|

市場調查報告書

商品編碼

1444840

穀物儲倉 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Grain Storage Silos - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

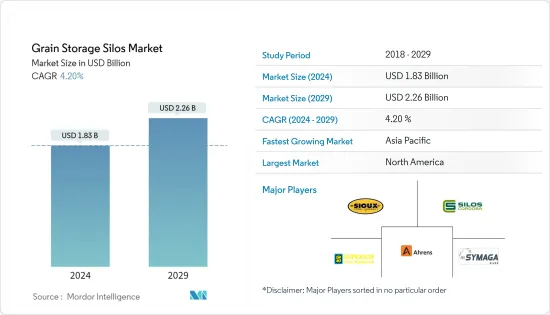

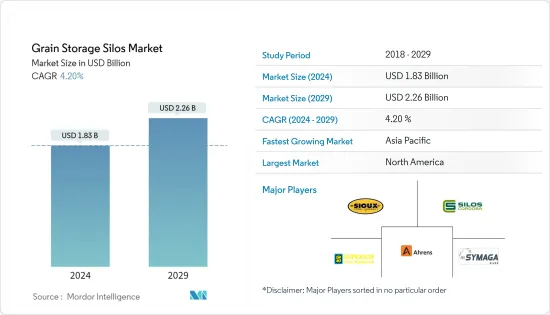

穀物儲倉市場規模預計到 2024 年為 18.3 億美元,預計到 2029 年將達到 22.6 億美元,在預測期內(2024-2029 年)CAGR為 4.20%。

主要亮點

- 由於人口的增加,世界各地的農業生產力正在提高。儘管生產力不斷擴大,但由於糧食損失,自給自足仍是關鍵問題之一。糧食損失的發生是由於缺乏適當的儲存設施,導致價格下跌和農民利潤減少。對適當的收穫後儲存設施的需求有助於全球糧倉市場的發展。因此,該市場的關鍵促進因素包括糧食價格波動和大容量儲存需求上升。

- 同時,母公司不斷增加的投資和技術發展也在推動市場。例如,在印度,2021 年,印度最大的私人農業收穫後管理公司國家商品管理服務有限公司 (NCML) 在哈里亞納邦推出了四個公共倉儲筒倉設施。由於糧食庫存逐年增加,需要更大的儲存能力,這推動了全球市場的發展。

- 此外,糧食儲存對於發展中國家和已開發國家都非常重要,因為它們儲存大量糧食以供將來使用和出口。因此,害蟲、囓齒動物和鳥類對穀物的腐敗造成了農作物的重大損失。例如,北美的糧倉市場龐大。該地區的農民很少在銷售年度結束時持有大量庫存。小麥、大麥、玉米、大豆和其他穀物的庫存幾乎全部來自非農場。此外,該地區的公司還在擴大筒倉的儲存容量,以儲存大量穀物。因此,這些因素有助於預測期內的市場成長。

糧食儲存筒倉市場趨勢

大容量儲存需求不斷成長

美國、俄羅斯、印度、巴西等世界主要糧食生產國對糧食倉儲的需求不斷成長,推動了研究期間穀物儲倉產業的發展。此外,投入成本的上升和糧食儲存所需的大量投資促使所有地區對筒倉的需求增加。根據國際穀物理事會(IGC)的數據,全球小麥庫存從2020年的2.76億噸增加到2021年的2.78億噸。穀物產量的增加促使預測期內市場的成長。

此外,埃及的穀物尤其是小麥依賴進口。烏克蘭和俄羅斯之間的衝突給小麥供應帶來課題。即使採取額外措施使其小麥供應多樣化,全球價格上漲仍將阻礙埃及從國際來源購買大量小麥的能力。因此,埃及繼續建造新的筒倉並擴大儲存能力,這可能使埃及能夠限制進口以抵禦價格飆升。

除此之外,由於糧食運輸的自動化,筒倉是一種具有成本效益的糧食儲存方式,從長遠來看營運成本較低。由於監控和資料採集 (SCADA) 系統實現自動化操作,因此筒倉的裝卸成本也低於穀物倉庫。筒倉的成本效益和大容量的優勢正在推動全球糧食儲存筒倉市場的發展。

北美主導市場

2020 年,北美地區使用筒倉儲存糧食的比例最大。根據美國農業部 (USDA) 的數據,過去 10 年,農場內儲存量增加了 16 億蒲式耳,非農場儲存量增加了 2.2 蒲式耳。億蒲式耳,分別成長14% 和24%。該國的生產商大多喜歡平底或漏斗底筒倉,因為它們可以用於長期儲存。它增加了美國平底筒倉或漏斗底筒倉的市場。

此外,美國的糧食儲存能力在過去20年中大幅提高。根據美國農業部統計,2020年全國糧食儲存量約253億蒲式耳。玉米、大豆、小麥和其他作物的儲存在絕對數量、收穫時間和生產地點方面有所不同。在全國範圍內,玉米在糧食庫存中占主導地位。收穫後玉米占美國穀物庫存的四分之三以上,其中大部分玉米庫存都在農場。 2021 年,在玉米總庫存中,農場庫存為 72.3 億蒲式耳,比 2020 年增加 3%。主要糧食作物庫存的增加促使預測期內市場成長。

同時,根據美國農業部的數據,美國和中國最近對初級商品徵收關稅導致美國農民累積了糧食剩餘,促使可用庫存總量的 20% 被大豆、玉米、和小麥。由於現有筒倉已滿負荷,預計在預測期內,全國對更多大型筒倉的需求將進一步增加。

糧食倉儲產業概況

糧食倉儲市場較為分散,主要參與者佔市場佔有率較少。 Ahrens Agri、布勒集團、蘇科思鋼鐵公司、Symaga 和 Silos Cordoba 是所研究市場的主要參與者。新產品發布、合作和收購是全球市場領先公司採取的主要策略。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 市場促進因素

- 市場限制

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場區隔

- 類型

- 鋼筒倉

- 金屬筒倉

- 其他類型

- 產品

- 平底筒倉

- 料斗底部筒倉

- 飼料漏斗

- 農場筒倉

- 地理

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 俄羅斯

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 印度

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 南美洲其他地區

- 中東和非洲

- 南非

- 中東和非洲其他地區

- 北美洲

第 6 章:競爭格局

- 最常用的策略

- 市佔率分析

- 公司簡介

- Rostfrei Steels

- Superior Grain Equipment

- Henan Sron Silo Engineering Co.

- Silos Cordoba

- Sioux Steel Company

- Skess Corporation

- Nelson

- Symaga

- Arsenal Steel Silos

- Ahrens Agri

第 7 章:市場機會與未來趨勢

The Grain Storage Silos Market size is estimated at USD 1.83 billion in 2024, and is expected to reach USD 2.26 billion by 2029, growing at a CAGR of 4.20% during the forecast period (2024-2029).

Key Highlights

- Agricultural productivity is increasing worldwide due to the increasing population. Despite the expanding productivity, self-sufficiency is one of the critical problems due to grain losses. This grain loss happens due to proper storage facilities' unavailability, which leads to a price drop and a decrease in the profits for the farmers. The need for appropriate post-harvest storage facilities aids the market for grain silos across the globe. Therefore, the critical drivers for this market include fluctuating grain prices and rising demand for large-capacity storage.

- Along with this, the primary company's increasing investments and technological developments are also driving the market. For instance, in India, in 2021, National Commodities Management Services Limited (NCML), India's largest private-sector agriculture post-harvest management company, launched four public storage silo facilities in Haryana. Due to the increase in grain stocks every year, there is a need to have larger storage capacities, which is driving the market globally.

- Furthermore, the storage of grains is of great importance in developing and developed countries as they store large grain capacities for future use and export. Thus, the spoilage of grains by pests, rodents, and birds causes significant losses to the crops. For instance, The market for grain silos is huge in North America. Farmers in the region rarely hold substantial inventories at the end of a marketing year. Inventories of wheat and barley, corn, soybeans, and other grains are almost entirely held off-farm. Additionally, companies in the region are also expanding the silo's storage capacity to store a large volume of grains. Hence, these factors aid the market growth in the forecast period.

Grain Storage Silos Market Trends

Rising Demand for Large Capacity Storage

The growing demand for grain storage from the leading grain-producing countries in the world, namely, the United States, Russia, India, Brazil, and others, have driven the grain storage silos industry during the study period. Further, rising input costs and heavy investments required in grain storage led to a rise in demand for silos across all regions. According to the International Grains Council (IGC), the global wheat stock increased from 276 million metric tons in 2020, and the stock accounted for 278.0 million tons in 2021. This increase in the production of grains led to the market's growth in the forecast period.

Further, Egypt relies on imports for grains, especially wheat. The conflict between Ukraine and Russia caused wheat supply challenges. Even with additional measures to diversify its wheat supply, rising global prices would impede Egypt's ability to purchase large volumes of wheat from international sources. Therefore, Egypt continued to build new silos and expand its storage capacity, which may allow Egypt to limit imports to withstand price spikes.

Along with this, silos are cost-effective modes of grain storage due to the automation of grain transport, resulting in low operational costs in the long run. The loading and unloading costs of silos are also low than grain warehouses, as automation is operated by the Supervisory Control and Data Acquisition (SCADA) system. The benefits of cost-effectiveness and the large holding capacity of silos are driving the grain storage silos market globally.

North America Dominates the Market

North America held the largest share in using silos for grain storage in 2020. As per the United States Department of Agriculture (USDA), in the last ten years, the on-farm storage increased by 1.6 billion bushels and off-farm storage by 2.2 billion bushels, registering a growth of 14% and 24%, respectively. The producers in the country mostly prefer flat-bottom or hopper-bottom silos as they can be used for long-term storage. It increased the market for flat-bottom silos or hopper-bottom silos in the United States.

Moreover, the US grain storage capacity improved substantially in the last 20 years. According to USDA, in 2020, the national grain storage capacity was approximately 25.3 billion bushels. Corn, soybeans, wheat, and other crop storage differ concerning the absolute quantity, harvest timing, and production location. Nationally, corn dominates grain inventories. Post-harvest corn makes up more than three-quarters of US grain inventories, with the majority of corn inventory held on-farm. Of the total corn stocks, 7.23 billion bushels were stored on farms in 2021, an increase of 3% from 2020. This increase in the stocks of major grain crops leads to market growth during the forecast period.

Along with this, as per USDA, the recent imposition of tariffs by both the United States and China on primary commodities led to the accumulation of grain surplus for the US farmers, resulting in 20% of the total available storage filled with soybean, corn, and wheat. It is anticipated to further boost the need for more large storage silos across the country during the forecast period, as the existing ones are reaching full capacity.

Grain Storage Silos Industry Overview

The grain storage silos market is fragmented, in which major players account for less market share. Ahrens Agri, Buhler Group, Sioux Steel Company, Symaga, and Silos Cordoba are the major players in the market studied. New product launches, partnerships, and acquisitions are the major strategies adopted by the leading companies in the market globally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Steel Silos

- 5.1.2 Metal Silos

- 5.1.3 Other Types

- 5.2 Product

- 5.2.1 Flat Bottom Silos

- 5.2.2 Hopper Bottom Silos

- 5.2.3 Feed Hoppers

- 5.2.4 Farm Silos

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United Sates

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Netherlands

- 5.3.2.7 Russia

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Rostfrei Steels

- 6.3.2 Superior Grain Equipment

- 6.3.3 Henan Sron Silo Engineering Co.

- 6.3.4 Silos Cordoba

- 6.3.5 Sioux Steel Company

- 6.3.6 Skess Corporation

- 6.3.7 Nelson

- 6.3.8 Symaga

- 6.3.9 Arsenal Steel Silos

- 6.3.10 Ahrens Agri