|

市場調查報告書

商品編碼

1444468

超級電腦:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Supercomputers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

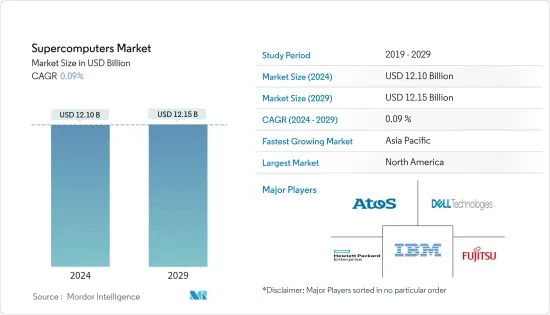

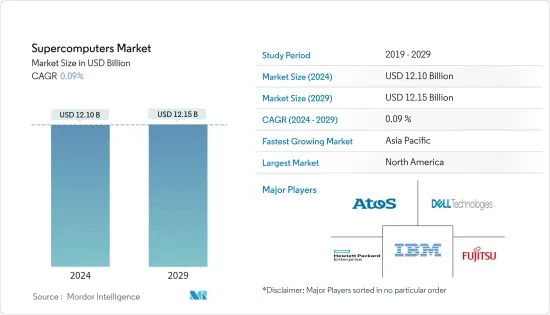

超級電腦市場規模預計到 2024 年為 121 億美元,預計到 2029 年將達到 121.5 億美元,在預測期內(2024-2029 年)年複合成長率為 0.09%。

雲端技術日益廣泛的使用是超級電腦市場的主要趨勢之一。隨著工作負載的增加,超級運算中心正在採用雲,並行應用程式在雲端中運行,因為它們不需要特定的架構。

主要亮點

- 現代超級電腦的架構主要由平行處理組成,即將一個問題分成幾個部分,同時處理多個部分。百萬兆級計算是全球投資運算系統的重要趨勢。每秒至少可以執行一次 exaFLOPS 計算。

- 超級電腦將為國家的科學進步和國家安全做出巨大貢獻。超級運算中心擴大使用雲端服務來處理工作負載和安全性。雲端服務運作不需要高度專業化基礎架構的平行程序。然而,我們預計未來幾年將會看到更複雜的應用程式在雲端上運行。例如,美國超級電腦製造商Cray與微軟合作,將其設備和儲存系統部署在Azure雲端平台上。 Microsoft Azure 讓客戶在 Microsoft Azure 雲端服務上執行最具策略性的工作負載。

- 市場供應商的增加是出於保持競爭力並提供具有更高處理能力的尖端技術的願望。 2022 年 2 月,印度政府部署了一台名為 Param Pravega 的強大超級電腦,擁有 3.3 petaflops 的超級運算能力。它是在班加羅爾印度科學研究所設立的,也是「舉措製造」計畫的一部分。

- 主要公司增加對超級電腦研發的投資有助於增加市場收益。例如,英特爾與美國能源局阿貢國家實驗室合作開發的超級電腦Aurora,用於人工智慧研究,其速度是預期的兩倍。據英特爾稱,這台電腦每秒可以處理 2 兆次計算。新興國家聯邦組織活動的擴大預計也將推動市場收益的成長。

- 安裝成本高和空間不足是市場收益擴大的主要障礙。超級電腦的成本是普通電腦的 10 倍,並且需要大量的維護成本。必須任命一個專門的團隊來監督和管理超級電腦,並使用特定的應用程式來檢測問題以及一般機器的使用情況。缺點除了價格高之外,還包括尺寸、維護、功耗和散熱。

- 由於 COVID-19,企業(包括政府和教育等公共和私營部門)對資料中心、人工智慧和機器學習的需求激增。這種成長對超級電腦的需求產生了積極的影響。這種成長預計將持續到 2022年終,從而擴大超級電腦在各個最終用戶產業的影響力和重要性。 IBM 正在與美國COVID-19 部門和白宮科技政策辦公室合作,提供超過 330 petaflops 的處理能力、775,000 個治療方法和潛力治療方法。

超級電腦市場趨勢

對更高處理能力的需求不斷成長以推動市場成長

- 由於需要管理和處理大量資料,公司尋求分析這些資料以支援決策。最終用戶也希望保持他們的競爭優勢。因此,與較少依賴資料的組織相比,高度資料驅動的組織顯著改善了決策。對資料管理和決策的更高處理能力不斷成長的需求正在推動超級電腦市場的發展。

- 許多專注於提高各個最終用戶領域處理能力的供應商進一步推動了市場的發展。例如,印度理工學院甘地訥格爾分校 (IIT Gandhinagar) 於 2022 年 5 月推出了 Param Ananta。這為多個領域的研究計劃提供了額外的空間,包括機器學習、資料科學、計算流體力學、生物工程等。

- BFSI 產業已與許多供應商合作實施自動化並投入研究計劃,推動超級電腦市場的擴張。例如,2022年1月,創新科技部(ITM)與OTP銀行合作打造了人工智慧超級電腦的第一個模組。該模組採用匈牙利特定語言模型構建,允許您管理匈牙利地區的電話銀行業務業務。

- 此外,超級電腦架構的第一個分區是使用 Atos 的 BullSequana 部門(CEA/DAM)發布的。它是最廣泛的超級運算系統,基於已安裝的通用 CPU,具有 12,960 個 AMD 處理器。它使用 4.96 MW 的功率,並具有 23.2 petaflops 的運算能力。

- 美國國防部資助軍事和國防研究。超級電腦方面也正在進行大量工作,特別是支援美國運輸司令部的通用緊急行動要求。該計劃正在尋找方法來大幅降低與 COVID-19 乘客航空運輸相關的風險,同時利用空軍為機組人員和醫務相關人員提供服務。

- 世界各國政府意識到他們需要超級電腦來實現經濟安全和競爭。他們使用超級電腦開發尖端電子戰設備和防禦系統。

亞太地區成長強勁

亞太地區在技術方面正在快速成長。中國和日本等國家對該地區超級運算系統的快速成長負有主要責任。

- 與其他國家相比,中國等國家擁有發達的超級運算環境,投資規模也較大。根據 Top500.org 的數據,截至 2022 年 6 月,中國擁有世界 500 台最強大的超級電腦中的約 173 台,是最接近的競爭對手美國的三倍,另外還有 128 台超級電腦。

- 據通訊,中國研究人員聲稱已經建造了一台原型量子電腦,可以透過高斯玻色子取樣檢測多達 76 個光子。中國研究人員正在與Google、亞馬遜和微軟公司等美國大公司爭奪技術主導。此外,習近平政府聲稱正在斥資 100 億美元建設量子資訊科學國家實驗室,作為更大規模推動該領域的一部分。

- 印度等新興國家在亞太市場的成長中發揮關鍵作用。該國已推出國家超級運算任務,計畫在2023年吸引投資7.3億美元,建造由73個高效能運算設施組成的超級運算網格。據科學技術部 (DST) 稱,印度計劃在 2022 年至今推出四台新超級電腦,提高超級電腦能力。安裝完成後,超級電腦總數將增加至19台。

- 日本也是亞太超級超級電腦市場的主要貢獻者,擁有全球 500 台最強大的超級電腦中約 33 台,持有K 電腦。日本2020年的旗艦計畫旨在投資超過10億美元,開發比該國K電腦更有效率的系統。 2022年8月,日本超級電腦「富嶽」啟動,旨在發現新藥和預測惡劣天氣。

- 根據法韓會議的報告,韓國計劃在 2030 年建造五台速度最快的百億億次百萬兆級超級電腦之一,可能使用國產晶片。這些處理能力趨勢將進一步推動亞太地區超級運算的成長。

超級電腦產業概況

超級電腦市場正在整合,少數主要企業佔據了更大的市場佔有率。主要企業包括 HPE、Atos SE、戴爾公司、富士通公司、IBM 公司、聯想公司和 NEC Technologies India Private Limited。

- 2022 年 1 月 - Meta(以前稱為 Facebook)演變成新一代 AI,稱為 AI Research SuperCluster (RSC),旨在為令人印象深刻的壯舉等即時互動提供支援。世界正在建造一台大型新型超級電腦.它可以幫助使用不同語言的大型團體無縫協作研究計劃或一起玩 AR 遊戲。

- 2021 年 11 月 - Atos SE 與 NVIDIA 合作,透過卓越人工智慧實驗室 (EXAIL) 下的百億億次級超級運算推進醫療保健和氣候研究計算。該計劃旨在匯集科學家和研究人員,支持歐洲計算技術、教育和研究的進步。此次合作還包括研究人員在 Djurich 超級運算中心歐洲最快的超級電腦上運行新的人工智慧和深度學習模型。

- 2021 年 11 月 - 慧與宣布推出歐洲最強大的超級電腦,該電腦將在法國三個高性能計算 (超級電腦 ) 中心之一的 CINES(國家高等教育計算中心)安裝和運行。他們的一台電腦。這台新超級電腦由法國國家機構 GENCI 採購,該機構投資並提供 HPC 資源以支援法國的學術和工業研究界。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 對更高處理能力的需求不斷成長

- 加大研究投入

- 市場限制因素

- 初始設定成本高

- 安裝空間大

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間敵對的強度

- 評估 COVID-19 對市場的影響

第5章市場區隔

- 按最終用戶產業

- 商業業

- 政府機關

- 調查機構

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭形勢

- 公司簡介

- Atos SE

- Intel Corporation

- Hewlett Packard Enterprise

- Dell EMC(Dell Technologies Inc.)

- Fujitsu Ltd

- IBM Corporation

- Lenovo Inc.

- NEC Technologies India Private Limited

第7章 投資分析

第8章市場機會與未來趨勢

The Supercomputers Market size is estimated at USD 12.10 billion in 2024, and is expected to reach USD 12.15 billion by 2029, growing at a CAGR of 0.09% during the forecast period (2024-2029).

The increasing use of cloud technology is one of the significant supercomputer market trends. With the growing workload, supercomputing centers are adopting the cloud, and the cloud is running parallel applications as they do not require particular architecture.

Key Highlights

- A modern supercomputer's architecture is majorly configured with parallel processing, meaning it splits the problems into pieces while working on several pieces simultaneously. Exascale computing is a significant trend that has enabled worldwide investment in computing systems. Exascale can provide at least one exaFLOPS (a quintillion) calculation per second.

- Supercomputers substantially contribute to the scientific progress of a country and national security. Supercomputing centers are increasingly using cloud services to handle workloads and security. Cloud service executes parallel programs that do not require a highly specialized infrastructure. However, more sophisticated apps are expected to be run on the cloud in the coming years. For instance, Cray, a supercomputer manufacturer located in the U.S., partnered with Microsoft to deploy its devices and storage systems to the Azure Cloud platform. By using Microsoft Azure, customers can run their most strategic workload in Microsoft Azure's cloud service.

- The increase in market suppliers is driven by the desire to stay competitive and provide the most advanced technologies with higher processing power. In February 2022, A powerful supercomputer named Param Pravega with a supercomputing capability of 3.3 petaflops was introduced by the Indian government. It was installed at the Indian Institute of Science in Bangalore as part of the Made in India initiative.

- Increased investments in the R&D of supercomputers by significant companies are contributing to the market's revenue growth. For instance, Aurora, a supercomputer built by Intel in the Chicago suburbs with the U.S. Department of Energy's Argonne National Laboratory for artificial intelligence research, will be twice as fast as anticipated. According to Intel, the computer can process two quintillion calculations per second. Expanding federal organization activities in developing countries is also expected to fuel market revenue growth.

- The high installation cost and ample space are significant barriers to expanding market revenue. Supercomputers are ten times more expensive than regular computers and have a hefty maintenance cost. A specialist team must be appointed to oversee and manage a supercomputer, and a specific application is employed that can detect issues as well as general machine usage. Its drawbacks are its size, maintenance, power consumption, and heat release, in addition to its high price.

- Due to COVID-19, there has been an exponential spike in need for data centers, AI, and ML among businesses, including those in the public and private sectors of government and education. This growth is positively impacting the demand for supercomputers. It is anticipated that this growth will continue through the end of 2022, spreading the influence and significance of supercomputers across a range of end-user industries. IBM, in association with the U.S. Department of Energy and the White House Office of Science and Technology Policy, launched the COVID-19 high-performance consortium with 16 systems that have more than 330 petaflops of processing power, 775,000 CPU cores, 34,000 GPUs, and counting in better understanding COVID-19, its treatments, and potential cures.

Supercomputers Market Trends

Increasing Demand for Higher Processing Power to Drive the Market Growth

- Enterprises with vast amounts of data to manage and process are looking to analyze this data to aid decision-making. It is also desired by end users to maintain a competitive advantage. Thus, highly data-driven organizations are witnessing significant improvements in decision-making than those who rely less on data. This increasing demand for higher processing power for managing data and decision-making is driving the supercomputers market.

- The market is further driven by many vendors' emphasis on more processing power for various end-user sectors. For instance, IIT Gandhinagar introduced Param Ananta in May 2022, which had additional space for research projects in multiple disciplines, including machine learning, data science, computational fluid dynamics, bioengineering, and more.

- The BFSI industry is partnering with many vendors for automation implementation and spending on research projects, fueling the supercomputer market's expansion. For instance, in January 2022, the Ministry of Innovation and Technology (ITM) and OTP Bank collaborated to build the first module of an AI supercomputer. The module was built in a unique Hungarian language model and will be able to manage phone banking operations in their region.

- Additionally, the first partition of "EXA1," a supercomputer built using Atos' BullSequana XH2000 architecture and featuring increased processing power for military and defense applications, was announced in November 2021 Atos and the CEA's Military Applications Division (CEA/DAM). It is the most extensive supercomputing system based on installed general-purpose CPUs, with 12,960 AMD processors. It uses 4.96 MW of power and has a computational capacity of 23.2 petaflops.

- The US Department of Defense is funding research in the military and defense fields. Significant work on supercomputers has also been performed, especially in support of a shared urgent operational requirement from the US Transportation Command. The project looks at ways to dramatically reduce the risk associated with airlifting COVID-19 passengers while utilizing the air force for aircrews and medical personnel.

- Governments worldwide recognize that supercomputers are necessary for achieving economic security and competitiveness for their respective countries. They are using supercomputers to develop state-of-the-art electronic warfare equipment and defense systems.

Asia-Pacific to Register a Significant Growth Rate

Asia-Pacific has been rapidly growing in terms of technology. Countries like China and Japan are majorly responsible for the region's rapid growth of supercomputing systems.

- Countries like China have well-developed supercomputing landscapes, with significant investments compared to other countries. According to Top500.org, as of June 2022, around 173 of the world's 500 most powerful supercomputers were located in China, three times more than its nearest competitor, the United States, accounting for an additional 128 supercomputers.

- According to Xinhua news agency, researchers from China claimed to have built a quantum computer prototype capable of detecting up to 76 photons through Gaussian boson sampling. Chinese researchers compete against major US corporations, including Google, Amazon, and Microsoft Corporation, for a lead in the technology. Additionally, Xi Jinping's government claimed it is building a USD 10 billion National Laboratory for Quantum Information Sciences as part of a big push in the field.

- Emerging nations like India play a significant role in the growth of the Asia-Pacific market. The National Supercomputing Mission in the country was introduced to raise USD 730 million in investment by 2023 to build a supercomputing grid, which will comprise 73 high-performance computing facilities. According to the Department of Science and Technology (DST), India was set to experience a boost in supercomputing capacities by launching four new supercomputers deployed in 2022 till date. Once deployed, the total number of supercomputers would grow to 19.

- Japan is another major contributor to the Asia-Pacific supercomputer market, with around 33 of the world's 500 most powerful supercomputers, including the K computer. Japan's flagship program 2020 aimed to invest more than USD 1 billion to develop more efficient systems than the K computer in the country. In August 2022, Japan's Fugaku supercomputer was launched to discover new drugs and predict severe weather forecasts.

- According to the report from French-Korean Conference, South Korea plans to build one of the five fastest exascale supercomputers by 2030, potentially with local chips. Such processing capabilities trends further encourage supercomputing growth in the Asia-Pacific region.

Supercomputers Industry Overview

The supercomputers market is consolidated due to a few significant players holding a greater market share. Some key players include HPE, Atos SE, Dell Inc., FUJITSU Corporation, IBM Corporation, Lenovo Inc., and NEC Technologies India Private Limited.

- January 2022 - Meta, formerly known as Facebook, is building a massive new supercomputer in the world intending to advance into a new generation of AI known as the AI Research SuperCluster (RSC) to power up real-time interactions, such as the impressive feat of helping large groups of people, each speaking a different language, seamlessly collaborate on a research project or play an AR game together.

- November 2021 - Atos SE partnered with NVIDIA to advance healthcare and climate research computing with Exascale Super Computing under Excellence AI Lab (EXAIL). The project aims to bring scientists and researchers together to help advance European computing technologies, education, and research. The partnership also includes researchers running new AI and deep learning models on Europe's fastest supercomputer at the Julich Supercomputing Center.

- November 2021 - Hewlett Packard Enterprise announced that it is building one of Europe's most powerful supercomputers to be installed and operated at CINES (National Computing Center for Higher Education), one of the three high-performance computing (HPC) centers in France. The new supercomputer was procured by GENCI, a French national agency that invests and provides HPC resources to support France's academic and industrial research communities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Higher Processing Power

- 4.2.2 Increasing Investments in Research

- 4.3 Market Restraints

- 4.3.1 High Initial Setup Cost

- 4.3.2 Large Installation Space

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact on the market

5 MARKET SEGMENTATION

- 5.1 By End User Industry

- 5.1.1 Commercial Industries

- 5.1.2 Government Entities

- 5.1.3 Research Institutions

- 5.2 By Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Atos SE

- 6.1.2 Intel Corporation

- 6.1.3 Hewlett Packard Enterprise

- 6.1.4 Dell EMC (Dell Technologies Inc.)

- 6.1.5 Fujitsu Ltd

- 6.1.6 IBM Corporation

- 6.1.7 Lenovo Inc.

- 6.1.8 NEC Technologies India Private Limited