|

市場調查報告書

商品編碼

1444858

嵌入式分析:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Embedded Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

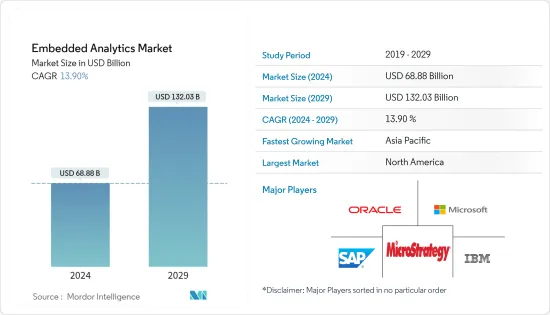

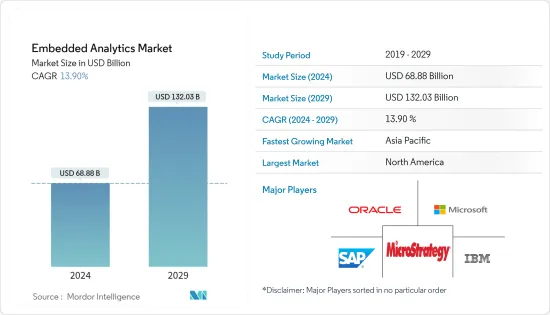

嵌入式分析市場規模預計到 2024 年為 688.8 億美元,預計到 2029 年將達到 1320.3 億美元,預測期內(2024-2029 年)年複合成長率為 13.90%。

嵌入式分析是整合到公司軟體程式中的最終用戶 BI 和分析解決方案。嵌入式分析是嵌入式應用程式的一個元件,而不是獨立於平台的服務。這項研究使用戶能夠使用高品質的資料並快速建立報告。

主要亮點

- 推動嵌入式分析市場的關鍵因素是巨量資料和物聯網 (IoT) 在企業中的擴展、行動裝置和雲端技術的可靠性以及資料分析與業務應用程式整合的需求不斷成長。

- 此外,資料數量和種類的不斷增加,以及銀行和其他金融機構對金融交易 IT 系統的需求不斷增加,也推動了對嵌入式分析的需求。

- 巨量資料應用的增加將大大促進嵌入式分析的接受。因此,巨量資料和分析解決方案的收益近年來持續成長。

- 然而,高昂的更換成本以及舊有系統與新 API 的不相容預計將增加資料短缺的風險,並阻礙預測期內的市場收益成長。

- 市場報告指出,COVID-19感染疾病市場創造了成長機會,因為網路購物、食品訂購和數位化付款方式為企業提供了資料池。內建分析工具透過產生的數位化資料,在 COVID-19 疫情期間為企業提供資料趨勢和見解,推動市場成長。

嵌入式分析市場趨勢

行動裝置和雲端運算技術的使用增加,導致顯著成長

- 雲端技術和行動裝置對於有效使用高級業務應用程式至關重要。與嵌入式分析軟體整合的行動裝置支援即時資料視覺化。

- 雲端運算技術的越來越多的使用預計將改善業務營運並更好地洞察客戶行為,從而推動市場收益成長。

- 此外,對嵌入式分析軟體的需求不斷成長,以提高生產力、節省營運成本並節省審查資料的時間。由於這些原因,對嵌入式分析軟體的需求預計在預測期內將會增加。

- 公司可以使用雲端運算來整合資料並提高對資料的理解。雲端基礎的資料倉儲提供對資訊的即時、安全存取。此外,此整合還可以透過資料分析實現即時預測模型。

- 許多公司正在採用雲端業務分析,因為它提供了可擴展、有彈性且經濟實惠的基礎設施,並且不需要持續維護內部基礎設施。雲端運算的日益普及迫使企業開發強大的平台,使資料和本地資料都受益。

預計北美將佔據主要佔有率

- 與其他地區相比,北美地區在各個最終用戶產業中採用資料現代化技術的比例最高。這是推動該地區採用嵌入式分析等各種分析解決方案的主要因素。該地區是蘋果、Facebook、IBM 和谷歌等許多大公司的所在地,在 ICT 行業中保持著領先地位。

- 此外,先進技術的實施、對適當技術基礎設施的需求不斷增加、對嵌入式分析工具的需求隨之增加以及全部區域眾多公司的存在正在推動嵌入式分析軟體市場的成長。

- 醫療保健、BFSI 和製造等多個最終用戶行業已大量採用嵌入式分析等分析解決方案,並在該地區佔據主導地位。因此,在預測期內,該地區嵌入式分析解決方案的採用預計將大幅增加。

- 該地區也是雲端服務應用領域的強勢參與者。因此,該國的分析提供者正在透過在雲端領域建立合作夥伴關係和協作來進行創新。

嵌入式分析產業概述

由於IBM公司、SAP SE和微軟公司等跨國公司的存在,嵌入式分析市場競爭非常激烈。隨著許多新興國家的中小企業從傳統模式轉向經營模式經營模式,企業正在尋求新興市場以獲得競爭優勢。數字和資料驅動的。

- 2022 年 7 月 - TIBCO Software 宣布對 TIBCO Cloud Integration 進行重大增強,TIBCO Cloud Integration 是由 TIBCO Cloud 提供支援的業界認可的 iPaaS 服務。這擴大了跨混合環境整合應用程式、資料和裝置的可能性,幫助客戶在面臨不確定性時加快業務發展。 TIBCO Cloud Integration 顯著加速了整個企業的業務流程自動化和數位資產整合。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 技術簡介

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 業務資料高階分析技術的需求不斷成長

- 資料驅動組織的興起

- 行動 BI 和巨量資料分析的採用率不斷提高

- 行動裝置和雲端運算技術的使用增加

- 市場限制因素

- 許可挑戰和相關成本增加

第6章市場區隔

- 按解決方案

- 軟體

- 服務

- 按組織規模

- 中小企業

- 主要企業

- 按配置

- 雲

- 本地

- 按最終用戶產業

- BFSI

- 資訊科技/通訊

- 衛生保健

- 零售

- 能源和公共

- 製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭形勢

- 公司簡介

- IBM Corporation

- Microsoft Corporation

- SAP SE

- SAS Institute Inc.

- MicroStrategy Incorporated

- Oracle Corporation

- Tableau Software(Sales Force, Inc.)

- TIBCO Software, Inc.

- Birst, Inc.(Infor Inc.)

- Logi Analytics, Inc

- QlikTech International AB

- Sisense Inc.

- Information Builders, Inc.

- OpenText Corp.

- Yellowfin International Pty Ltd

- GoodData Corporation

- Izenda, Inc.

- Vertica Systems, Inc.(HPE)

- WNS Global Services SA(Pty)Ltd

- Exago, Inc.

第8章投資分析

第9章市場的未來

The Embedded Analytics Market size is estimated at USD 68.88 billion in 2024, and is expected to reach USD 132.03 billion by 2029, growing at a CAGR of 13.90% during the forecast period (2024-2029).

Embedded analytics is a BI and analytics solution aimed at end users that are integrated into company software programs. Embedded analytics is a component of the intrinsic application rather than a platform-independent service. This study enables users to work with higher-quality data and generate reports quickly.

Key Highlights

- The primary factors driving the embedded analytics market are big data and the Internet of Things (IoT) expansion in businesses, the dependability of mobile devices and cloud technologies, and the rising demand for data analytics integration with business applications.

- In addition, the increase in volume and variety of data and the growing demand for IT systems for financial transactions in banks and other financial institutes are also driving the need for embedded analytics.

- An increase in big data applications would significantly contribute to the acceptance of embedded analytics. Thus, there has been consistent growth in big data and analytics solutions' revenue in recent years.

- However, high replacement costs and legacy systems are incompatible with new APIs, which increases the risk of data insufficiency, which is expected to hamper the market revenue growth during the forecast period.

- The market report finds that the COVID-19 pandemic created growth opportunities for the market as Online shopping, food ordering, and digitized payment methods provided a data pool to businesses. Embedded analytic tools provided companies with data trends and insights during COVID-19 through the generated digitized data, which boosted market growth.

Embedded Analytics Market Trends

Increasing Use of Mobile Devices and Cloud Computing Technologies to Witness Significant Growth

- To effectively use advanced business applications, cloud technologies and mobile devices are crucial. Mobile devices integrated with embedded analytics software support real-time data visualization.

- Increased use of cloud computing technology improves business operations and provides better insight into customer behavior, which is anticipated to drive market revenue growth.

- Additionally, the growing requirement for embedded analytics software will boost productivity, save operating expenses, and save time when reviewing data. The demand for embedded analytics software is anticipated to increase due to these reasons over the forecast period.

- Businesses can combine data and improve the comprehension of their data with the help of cloud computing. Through a cloud-based data warehouse, information may be instantly and securely accessible. Additionally, consolidation makes real-time prediction models possible through data analysis.

- Numerous businesses employ cloud business analytics because it provides scalable, elastic, and affordable infrastructure that doesn't require ongoing maintenance of internal infrastructure. The rising popularity of cloud computing pushes enterprises to develop a solid platform that can benefit both hosted and on-premise data.

North America is Expected to Hold Major Share

- The adoption of data modernization technologies across various end-user industries in the North America region is the highest, compared to other regions; it is the major factor driving the adoption of various analytical solutions, like embedded analytics in the region. The region maintains its position in the ICT industry, as it is home to many large corporations, such as Apple, Facebook, IBM, and Google.

- Moreover, The implementation of advanced technology, Increasing demand for Adequate technology infrastructure, the subsequent growth in the demand for embedded analytics tools, and the presence of a large number of enterprises across the region drive the Embedded Analytics software market to grow.

- Several end-user industries, like healthcare, BFSI, and manufacturing, among others, with significant adoption of analytics solutions, such as embedded analytics, hold a dominant position in the region. Hence, the adoption of embedded analytics solutions, in the region, is expected to grow significantly during the forecast period.

- Also, the region is a dominant player in the cloud services applications. Therefore, the analytics providers in the country are innovating by entering partnerships and collaborations in the caloud space.

Embedded Analytics Industry Overview

The embedded analytics market is highly competitive because of the the presence of global corporations like IBM Corporation, SAP SE,Microsoft Corporation, Companies pursue emerging markets to obtain competitive advantages since many small and medium-sized businesses in developing countries switch from traditional business models to digital and data-driven ones.

- July 2022 - TIBCO software has announced significant enhancements to TIBCO cloud integration, its industry-recognized iPaaS offering by TIBCO cloud, which expands the potential for integration of applications, data, and devices across hybrid environments, assisting customers grappling in a volatile to accelerate business outcomes. TIBCO Cloud Integration delivers remarkably faster automation of business processes and integration of digital assets across the enterprise.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Advanced Analytical Techniques for Business Data

- 5.1.2 Increasing number of Data Driven Organizations

- 5.1.3 Increasing Adoption of Mobile BI and Big Data Analytics

- 5.1.4 Increasing Use of Mobile Devices and Cloud Computing Technologies

- 5.2 Market Restraints

- 5.2.1 Licensing Challenges and Higher Associated Costs

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Software

- 6.1.2 Service

- 6.2 By Size of Organisation

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Deployment

- 6.3.1 Cloud

- 6.3.2 On-premise

- 6.4 By End-user Vertical

- 6.4.1 BFSI

- 6.4.2 IT and Telecommunication

- 6.4.3 Healthcare

- 6.4.4 Retail

- 6.4.5 Energy and Utilities

- 6.4.6 Manufacturing

- 6.4.7 Other End-user Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 SAP SE

- 7.1.4 SAS Institute Inc.

- 7.1.5 MicroStrategy Incorporated

- 7.1.6 Oracle Corporation

- 7.1.7 Tableau Software (Sales Force, Inc.)

- 7.1.8 TIBCO Software, Inc.

- 7.1.9 Birst, Inc. (Infor Inc.)

- 7.1.10 Logi Analytics, Inc

- 7.1.11 QlikTech International AB

- 7.1.12 Sisense Inc.

- 7.1.13 Information Builders, Inc.

- 7.1.14 OpenText Corp.

- 7.1.15 Yellowfin International Pty Ltd

- 7.1.16 GoodData Corporation

- 7.1.17 Izenda, Inc.

- 7.1.18 Vertica Systems, Inc. (HPE)

- 7.1.19 WNS Global Services SA (Pty) Ltd

- 7.1.20 Exago, Inc.