|

市場調查報告書

商品編碼

1444710

智慧電錶 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Smart Meters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

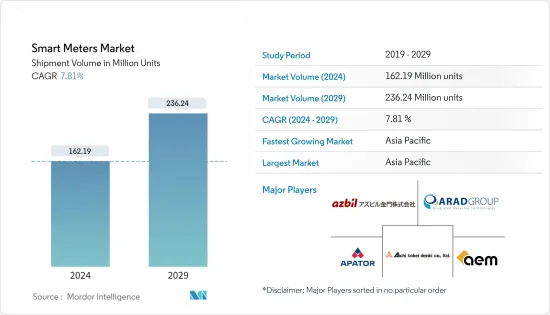

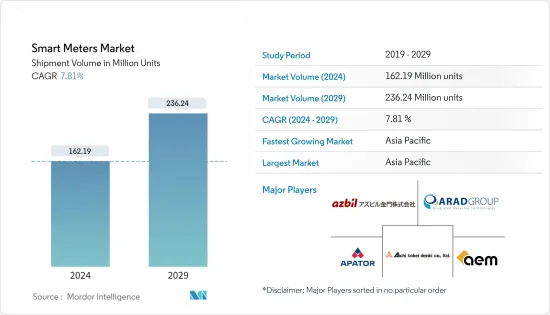

就出貨量而言,智慧電錶市場規模預計將從2024年的1.6219億台成長到2029年的2.3624億台,預測期間(2024-2029年)CAGR為7.81%。

為了提高電網的有效性,世界各地引進智慧電網。因此,包括智慧電錶在內的智慧電網全球部署。為了因應污染對環境的負面影響,世界各國製定排放控制規則。這是推動市場的主要因素。

主要亮點

- 由於其雙向通訊能力,智慧電錶在全球更廣泛的採用,用於各種部署,包括電力、天然氣和水。此功能允許公用事業供應商和消費者即時追蹤公用事業使用情況,並鼓勵供應商遠端啟動、讀取或切斷供應。

- 在非主要模式下,消費性電子產品、辦公設備和其他插頭負載消耗了住宅和商業總電力的近 15%至20%。大部分能量在它們以低功耗模式運行時消耗(即使它們未使用)。消費者越來越傾向於安裝智慧能源管理系統來追蹤此類情況。

- 智慧電錶的部署還可以實現家庭能源管理系統(HEMS)或建築能源管理系統(BEMS)的實施,實現單一家庭或整個建築物的電力使用情況的可視化。

- 此外,數位化加速能源效率措施的現代化,因此智慧電網的部署在全球範圍內不斷增加,因為它們能夠動態最佳化供應並促進太陽能等再生能源的大量電力供應。

- 此外,政府支持和投資的增加預計將促進智慧電錶在該國的採用和部署。例如,印度國有能源效率服務有限公司(EESL)根據印度政府智慧電錶國家計劃,在印度各地完成了約 100 萬個智慧電錶的安裝。 EESL 設定的目標是在未來幾年安裝 2.5 億盧比的智慧電錶。此外,需要在該國建立智慧電錶製造基地,以確保在全國各地安裝的電錶數量充足,排除壟斷,預計將成為主要推動力。

- 全球新冠肺炎(COVID-19)疫情造成的封鎖導致許多產業的營運陷入停頓。結果,智慧電錶的出貨量和安裝量下降。

- 然而,隨著COVID-19要求逐漸放寬,預計隨著時間的推移,智慧電錶的安裝量也會增加。大多數能源供應商很容易鼓勵他們的消費者在許多已開發地區更新到智慧電錶。

智慧電錶市場趨勢

智慧電錶主導市場並將在預測期內繼續佔據主導地位

- 預計更多的政府支持和投資將加速亞太地區智慧電錶的採用和部署。為了防止壟斷,確保整個地區可以安裝的智慧電錶的充足供應,還需要在該地區建立製造基地。敦促各州政府在三年內實施智慧電錶,並獲得了約 2,200 億印度盧比(26.77 億美元)的撥款用於電力和再生能源領域。

- 根據GSMA預測,到2025年,北美地區預計將有約14億棟智慧建築和7億棟智慧家居,主要是美國和加拿大,因此智慧建築和智慧家庭數量的不斷增加預計也會導致智慧家庭的成長。銷售智慧電錶。

- 此外,城市化進程的加速和人們越來越注重發展城市生活方式,導致智慧家庭技術和設備的部署擴大,其中包括自動控制電力、照明和能源以避免浪費。因此,全球家庭擴大採用智慧家庭設備和技術,預計將進一步促進智慧電錶在住宅領域的成長。

- 在非主要模式下,消費性電子產品、辦公設備和其他插頭負載消耗了住宅和商業總電力的近 15%至20%。大部分能量在它們以低功耗模式運行時消耗(即使它們未使用)。消費者越來越傾向於安裝智慧能源管理系統來追蹤此類場景。

- 根據美國能源情報署(EIA)的資料,未來三十年全球發電量預計將增加一倍以上,到2050年達到約14.7太瓦。2020年,全球發電裝置容量為7.1太瓦,這顯示需求旺盛。因為全球電力不斷成長。公用事業公司管理和最佳化其能源分配網路的需求日益成長。因此,提供有關能源消耗的詳細資訊可以幫助消費者找到減少能源使用並使用智慧電錶節省資金的機會,預計將增加全球智慧電錶的採用。

亞太地區將持有主要佔有率

- 中國目前在亞太地區處於領先地位,由於華南政府和國家電網(中國僅有的兩家推動這項進程的電網公司)的嚴格要求,該計畫的推出正處於高峰期。然而,中國目前已接近全臉部署,投放的逐漸結束導致年度需求大幅減少。

- 中國是智慧電錶的主要製造商,本土企業數量眾多。它也是最大的智慧電錶生產商之一,智慧電錶在推出階段主要用於家庭用途。國營企業在中國市場佔據主導地位。因此,非中國公司幾乎不可能在該國競爭。

- 日本是世界第五大碳排放國。2021年,迫於許多環保組織和歐洲國家的壓力,日本政府承諾在2030年減量46%。智慧電網的實施、增強的電力和配電網路以及低碳能源可能有助於實現這一目標。

- 當時,由於日本政府的大力支持、放鬆管制以及多個大型計畫的成本普遍下降,投資者對日本智慧電網技術的興趣顯著增加。根據《亞洲電力》報道,預計到2024年全國智慧電錶安裝量將達到 8,000 萬個。

- 這些改進主要歸功於智慧電錶、DES 和儲能技術的部署,但也出現了許多試點計畫和虛擬發電廠(VPP)、區塊鏈和車輛到電網(V2G)技術等其他創新的發展。此外,日本政府計劃斥資20 兆日圓(1,550 億美元)促進對新電網技術、節能住宅和其他技術的投資,以減少國家的碳足跡。

- 亞太地區的其他地區包括紐西蘭、印度、澳洲、菲律賓、印尼、泰國、韓國、馬來西亞、新加坡、越南、孟加拉、巴基斯坦等國家和大陸。預計在預測期內,多項政府措施、合作夥伴關係、創新和收購將推動該地區的市場成長。

智慧電錶產業概況

智慧電錶市場競爭激烈,由AEM、Aichi Tokei Denki、Apator SA、Arad Group 和Azbil Kimmon 等幾家主要參與者組成。大規模投資的介入增加了現有參與者的壁壘,推動了該行業的發展走向競爭。此外,智慧電錶擴大被各種最終用戶部署。因此,需求的大幅增加以及政府增加各地區推出數量的措施預計將加劇市場參與者之間的競爭程度。

2023年1月,Badger Meter Inc.宣布策略收購智慧水監測解決方案供應商Syrinix Ltd.。透過此次收購,該公司目的是將 Syrinix 的硬體軟體功能添加到我們的智慧水解決方案組合中。同樣,它還收購了智慧測量和智慧水質監測領域的領導者Analytical Technology, Inc.(Ati)和Scan GmbH。

2023年1月,Diehl Stiftung & Co. KG宣布,盧安達首都基加利的水與衛生公司(WASAC)選擇Diehl表計採用儀表技術,以實現其網路現代化,以實現永續發展。 WASAC 認知到 AURIGA 適合透過安裝可靠的水錶來實現減少無收益水的主要目標。 AURIGA 水錶將構成未來 AMR 解決方案的基礎。

2022年12月,Apator SA推出了專為工業應用設計的smartESOX pro和雙向智慧電錶OTUS 3。也展示了其他智慧選項,例如 Ultrimis W 超音波水錶和 iSMART2 瓦斯表。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭程度

- 產業價值鏈分析

- COVID-19 對產業的影響

第5章 市場動態

- 市場促進因素

- 增加智慧電網專案投資

- 需要提高公用事業效率

- 支持性政府法規

- 智慧城市部署的成長

- 所有最終用戶對永續公用事業供應的需求

- 市場挑戰

- 高成本和安全問題

- 與智慧電錶的整合困難

- 基礎建設安裝資金投入不足,缺乏投資報酬率

- 公用事業供應商轉換成本

第6章 市場細分

- 按地理位置 - 智慧瓦斯表

- 北美洲

- 美國

- 加拿大和中美洲

- 歐洲

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 亞太地區其他地區

- 世界其他地區

- 北美洲

- 按地域-智慧水錶

- 北美洲

- 美國

- 加拿大和中美洲

- 歐洲

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 亞太其他地區

- 世界其他地區

- 北美洲

- 按地理位置-智慧電錶

- 北美洲

- 美國

- 加拿大和中美洲

- 歐洲

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 亞太地區其他地區

- 世界其他地區

- 北美洲

第7章 競爭格局

- 公司簡介

- AEM

- Aichi Tokei Denki Co.Ltd.

- Apator SA

- Arad Group

- Azbil Kimmon Co. Ltd.

- Badger Meter Inc.

- Diehl Stiftung & Co. KG

- Elster Group GmbH(Honeywell International Inc.)

- General Electric Company

- Hexing Electric company Ltd.

- Holley Technology Ltd.

- Itron Inc.

- Jiangsu Linyang Energy Co. Ltd.

- Kamstrup A/S

- Landis+ GYR Group AG

- Mueller Systems LLC(Muller Water Products Inc.)

- EDMI Limited(OSAKI ELECTRIC CO. LTD.)

- Neptune Technology Group Inc.(Roper Technologies, Inc.)

- Ningbo Sanxing Medical Electric Co., Ltd

- Pietro Fiorentini SpA

- Sagemcom SAS

- Sensus USA Inc.(Xylem Inc.)

- Aclara Technologies LLC(Hubbell Inc.)

- Wasion Holdings Limited

- Yazaki Corporation

- Zenner International GmbH & Co. KG

第8章 市場機會與未來趨勢

- 市場的未來 - 智慧電錶

- 市場的未來 - 智慧瓦斯表

- 市場的未來 - 智慧水錶

The Smart Meters Market size in terms of shipment volume is expected to grow from 162.19 Million units in 2024 to 236.24 Million units by 2029, at a CAGR of 7.81% during the forecast period (2024-2029).

In order to increase the effectiveness of electrical networks, smart grids are being introduced all over the world. As a result, smart grids, which include smart electricity meters, are being deployed globally. To combat the negative impacts of pollution on the environment, nations all over the world are enacting emission control rules. This is the main factor driving the market.

Key Highlights

- Due to their two-way communication capability, smart meters are being adopted more widely across the globe for various deployments, including electricity, gas, and water. This feature allows both utility suppliers and consumers to track utility usage in real-time and encourages suppliers to start, read, or cut off supply remotely.

- Consumer electronics, office equipment, and other plug loads consume nearly 15% to 20% of the total residential and commercial electricity while not in the primary mode. Most of this energy is consumed when they operate in low-power modes (even while they are not in use). Consumers are increasingly tending to install a smart energy management system to track such scenarios.

- Smart meters deployment also enables the implementation of a Home Energy Management System (HEMS) or Building Energy Management System (BEMS) that allows visualization of the electric power usage in individual homes or entire buildings.

- Further, digitization is accelerating and modernizing energy efficiency measures, due to which the deployment of smart grids is increasing globally, as they are capable of dynamically optimizing supply and fostering supply of large amounts of electricity from renewable energy sources such as solar power.

- Moreover, increasing government support and investments are expected to boost smart meters adoption and deployment in the country. For instance, India's state-owned Energy Efficiency Services Limited (EESL) completed the installation of approximately 10 lakh smart meters across India under the Government of India's Smart Meter National Programme. EESL set the target to install 25 crore smart meters over the next few years. Also, the need to establish a manufacturing base of smart electricity meters in the country to ensure an adequate supply of an adequate number of meters to be installed all over the country, by ruling out monopoly, is expected to act as a major driver.

- Lockdowns caused by the global COVID-19 epidemic caused a number of operations in many industries to come to a standstill. As a result, there was a decline in smart meter shipments and installations.

- However, as the COVID-19 requirements are gradually relaxed, it is anticipated that over time, the installation of smart meters will rise as well. The majority of energy providers are easily encouraging their consumers to update to smart meters in many developed locations.

Smart Meters Market Trends

Smart Electricity Meter Dominates the Market and will Continue its Dominance Over the Forecast Period

- Greater government support and investments are anticipated to accelerate the adoption and deployment of smart meters in Asia and the Pacific. In order to prevent monopolies and ensure an adequate supply of smart electricity meters that can be installed throughout the region, it is also necessary to establish a manufacturing base in the area. The state governments were urged to implement smart meters in three years and received an allocation of about INR 2,20,000 million (USD 2.677 billion) for the power and renewable energy sectors.

- According to the GSMA, by 2025, around 1.4 billion smart buildings and 700 million smart homes are expected to be in North America, mainly the United States and Canada, so an increasing number of smart buildings and homes are expected to also lead to an increase in the sale of smart electricity meters.

- Moreover, increasing urbanization and the increasing inclination toward a focus on developing urban lifestyles led to the expansion of the deployment of smart home technologies and devices, which involve automatic control of electricity, light, and energy to avoid wastage. Hence, the increasing adoption of smart home devices and technologies across homes globally is further expected to foster the growth of smart meters in the residential segment.

- Consumer electronics, office equipment, and other plug loads consume nearly 15% to 20% of the total residential and commercial electricity while not in the primary mode. Most of this energy is consumed when they operate in low-power modes (even while they are not in use). Consumers are increasingly inclined to install a smart energy management system to track such scenarios.

- According to the Energy Information Administration (EIA), global electricity generation capacity is expected to more than double in the next three decades, reaching approximately 14.7 terawatts by 2050. In 2020, the world's installed electricity capacity stood at 7.1 terawatts, which shows the demand for electricity around the globe is growing continuously. There is a growing need for utilities to manage and optimize their energy distribution networks. Thus, the availability of detailed information about energy consumption, which can help the consumer identify opportunities to reduce energy usage and save money with smart electricity meters, is projected to increase the adoption of smart electricity meters globally.

Asia-Pacific to Hold Major Share

- China is currently the leading segment in Asia Pacific, with the rollout at its peak due to strict mandates by the government of South China and State Grid, the only two grid companies in the country that drive the process. However, China is currently approaching full deployment, and the gradual end of the launch results in a significant reduction in annual demand.

- China is a major manufacturer of smart electricity meters, with a strong presence of local companies. It is also one of the largest producers of smart electric meters, which were consumed for domestic purposes during the rollout phase. State-owned enterprises dominate the Chinese market. Thus, it is nearly impossible for non-Chinese companies to compete in the country.

- Japan is the fifth-largest carbon emitter in the world. In 2021, the Japanese government promised to reduce emissions by 46% by 2030 due to pressure from many environmental organizations and European nations. Smart grid implementation, enhanced power and distribution networks, and low-carbon energy sources will likely help achieve this objective.

- By then, investor interest in smart grid technology was seen to have significantly increased in Japan due to the country's strong backing from the government, deregulation, and generally declining costs, with several large-scale projects. According to an Asian Power article, it is anticipated that up to 80 million smart meters will be installed nationwide by 2024.

- These improvements have mainly resulted from deploying smart electricity meters, DES, and energy storage technologies but have also seen numerous pilot projects and developments into other innovations like virtual power plants (VPPs), blockchain, and vehicle-to-grid (V2G) technologies. Additionally, the Japanese government plans to spend JPY 20 trillion (USD 155 billion) on promoting investments in new power grid technology, energy-saving homes, and other technology to reduce the nation's carbon footprint.

- The rest of the Asia-Pacific region contains countries and continents like New Zealand, India, Australia, the Philippines, Indonesia, Thailand, South Korea, Malaysia, Singapore, Vietnam, Bangladesh, Pakistan, and many more. Several government initiatives, partnerships, innovations, and acquisitions are expected to fuel market growth in the region during the projected period.

Smart Meters Industry Overview

The smart meter market is highly competitive and consists of several major players such as AEM, Aichi Tokei Denki Co., Ltd., Apator SA, Arad Group, and Azbil Kimmon Co., Ltd. The involvement of large-scale investments is increasing the barriers for the existing players, thereby pushing the industry toward competition. Also, smart meters are increasingly being deployed by various end users. Hence, the substantial increase in demand and government initiatives to increase the number of rollouts in various regions are expected to increase the degree of competition among the market players.

In January 2023, Badger Meter Inc. announced the strategic acquisition of Syrinix Ltd., a provider of intelligent water monitoring solutions. Through this acquisition, the company aims to add the hardware-enabled software capabilities of Syrinix to our smart water solutions portfolio. Similarly, it has also acquired Analytical Technology, Inc. (Ati) and Scan GmbH, leaders in intelligent measurement and smart water quality monitoring.

In January 2023, Diehl Stiftung & Co. KG announced that the Water and Sanitation Corporation (WASAC) in Rwanda's capital, Kigali, chose Diehl Metering for meter technology to modernize its network for its sustainability efforts. WASAC recognized the suitability of AURIGA to achieve its primary objective of reducing non-revenue water by installing reliable meters. The AURIGA water meter will form the basis for a future AMR solution.

In December 2022, Apator SA presented the smartESOX pro, which was specially designed for industrial applications, and the OTUS 3, a bidirectional smart electricity meter. Other smart options were presented, such as the Ultrimis W ultrasonic water meter and the iSMART2 gas meter.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Investments in Smart Grid Projects

- 5.1.2 Need for Improvement in Utility Efficiency

- 5.1.3 Supportive Government Regulations

- 5.1.4 Growth in Smart City Deployment

- 5.1.5 Demand for Sustainable Utility Supply for All End Users

- 5.2 Market Challenges

- 5.2.1 High Costs and Security Concerns

- 5.2.2 Integration Difficulties with Smart Meters

- 5.2.3 Lack of Capital Investment for Infrastructure Installation and Lack of ROI

- 5.2.4 Utility Supplier Switching Costs

6 MARKET SEGMENTATION

- 6.1 By Geography - Smart Gas Meter

- 6.1.1 North America

- 6.1.1.1 United States

- 6.1.1.2 Canada and Central America

- 6.1.2 Europe

- 6.1.2.1 United Kingdom

- 6.1.2.2 France

- 6.1.2.3 Italy

- 6.1.2.4 Rest of Europe

- 6.1.3 Asia Pacific

- 6.1.3.1 China

- 6.1.3.2 Japan

- 6.1.3.3 Rest of Asia Pacific

- 6.1.4 Rest of the World

- 6.1.1 North America

- 6.2 By Geography - Smart Water Meter

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada and Central America

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 France

- 6.2.2.3 Italy

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 Rest of Asia-Pacific

- 6.2.4 Rest of the World

- 6.2.1 North America

- 6.3 By Geography - Smart Electricity Meter

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada and Central America

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 France

- 6.3.2.3 Italy

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 Rest of Asia Pacific

- 6.3.4 Rest of the World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AEM

- 7.1.2 Aichi Tokei Denki Co.Ltd.

- 7.1.3 Apator SA

- 7.1.4 Arad Group

- 7.1.5 Azbil Kimmon Co. Ltd.

- 7.1.6 Badger Meter Inc.

- 7.1.7 Diehl Stiftung & Co. KG

- 7.1.8 Elster Group GmbH (Honeywell International Inc.)

- 7.1.9 General Electric Company

- 7.1.10 Hexing Electric company Ltd.

- 7.1.11 Holley Technology Ltd.

- 7.1.12 Itron Inc.

- 7.1.13 Jiangsu Linyang Energy Co. Ltd.

- 7.1.14 Kamstrup A/S

- 7.1.15 Landis+ GYR Group AG

- 7.1.16 Mueller Systems LLC (Muller Water Products Inc.)

- 7.1.17 EDMI Limited (OSAKI ELECTRIC CO. LTD.)

- 7.1.18 Neptune Technology Group Inc. (Roper Technologies, Inc.)

- 7.1.19 Ningbo Sanxing Medical Electric Co., Ltd

- 7.1.20 Pietro Fiorentini SpA

- 7.1.21 Sagemcom SAS

- 7.1.22 Sensus USA Inc. (Xylem Inc.)

- 7.1.23 Aclara Technologies LLC (Hubbell Inc.)

- 7.1.24 Wasion Holdings Limited

- 7.1.25 Yazaki Corporation

- 7.1.26 Zenner International GmbH & Co. KG

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 8.1 Future of the Market - Smart Electricity Meter

- 8.2 Future of the Market - Smart Gas Meter

- 8.3 Future of the Market - Smart Water Meter