|

市場調查報告書

商品編碼

1444857

邊緣分析 - 市佔率分析、產業趨勢與統計、成長預測(2024 - 2029 年)Edge Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

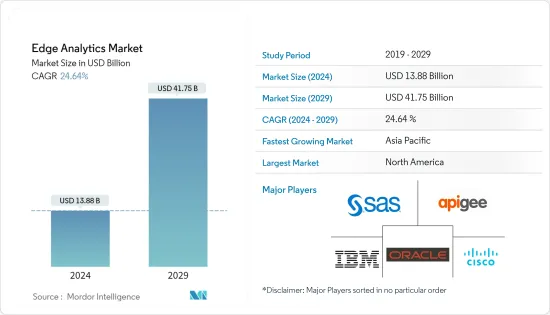

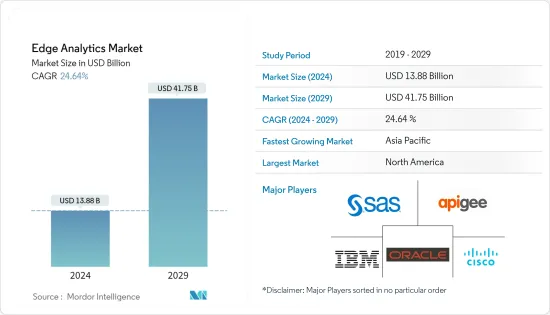

邊緣分析市場規模預計到 2024 年為 138.8 億美元,預計到 2029 年將達到 417.5 億美元,在預測期內(2024-2029 年)CAGR為 24.64%。

邊緣分析是一項新興技術,由於更接近資料來源,預計將減輕雲端伺服器的負載。邊緣分析可以即時分析資料,從而實現對雲端服務的更高依賴。製造、醫療保健和零售等行業預計將從處理資料的即時可用性中獲益最多,使他們能夠利用即時決策實現更高的效率。

主要亮點

- 邊緣分析是一種資料收集和分析策略,其中對節點、網路交換器或另一個網路端點邊緣的資料進行自動分析計算,而不是等待資料轉發回集中式資料儲存。

- 網路和雲端採用的增加為未來全球邊緣分析產業提供了巨大的前景。此外,對自動化的需求不斷成長推動了市場的成長。

- 在連接設備的幫助下,大量資料的激增正在推動邊緣分析市場的成長,即時智慧成為網路設備上邊緣分析成長的催化劑,並採用邊緣分析,提高可擴展性和成本最佳化。

- 然而,缺乏安裝和管理基於邊緣的解決方案的熟練人員阻礙了市場發展。預計網路節點效率的提高將為整個預測年度擴大邊緣分析市場規模提供利潤豐厚的前景。

- COVID-19 大流行對邊緣分析市場產生了積極影響,由於遠端工作趨勢和員工在COVID-19 封鎖期間無法工作,該市場在此期間表現出顯著成長,這促使了對自動化和物聯網解決方案的需求在此期間,協助邊緣分析市場的成長。大流行後,隨著數位化技術的日益採用,市場也在快速成長。

邊緣分析市場趨勢

互聯設備上數據傳播的增加推動了市場成長

- 每天產生的大量資料儲存在雲端中,進一步推動了對邊緣分析的需求。據思科系統公司稱,2017 年拉丁美洲消費者管理的網際網路協定 (IP) 月流量資料為每月 0.7 艾字節,預計到 2022 年將成長至 1.92 艾字節。

- 據 Errision 稱,固定無線接入 (FWA) 的每月資料流量預計為2021 年的16.6 艾字節,高於2020 年的9.7 艾字節。預計未來幾年將出現強勁成長,預計到2021 年每月FWA資料流量將達到近 130 艾字節。2028 年。FWA是一項透過5G、4G或3G實現固定寬頻連接的技術,可在基礎設施有限的地區提供寬頻連線。到 2021 年,FWA資料流量將超過 5G 行動連線流量,但預計 5G 行動流量到 2024 年將超過 FWA 流量。

- 此外,大量資料儲存在邊緣,希捷預計到 2025 年,物聯網設備將產生超過 90 zetta位元組的資料。預計資料準備對於物聯網、人工智慧和區塊鏈等下一代技術至關重要。

- 此外,即時收集資料的自動分析計算的邊緣分析功能,而不是將資料發送回集中式資料存儲或伺服器,將成為智慧城市等新概念的核心,因此增加了對智慧城市技術預計將推動邊緣分析市場的發展,從而為最終用戶提供更快、響應更快的服務。

- 邊緣運算在技術領域已經存在了一段時間,它極大地提高了網路效能。由於邊緣運算,資料分析部分依賴網路頻寬來將資料保存在靠近資料來源的地方。此外,邊緣運算使資料的處理和儲存遠離孤島設置,更接近最終用戶,並在設備、霧層或邊緣資料中心進行處理。

北美有望成為最大市場

- 由於在政府法規和合規性的支持下,中小型企業對邊緣分析的接受度不斷提高,美國仍然是邊緣分析的重要市場。此外,邊緣分析市場的顯著成長可歸因於主要採用邊緣分析服務的製造和電信產業的高度集中。對邊緣分析的需求與雲端流量直接相關。由於雲端流量的大幅增加,可以觀察到市場的顯著成長。

- 北美保險公司正在改變他們利用雲端運算的方式。雖然財產和意外傷害保險公司以及人壽保險公司都採用雲端來提高敏捷性、提高營運效率、吸引新人才並降低營運成本,但保險公司將雲端視為業務資產的趨勢正在顯現。透過使用分散式邊緣運算架構,可以顯著降低雲端營運成本,其中邊緣設備共同處理雲端設備無法獨立處理的關鍵操作,從而減少對雲端的依賴。

- 此外,該地區還見證了感測器技術的顯著成長。透過將感測器技術創新與降低硬體成本相結合,可以建立邊緣到雲端的範例。具有處理單元的感測器可以幫助在不一致的雲端環境中採取關鍵操作,並隨後與雲端同步。

- 眾所周知,加拿大是新技術的早期採用者。目前大多數新技術都是資料密集的。它們創建、處理和傳輸大量資料,因此由資料中心和雲端組成的當前基礎設施正在逐漸接近其最大容量。

- 鑑於目前產生和使用的新資料量,這些基礎設施將無法支援客戶的需求。在涉及的所有參數中,延遲將是業務最關鍵的因素。

邊緣分析產業概述

邊緣分析市場高度分散,主要參與者包括 Cisco Systems Inc.、Oracle Corporation、SAS Institute Inc.、IBM Corporation 和 Apigee Corporation。市場參與者正在採取合作夥伴關係、創新和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2022 年 6 月 - IT 基礎架構服務領先供應商之一 Kyndryl 與思科宣佈建立技術合作夥伴關係,以協助企業客戶加速向由思科解決方案和 Kyndryl 託管服務驅動的資料驅動型組織轉型。

- 2022 年 6 月 - 先鋒合作夥伴 SAS 和 ClearBlade 正在協助製造、石油和天然氣以及運輸等資產密集型行業的營運經理通過以更簡單的方式釋放所有流資料的價值,最大限度地提高其營運技術(OT ) 設備的效率和成本效益的方式。合作夥伴正在物聯網連接資產上利用人工智慧 (AI) 和機器學習,使 OT 管理人員能夠在邊緣和雲端存取、分析流資料並採取行動,而無需依賴 IT 或資料科學家,從而縮短了從幾個月到幾週。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力 - 波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭激烈程度

- 技術簡介

- 描述性分析

- 預測分析

- 規範性分析

- 診斷分析

- 產業價值鏈分析

- COVID-19 對市場的影響

第 5 章:市場動態

- 市場促進因素

- 物聯網中連接設備數量的成長

- 透過連接設備傳播的數據不斷增加

- 市場限制

- 新興階段採用邊緣技術

- 資料安全和安保的威脅

第 6 章:市場區隔

- 依部署類型

- 本地部署

- 雲

- 依組件

- 解決方案

- 服務(專業和託管服務)

- 依最終用戶產業

- 銀行、金融服務和保險 (BFSI)

- 資訊科技和電信

- 製造業

- 衛生保健

- 零售

- 其他最終用戶產業

- 依地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 日本

- 中國

- 印度

- 亞太地區其他地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第 7 章:競爭格局

- 公司簡介

- Cisco Systems Inc.

- Oracle Corporation

- SAS Institute Inc.

- IBM Corporation

- Apigee Corporation

- Predixion Software

- AGT International Inc.

- Foghorn Systems

- CGI Group Inc.

- Intel Corporation

- Greenwave Systems

- Microsoft Corporation

第 8 章:投資分析

第 9 章:市場的未來

The Edge Analytics Market size is estimated at USD 13.88 billion in 2024, and is expected to reach USD 41.75 billion by 2029, growing at a CAGR of 24.64% during the forecast period (2024-2029).

Edge Analytics is an emerging technology expected to ease the load on cloud servers as it is closer to the data source. Edge Analytics can analyze data in real-time, enabling higher dependencies on cloud services. Industries like Manufacturing, healthcare, and retail are expected to benefit the most from the real-time availability of processed data, enabling them to achieve higher efficiencies using real-time decision-making.

Key Highlights

- Edge analytics is a data collecting and analysis strategy in which an automated analytical calculation is done on data at the edge of a node, network switch, or another network endpoint instead of waiting for the data to be relayed back to centralized data storage.

- An increase in internet and cloud adoption offers enormous prospects for the global edge analytics industry in the future. Moreover, the rising need for automation boosts the market growth.

- The proliferation of a large amount of data with the help of connected devices is driving the growth of the edge analytics market, with real-time intelligence acting as a catalyst for the growth of edge analytics on network devices and adopting edge analytics, increasing scalability and cost optimization.

- However, the lack of skilled personnel to install and manage edge-based solutions hinders market development. The increasing network node efficiency is predicted to provide lucrative prospects for advancing the edge analytics market size throughout the forecast year.

- The COVID-19 pandemic had a positive impact on the edge analytics market, which exhibited significant growth during the period, owing to remote working trends and employee unavailability during the period of COVID-19 lockdowns, which prompted the need for automation and IoT solutions during the period, assisting in the growth of the edge analytics market during the period. Post-pandemic also, the market is growing rapidly with the increased adoption of digitization technologies.

Edge Analytics Market Trends

Rising Propagation of Data Over Connected Devices Drives the Market Growth

- The need for Edge Analytics is further driven by the massive amount of data generated on everyday, which is stored on the cloud. According to Cisco Systems, the data on consumer-managed Internet Protocol (IP) monthly traffic in Latin America was 0.7 exabytes per month in 2017, expected to grow to 1.92 exabytes in 2022.

- According to Errision, Monthly data traffic through fixed wireless access (FWA) was measured at 16.6 exabytes in 2021, up from 9.7 exabytes in 2020. Strong growth is expected over the coming years, with monthly FWA data traffic forecast to reach almost 130 exabytes by 2028. FWA is a technology enabling a fixed broadband connection via 5G, 4G, or 3G and can provide broadband connections in areas with limited infrastructure. FWA data traffic outstripped that of 5G mobile connections in 2021, though 5G mobile traffic is expected to surpass FWA traffic by 2024.

- Moreover, a large amount of data is stored on the Edge, and Seagate estimates that the IoT devices will generate more than 90 zettabytes of data by 2025. Data readiness is expected to be critical for next-generation technologies like IoT, AI, and blockchain.

- Also, the edge analytics capabilities of automatic analytical computation of collected data in real-time, instead of sending the data back to the centralized data store or server, will be the core of new concepts, like smart cities, due to which increased investment in smart cities technology is expected to boost the market for edge analytics that will provide faster and responsive services to end user.

- Edge Computing has been in the technological space for some time, surging network performance. Due to edge computing, data analytics partly relies on the network bandwidth to save data close to the data source. Also, edge computing makes data handled and stored away from the silo setup closer to end users, with processing in the device, the fog layer, or the edge data center.

North America is Expected to Register the Largest Market

- The United States remains a prominent market for Edge Analytics due to the increasing acceptance of edge analytics among small and medium-scale firms, supported by government regulations and compliance. Additionally, the significant growth of the edge analytics market can be attributed to the high concentration of manufacturing and telecommunication industries that majorly adopt edge analytics services. The demand for edge analytics is directly related to cloud traffic. Due to the huge increase in cloud traffic, significant growth in the market can be observed.

- North American Insurance companies are changing the way they utilize cloud computing. While both property & casualty and life insurers have employed the cloud to increase agility, increase operating efficiency, attract new talent and reduce operating costs, there is an emerging trend in insurers viewing the cloud as a business asset. Cloud operations cost can be significantly reduced by using a distributed edge computing architecture, where edge devices together process a critical operation, which a cloud device cannot process independently, thereby reducing cloud dependency.

- Also, significant growth in sensor technology can be witnessed in the region. By combining sensor technology innovations with reducing hardware costs, the edge-to-cloud paradigm can be established. Sensors with processing units can help take critical actions in an inconsistent cloud environment and later synchronize with the cloud.

- Canada is known to be an early adopter of new technologies. Most new technologies at present are data intensive. They create, process, and transfer large amounts of data, due to which the current infrastructure, consisting of data centers and the cloud, is inching toward its maximum capacity.

- With the amount of new data generated and used at present, these infrastructures won't support the needs of their customers. Of all the parameters involved, latency will be the most crucial factor for the business.

Edge Analytics Industry Overview

The edge analytics market is highly fragmented with the presence of major players like Cisco Systems Inc., Oracle Corporation, SAS Institute Inc., IBM Corporation, and Apigee Corporation. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- June 2022 - Kyndryl, one of the leading providers of IT infrastructure services, and Cisco announced a technological partnership to assist corporate clients in accelerating their transition into data-driven organizations driven by Cisco solutions and Kyndryl managed services.

- June 2022 - Pioneering partners SAS and ClearBlade are assisting operations managers in asset-intensive industries such as manufacturing, oil and gas, and transportation in maximizing the effectiveness of their operational technology (OT) equipment by unlocking the value of all streaming data in a simpler and cost-effective manner. The partners are leveraging artificial intelligence (AI) and machine learning on IoT-connected assets to enable OT executives to access, analyze, and act on streaming data at the Edge and in the Cloud without relying on IT or data scientists, shortening the process from months to weeks.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.3.1 Descriptive Analytics

- 4.3.2 Predictive Analytics

- 4.3.3 Prescriptive Analytics

- 4.3.4 Diagnostic Analytics

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Number of Connected Devices in IoT

- 5.1.2 Rising Propagation of Data Over Connected Devices

- 5.2 Market Restraints

- 5.2.1 Adoption of Edge Technology in Nascent stage

- 5.2.2 Threat of Data Safety and Security

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-Premises

- 6.1.2 Cloud

- 6.2 By Component

- 6.2.1 Solutions

- 6.2.2 Services (Professional and Managed Services)

- 6.3 By End User Industry

- 6.3.1 Banking, Financial Services, and Insurance (BFSI)

- 6.3.2 IT and Telecommunication

- 6.3.3 Manufacturing

- 6.3.4 Healthcare

- 6.3.5 Retail

- 6.3.6 Other End-user Industry

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 Japan

- 6.4.3.2 China

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Oracle Corporation

- 7.1.3 SAS Institute Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Apigee Corporation

- 7.1.6 Predixion Software

- 7.1.7 AGT International Inc.

- 7.1.8 Foghorn Systems

- 7.1.9 CGI Group Inc.

- 7.1.10 Intel Corporation

- 7.1.11 Greenwave Systems

- 7.1.12 Microsoft Corporation