Google有限責任公司、亞馬遜網路服務公司、IBM公司和BigML公司。合作夥伴和收購等策略旨在增強產品供應並獲得永續的競爭優勢。

2022年7月,IBM宣布收購Databand.ai。 Databand.ai 是資料可觀測性軟體的領先供應商,可協助組織在錯誤、管道故障和品質差等資料問題影響收益之前解決這些問題。透過此次發布,IBM 的軟體產品組合擴展到資料、人工智慧和自動化領域,涵蓋了全方位的可觀察性。這使組織能夠確保可信任資料在正確的時間掌握在正確的個人手中。

2022 年 6 月,亞馬遜推出了 Code Whisperer,這是一項利用機器學習為軟體開發人員產生程式碼提案的新服務。這是該公司雲端產品的第一個補充。該工具目前處於預覽階段,旨在幫助程式設計師編寫可以更快地為人工智慧計劃建立訓練資料集的程式碼。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵意強度

- 替代產品的威脅

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 對預測和分析解決方案的需求不斷成長

- 改善消費者體驗的需求不斷成長

- 市場挑戰

- 與資料外洩和駭客攻擊相關的風險

第6章市場區隔

- 按配置

- 民眾

- 私人的

- 混合

- 按組織規模

- 中小企業

- 主要企業

- 按最終用戶產業

- BFSI

- 零售

- 衛生保健

- 資訊科技和電信

- 製造業

- 能源

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭形勢

- 公司簡介

- Microsoft Corporation

- Google LLC

- Amazon Web Services, Inc.

- IBM Corporation

- BigML Inc

- DATAIKU SAS

- Salesforce.com Inc.

- SAS Institute Inc

- Oracle Corporation

- H2O.Ai Inc

- Craft.AI

第8章投資分析

第9章市場機會與未來趨勢

The AI-as-a-Service Market size is estimated at USD 15.09 billion in 2024, and is expected to reach USD 72.22 billion by 2029, growing at a CAGR of 36.78% during the forecast period (2024-2029).

With the increasing number of enterprises and competition, companies are rigorously trying to integrate artificial intelligence (AI) technology into their application, business, analytics, and services. Moreover, companies are trying to reduce their operational cost to increase profit margins, due to which Artificial Intelligence-as-a-Service (AIaaS) is gaining more prominence over the cloud. Notably, companies are more interested in cloud-based machine learning, which helps in experimenting with their offerings.

Key Highlights

- The rising trend of multi-cloud functioning and the growing need for cloud-based intelligence services are also increasing the demand for AI as a service. According to IBM, by 2021, 98% of the organization's plans will adopt multi-cloud architectures, with only 41% having a multi-cloud management strategy and just 38% having procedures and tools to operate a multi-cloud environment. This creates a massive opportunity for AI services.

- Furthermore, the IBM AI adoption index 2022 states, " A tipping point has been reached in using artificial intelligence (AI) and its effects on businesses and society. The adoption rate of AI globally increased significantly and is at 35%, up four points from the previous year. And the usage of AI is nearly universal in several sectors and nations. Organizations worldwide are quickly gaining new advantages and efficiencies from AI thanks to new automation capabilities, improved usability and accessibility, and a more comprehensive range of tried-and-true use cases. Virtual assistants and other ready-made corporate solutions like IT incorporate AI into their operations. The fact that 44% of firms are working to integrate AI into current apps and processes supports the argument that accessibility is important.

- Many government organizations, especially in emerging economies, also understand the benefits and power of AI; hence, they are extensively promoting AI-based infrastructure development. For instance, Niti Aayog in India launched a national program on AI, including R&D, with increased budget allocation for Digital India to promote AI, machine learning, 3D printing, and other technologies.

- The need for AI services has grown, and many cloud providers offer AIaaS and MLaaS. As a result, the global cloud market recorded significant growth in the healthcare segment in 2020. AI and ML technology is being used considerably to fight COVID-19. For instance, several researchers are using machine learning to create a smart monitoring system that tracks and detects suspected COVID-19 infected persons. One proposed system is a new framework integrating machine learning, cloud, fog, and Internet of Things (IoT) technologies to create a COVID-19 disease monitoring and prognosis system.

- O'Reilly's 2021 AI Adoption in the Enterprise report, which surveyed more than 3,500 business leaders, found that a lack of skilled people and difficulty hiring topped the list of challenges in AI, with 19% of respondents citing it as a "significant" barrier. The O'Reilly report suggests that the second-most significant barrier to AI adoption is a lack of quality data, with 18% of respondents saying their organization is only beginning to realize the importance of high-quality data.

Artificial Intelligence as a Service (AIaaS) Market Trends

Increasing Demand for Predictive and Analytics Solutions is Expected to Drive Market Growth

- The increasing demand for predictive and analytics solutions would drive the artificial intelligence-as-a-service (AIaaS) market. AIaaS refers to outsourcing artificial intelligence (AI) computational and analytical capabilities to third-party service providers offering AI solutions and tools over the Internet.

- With advancements in AI technology, businesses across various industries recognize the potential benefits of integrating AI into their operations. AI can help improve efficiency, enhance customer experiences, and make data-driven decisions. However, implementing AI infrastructure and developing AI models in-house can take time and effort. AIaaS provides a cost-effective and convenient alternative by offering pre-built AI solutions and platforms.

- AIaaS platforms offer scalability and flexibility, allowing businesses to access AI resources according to their requirements. As the demand for predictive and analytics solutions grows, companies can easily scale up their AI capabilities by leveraging AIaaS services. This flexibility enables organizations to adapt to changing business needs without significant upfront investments in infrastructure and expertise.

- AIaaS eliminates the need for businesses to invest in expensive hardware, software, and specialized AI expertise. By leveraging AIaaS solutions, companies can access AI capabilities on a subscription or pay-per-use basis, reducing upfront costs and making AI more accessible to a broader range of organizations. This cost efficiency is particularly beneficial.

- Adopting predictive analytics in healthcare requires robust AI capabilities, computational power, and expertise. AIaaS platforms offer healthcare organizations the convenience and accessibility of accessing AI and predictive analytics tools without significant upfront investments. As healthcare providers and payers increasingly recognize the value of predictive analytics, the demand for AIaaS solutions in the healthcare sector is expected to grow, driving the overall AIaaS market. According to Philips, as of the second month of the previous year, 92 percent of healthcare leaders surveyed in Singapore reported that they had either implemented or were implementing predictive analytics in their healthcare organization, the highest adoption rate among all countries examined. China stood second with a 79 percent adoption rate, followed by Brazil and the United States with 66 percent.

North America is Expected to Hold Significant Market Share

- The North American Artificial Intelligence-as-a-Service (AIaaS) market is one of the largest markets for AIaaS solutions. North America is home to major technology hubs, such as Silicon Valley, which foster innovation and drive technological advancements. The region has a robust infrastructure and a highly skilled workforce, enabling the development and deployment of AI technologies. This technological ecosystem creates a favorable environment for AIaaS providers to offer solutions and services.

- The United States has a robust innovation ecosystem fueled by strategic federal investments in advanced technology, complemented by the presence of visionary scientists and entrepreneurs coming together from across the world and renowned research institutions, which have propelled the development of AI in the North American region.

- According to the National Security Commission on Artificial Intelligence, its final report proposed that Congress increase federal R&D funding for AI by a factor of two annually, up to a total of USD 32 billion in fiscal 2026. The federal R&D budget was expected to be increased by 28% from FY 2021 authorized levels to more than USD 204 billion under the Biden administration's fiscal 2023 budget plan. The National AI Research Institutes, both new and established, would get some of those funds. To address the difficulties of AI research and workforce development, these institutes bring together the commercial sector, organizations, academics, and federal, state, and municipal authorities. Such government initiatives for the development of AI will drive the market.

- The North American region has a thriving AI industry with numerous startups, technology giants, and research institutions focused on advancing AI technologies. This ecosystem fosters innovation and drives demand for AIaaS solutions. Companies in sectors like healthcare, finance, retail, and manufacturing are actively adopting AI technologies to gain a competitive edge, further fueling the growth of the AIaaS market in North America.

- Many organizations in North America are undergoing digital transformation initiatives, aiming to leverage AI technologies to enhance their operations, optimize processes, and gain insights from their data. AIaaS plays a crucial role in these initiatives, providing businesses with a scalable and cost-effective way to access AI capabilities without significant upfront investments in infrastructure and expertise-the need for businesses to remain competitive drives the demand for AIaaS solutions.

Artificial Intelligence as a Service (AIaaS) Industry Overview

The artificial intelligence-as-a-service (AIaaS) market is highly fragmented, with the presence of major players like Microsoft Corporation, Google LLC, Amazon Web Services, Inc., IBM Corporation, and BigML Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain a sustainable competitive advantage.

In July 2022, IBM announced the acquisition of Databand.ai, a major provider of data observability software that assisted organizations in resolving data issues such as mistakes, pipeline failures, and low quality before they influenced their bottom line. The announcement expanded IBM's software portfolio across data, AI, and automation to cover the whole spectrum of observability. It assisted organizations in ensuring that trustworthy data was in the hands of the appropriate individuals at the right time.

In June 2022, Amazon launched "Code Whisperer,' a new service that used machine learning to generate code suggestions for software developers. It is the first addition to its cloud offering. This tool, currently in preview, is intended to help programmers write code faster and build training datasets for their artificial intelligence projects.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Predictive and Analytics Solutions

- 5.1.2 Rising Demand for Enhancing Consumer Experience

- 5.2 Market Challenges

- 5.2.1 Risks Associated with Data Breaches and Hacks

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Public

- 6.1.2 Private

- 6.1.3 Hybrid

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprise

- 6.2.2 Large Enterprise

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Retail

- 6.3.3 Healthcare

- 6.3.4 IT and Telecom

- 6.3.5 Manufacturing

- 6.3.6 Energy

- 6.3.7 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 Google LLC

- 7.1.3 Amazon Web Services, Inc.

- 7.1.4 IBM Corporation

- 7.1.5 BigML Inc

- 7.1.6 DATAIKU SAS

- 7.1.7 Salesforce.com Inc.

- 7.1.8 SAS Institute Inc

- 7.1.9 Oracle Corporation

- 7.1.10 H2O.Ai Inc

- 7.1.11 Craft.AI