|

市場調查報告書

商品編碼

1444735

聚丙烯纖維:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Polypropylene Fibers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

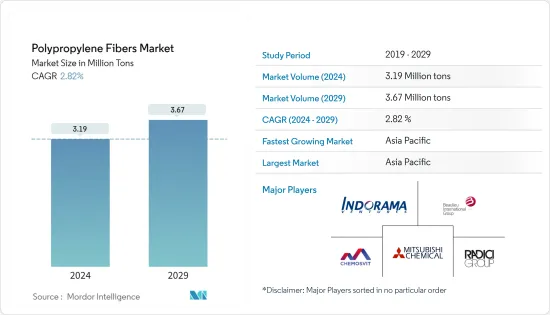

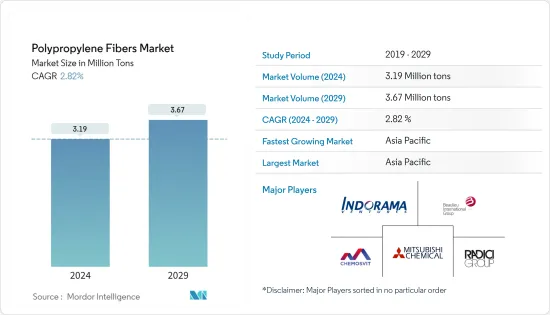

預計2024年聚丙烯纖維市場規模為319萬噸,預計2029年將達到367萬噸,在預測期間(2024-2029年)年複合成長率為2.82%。

COVID-19感染疾病造成的供應鏈中斷、分包商和材料短缺以及為控制費用而取消的合約都影響了全球市場的成長。不過,預計疫情過後市場將穩定成長。

主要亮點

- 短期內,推動市場的關鍵因素是聚丙烯纖維在衛生和醫療保健領域的使用不斷增加,以及建設產業對這些纖維的需求不斷增加。

- 更便宜的替代品和更低的熔點等因素可能會阻礙市場成長。

- 再生聚丙烯纖維的前景可能代表市場成長的機會。

- 亞太地區主導全球聚丙烯纖維市場,也可能在預測期內呈現最高成長率。

聚丙烯(PP)纖維市場趨勢

紡織業主導市場

- PPF在紡織業的應用包括紡織品、紡織材料以及床罩、地毯、襯墊、墊子、膠帶、繩索、服飾(家用、運動、兒童防護設備)、工業紡織品以及環保包括其他PP基紡織材料,例如作為纖維。溫和的紡織品。丙綸短纖維主要分類有地毯型、毛型、棉型、超細纖維等。

- 聚丙烯繩用於農業和作物包裝。它還可以用於重型水果和蔬菜人工林,幫助水果和蔬菜牢固地固定在莖和樹枝上。

- 技術過濾器用於各種工業應用,例如濕式過濾和製藥。這些過濾器對油漆、塗料、石化產品等具有優異的耐化學性。

- 根據美國人口普查局的資料,疫情過後,2021 年合成纖維出口量增加。

- 近年來,中國服裝市場成長放緩,並受到COVID-19危機的進一步打擊。透過轉向線上平台,服裝產業經歷了重大轉型。到2023年終,中國市場約58%的收益可透過線上銷售產生。

- 美國紡織業在生產纖維、紗線、織物以及服裝、家居用品和其他纖維最終產品的原料方面具有全球競爭力。根據政府機構 SelectUSA 的數據,該國的紡織和服裝業價值近 700 億美元,是最大的製造業之一。

- 因此,基於以上幾個方面,紡織領域可望佔據市場主導地位。

亞太地區主導市場

- 亞太地區主導全球聚丙烯纖維市場,並可能在預測期內呈現最高成長率。由於其大規模的製造活動,中國是聚丙烯纖維的主要生產國。

- 隨著全球對外科口罩和個人防護設備的需求激增,中國的幾家生產商已轉向生產聚丙烯(PP)纖維。

- 最近在中國開始生產PP纖維的公司包括寶豐、延安延長石油、石家莊石化、大連石化、浙江石化、陝西延長中煤和撫順石化。

- 中國是世界上最大的紡織品和服飾生產國和出口國。由於中國龐大的產能,導致紡織品和服飾供過於求。

- 然而,人事費用上升和全球保護主義抬頭削弱了其競爭力。近年來,該國的人事費用大幅增加,超過亞洲許多其他國家。

- 中國擁有僅次於美國的全球第二大醫療保健產業,其醫療保健市場變得更具挑戰性,特別是考慮到 2020 年 COVID-19感染疾病。中國預計將佔全球醫療保健產業的25%。到 2030 年增加收入。

- 到2022年,印度醫療保健產業預計將達到3,720億美元,這主要是由於健康意識的提高、保險的普及、收入的增加和疾病發生率的上升。印度的醫療保健產業受益於每年 1.6% 的人口成長。超過1億的人口老化、文明病發病率的增加、收入的增加以及健康保險普及的提高正在推動該行業發展更先進、更精準的醫療設備。

- 佔全球醫療市場80%的印度醫院業正面臨國內外投資者的龐大投資需求。到2023年,醫院業預計將達到1,320億美元。

- 在日本,65歲及以上的人口約佔全國總人口的30%,預計到2050年將達到40%左右。日本人口的快速老化、慢性病和文明病疾病患者數量的增加、全民健康保險覆蓋和監管措施正在推動日本醫療保健市場的發展。日本正在加強其醫療領域,因為其人口老化速度比其他國家更快。

- 韓國的醫療保健產業正處於重大轉型的邊緣。這是由於人口快速老化和最低的出生率。未來幾年,韓國醫療保健市場預計將經歷大規模發展,以滿足消費者不斷成長的需求。

- 所有這些因素預計將在預測期內提振亞太地區聚丙烯纖維市場。

聚丙烯(PP)纖維產業概況

全球聚丙烯纖維市場部分分散,參與者眾多。然而,主要參與者 Indorama Ventures 佔有重要的市場佔有率。其他主要企業(排名不分先後)包括 Beaulieu Fibers International (BFI)、Chemosvit Fibrochem SRO、Radici Partecipazioni SpA、Indorama Ventures 和 Mitsubishi Chemical Corporation。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 增加衛生和保健領域的使用

- 建設產業的需求不斷增加

- 抑制因素

- 更便宜的替代品的可用性

- 熔點低,無法在某些應用中使用

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

- 原料分析

第5章市場區隔(市場規模(數量))

- 類型

- 訂書釘

- 紗

- 最終用戶產業

- 纖維

- 建造

- 醫療保健和衛生

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 土耳其

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業採取的策略

- 公司簡介

- ABC Polymer Industries LLC

- Beaulieu Fibres International(BFI)

- Belgian Fibers

- Chemosvit Fibrochem SRO

- China National Petroleum Corporation

- DuPont

- Fiberpartner Aps

- Freudenberg Group

- Indorama Ventures

- International Fibres Group

- Radici Partecipazioni SpA

- Sika AG

- Mitsubishi Chemical Corporation

- Huimin Taili Chemical Fiber Products Co. Ltd

- Tri Ocean Textile Co. Ltd

- W. Barnet GmbH &Co. KG

- Zenith Fibres Ltd

- Kolon Fiber Inc.

第7章市場機會與未來趨勢

- 再生聚丙烯纖維的未來應用

The Polypropylene Fibers Market size is estimated at 3.19 Million tons in 2024, and is expected to reach 3.67 Million tons by 2029, growing at a CAGR of 2.82% during the forecast period (2024-2029).

The supply chain disruptions, subcontractors and materials shortage, and contract termination to control expenses, all of which occurred due to the COVID-19 pandemic, impacted the market's growth on a global level. However, post-pandemic, the market is expected to grow steadily.

Key Highlights

- Over the short term, the significant factors driving the market are the rising usage of polypropylene fibers in hygiene and health care and the increasing demand for these fibers from the construction industry.

- Factors such as cheaper substitute availability and lower melting points will likely hinder the market's growth.

- The prospects of recycled polypropylene fibers are likely to act as opportunities for market growth.

- Asia-Pacific dominated the global polypropylene fibers market, and it is also likely to witness the highest growth rate during the forecast period.

Polypropylene (PP) Fiber Market Trends

Textile Industry to Dominate the Market

- PPF applications in the textile industry include fibers, fibrous materials, and other PP-based textile materials, including bed covers, carpets, underlays, rugs, tapes, ropes, clothing (home, sport, children's protective), technical textiles, and environmentally-friendly textiles. The primary classification of PP staple fibers is carpet, woolen, cotton types, and microfibers.

- Polypropylene ropes are used for agriculture and crop packing. They can also be used in heavy fruit and vegetable plantations to help the fruit/vegetable hold on to its stem or branch.

- Technical filters are used in various industrial applications, such as wet filtration and pharmaceuticals. These filters provide excellent chemical resistance to paints, coatings, petrochemicals, etc.

- According to data from US Census Bureau, synthetic textile exports increased post-pandemic in 2021.

- In recent years, China's apparel market slowed down and was further hit by the COVID-19 crisis. The apparel industry underwent a significant transition by shifting toward online platforms. By the end of 2023, approximately 58% of China's market revenue may get generated through online sales.

- The textile industry in the United States is globally competitive in manufacturing raw materials for textiles, yarns, fabrics, apparel, home furnishings, and other textile-based finished products. According to SelectUSA, a governmental organization, the country's textile and apparel industry is worth nearly USD 70 billion and is one of the largest manufacturing industry sectors.

- Thus, based on the aspects above, the textile segment is expected to dominate the market.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the global polypropylene fibers market and is likely to witness the highest growth rate during the forecast period. China is a leading producer of polypropylene fibers due to the high number of large-scale manufacturing activities.

- Several Chinese producers have switched to making polypropylene (PP) fibers amid a spike in the global demand for surgical masks and personal protective gear.

- The companies that recently started producing PP fiber in China are Baofeng, Yan'an Yanchang Petroleum, Shijiazhuang Petrochemical, Dalian Petrochemical, Zhejiang Petrochemical, Shaanxi Yanchang ChinaCoal, and Fushun Petrochemical, among others.

- China is the world's largest producer and exporter of textiles and clothing. Due to its enormous production capacity, China includes an oversupply of textiles and clothing products.

- However, the increasing labor costs and rising global protectionism weakened its competitiveness. The labor costs in the country increased significantly in recent years and surpassed that of many other countries in Asia.

- China includes the second-largest healthcare industry in the world, after the United States, and its healthcare market is more rigorous, especially in light of the COVID-19 pandemic in 2020. China is expected to account for 25% of the global healthcare industry's revenue by 2030.

- The healthcare sector in India is expected to reach USD 372 billion by 2022, mainly driven by increasing health awareness, access to insurance, rising income, and diseases. The medical sector in India is benefiting from the growing population at a rate of 1.6% per year. An aging population of over 100 million, rising lifestyle disease incidences, rising incomes, and increased penetration of health insurance are fueling the growth of more sophisticated and accurate medical devices in the industry.

- The hospital industry in India, which accounts for 80% of the global healthcare market, is witnessing colossal investor demand from international and domestic investors. The hospital industry is expected to reach USD 132 billion by 2023.

- In Japan, the 65-and-above demographic represents around 30% of the country's total population and is expected to reach about 40% by 2050. The rapidly aging Japanese people, the increasing number of patients with chronic and lifestyle diseases, and universal health insurance coverage and regulatory measures are driving the Japanese healthcare market. Japan is boosting its medical sector as its citizens are getting older at a faster rate than the citizens of any other nation.

- The South Korean healthcare sector is on the brink of a massive changeover. It is because of the rapid growth in the aging population and the lowest birth rate. Over the coming years, the South Korean healthcare market is expected to witness massive development that will address the growing needs of consumers.

- All these factors are expected to boost the polypropylene fibers market in Asia-Pacific over the forecast period.

Polypropylene (PP) Fiber Industry Overview

The global polypropylene fibers market is partially fragmented, with many players. However, the leading company, Indorama Ventures, occupies a considerable market share. Other key players (in no particular order) include Beaulieu Fibers International (BFI), Chemosvit Fibrochem SRO, Radici Partecipazioni SpA, Indorama Ventures, and Mitsubishi Chemical Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Usage in Hygiene and Healthcare

- 4.1.2 Rising Demand from the Construction Industry

- 4.2 Restraints

- 4.2.1 Availability of Cheaper Substitutes

- 4.2.2 Low Melting Point Hinders Usage in Some Applications

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Raw Material Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Staple

- 5.1.2 Yarn

- 5.2 End-user Industry

- 5.2.1 Textile

- 5.2.2 Construction

- 5.2.3 Healthcare and Hygiene

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Turkey

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ABC Polymer Industries LLC

- 6.4.2 Beaulieu Fibres International (BFI)

- 6.4.3 Belgian Fibers

- 6.4.4 Chemosvit Fibrochem SRO

- 6.4.5 China National Petroleum Corporation

- 6.4.6 DuPont

- 6.4.7 Fiberpartner Aps

- 6.4.8 Freudenberg Group

- 6.4.9 Indorama Ventures

- 6.4.10 International Fibres Group

- 6.4.11 Radici Partecipazioni SpA

- 6.4.12 Sika AG

- 6.4.13 Mitsubishi Chemical Corporation

- 6.4.14 Huimin Taili Chemical Fiber Products Co. Ltd

- 6.4.15 Tri Ocean Textile Co. Ltd

- 6.4.16 W. Barnet GmbH & Co. KG

- 6.4.17 Zenith Fibres Ltd

- 6.4.18 Kolon Fiber Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Future Applications For Recycled Polypropylene Fibers