|

市場調查報告書

商品編碼

1444593

鈧 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Scandium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

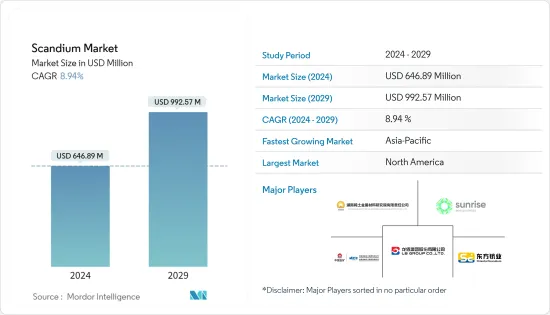

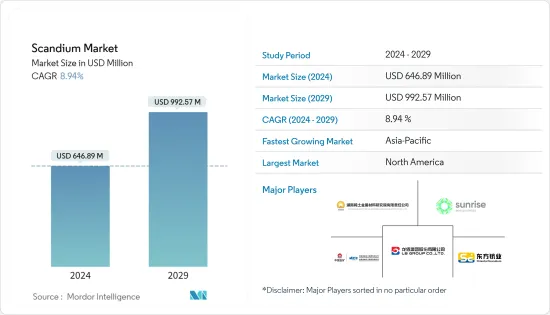

2024年鈧市場規模預計為6.4689億美元,預計到2029年將達到9.9257億美元,在預測期內(2024-2029年)CAGR為8.94%。

COVID-19 大流行對鈧市場產生了負面影響。由於封鎖,航空航太和國防、陶瓷和電子產品等主要最終用戶領域在 COVID-19 期間暫停,從而減少了鈧的使用量。 2020年後,由於主要終端用戶區隔市場的持續活動,市場穩步擴張。

主要亮點

- 推動市場成長的主要因素是固體氧化物燃料電池(SOFC)的使用不斷增加以及航空航太和國防工業對鋁鈧合金的需求不斷成長。

- 但鈧的高價格以及鈧並不總是可用的事實可能會阻礙所研究的市場的成長。

- 儘管如此,不斷發展的能源儲存技術和汽車行業的可能用途可能會在未來幾年為市場帶來機會。

- 在預測期內,美國預計將領先並實現最大成長。

鈧市場趨勢

固態氧化物燃料電池 (SOFC) 領域將主導市場

- SOFC 使用稱為電解質的固體氧化物材料,有助於將負氧離子從陰極移動到陽極。在這些電池中,陽極和陰極由覆蓋電解質的特殊墨水製成。因此,SOFC 不需要任何貴金屬、腐蝕性酸或熔融材料。

- 電解質材料承受高溫以催化天然氣轉化為能量。然而,催化轉化過程的高溫會促使陶瓷電解質快速分解,增加資本和維護成本。

- 在固體電解質中使用鈧有助於系統在比傳統 SOFC 低得多的溫度下工作。因此,鈧的使用有助於降低SOFC的成本,這使得它們更容易在許多地方用於發電。

- 隨著電價上漲,人們將需要使用更環保的方式來發電,這可能會為SOFC創造大量市場機會,並使鈧變得更加重要。

- 由於對煤炭和天然氣等傳統能源的環境問題日益關注,未來固體氧化物燃料電池的需求可能會增加。

- SOFC擴大應用於交通運輸、工業設備、發電、冷卻、救災以及沒有電網連接的地方。

- 固態氧化物燃料電池 (SOFC) 是一種電化學裝置,透過在離子導電氧化物電解質中結合氧化劑和燃料來直接髮電。此外,GOV.UK 表示,2022 年 11 月,英國所有電力供應商每月用電量約為 24.3 墨瓦時。這一趨勢預計將支持研究市場。

- 考慮到所有這些因素,固態氧化物燃料電池市場對鈧的需求可能會在不久的將來大幅增加。

美國主導市場

- 美國是最早商業化使用燃料電池的國家之一。越來越多的最終用戶,特別是汽車行業的最終用戶,以及政府的資助使這成為可能。

- 以SOFC為基礎的燃料電池可用於輕型車輛和倉庫堆高機,以取代內燃機。這將使車輛更加節能,並有助於實現減少運輸部門石油使用和污染的目標。這可能會促使該國使用的燃料電池數量大幅增加。

- 美國擁有世界上最大的航空航太工業。據FAA稱,2022年美國飛機數量有所增加,估計通用航空機隊數量從2021年的204,405架增加到2022年的204,590架。這可能會增加該國的鈧使用量。

- 鈧的主要應用是與鋁形成合金。由於其優異的耐用重量比和耐腐蝕性能,鈧鋁合金被廣泛應用於機身製造、薄型機身、焊接儲氣罐、儀表板結構等。這些合金可減輕重量約15-20%,提高飛機的燃油經濟性。

- 世界上最大的機隊之一位於美國,美國也擁有北美最大的航空市場。航空航太零件向法國、中國和德國等國家的強勁出口以及美國健康的消費者支出推動了航空航太領域的製造業務。預計這將對該國的鈧市場產生有利影響。

- 美國聯邦航空管理局 (FAA) 預計,到 2041 年,美國商業機隊將以年均 2% 的速度成長,達到 8,756 架。因此,對鈧零件的需求可能會增加,這些零件包括:用於許多飛機應用。

- 此外,行業合約和協議正在刺激商用和國防飛機的生產。例如,2022 年 8 月,波音公司獲得了 KC-46A 空軍生產批次 8 飛機、訂購和許可證的合約的修改 (P00215)。其中還包括 15 架額外的 KC-46A 飛機。該合約100%對以色列的對外軍售價值為886,242,124美元。

- 在2022年軍事預算中,美國政府撥款7,682億美元用於國防項目。這比拜登政府的第一份預算提案增加了2%,也顯示航空航太業正在使用更多的鈧基材料。

- 上述所有因素都可能推動預測期內美國鈧市場的成長。

鈧行業概況

鈧市場本質上是部分整合的。該市場的一些主要參與者(排名不分先後)包括湖南稀土金屬材料研究院、中國冶金科工集團公司(中冶集團)、日出能源金屬有限公司、龍柏集團和河南榮嘉鈧釩科技有限公司等。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 促進要素

- 固態氧化物燃料電池 (Sofc) 的使用不斷增加

- 航太和國防工業對鋁鈧合金的需求不斷增加

- 限制

- 鈧成本高

- 供應不一致

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

- 價格分析

- 環境影響分析

第 5 章:市場區隔(市場價值規模)

- 產品類別

- 氧化物

- 氟化物

- 氯化物

- 硝酸鹽

- 碘化物

- 合金

- 碳酸鹽和其他產品類型

- 最終用戶產業

- 航太和國防

- 固態氧化物燃料電池

- 陶瓷

- 燈光

- 電子產品

- 3D列印

- 體育用品

- 其他最終用戶產業

- 地理

- 生產分析

- 中國

- 俄羅斯

- 菲律賓

- 世界其他地區

- 消費分析

- 美國

- 中國

- 俄羅斯

- 日本

- 巴西

- 歐洲聯盟

- 世界其他地區

- 生產分析

第 6 章:競爭格局

- 併購、合資、合作與協議

- 市佔率 (%) **/排名分析

- 領先企業採取的策略

- 公司簡介

- China Metallurgical Group

- Guangdong Dongfang Zirconium Technology Co. Ltd.

- Guangxi Maoxin Technology Co. Ltd.

- Henan Rongjia Scandium Vanadium Technology Co. Ltd

- Huizhou Top Metal Materials Co. Ltd (TOPM)

- Hunan Rare Earth Metal Materials Research Institute Co., Ltd

- Hunan Oriental Scandium Co.,Ltd.

- JSC Dalur

- Longbai Group Co., Ltd.

- NioCorp Development Ltd.

- Rio Tinto

- Rusal

- Scandium International Mining Corp.

- Stanford Materials owned by Oceania International LLC

- Sumitomo Metal Mining Co., Ltd. (taganito Hpal nickel Corp.)

- Sunrise Energy Metals Limited

- Treibacher Industrie AG

第 7 章:市場機會與未來趨勢

- 汽車產業的潛在應用

- 不斷發展的能源儲存技術

The Scandium Market size is estimated at USD 646.89 million in 2024, and is expected to reach USD 992.57 million by 2029, growing at a CAGR of 8.94% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the scandium market. Due to the lockdown, major end-user segments such as aerospace and defense, ceramics, and electronics were suspended during COVID-19, reducing scandium usage. After 2020, the market expanded steadily because of the continued activities in major end-user segments.

Key Highlights

- The major factors driving the market's growth are the increasing usage of solid oxide fuel cells (SOFCs) and the growing demand for aluminum-scandium alloys in the aerospace and defense industries.

- But the high price of scandium and the fact that it isn't always available are likely to keep the studied market from growing.

- Still, growing technology for storing energy and possible uses in the auto industry are likely to give the market opportunities in the years to come.

- During the forecast period, the United States is expected to lead and see the most growth.

Scandium Market Trends

Solid Oxide Fuel Cells (SOFCs) Segment to Dominate the Market

- SOFCs use a solid oxide material called an electrolyte, which helps move negative oxygen ions from the cathode to the anode. In these cells, the anode and cathode are made from special inks that cover the electrolyte. Therefore, SOFCs do not require any precious metal, corrosive acids, or molten material.

- Electrolyte materials are subjected to high temperatures to catalyze natural gas conversion to energy. However, the high temperature for the catalyzing conversion process can lead to the quick degradation of ceramic electrolytes, adding to the capital and maintenance costs.

- Using scandium in solid electrolytes helps the system work at much lower temperatures than traditional SOFCs. So, the use of scandium helped lower the cost of SOFCs, which made them easier to use for power generation in many places.

- As electricity prices go up, people will need to use more environmentally friendly ways to make power, which is likely to create a lot of market opportunities for SOFCs and make scandium even more important.

- Due to growing environmental concerns regarding traditional energy sources like coal and natural gas, solid oxide fuel cells are likely to see increased demand in the future.

- SOFCs are being used more and more in transportation, industrial equipment, power generation, cooling, disaster relief, and places where there is no grid connection.

- A solid oxide fuel cell (SOFC) is an electrochemical device that helps make electricity directly by combining an oxidant and a fuel across an ionic conducting oxide electrolyte. Also, GOV.UK says that in November 2022, all electricity suppliers in the United Kingdom used about 24.3 terawatt-hours of electricity each month. This trend is expected to support the study market.

- Taking all of these things into account, the solid oxide fuel cell market is likely to see a big increase in demand for scandium in the near future.

The United States to Dominate the Market

- The United States was one of the first countries to use fuel cells commercially. A growing number of end users, particularly in the auto industry, and government funding made this possible.

- SOFC-based fuel cells could be used in light-duty vehicles and warehouse forklifts to replace internal combustion engines.This would make the vehicles more fuel-efficient and help reach goals of cutting oil use and pollution from the transportation sector. It is likely to lead to a big increase in the number of fuel cells used in the country.

- The United States has the largest aerospace industry in the world. According to the FAA, the number of aircraft in the United States increased in 2022, with estimates indicating that the general aviation fleet was 204,590 in 2022, up from 204,405 in 2021. It is likely to increase scandium usage in the country.

- The main application for scandium is in the form of an alloy with aluminum. Due to their excellent durability-to-weight ratio and corrosion-resistant performance, scandium-aluminum alloys are widely employed in the construction of airframes, thinner fuselages, welded gas tanks, dashboard panel structures, etc. These alloys allow for weight reductions of about 15-20%, which improves the fuel economy of airplanes.

- One of the largest fleets in the world is in the United States, which also has the largest aviation market in North America. Strong exports of aerospace components to countries like France, China, and Germany and healthy consumer spending in the United States have driven the manufacturing operations in the aerospace sector. This is anticipated to have a beneficial impact on the country's scandium market.

- The Federal Aviation Administration (FAA) projects that the commercial fleet in the United States will expand by an average annual growth rate of 2% per year to 8,756 in 2041. As a result, there will likely be more demand for scandium parts, which are used in a number of aircraft applications.

- Additionally, industry contracts and agreements are spurring the production of commercial and defense aircraft. For instance, in August 2022, a modification (P00215) to the contract for KC-46A Air Force Production Lot 8 aircraft, subscriptions, and licenses was given to the Boeing Company. This also includes 15 extra KC-46A planes. 100% of the contract's foreign military sales to Israel are valued at USD 886,242,124.

- In the 2022 military budget, the US government set aside USD 768.2 billion for national defense projects. This is a 2% increase over the first budget proposal from the Biden administration and a sign that the aerospace industry is using more scandium-based materials.

- All factors above are likely to fuel scandium market growth in the United States over the forecast period.

Scandium Industry Overview

The scandium market is partially consolidated in nature. Some of the market's major players (not in any particular order) include Hunan Rare Earth Metal Materials Research Institute Co., Ltd., China Metallurgical Group Corporation (MCC Group), Sunrise Energy Metals Limited, Longbai Group Co., Ltd., and Henan Rongjia Scandium Vanadium Technology Co., Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage in Solid Oxide Fuel Cells (Sofcs)

- 4.1.2 Increasing Demand for Aluminum-Scandium Alloys in the Aerospace and Defense Industry

- 4.2 Restraints

- 4.2.1 High Cost of Scandium

- 4.2.2 Inconsistent Supply

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Analysis

- 4.6 Environmental Impact Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Oxide

- 5.1.2 Fluoride

- 5.1.3 Chloride

- 5.1.4 Nitrate

- 5.1.5 Iodide

- 5.1.6 Alloy

- 5.1.7 Carbonate and Other Product Types

- 5.2 End-user Industry

- 5.2.1 Aerospace and Defense

- 5.2.2 Solid Oxide Fuel Cells

- 5.2.3 Ceramics

- 5.2.4 Lighting

- 5.2.5 Electronics

- 5.2.6 3D Printing

- 5.2.7 Sporting Goods

- 5.2.8 Other End-user Industries

- 5.3 Geography

- 5.3.1 Production Analysis

- 5.3.1.1 China

- 5.3.1.2 Russia

- 5.3.1.3 Philippines

- 5.3.1.4 Rest of the World

- 5.3.2 Consumption Analysis

- 5.3.2.1 United States

- 5.3.2.2 China

- 5.3.2.3 Russia

- 5.3.2.4 Japan

- 5.3.2.5 Brazil

- 5.3.2.6 European Union

- 5.3.2.7 Rest of the World

- 5.3.1 Production Analysis

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 China Metallurgical Group

- 6.4.2 Guangdong Dongfang Zirconium Technology Co. Ltd.

- 6.4.3 Guangxi Maoxin Technology Co. Ltd.

- 6.4.4 Henan Rongjia Scandium Vanadium Technology Co. Ltd

- 6.4.5 Huizhou Top Metal Materials Co. Ltd (TOPM)

- 6.4.6 Hunan Rare Earth Metal Materials Research Institute Co., Ltd

- 6.4.7 Hunan Oriental Scandium Co.,Ltd.

- 6.4.8 JSC Dalur

- 6.4.9 Longbai Group Co., Ltd.

- 6.4.10 NioCorp Development Ltd.

- 6.4.11 Rio Tinto

- 6.4.12 Rusal

- 6.4.13 Scandium International Mining Corp.

- 6.4.14 Stanford Materials owned by Oceania International LLC

- 6.4.15 Sumitomo Metal Mining Co., Ltd. (taganito Hpal nickel Corp.)

- 6.4.16 Sunrise Energy Metals Limited

- 6.4.17 Treibacher Industrie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Potential Applications in Automotive industry

- 7.2 Growing technology for storing energy