|

市場調查報告書

商品編碼

1685814

機器視覺系統 (MVS) -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Machine Vision Systems (MVS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

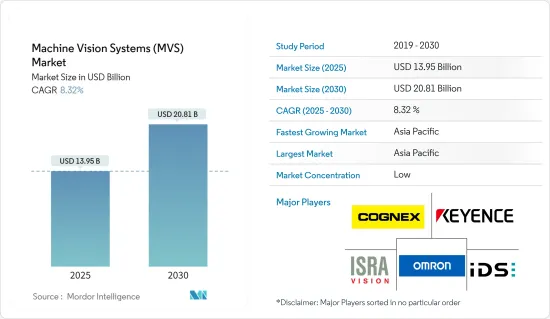

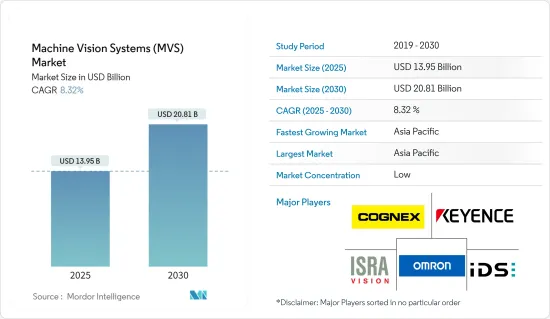

機器視覺系統市場規模預計在 2025 年為 139.5 億美元,預計到 2030 年將達到 208.1 億美元,在市場估計和預測期(2025-2030 年)內以 8.32% 的複合年成長率成長。

機器視覺系統依靠工業相機內部受專門光學元件保護的數位感測器來捕捉影像,以便電腦硬體和軟體可以處理、分析和測量各種特性以進行決策。

主要亮點

- 過去幾十年,工業自動化逐漸發展,市場結構幾乎沒有改變。但由於技術顛覆、產業回流、全球技術純熟勞工短缺以及環境、社會和管治(ESG) 措施等宏觀趨勢,變化的步伐正在加快。最近,第一波新冠疫情導致大部分製造業放緩。但這只是暫時的。隨著製造業的復甦,產量激增。隨著企業開始復工,保持社交距離仍是新常態,越來越多的員工無法佔用同一工作空間或進入辦公室,因此對視覺和自動化系統的需求日益成長,以填補這一空白。

- 工業自動化的潛力在一小部分被稱為「數位燈塔工廠」的製造基地中表現得最為明顯。這些工廠在自動化方面處於領先地位。根據世界經濟論壇的一項研究,93%的燈塔工廠已透過採用自動化實現了成長效益。大部分成長效益來自於提高產量的能力,自動化為少數工廠帶來了新的收入來源。

- 因此,他們看到機器視覺的應用激增,並積極尋找在其營運中實施這項革命性技術的方法。決策者一直在尋找提高生產力、品質和可追溯性的方法,並因此發現製造和物流線中越來越多的應用可以透過機器視覺進行改進。

- 這一成長是由製造業對改進產品檢驗和品管的需求,以及製造和倉儲業對更智慧協作機器人的不斷成長的需求所推動的。此外,自動化和機器視覺技術提高了業務效率和生產力,降低了生產成本並擴展了工人的能力。

- 推動成長的另一個因素是製造業需要改進產品檢驗和品管,以及製造和倉儲對更智慧的協作機器人的需求不斷成長。此外,自動化和機器視覺技術提高了業務效率和生產力,降低了生產成本並擴展了工人的能力。

- 然而,目前市場缺乏能夠有效整合高品質圖形、使用者友善介面和以程式碼為中心的演算法的高度適應性軟體。因此,上述熟練工人的短缺正在阻礙市場擴張。

機器視覺系統(MVS)市場趨勢

相機是最大的硬體部分

- 機器視覺相機在工業影像處理鏈中發揮關鍵作用。這些相機使用特定的通訊協定與電腦通訊,然後電腦可以分析影像資料並調整相機設定。機器視覺相機具有廣泛的應用範圍。它們可用於生產控制、物體流控制、表面檢查、電子元件製造、機器人引導等。

- 機器視覺相機可以將光學影像轉換為類比或數位訊號。這些攝影機採用基於 PC 的處理硬體和軟體演算法來分析影像、視訊和資料,從而實現手動任務的自動化。另一方面,傳統的智慧相機是自足式的單元,將機器視覺相機、處理器和照明設備整合到一個緊湊的機殼中。這些智慧相機無需單獨的 PC 即可擷取和分析影像和資料。

- 智慧相機已成為 MV 系統中流行的硬體組件。透過整合照明、影像感測器、軟體和 I/O,它大大簡化了機器視覺系統設計過程。隨著時間的推移,智慧相機的功能和規格不斷擴展。這包括推出具有更大影像感測器的模型、充當智慧相機的嵌入式視覺相機的出現,以及開發可以執行深度學習和人工智慧任務的新型相機。

- 機器視覺已成為相機技術的前沿進步,並正在徹底改變物流、製造和智慧設備等多個工業領域。智慧相機技術的發展使製造商能夠輕鬆開發和實施根據客戶特定要求量身定做的機器視覺模型,幫助客戶從其寶貴的資料中獲得全面、可操作的見解。由於外形規格小巧、處理能力強的智慧相機日益普及,預計該市場將大幅成長。

- 例如,2023 年 5 月,Jivid 推出了其突破性的最先進的 3D 彩色相機系列,預計將對機器視覺和自動化領域產生重大影響。此次發展將使公司進一步增強其能力,使客戶能夠在包括拆垛、箱式揀選、拾取和放置、組裝、包裝和品管等各種應用中最佳化效率和生產力。這些發展預計將增加市場機會並為市場提供顯著的推動力。

- 該技術的應用涉及許多行業,包括機器人引導和自動化、品管和檢查以及地圖繪製。在技術進步和各行各業對自動化日益成長的需求的推動下,機器人在製造業中的應用預計將擴大相機在機器視覺系統中的潛力。例如,國際機器人聯合會(IFR)2023年的一項研究發現,美國製造業在2023年大幅加大了自動化力度,工業機器人安裝數量飆升12%,達到44,303台。

亞太地區預計將佔據主要市場佔有率

- 中國工業生產率高,是世界上成長最快的國家之一。這推動了該國的機器視覺系統市場的發展。投資計畫旨在提高成長品質、解決環境問題並減少產能過剩。與製造工廠的規模和員工數量相比,該國實施工廠自動化、流程和機器人技術的公司數量很少。這將為中國機器視覺領域的企業創造巨大的機會。

- 日本在半導體和電子產業中也佔有重要地位。根據WSTS預測,日本半導體產業銷售額預計在2022年成長14.2%,並在未來幾年持續成長。此外,由於該國正在採取各種措施來增加自動駕駛汽車的採用,預計該國汽車行業的成長也將在預測期內支持市場成長。

- 韓國蓬勃發展的汽車工業正在推動對機器視覺系統的需求。不斷成長的消費者需求和政府的支持政策是推動自動駕駛汽車和電動車普及的主要因素。根據韓國國土交通省發布的報告,2022年韓國註冊的電動車數量將達到約39萬輛,較2013年大幅增加。加上混合動力汽車汽車和氫動力汽車,環保汽車約佔韓國註冊汽車總數的6.2%。

- 印度的工業自動化部門正在透過添加數位和實體技術來實現最佳性能,徹底改變製造業。此外,對零廢棄物製造和更快上市時間的重視正在推動市場成長。

- 亞太地區其他地區包括台灣、新加坡、印尼、馬來西亞、泰國、澳洲等。在印度尼西亞,工業 4.0 的出現正在推動市場發展,重點是食品和飲料、紡織和服飾、汽車、化學和電子行業採用自動化系統。印尼和德國之間的一項政府間計劃正在加強該國的Start-Ups生態系統。

- 該地區擁有強大的電子和半導體市場,吸引了跨國企業在該地區開展業務。這是推動新解決方案需求的一個主要因素。消費品和食品加工產業需要節省成本、高功率的解決方案。自動化不僅可以實現這些目的,還可以帶來其他好處,例如品質合規性和產品即時評估。這些新興市場在創造需求方面發揮關鍵作用。

機器視覺系統(MVS)市場概覽

機器視覺系統市場高度分散,主要參與者包括康耐視公司、基恩士公司、歐姆龍公司、Isra Vision AG(阿特拉斯科普柯集團)和 IDS Imaging Development Systems GmbH(Paul Hartmann AG)。市場參與企業正在採取夥伴關係和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023年10月,艾默生宣布收購NI。 NI 增加了艾默生在離散市場的終端市場曝光度,成為艾默生第二大工業部門。 NI 約 20% 的銷售額來自軟體,這筆交易還將增加艾默生在高成長工業軟體市場的曝光率。收購 NI 提升了艾默生作為全球自動化領導者的地位,並擴大了機會利用近岸外包、數位轉型、永續性和脫碳等關鍵趨勢的機會。

- 2023年8月,康耐視公司以2.75億美元的價格從中信資本控股有限公司的私募股權關聯公司Trustar Capital手中收購了Moritex公司。 Moritex 是全球領先的光學元件供應商,在日本擁有強大的影響力。預計 Moritex 將為康耐視貢獻約 6% 至 8% 的銷售額,並在 2025 年增加 GAAP EPS。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場動態

- 市場促進因素

- 品質檢驗需求日益成長

- 對視覺引導機器人系統的需求不斷增加

- 市場限制

- 缺乏靈活的機器視覺解決方案

第6章市場區隔

- 按組件

- 硬體

- 視覺系統

- 相機

- 光學和照明系統

- 影像擷取器

- 其他硬體

- 軟體

- 硬體

- 按產品

- 基於PC

- 智慧型相機底座

- 按最終用戶產業

- 食品和飲料

- 醫療保健和製藥

- 物流與零售

- 車

- 電子和半導體

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞洲

- 中國

- 日本

- 韓國

- 印度

- 澳洲和紐西蘭

- 北美洲

第7章競爭格局

- 公司簡介

- Cognex Corporation

- Keyence Corporation

- Omron Corporation

- Isra Vision AG(Atlas Copco Group)

- IDS Imaging Development Systems GmbH(Paul Hartmann AG)

- National Instruments Corporation(Emerson)

- MVTec Software GmbH

- Sony Group Corporation

- Teledyne DALSA(Teledyne Technologies Company)

- Toshiba Corporation

第8章投資分析

第9章 市場機會與未來趨勢

The Machine Vision Systems Market size is estimated at USD 13.95 billion in 2025, and is expected to reach USD 20.81 billion by 2030, at a CAGR of 8.32% during the forecast period (2025-2030).

Machine vision systems rely on digital sensors protected inside industrial cameras with specialized optics to acquire images so that computer hardware and software can process, analyze, and measure various characteristics for decision-making.

Key Highlights

- Over the past few decades, industrial automation has evolved gradually, with few changes in market structure. But the pace of change is accelerating thanks to technology disruptions and macro trends such as reshoring, a global skilled-labor shortage, and environmental, social, and governance (ESG) efforts. In the recent past, the first wave of the COVID-19 pandemic created a slowdown in much of manufacturing. However, it was only temporary. As manufacturing returned, there was a boom in production. As companies began to return to work while maintaining social distancing as the new norm, there was an increased need for vision systems and automation systems to help fill the void, with more workers being unable to occupy the same workspace or unable to come in.

- The potential of industrial automation is most obvious in the tiny percentage of manufacturing sites known as "digital lighthouse factories." These plants are leading the way in automation. A survey by the World Economic Forum found that 93% of lighthouse factories had gotten a growth benefit from their embrace of automation. Most of the growth benefit came from the ability to increase their output, with automation leading to new revenue streams for a handful of factories.

- As a result, machine vision is experiencing a surge in adoption, with organizations actively seeking more ways to deploy this transformative technology across their operations. Decision-makers are continually searching for ways to enhance productivity, quality, and traceability, and as a result, are identifying more applications on their manufacturing and logistics lines that can be improved with machine vision.

- Driving this growth is the need for improved product inspection and quality control in the manufacturing sector, as well as the growing demand for smarter collaborative robots in manufacturing and warehousing. Automation and machine vision technologies also improve operational efficiency and productivity, reduce production costs, and expand worker capabilities.

- Another factor driving growth is the need for improved product inspection and quality control in the manufacturing sector, as well as the growing demand for smarter collaborative robots in manufacturing and warehousing. Automation and machine vision technologies also improve operational efficiency and productivity, reduce production costs, and expand worker capabilities.

- However, the current market is experiencing a deficiency in adaptable software that effectively integrates high-quality graphics and user-friendly interfaces with code-centric algorithms. Thus, due to the aforementioned shortage of proficient individuals, the market encounters a hindrance in its expansion.

Machine Vision Systems (MVS) Market Trends

Cameras to be the Largest Hardware Segment

- Machine vision cameras play a crucial role in the industrial image processing chain. These cameras utilize a particular protocol to communicate with a computer, which then analyzes the image data and can even adjust the camera's settings. The applications of machine vision cameras are diverse and extensive. They can be utilized for production control, managing object flow, inspecting surfaces, manufacturing electronic components, and guiding robots.

- Machine vision cameras are capable of transforming an optical image into an analog or digital signal. These cameras employ PC-based processing hardware and software algorithms to analyze images, videos, and data, facilitating the automation of manual tasks. On the other hand, traditional smart cameras are self-contained units that integrate a machine vision camera, a processor, and lighting within a compact enclosure. These smart cameras have the ability to capture and analyze images and data without requiring a separate PC.

- Smart cameras are becoming a popular hardware component in the MV System. They have greatly simplified the process of designing machine vision systems by integrating lighting, image sensors, software, and I/O. Over time, the capabilities and specifications of smart cameras have expanded. This includes the introduction of models with larger image sensors, the emergence of embedded vision cameras that can function as smart cameras, and the development of new cameras that are capable of executing deep learning and artificial intelligence tasks.

- Machine vision has emerged as a cutting-edge advancement in camera technology, revolutionizing multiple industrial sectors such as logistics, manufacturing, and smart devices. With the advent of smart camera technologies, manufacturers can effortlessly develop and implement machine vision models tailored to their customer's specific requirements, helping customers gain comprehensive and actionable insights from valuable data. The market is poised to witness significant growth due to the rising popularity of smart cameras, which offer enhanced processing capabilities in compact form factors.

- For instance, in May 2023, Zivid launched a revolutionary line of its latest 3D color cameras, poised to make a significant impact on the machine vision and automation sectors. This development empowers the company to further enhance its capabilities, enabling customers to optimize efficiency and productivity across various applications such as de-palletizing, bin-picking, pick-and-place, assembly, packaging, and quality control. Such developments are expected to increase the potential of the market opportunities and drive the market at a significant rate.

- The utilization of technology spans numerous industries, encompassing robotic guidance and automation, quality control and inspection, as well as mapping. The growing adoption of robotics in the manufacturing sector is anticipated to amplify the potential of cameras for machine vision systems, driven by technological advancements and the rising demand for automation in various industries. For instance, according to a survey published by the International Federation of Robotics (IFR) in 2023, In 2023, U.S. manufacturing firms significantly ramped up their automation efforts, with industrial robot installations surging by 12% to a total of 44,303 units.

Asia-Pacific is Expected to Hold Significant Market Share

- China is one of the world's fastest-growing countries with a high industrial production rate. This acts as a driver for the machine vision systems market in the country. Investments are planned to improve the quality of growth, address environmental issues, and reduce overcapacity. The number of companies deploying factory automation, process, and robotics technologies in the country is smaller than the enormous scale of its manufacturing facilities and the number of workers it employs. This represents a big opportunity for companies in China's machine vision sector.

- Japan also holds a significant position in the semiconductor and electronics industries as it is home to some essential semiconductor manufacturers. According to WSTS, the semiconductor industry revenue in Japan grew by 14.2% in 2022, and it is expected to grow further over the coming years. Furthermore, the country's growing automotive industry is also expected to support market growth over the forecast period as various steps have been taken to increase the adoption of autonomous vehicles.

- In South Korea, the automotive industry is flourishing, driving the demand for machine vision systems. Growing consumer demand and supportive government policies are among the significant factors driving the country's adoption of autonomous and electric vehicles. According to a report published by the Ministry of Land, Infrastructure and Transport (South Korea), around 390 thousand electric vehicles were registered in South Korea in 2022, with a sharp increase recorded after 2013. Together with hybrid and hydrogen vehicles, the share of environment-friendly vehicles among the total number of registered vehicles in South Korea was about 6.2%.

- India's industrial automation sector has been revolutionized by the addition of digital and physical technologies in manufacturing to deliver optimal performance. Additionally, emphasis on zero-waste manufacturing and a shorter time-to-market has increased market growth.

- The rest of Asia-Pacific comprises Taiwan, Singapore, Indonesia, Malaysia, Thailand, Australia, etc. In Indonesia, the onset of Industry 4.0 is driving the market studied, with a focus on implementing automation systems in the food and beverage, textiles and clothing, automotive, chemical, and electronics industries. Cross-government initiatives between Indonesia and Germany are strengthening the start-up ecosystem in the country.

- The presence of strong electronics and semiconductor markets in the region has pushed multinational industries to establish their operations there. This has been a significant factor in the growing demand for new solutions. Cost-cutting and high-output solutions are a few sought-out solutions in the consumer goods and food processing industry. Automation serves these purposes and brings additional benefits, such as quality adherence and real-time assessment of the products. These developments have been critical in demand generation in these regional markets.

Machine Vision Systems (MVS) Market Overview

The machine vision systems market is highly fragmented, with the presence of major players like Cognex Corporation, Keyence Corporation, Omron Corporation, Isra Vision AG (Atlas Copco Group), and IDS Imaging Development Systems GmbH (Paul Hartmann AG). The players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- October 2023: Emerson announced the acquisition of NI. NI increases Emerson's end market exposure in discrete markets, which will be Emerson's second largest industry segment. With approximately 20% of its sales in software, NI also increases Emerson's exposure to high-growth industrial software markets. The acquisition of NI advances Emerson's position as a global automation leader and expands its opportunities to capitalize on critical secular trends like nearshoring, digital transformation, sustainability, and decarbonization.

- August 2023: Cognex Corporation acquired Moritex Corporation (Moritex) from Trustar Capital, a private equity affiliate of CITIC Capital Holdings Limited, for USD 275 million. Moritex is a leading global provider of optics components with a strong presence in Japan. Moritex is expected to contribute around 6-8% of Cognex's revenue, and the acquisition is expected to be accretive to GAAP EPS in 2025.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Need for Quality Inspections

- 5.1.2 Increasing Demand for Vision-guided Robotic Systems

- 5.2 Market Restraints

- 5.2.1 Scarcity of Flexible Machine Vision Solutions

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.1.1 Vision Systems

- 6.1.1.2 Cameras

- 6.1.1.3 Optics and Illumination Systems

- 6.1.1.4 Frame Grabbers

- 6.1.1.5 Other Types of Hardware

- 6.1.2 Software

- 6.1.1 Hardware

- 6.2 By Product

- 6.2.1 PC-based

- 6.2.2 Smart Camera-based

- 6.3 By End-user Industry

- 6.3.1 Food and Beverage

- 6.3.2 Healthcare and Pharmaceutical

- 6.3.3 Logistics and Retail

- 6.3.4 Automotive

- 6.3.5 Electronics and Semiconductors

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 South Korea

- 6.4.3.4 India

- 6.4.4 Australia and New Zealand

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cognex Corporation

- 7.1.2 Keyence Corporation

- 7.1.3 Omron Corporation

- 7.1.4 Isra Vision AG (Atlas Copco Group)

- 7.1.5 IDS Imaging Development Systems GmbH (Paul Hartmann AG)

- 7.1.6 National Instruments Corporation (Emerson)

- 7.1.7 MVTec Software GmbH

- 7.1.8 Sony Group Corporation

- 7.1.9 Teledyne DALSA (Teledyne Technologies Company)

- 7.1.10 Toshiba Corporation