|

市場調查報告書

商品編碼

1640661

先進計量基礎設施:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Advanced Metering Infrastructure - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

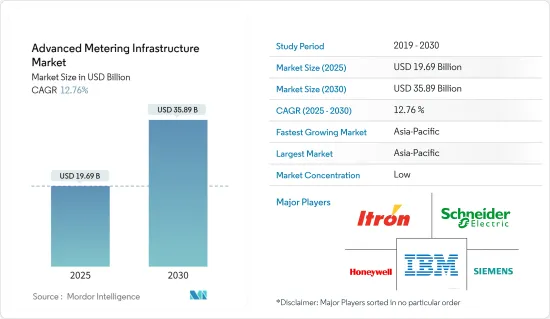

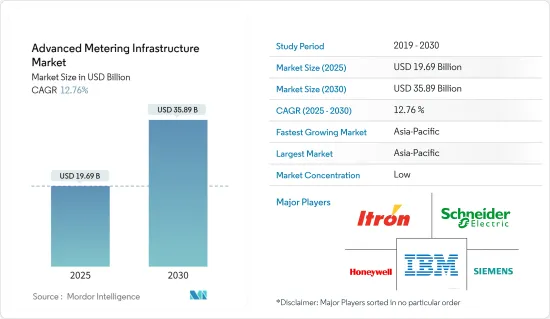

先進計量基礎設施市場規模在 2025 年預估為 196.9 億美元,預計到 2030 年將達到 358.9 億美元,預測期內(2025-2030 年)的複合年成長率為 12.76%。

智慧電錶是公共產業行業的一項變革性技術。這些技術先進的儀表可以更深入地了解能源使用情況。智慧電錶正在被世界各地採用作為先進計量基礎設施發展的一部分。

主要亮點

- 開發一體化、資訊化的電網及其他分析其模式的支援軟體將為用戶帶來巨大的利益。這種電網被稱為智慧電網,它將支援分散生產的擴張,降低成本,提高能源效率,並提高生產、輸電和配電系統的可靠性和安全性。 AMI 是智慧電網計畫的重要組成部分。政府機構和電力公司正在將 AMI 系統作為更大規模「智慧電網」計畫的一部分。

- 根據歐盟委員會的研究,到2024年,歐盟預計將安裝約2.25億塊電力智慧電錶和5,100萬塊天然氣智慧電錶。到2024年,預計44%的歐洲消費者將擁有智慧燃氣表,77%的歐洲消費者將擁有智慧電錶。

- 另一方面,COVID-19 疫情對市場成長產生了正面影響。這是因為能源和公共產業部門提供基本服務,迫使其重新思考如何開展業務以及如何與員工和客戶互動。儘管 COVID-19 疫情已經影響到我們電網的幾乎所有方面,但維護電網安全仍然是公共產業的首要任務。 AMI 幫助公用事業公司在疫情期間維持收入流量並管理各種遠端操作。

- 擴大、現代化和分散電力基礎設施,使其更加可靠,而世界經濟論壇等組織計劃在未來 25 年內為智慧電網投資 7.6 兆美元,將有助於讓全球的智慧電網更加實惠。會發生改變。

- 據估計,到2030年,全球能源產業每年平均需要在電網上投資約6,000億美元,才能在2050年實現淨零碳排放。因此,創新需要一系列公共和私人組織共同努力來推動通用的能源目標。這個願景如今正在歐洲成為現實。八大電力公司組成了智慧二次變電站聯盟(E4S),英特爾和其他公司也在共同努力使智慧電網成為現實。

- 此外,低頻寬、低成本、不延遲敏感的計量需求推動了高階計量基礎設施 (AMI)通訊網路的發展。網路和每個電錶內的通訊模組都必須盡可能低成本。在 AMI 的早期,窄頻通訊(PLC) 和 RF 網格是推動其使用的主要通訊技術。隨著通訊技術的發展,寬頻PLC、低功率廣域網路(LPWAN)等新技術正成為主流。

- 儘管 AMI 具有許多優點,但由於標準化、初始成本高以及與其他電網系統的整合,其採用很困難。這將提高智慧電錶硬體的價格。此外,不同的智慧電錶根據營運需求和消費者需求設計了額外的參數,從而增加了成本。雖然投資新技術、管理預算和獲得額外資金可能很困難,但投資報酬率需要精確。

進階計量基礎設施 (AMI) 市場趨勢

智慧電錶設備將佔據較大的市場佔有率

- 智慧電錶解決方案包括位於電錶內或附在電錶上的電錶或具有通訊功能(單向或雙向)的模組。智慧電錶越來越受歡迎,因為它們允許電錶和公用事業公司使用的中央系統之間進行雙向通訊。這是因為人們主要關心的是使用更多的能源。

- 智慧電錶正被應用於天然氣、電力和水等多種領域。原因是雙向通訊能力允許公共產業和消費者即時監控公用事業收費的使用情況,並鼓勵供應商遠端啟動、讀取和關閉供應。智慧電錶的引入也使得引入家庭能源管理系統 (HEMS) 和建築能源管理系統 (BEMS) 成為可能,這些系統可以可視化單一家庭和整個建築的電力情況。

- 為了提高電網的效率,世界各國政府正在投資數十億美元安裝智慧電網和智慧電錶。此外,全球範圍內正在不斷推出許多新的智慧城市計劃。這些因素可能會推動全球對智慧電錶的需求。

- 為了創建更清潔、更有效率的能源系統,中國和印度等國家正在不斷在住宅和商業建築中安裝智慧電錶。世界各國政府正在推出多項新措施來鼓勵使用智慧電錶。例如,印度政府於 2021 年推出的《修訂配電產業計畫》(RDSS)要求在 2025 年 3 月底部署 2,500 萬台智慧預付電錶。亞洲國家正在加速推廣智慧電錶。

- 此外,根據 Mercom Capital 的數據,2022 年 1 月,印度北方邦安裝的智慧電錶數量居全國之冠,超過 115 萬台。其次是比哈爾邦和拉賈斯坦邦。能源效率服務有限公司是一家由全國各地電力配送公司組成的合資企業,負責安裝智慧電錶。亞洲各地智慧電錶安裝的快速發展預計將推動市場成長。

軟體和雲端處理的發展、對電網系統數位化的投資不斷增加、解決能源浪費的需要不斷成長以及使用物聯網的人數不斷增加,預計將在未來推動市場成長。

預計北美將出現顯著成長

- 由於智慧電錶的快速普及,北美預計將佔據先進計量基礎設施 (AMI) 市場的大部分佔有率。美國是該地區的領先國家,透過美國復甦與再投資法案(ARRA)和智慧電網投資津貼(SGIG)計畫引領智慧電錶市場。

- 在美國,住宅數量代表著燃氣公共事業的市場潛力。隨著更多新住宅的建設,越來越多的住宅將安裝智慧電錶作為 AMI 計劃的一部分,這種採用將繼續下去。根據美國能源資訊署(EIA)的數據,截至2021年,美國安裝的先進電錶超過1.11億台。該國正在穩步擴大其先進計量基礎設施的範圍。預計不久的將來這一數字還會增加。

- 此外,加拿大在五年多前政府頒布強制規定後,也大規模採用智慧電錶,主要目的是減少尖峰負載。因此,不斷成長的需求和嚴格的法規正在刺激終端用戶採用智慧電錶。

- 據美國能源效率經濟委員會(ACEEE)稱,美國太平洋煤氣電力公司透過其住宅維修計劃中的 AMI 目標,使目標住宅的節能效果提高了 3.5 倍。此外,智慧電錶與資料分析等技術的結合預計將進一步推動該地區的市場成長。

- 此外,2021 年 4 月,Aclara Technologies LLC 宣布,奧斯汀公用事業公司 (美國 Utilities) 將部署基於 Aclara RF 網路的端到端先進計量基礎設施解決方案,為其電力、天然氣和水客戶提供服務。點對多點 AMI 網路取代了手動抄表系統並支援該公共產業的 12,000 個電錶、9,500 個水錶和 11,000 個瓦斯表。

- 此外,2021 年,卡拉韋拉斯縣水務局將與 Mueller Systems 合作部署高級計量基礎設施 (AMI) 網路。該網路將覆蓋 1,000 平方英里並擁有 13,000 個 AMI 端點。該計劃將更換該地區的大部分電錶,並為所有電錶增添通訊功能。卡拉韋拉斯縣水務局為全縣六個服務區的 13,000 多個市政、住宅和商業客戶提供供水服務。

進階計量基礎設施 (AMI) 產業概覽

先進計量基礎設施市場高度分散。整合 IT 電網及其他支援模式分析軟體的開發、智慧電錶和水錶解決方案使用率的提高以及整個全部區域的數位化努力正在推動先進計量基礎設施市場的發展。整體而言,現有競爭對手之間的敵意較高。

2022年12月,西門子將訂單新契約,為北三角洲電力配送公司建造配電管理系統和先進的計量基礎設施。此外,控制中心還透過部署尖端IT應用和智慧系統來確保智慧電網管理,從而提高電力供應的效率、品質和穩定性。

2022 年 12 月,ESB Networks 將收購 Trilliant Networks Operations,後者是 Trilliant Networks 的一個部門,Trilliant Networks 是全球大型公司的高級計量基礎設施(AMI)、智慧電網、智慧城市和物聯網(IIoT) 解決方案提供智慧電錶。該計劃使客戶更容易管理他們的能源使用,節省資金並減少他們的碳排放。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響

第5章 市場動態

- 市場促進因素

- 轉向節能/節能替代品

- 政府採取優惠措施鼓勵採用

- 市場挑戰

- 初期成本高

第6章 市場細分

- 按類型

- 智慧電錶設備(電、水、氣)

- 解決方案

- 儀表通訊基礎設施(解決方案)

- 軟體

- 儀表資料管理

- 儀表資料分析

- 其他軟體

- 服務(專業 - 專案管理、實施、諮詢、託管)

- 按最終用戶

- 住宅

- 商業的

- 產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Itron Inc.

- IBM Corporation

- Landis+Gyr

- Sensus Solutions

- Siemens AG

- Tieto Corporation

- Aclara Technologies LLC

- Cisco Systems Inc.

- Mueller Systems LLC

- Trilliant Inc.

- Schneider Electric SE

- Honeywell International Inc.

第8章投資分析

第9章:未來市場展望

The Advanced Metering Infrastructure Market size is estimated at USD 19.69 billion in 2025, and is expected to reach USD 35.89 billion by 2030, at a CAGR of 12.76% during the forecast period (2025-2030).

Smart meters represent a transformative technology for the utility industry. These technologically advanced meters provide greater insight into the usage of energy. Smart meters have been employed as a part of advanced metering infrastructure development initiatives around the world.

Key Highlights

- Developing an integrated and IT-enabled power grid and other support software to analyze the patterns provides significant benefits to the user. Such a grid, known as a "smart grid," supports the expansion of distributed production, lowers costs, promotes energy efficiency, and improves the reliability and security of the entire production, transmission, and distribution system. AMI is a vital part of any smart grid initiative. Government agencies and utilities are turning toward AMI systems as part of larger "smart grid" initiatives.

- Smart meter pilot projects are also being launched in European nations like France and the U.K. In the EU, approximately 225 million smart meters for electricity and 51 million for gas will be installed by 2024, according to a study by the European Commission. By 2024, it is anticipated that 44% of European consumers will have smart gas meters, and 77% of them will have smart electric meters.

- The COVID-19 outbreak, on the other hand, had a positive impact on market growth because the energy and utility sectors provide essential services that have forced the sector to rethink how their operations are carried out and how they engage with both their employees and their customers. While the COVID-19 pandemic affected nearly every other aspect, the need to maintain a secure grid remains at the forefront of priorities for utilities. AMI has helped utilities maintain their revenue flow and manage various remote operations during the pandemic.

- Expanding, modernizing, and decentralizing the electricity infrastructure to make it more reliable, as well as planned investments from groups like the World Economic Forum, which has set aside USD 7.6 trillion for smart grids over the next 25 years, are expected to change the way many markets work around the world.

- For the global energy sector to achieve net-zero carbon emissions by 2050, it is estimated that investment in electricity grids must average about USD 600 billion annually through 2030. Therefore, innovation will involve a variety of public and private organizations working together to advance common energy goals. This vision is currently being implemented in Europe. Eight major electric utility providers have formed the Edge for Smart Secondary Substation Alliance (E4S), a partnership with which Intel and other businesses are collaborating to create a smart grid.

- Moreover, Advanced Metering Infrastructure (AMI) communications networks are driven by the need for low-bandwidth, low-cost, delay-insensitive metering. Both the network and the communications module in each meter must be as low-cost as possible. In the early days of AMI, narrow-band power-line communication (PLC) and RF-mesh were the main communication technologies that pushed the use of AMI. As communication technology has developed, newer technologies, like broadband PLC and low-power wide-area networks (LPWAN), have become bigger trends.

- Although AMI has many advantages, implementing it is difficult due to standardization, high upfront costs, and integration with other grid systems. This raises the price of smart metering hardware. Additionally, based on operational needs and consumer demands, various smart meters are designed with additional parameters, which raises their cost. While investing in new technology, managing budgets or securing additional funding is difficult, and the ROI must be precise.

Advanced Metering Infrastructure (AMI) Market Trends

Smart Metering Devices Will have the Significant Market Share

- Smart metering solutions include meters or modules with communication capabilities (either unidirectional or bidirectional) embedded within the meter or attached to the meter. Smart meters are becoming more popular because they allow two-way communication between the meter and the central system used by utilities. This is because the main concern is that people are using more energy.

- Smart meters are increasingly being adopted for multiple deployments, such as gas, electricity, and water, due to their two-way communication feature, which enables real-time monitoring of utility usage by both the utility supplier and consumer and also encourages the start, reading, and cutting off of supply remotely by the supplier. Smart meter deployment also enables the implementation of a home energy management system (HEMS) or building energy management system (BEMS) that allows visualization of the electric power usage in individual homes or entire buildings.

- To increase the effectiveness of power networks, governments worldwide are investing billions of dollars in installing smart grids and smart meters. Additionally, numerous fresh smart city initiatives are continuously being introduced globally. Such factors will raise the demand for smart meters globally.

- In order to create a cleaner and more effective energy system, nations like China and India are constantly installing smart meters in residential and commercial structures. Governments are starting a number of new initiatives to promote the use of smart meters. For instance, the Revamped Distribution Sector Scheme (RDSS), which was introduced by the Indian government in 2021, calls for the deployment of 25 crore smart prepaid meters by the end of March 2025. Asian countries are positioning themselves to move forward with the adoption of smart meters.

- Additionally, according to Mercom Capital, the state of Uttar Pradesh in India had the most smart meters installed nationwide in January 2022, with over 1.15 million of them. Bihar and Rajasthan came after this. Energy Efficiency Services Limited, a joint venture company established by various public power distribution companies in the nation, took on the installation of smart meters. Such a rapid pace for the installation of smart meters across the Asian region will boost market growth.

In the future, developments in software and cloud computing, rising investments in digitalizing grid systems, a growing need to deal with energy waste, and more people using the internet of things are all expected to help the market grow.

North America Region is Expected to Grow at Significant Pace

- North America is expected to hold a prominent share in the Advanced Metering Infrastructure (AMI) market due to the rapid adoption of smart metering in the region. Favorable government initiatives and increasing government investments in smart meter deployment across regions drive market growth.The United States is the key country in the region, driving the smart meter market through the American Recovery and Reinvestment Act (ARRA) and the Smart Grid Investment Grant (SGIG) program.

- In the United States, the number of houses represents the market potential for gas-enabled utilities. As more new houses are built, a growing proportion of homes will have smart meters installed as part of the AMI program, which continues its widespread adoption. According to the US Energy Information Administration (EIA), over 111 million advanced meters were installed in the US as of 2021. The nation has been steadily increasing the scope of its advanced metering infrastructure. It is also expected to increase in the near future.

- Further, Canada has also witnessed the large-scale incorporation of smart electricity meters after the governmental mandate was introduced more than five years ago with the prime motive of reducing peak-time loads. Thus, increasing demand and stringent regulations are stimulating the adoption of smart meters among end users.

- Along with leveraging smart electric meters for energy efficiency, targeted programs for end users are likely to benefit.As per the American Council for an Energy-Efficient Economy (ACEEE), Pacific Gas & Electric in the United States reported that AMI targeting for a home retrofit program delivered 3.5 times more energy savings in the targeted homes. Additionally, the integration of smart electric meters with technologies such as data analytics is expected to further foster the growth of the market in the region.

- Moreover, in April 2021, Aclara Technologies LLC, US, announced that Austin Utilities would implement an end-to-end advanced metering infrastructure solution based on the Aclara RF network to serve its electric, gas, and water customers. The point-to-multipoint AMI network replaces a manual meter-reading system and supports 12,000 electric, 9,500 water, and 11,000 gas meters for the combination utility.

- Also in 2021, Calaveras County Water District partnered with Mueller Systems for the deployment of an advanced metering infrastructure (AMI) network. It will cover 1,000 square miles with 13,000 AMI endpoints. The project replaces most of the district's meters and adds communication capabilities to all meters. Calaveras County Water District provides water service to over 13,000 municipal, residential, and commercial customers in six service areas throughout the county.

Advanced Metering Infrastructure (AMI) Industry Overview

The advanced metering infrastructure market is highly fragmented. The development of integrated and IT-enabled power grids and other support software to analyze the patterns, the increase in the use of smart meters and water metering solutions, and digitization initiatives across regions provide lucrative opportunities in the advanced metering infrastructure market. Overall, the competitive rivalry among existing competitors is high.

In December 2022, Siemens will be awarded a new contract to establish a distribution management system and advanced metering infrastructure for North Delta Electricity Distribution Company. Additionally, the control centers aim to enhance the efficiency, quality, and stability of the power supply by implementing the most advanced IT applications and intelligent systems to ensure smart grid management.

In December 2022, ESB Networks will choose Trilliant Networks Operations (UK) Ltd., a division of the leading global provider of solutions for advanced metering infrastructure (AMI), the smart grid, smart cities, and the Internet of Things (IIoT), as one of the suppliers to provide smart meters in support of the implementation of Ireland's National Smart Metering Programme. Customers will find it simpler to manage their energy use, save money, and reduce their carbon footprint thanks to the program.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Shift Toward Energy Efficient/Saving Alternatives

- 5.1.2 Favorable Governmental Initiatives Driving Adoption

- 5.2 Market Challenges

- 5.2.1 High Initial Costs

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Smart Metering Devices (Electricity, Water, and Gas)

- 6.1.2 Solution

- 6.1.2.1 Meter Communication Infrastructure (Solution)

- 6.1.2.2 Software

- 6.1.2.2.1 Meter Data Management

- 6.1.2.2.2 Meter Data Analytics

- 6.1.2.2.3 Other Software Types

- 6.1.3 Services (Professional - Program Management, Deployment and Consulting and Managed)

- 6.2 End-user

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Itron Inc.

- 7.1.2 IBM Corporation

- 7.1.3 Landis+Gyr

- 7.1.4 Sensus Solutions

- 7.1.5 Siemens AG

- 7.1.6 Tieto Corporation

- 7.1.7 Aclara Technologies LLC

- 7.1.8 Cisco Systems Inc.

- 7.1.9 Mueller Systems LLC

- 7.1.10 Trilliant Inc.

- 7.1.11 Schneider Electric SE

- 7.1.12 Honeywell International Inc.