|

市場調查報告書

商品編碼

1685828

企業應用整合:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Enterprise Application Integration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

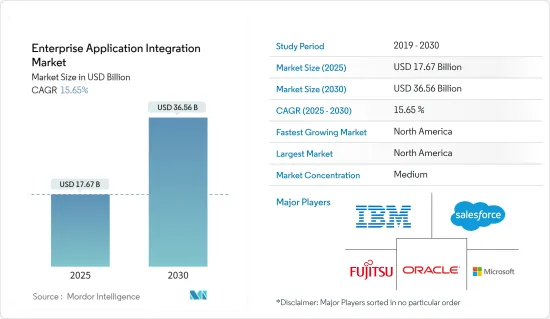

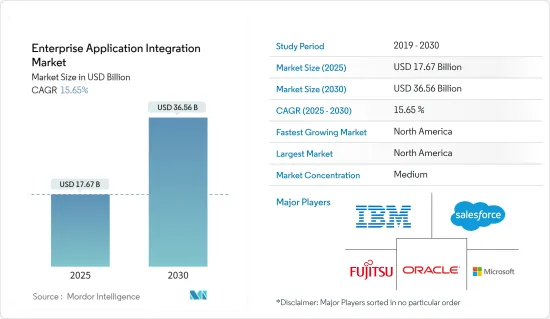

企業應用整合市場規模預計在 2025 年為 176.7 億美元,預計到 2030 年將達到 365.6 億美元,預測期內(2025-2030 年)的複合年成長率為 15.65%。

數位轉型正在改變企業格局

數位轉型正在徹底改變每個產業。隨著業務的發展,無縫整合各種應用程式的需求變得至關重要。企業應用程式整合 (EAI) 解決方案處於此轉變的最前沿,使組織能夠將其業務應用程式與相關資料庫和工作流程整合。 EAI 的採用正值企業軟體生態系統變得越來越複雜之時。根據 Okta 的《企業在工作》報告,大型企業平均部署 187 個應用程式,這表明全球應用程式使用量持續增加。這一趨勢凸顯了對強大的企業應用程式整合解決方案的迫切需求。

整合挑戰:

主要亮點

- 不同的系統:公司通常在互不相容的框架內營運,從而阻礙 ERP、CRM 和其他關鍵系統之間的資料交換。

- 自動化障礙:缺乏整合導致難以實現重複任務的自動化,進而影響業務效率。

- 財務影響:根據 Cleo 的報告,24% 的供應鏈公司每年因軟體系統整合不佳而損失超過 50 萬美元。

EAI 解決方案

主要亮點

- 中間件基礎設施:EAI 為不同應用程式和傳統設備之間的開放資料共用引入了一個安全平台。

- 統一方法:EAI 中間件平台將資料從應用程式的限制中解放出來,幫助實現資料的集中和整合。

- 提高營運效率:整合簡化了資訊共用,並提供了跨雲端運算、巨量資料和物聯網技術的更輕鬆的資料控制。

即時資料存取:敏捷企業的基石

隨著企業追求靈活性和業務效率,對即時資料存取和管理的需求正在激增。即時洞察對於做出明智的決策、改善客戶體驗和推動個人化至關重要。這一趨勢正在推動對雲端基礎的企業整合解決方案的投資,這些解決方案可以處理現代資料儲存庫的複雜性和數量。

市場反應

主要亮點

- 雲端連線:Qlik 引入了 Qlik-cloud資料連線。它是一種 iPaaS(整合平台即服務)解決方案,可將公司的所有資料來源即時連結到雲端。

- 本地優勢:本地部署允許即時監控業務,同時提高資料機密性。

- 全面的解決方案Persistent 的企業整合服務使軟體應用程式能夠無縫協作,提供跨多個管道的一致、即時的資料視圖。

對產業的影響

主要亮點

- 最佳化效能:即時資料整合可即時洞察整個軟體定義企業的業務績效。

- 更有效率的協作:EAI 工具和技術正在不斷發展,以提供即時洞察並促進跨多個應用程式的合作和資訊交流。

- 管理複雜性:單一服務正在興起,以更有效地處理各種基礎設施和應用程式問題。

API主導整合:推動互聯企業

行動應用程式、物聯網設備和穿戴式裝置的激增推動了以 API 為中心的整合的需求。即時 API 驅動的整合支援可隨時監控各種參數的應用程式,促進跨多個平台的無縫資料流和同步。

大規模連結:

主要亮點

- 設備激增:思科預測,到 2030 年將有 5,000 億台設備連接到網際網路,凸顯了 EAI 在管理這一龐大生態系統中發揮的關鍵作用。

- 資料同步:即時應用程式整合確保個人電腦、筆記型電腦和手持裝置之間的資料一致性。

對企業的影響:

主要亮點

- 連結生態系統:隨著數位轉型的進展,企業軟體整合正在從後端角色轉變為連接整個生態系統的關鍵角色。

- 架構靈活性:EAI 解決方案正在不斷發展,以支援雲端和內部部署環境、敏捷交付和即插即用架構。

行業特定的採用趨勢 EAI 解決方案的採用因行業而異,其中 IT 和通訊、BFSI 和製造業處於領先地位。每個行業都在使用 EAI 來應對獨特的挑戰並利用新的機會。

資訊科技和電訊

主要亮點

- 市場領導地位:IT 和通訊領域預計到 2027 年將達到 72.8 億美元,複合年成長率為 17.64%。

- 電信整合:企業軟體整合計劃對於整合通訊產業客自訂和基於市場的應用系統、平衡技術和業務需求至關重要。

BFSI 部門:

主要亮點

- 數位付款:數位付款的興起推動了對強大資料管理系統的需求,從而刺激了 EAI 市場的成長。

- 創新平台:BlocPal International Inc. 開發的獨特實體和虛擬金融服務平台是該行業致力於綜合數位解決方案的一個例子。

製造業

知識工程:EAI 是整合分散式、自主製造系統和支援虛擬企業和大規模客製化等範例的關鍵。

主要亮點

- 競爭力:EAI對IT和基於知識的工程的有效利用提高了公司快速回應市場發展的能力。

- 展望未來:不斷發展的整合格局:企業應用整合的未來特徵是複雜性不斷增加,並且需要更複雜、更靈活的解決方案。隨著企業繼續嚴重依賴技術,整合各種應用程式的需求只會增加。

新興趨勢:

主要亮點

- 擴大整合範圍:未來的 EAI 解決方案將需要考慮組織內部和外部的大量端點。

- 快速創新:整合要求的變更率正在加快,需要更靈活、反應更快的 EAI 平台。

- 行動整合:預計 20% 的整合支出將用於行動裝置的資料整合,這必須解決間歇性連線和不同吞吐量等挑戰。

戰略問題

主要亮點

- 平衡穩定性和創新性:IT 領導者必須保持對關鍵系統的控制,同時促進存取這些系統的應用程式的快速迭代。

- 預取和快取:行動應用程式擴大採用複雜的資料預取和快取策略來彌補連線問題。

- 不斷適應:EAI 解決方案必須不斷發展,以支持數位轉型舉措所特有的快速創新步伐。

企業應用整合市場趨勢

IT 與通訊領域:最大的終端使用者領域

IT 和電訊領域正在成為企業應用整合 (EAI) 市場的主導力量,預計到 2027 年將達到 72.8 億美元,複合年成長率為 17.64%。這一顯著的成長證實了企業軟體整合解決方案在解決 IT 和通訊業複雜整合需求方面發揮的關鍵作用,尤其是在雲端運算和數位轉型領域。

雲端遷移推動整合需求

- 資料和基礎設施遷移:通訊業者擴大將資料、流程和基礎設施遷移到雲端,這是採用 EAI 的關鍵促進因素。

- 無縫運作:這種轉變需要強大的整合能力,以確保跨不同系統和應用程式的無縫運作。

- 雲端基礎的重點:企業越來越優先考慮資料平台即服務 (dPaaS) 而不是傳統的整合平台即服務 (iPaaS) 模型來擴充性其營運。

通訊業者核心流程整合

- 整合複雜性:通訊業者正在進行大規模 EAI計劃來支援核心流程,並正在建立中間件基礎設施來整合客自訂和市場應用系統。

- 跨境整合:電訊在其國際子公司之間協調技術解決方案面臨獨特的挑戰,凸顯了綜合整合平台的重要性。

即時整合與物聯網融合:

- 以 API 為中心的解決方案:行動應用程式、物聯網和穿戴式裝置的整合正在推動對即時、API主導的整合解決方案的需求。

- 設備爆炸式成長:預計到 2030 年將有 5,000 億台設備實現互聯,這凸顯了對強大、整合的解決方案來管理這些生態系統中的資料流的需求。

協作軟體解決方案推動整合需求

- 虛擬協作激增:Microsoft Teams 和 Zoom 等虛擬會議和協作工具的興起間接推動了整合企業解決方案的需求。

- 系統互通性:公司正在尋找將協同軟體與現有系統整合的解決方案,這進一步增加了對 EAI 的需求。

北美:成長最快的區域

北美是企業應用整合 (EAI) 市場成長最快的區域,預計到 2027 年將達到 142.6 億美元,複合年成長率為 16.41%。由於該地區在數位轉型方面處於領先地位,並且廣泛採用雲端基礎的企業整合解決方案,該地區正處於快速成長軌道。

應用程式整合變得越來越普遍:

- 高採用率:超過 93% 的美國企業使用商業應用程式,這為企業軟體整合供應商提供了沃土。

- 業務效率:隨著企業採用越來越多的應用程式,對於提高業務效率的無縫整合解決方案的需求持續成長。

策略夥伴關係和創新解決方案:

- 推動創新的夥伴關係:HiQ與歐洲雲端城市網路和Frends iPaaS平台的合作等策略合作夥伴關係正在推動混合雲端整合策略的創新。

- 法規合規性:這些夥伴關係關係致力於提供解決方案,確保完全遵守對公共和商業部門企業至關重要的資料法規。

雲端整合與數位轉型

- 技術顛覆:物聯網、雲端運算和數位轉型舉措的持續採用,推動了北美各產業對 EAI 解決方案的需求。

- 供應商焦點:IBM 和富士通等該地區的主要企業正透過基於 SaaS 的安全解決方案等創新引領市場,從而推動市場成長。

- 整合市場:北美 EAI 市場適度整合,全球參與者專注於最尖端科技以保持競爭力。

- 零信任架構:採用零信任架構來保障安全等創新對於在企業環境中部署 EAI 解決方案變得越來越重要。

企業應用整合產業概覽

全球企業主導半整合市場

企業應用整合 (EAI) 市場具有半整合結構的特點,IBM 公司、富士通有限公司和微軟等全球參與者佔據著相當大的市場佔有率。這些科技集團利用其廣泛的資源、全球影響力和技術專長來主導市場,而規模較小、創新的企業則利用專業化的解決方案為自己開闢利基市場。

全方位服務

端到端解決方案:全球領導者提供全面的企業應用程式整合解決方案,以滿足各行各業組織的不同需求。

夥伴關係生態系統:IBM 和微軟等公司已經建立了廣泛的合作夥伴生態系統,可以提供各種業務應用程式和資料來源的整合。

研發重點:

新興技術:主要企業正在大力投資研發,並專注於人工智慧 (AI)、機器學習和雲端運算方面的創新,以發展其 EAI 平台。

支援混合環境:此整合解決方案旨在支援混合雲端整合策略,確保內部部署和雲端基礎的基礎架構之間的平穩過渡。

創新且適應性強:

雲端原生架構:對可擴展和靈活解決方案的不斷成長的需求正在推動向雲端原生架構的轉變。

低程式碼/無程式碼工具:低程式碼/無程式碼工具的引入正在擴大整合能力的範圍,並使非技術用戶能夠為資料整合服務做出貢獻。

安全性與合規性:

資料隱私問題:隨著企業努力應對日益成長的資料隱私問題,EAI 供應商和供應商正在優先考慮其解決方案的安全性、合規性和管治功能,以獲得競爭優勢。

API 管理:EAI 的強大 API 管理正在成為一個關鍵的差異化因素,使企業能夠安全地整合大量應用程式和端點。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

- 技術簡介

第5章 市場動態

- 市場促進因素

- 數位轉型改變商業格局

- 對即時資料存取和管理的需求日益增加

- 面向互聯企業的 API主導整合

- 市場挑戰

- 開放原始碼軟體的可用性

- 缺乏整合導致重複任務難以自動化,進而影響業務效率。

- 評估新冠肺炎對產業的影響

第6章 市場細分

- 部署類型

- 本地

- 雲

- 混合

- 組織規模

- 大型企業

- 中小型企業

- 最終用戶產業

- BFSI

- 資訊科技/通訊

- 衛生保健

- 零售

- 政府

- 製造業

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- IBM Corporation

- Fujitsu Limited

- Microsoft Corporation

- MuleSoft LLC(Salesforce Inc.)

- Oracle Corporation

- SAP SE

- Software AG

- Tibco Software Inc.

- iTransition Group

第8章投資分析

第9章:市場的未來

The Enterprise Application Integration Market size is estimated at USD 17.67 billion in 2025, and is expected to reach USD 36.56 billion by 2030, at a CAGR of 15.65% during the forecast period (2025-2030).

Digital Transformation Reshaping Enterprise Landscapes

Digital transformation is revolutionizing industries across the board. As businesses evolve, the need for seamless integration of diverse applications becomes paramount. Enterprise Application Integration (EAI) solutions are at the forefront of this transformation, enabling organizations to unify databases and workflows associated with business applications. The adoption of EAI is driven by the increasing complexity of enterprise software ecosystems. According to Okta's "Businesses at Work" report, large organizations deploy an average of 187 applications, showcasing a consistent rise in application utilization globally. This trend underscores the critical need for robust enterprise application integration solutions.

Integration Challenges:

Key Highlights

- Disparate Systems: Businesses often operate with incompatible frameworks, hindering data exchange between ERP, CRM, and other critical systems.

- Automation Hurdles: The lack of integration makes automating simple tasks challenging, impacting operational efficiency.

- Financial Impact: Cleo's report reveals that 24% of supply chain companies lose over USD 500,000 annually due to inadequate software system integrations.

EAI Solutions:

Key Highlights

- Middleware Infrastructure: EAI introduces a secure platform for open data sharing between heterogeneous applications and legacy devices.

- Unified Approach: By removing data from application restrictions, EAI middleware platforms aid in centralized data management and integration.

- Operational Efficiency: Integration streamlines information sharing and provides ease in controlling data across cloud computing, Big Data, and IoT technologies.

Real-time Data Access: The Cornerstone of Agile Enterprises

The demand for real-time data access and management is surging as businesses strive for agility and operational efficiency. Real-time insights are crucial for making informed decisions, improving customer experiences, and driving personalization efforts. This trend is propelling investments in cloud-based enterprise integration solutions that can handle the complexity and volume of modern data repositories.

Market Response:

Key Highlights

- Cloud Connectivity: Qlik introduced Qlik-cloud data connectivity, an Integration Platform as a Service (iPaaS) solution, linking all enterprise data sources to the cloud in real-time.

- On-premise Advantages: On-premise implementations offer real-time monitoring of business operations with enhanced data confidentiality.

- Comprehensive Solutions: Persistent's Enterprise Integration Services enable seamless interfacing of software applications, providing a consistent, real-time view of data across multiple channels.

Industry Impact:

Key Highlights

- Performance Optimization: Real-time data integration allows for immediate insights into total business performance across software-defined enterprises.

- Collaborative Efficiency: EAI tools and technologies are evolving to deliver real-time insights, fostering successful cooperation and information exchange across multiple applications.

- Managed Complexity: Single services are emerging to handle issues across a diverse range of infrastructure and applications more effectively.

API-Driven Integration: Powering the Connected Enterprise

The proliferation of mobile applications, IoT devices, and wearables is driving the need for API-centric integration. Real-time, API-driven integration enables the creation of applications that can monitor various parameters on the go, facilitating seamless data flow and synchronization across multiple platforms.

Connectivity Scale:

Key Highlights

- Device Proliferation: Cisco projects that 500 billion devices will be connected to the Internet by 2030, emphasizing the critical role of EAI in managing this vast ecosystem.

- Data Synchronization: Real-time application integration ensures data consistency across PCs, laptops, and handheld devices

Enterprise Impact:

Key Highlights

- Ecosystem Binding: As digital transformation advances, enterprise software integration is shifting from back-end to a critical role in binding the entire ecosystem.

- Architectural Flexibility: EAI solutions are evolving to support cloud and on-premise environments, agile delivery, and plug-and-play architectures.

Industry-Specific Adoption TrendsThe adoption of EAI solutions varies across industries, with IT and telecom, BFSI, and manufacturing sectors leading the charge. Each sector leverages EAI to address unique challenges and capitalize on emerging opportunities.

IT and Telecom:

Key Highlights

- Market Leadership: The IT and telecom segment is projected to reach USD 7.28 billion by 2027, growing at a CAGR of 17.64%.

- Telecom Integration: Enterprise software integration projects are crucial for integrating custom and market application systems in telecom operations, balancing technology with business imperatives.

BFSI Sector:

Key Highlights

- Digital Payments: The rise of digital payment methods is driving the need for robust data management systems, fueling EAI market growth.

- Innovative Platforms: BlocPal International Inc.'s development of a unique physical and virtual financial services platform exemplifies the sector's push towards integrated digital solutions.

Manufacturing:

Knowledge Engineering: EAI is critical in integrating dispersed and autonomous manufacturing systems, supporting paradigms like virtual enterprise and mass customization.

Key Highlights

- Competitiveness: Efficient application of IT and knowledge-based engineering through EAI enhances firms' ability to respond swiftly to market developments.

- Future Outlook: Evolving Integration Landscape : The future of Enterprise Application Integration is characterized by increasing complexity and the need for more sophisticated, agile solutions. As organizations continue to rely heavily on technology, the demand for integrating diverse applications will only intensify

Emerging Trends:

Key Highlights

- Expanded Integration Scope: Future EAI solutions will need to consider a vastly larger collection of endpoints both inside and outside the organization.

- Rapid Innovation: The frequency of changes in integration requirements is accelerating, necessitating more flexible and responsive EAI platforms.

- Mobile Integration: It's projected that 20% of integration spending will be directed towards integrating data on mobile devices, addressing challenges like intermittent connectivity and variable throughput

Strategic Imperatives:

Key Highlights

- Balancing Stability and Innovation: IT leaders must maintain control over critical systems while fostering rapid iteration of applications accessing those systems.

- Prefetching and Caching: Mobile apps are increasingly employing sophisticated data prefetching and caching strategies to compensate for connectivity issues.

- Continuous Adaptation: EAI solutions must evolve to support the rapid pace of innovation that distinguishes digital transformation initiatives.

Enterprise Application Integration Market Trends

IT and Telecom Segment: Largest End-User Segment

The IT and Telecom segment emerges as the dominant force in the Enterprise Application Integration (EAI) market, projected to reach USD 7.28 billion by 2027 with a CAGR of 17.64%. The substantial growth underscores the critical role of enterprise software integration solutions in addressing the complex integration needs of the IT and Telecom industries, particularly in the realm of cloud computing and digital transformation.

Cloud Migration Drives Integration Demand:

- Data and Infrastructure Migration: The increasing migration of data, processes, and infrastructure to the cloud by banks and telecom operators is a significant driver for EAI adoption.

- Operational Seamlessness: This shift necessitates robust integration capabilities to ensure seamless operation across diverse systems and applications.

- Cloud-based Focus: Businesses are increasingly prioritizing data platform as a service (dPaaS) over traditional integration platform as a service (iPaaS) models to enhance operational scalability.

Telecom Operators' Core Process Integration:

- Complexity of Integration: Telecom operators are undertaking extensive EAI projects to support core processes, creating middleware infrastructures to integrate custom and market application systems.

- Cross-National Integration: Telecom companies face unique challenges in aligning technical solutions across international subsidiaries, emphasizing the importance of comprehensive integration platforms.

Real-Time Integration and IoT Convergence:

- API-Centric Solutions: The convergence of mobile applications, IoT, and wearables is driving the demand for real-time, API-driven integration solutions.

- Proliferation of Devices: By 2030, projections of 500 billion connected devices emphasize the need for robust integration solutions to manage the data flow across these ecosystems.

Collaborative Software Solutions Drive Integration Needs:

- Virtual Collaboration Surge: The rise of virtual meeting and collaboration tools, such as Microsoft Teams and Zoom, has indirectly boosted demand for integrated enterprise solutions.

- System Interoperability: Businesses are seeking solutions that integrate collaborative software with existing systems, further driving the need for EAI.

North America: Fastest-Growing Regional Segment

North America stands out as the fastest-growing regional segment in the Enterprise Application Integration (EAI) market, projected to reach USD 14.26 billion by 2027, registering a CAGR of 16.41%. The region's leadership in digital transformation and the widespread adoption of cloud-based enterprise integration solutions highlight its rapid growth trajectory.

Widespread Application Integration:

- High Adoption Rate: Over 93% of U.S. businesses utilize business applications, creating fertile ground for enterprise software integration providers.

- Operational Efficiency: As companies adopt more applications, the demand for seamless integration solutions that enhance operational efficiency continues to grow.

Strategic Alliances and Innovative Solutions:

- Partnerships Driving Innovation: Strategic collaborations, such as HiQ's alliance with the European Cloud City Network and the Frends iPaaS platform, are driving innovation in hybrid cloud integration strategies.

- Regulatory Compliance: These partnerships focus on offering solutions that ensure full compliance with data laws and regulations, critical for public and commercial sector businesses.

Cloud Integration and Digital Transformation:

- Technological Disruptions: The increasing adoption of IoT, cloud computing, and digital transformation initiatives is propelling the demand for EAI solutions across various industries in North America.

- Vendor Focus: Key players in the region, such as IBM and Fujitsu, are leading with innovations like SaaS-based security solutions, driving market growth.

- Consolidated Market: The North American EAI market is moderately consolidated, with global players focusing on cutting-edge technologies to maintain their competitive edge.

- Zero-Trust Architecture: Innovations such as the introduction of zero-trust architecture for security are becoming critical in the deployment of EAI solutions in enterprise environments.

Enterprise Application Integration Industry Overview

Global Players Dominate Semi Consolidated Market

The Enterprise Application Integration (EAI) market is characterized by a semi consolidated structure, with global players such as IBM Corporation, Fujitsu Ltd, and Microsoft holding significant market share. These technology conglomerates leverage their extensive resources, global presence, and technological expertise to dominate the market while smaller, innovative companies carve out niche roles with specialized solutions.

Comprehensive Offerings:

End-to-End Solutions: Global leaders offer comprehensive enterprise application integration solutions that cater to the diverse needs of organizations across industries.

Partnership Ecosystems: Companies like IBM and Microsoft have built extensive ecosystems of partners, enabling them to provide integration across a wide range of business applications and data sources.

Research and Development Focus:

Emerging Technologies: Key players invest heavily in R&D, focusing on innovations in artificial intelligence (AI), machine learning, and cloud computing to advance their EAI platforms.

Support for Hybrid Environments: Their integration solutions are designed to support hybrid cloud integration strategies, ensuring smooth transitions between on-premise and cloud-based infrastructures.

Innovation and Adaptability:

Cloud-Native Architectures: Market players are increasingly shifting towards cloud-native architectures to meet the growing demand for scalable, flexible solutions.

Low-Code/No-Code Tools: The introduction of low-code/no-code tools is expanding the reach of integration capabilities, allowing non-technical users to contribute to data integration services.

Security and Compliance:

Data Privacy Concerns: As enterprises grapple with growing data privacy concerns, EAI vendors and providers are emphasizing security, compliance, and governance features in their solutions to gain a competitive edge.

API Management: Robust API management for EAI is becoming a critical differentiator, allowing organizations to securely integrate a vast number of applications and endpoints.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Degree of Competition

- 4.4 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Digital Transformation Reshaping Enterprise Landscapes

- 5.1.2 Increasing Demand for Real-time Data Access and Management

- 5.1.3 API-Driven Integration Powering the Connected Enterprise

- 5.2 Market Challenges

- 5.2.1 Availability of Open Source Software

- 5.2.2 The lack of integration makes automating simple tasks challenging, impacting operational efficiency.

- 5.3 Assessment of Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 Deployment Type

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.1.3 Hybrid

- 6.2 Organisation Size

- 6.2.1 Large Enterprises

- 6.2.2 Small and Medium-sized Enterprises

- 6.3 End-user Industry

- 6.3.1 BFSI

- 6.3.2 IT and Telecom

- 6.3.3 Healthcare

- 6.3.4 Retail

- 6.3.5 Government

- 6.3.6 Manufacturing

- 6.3.7 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Fujitsu Limited

- 7.1.3 Microsoft Corporation

- 7.1.4 MuleSoft LLC (Salesforce Inc.)

- 7.1.5 Oracle Corporation

- 7.1.6 SAP SE

- 7.1.7 Software AG

- 7.1.8 Tibco Software Inc.

- 7.1.9 iTransition Group