|

市場調查報告書

商品編碼

1687273

光耦合器:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Optocouplers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

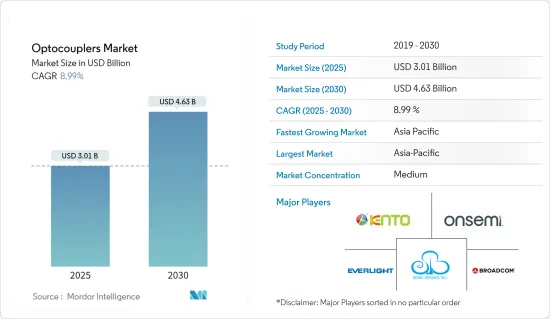

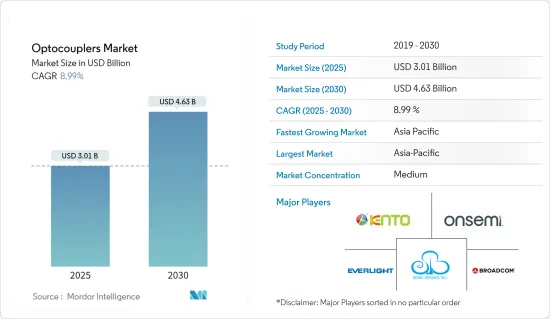

光耦合器市場規模預計在 2025 年為 30.1 億美元,預計到 2030 年將達到 46.3 億美元,預測期內(2025-2030 年)的複合年成長率為 8.99%。

工業自動化的擴展和許多最終用戶行業對訊號隔離解決方案的日益採用是預測期內市場研究的主要驅動力。光學無線系統的快速發展、電動和混合動力汽車需求的不斷成長以及數位光耦合器的出現可能會為光耦合器製造商帶來進一步的機會。

關鍵亮點

- 由於汽車、通訊和工業領域的需求不斷成長,光耦合器市場正在迅速擴張。由於光耦合器在通訊產業的應用日益廣泛,光耦合器市場也不斷擴大。

- 光耦合器通常會傳輸數位訊號,但在某些情況下也可以傳輸類比訊號。家用電子電器產品、智慧家用電子電器、電腦輔助設備等正在推動對光耦合器的需求。

- 由於無線設備、電動車需求不斷成長以及自動化等工業趨勢,光耦合器市場正在成長。公司正在投資光耦合器以提高其產品的性能。

- 預計有幾個關鍵因素將推動市場成長,包括工業自動化的擴張和訊號隔離解決方案的日益普及。隨著光學無線系統的快速發展、電動和混合動力汽車汽車需求的不斷成長以及數位光耦合器的出現,光耦合器製造商將面臨更多的機會。

- 光耦合器的可靠性受到挑戰。雖然 LED 故障可能是主要問題,但也提到了其他問題,例如界面污染和由於吸收水分而導致的熱機械應力。這些因素會導致光耦合器過早磨損。

光耦合器市場趨勢

工業自動化的成長推動了市場

- 工業領域傳統上一直是先進技術的領導採用者。隨著各行各業正在經歷新的技術變革,人工智慧、物聯網、機器學習、自動化和機器人等先進技術的採用顯著增加。 「工業4.0」概念正在推動該領域的數位轉型,使產業能夠實現即時決策,提高生產力、靈活性和敏捷性。

- 這種趨勢的轉變為研究市場的成長創造了良好的市場前景,因為需要安裝大量電氣和電子設備和電路來支援此類基礎設施。光耦合器旨在保護敏感的控制電路免受電壓波動、不必要的雜訊和電磁干擾的影響。光耦合器還可在工業應用中提供隔離,包括伺服自動化系統和工業機器人中的馬達控制電路、電源和光伏 (PV) 逆變器以及資料通訊和數位邏輯介面電路。

- 此外,在工業自動化應用中,光耦合器負責跨隔離屏障傳輸資料,同時濾除不必要的雜訊。如果該元件無法濾除不需要的噪聲,則可能會發生資料傳輸錯誤。影響 CMR 定義的因素包括共模電壓 (VCM) 以及瞬態訊號的上升和下降時間 (dv/dt)。透過增加 VCM 或 dv/dt 直到光耦合器輸出訊號處於相反的邏輯狀態來確定故障點。

- 在工業自動化通訊,印度、中國等開發中國家對光耦合器的需求正在增加。此外,由於光耦合器是自動化過程不可或缺的一部分,製造業擴大採用自動化也推動了市場的發展。

- 安裝數量最多的地區是亞洲和澳大利亞,預計2020年已安裝26.6萬台。預計2024年亞洲和澳洲將安裝37萬台工業機器人。

- 工業機器人由機械臂、人機介面(HMI)面板、控制板組成,因此需要對各個機器人零件和介面進行隔離,以確保整個機器人系統的安全運作。光耦合器是提供兩個電路之間電氣隔離的有效解決方案之一,可協助機器人系統促進各個功能單元之間的有效通訊。

亞太地區可望成為成長最快的市場

- 光耦合器最常用於提供安全隔離,以符合國家和國際監管要求。半導體產業的大量投資以及工業領域對高效光電元件不斷成長的需求正在推動亞太地區光耦合器的成長。

- 東亞是創新節能產品和汽車領域的主要貢獻者。然而,光耦合器還具有一個經常被忽視的優點:隔離電氣雜訊。中國憑藉其在半導體市場的強大支柱,成為該地區的主要影響者之一。該地區也是全球汽車產業和智慧型能源產品市場的主要貢獻者之一。

- 印度政府正在採取適當舉措,透過加大對製造業的關注來促進國家經濟發展。印度電子產業在出口和生產方面都取得了顯著的成長。工業領域對高效光電元件的需求不斷增加,加上半導體產業的大量投資,預計將推動該地區光耦合器的銷售。此外,政府鼓勵本地半導體市場成長的努力預計將吸引新參與企業。

- 在印度,為打造電子製造群,政府宣布了19個EMC(電子製造群),其中3個分配給安得拉邦政府。

- 根據中國國家統計局的數據,到2023年,工業業增加值將佔中國國內生產總值的31.7%左右。工業 4.0,也稱為第四次工業革命,是製造業的自動化和工業實踐的升級,推動了工業領域對光耦合器的需求。

- 光耦合器可用作開關設備或與其他電子設備配合使用,以隔離低電壓和高壓電路。在電子設備中,嵌入式系統通常依賴光耦合器接收來自外部感測器或開關的輸入訊號。印度政府最近宣布了一項為期四年、總額為 7,325 億盧比(8.882 億美元)的生產掛鉤激勵 (PLI) 計劃,面向國內筆記型電腦、平板電腦、個人電腦和伺服器製造商。未來四年內,PLI 計畫預計將透過生產賺取 3.26 兆印度盧比(395 億美元),透過出口賺取 2.45 兆印度盧比(297 億美元)。

光耦合器產業概況

光耦合器市場是一個半固定市場,主要參與者包括深圳健拓電子、億光電子、森霸感測科技、安森美半導體公司和博通。該市場的參與企業正在採取夥伴關係、創新和收購等策略來加強其產品供應並獲得永續的競爭優勢。

2022 年 11 月 Vishay Intertechnology Inc. (VSH) 正在採取重大舉措,使其分離產品線多樣化,以鞏固其在快速成長的光耦合器市場中的地位。該公司推出了線性光耦合器VOA300。汽車級VOA300元件具有業界領先的5300Vrms隔離電壓。

2022 年 8 月,東芝公司電子元件及儲存設備擴大了其智慧閘極驅動器和光電耦合器的產品線。 2.5A輸出智慧閘極驅動器光電耦合器「TLP5222」具有內建保護操作自動恢復功能。該系列還包括“TLP5212”、“TLP5214”和“TLP5214A”,它們不具備自動恢復功能,但可以透過向 LED 輸入訊號恢復正常運作。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力模型

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 市場影響

- 光耦合器全球出貨量

第5章市場動態

- 市場促進因素

- 混合動力電動車的需求不斷成長

- 提高工業自動化

- 市場限制

- 內在磨損

- 法規環境

第6章市場區隔

- 依產品類型

- 基於光電電晶體的光耦合器

- 基於LiDAR林頓電晶體的光耦合器

- 基於光三端雙向可控矽的光耦合器

- 光控矽光電耦合器

- 其他

- 按最終用戶產業

- 車

- 家用電子電器

- 通訊設備

- 工業的

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Shenzhen Kento Electronic Co. Ltd

- Everlight Electronics Co. Ltd

- Senba Sensing Technology Co. Ltd

- ON Semiconductor Corporation

- Broadcom Inc.

- Vishay Intertechnology Inc.

- Renesas Electronics Corporation

- Toshiba Electronic Devices & Storage Corporation(Toshiba Corp.)

- Isocom Components Ltd

- Panasonic Corporation

- Standex Electronics Inc.

- Skyworks Solutions Inc.

- Sharp Devices Europe

- LITE-ON Technology Inc.(Lite-On Technology Corporation)

第8章投資分析

第9章:市場的未來

The Optocouplers Market size is estimated at USD 3.01 billion in 2025, and is expected to reach USD 4.63 billion by 2030, at a CAGR of 8.99% during the forecast period (2025-2030).

The growing industrial automation and increasing adoption of signal isolation solutions across many end-user industries are major factors driving the market studied over the forecast period. Rapid advancements in optical wireless systems, the increasing demand for electric and hybrid vehicles, and the emergence of the digital optocoupler are likely to create more opportunities for optocoupler manufacturers.

Key Highlights

- The optocoupler market is expanding at a rapid rate due to large part to rising demand from the automotive, telecommunication, and industrial sectors. The optocoupler market is expanding due to the growing applications of optocouplers in the communication industry.

- The optocoupler typically transmits digital signals, though it can also transmit analog signals in a few specific circumstances. Consumer electronics, smart home appliances, and computer auxiliary devices are to blame for the rise in demand for optocouplers.

- The optocouplers market is growing due to trends in industries like wireless equipment, rising demand for electric vehicles, and automation. To enhance the performance of the products based on optocouplers, businesses have been investing in them.

- The market is expected to grow due to several key factors, including expanding industrial automation and the rising popularity of signal isolation solutions. There will probably be more opportunities for optocoupler manufacturers due to the quick development of optical wireless systems, the increasing demand for electric and hybrid vehicles, and the emergence of the digital optocoupler.

- Optocouplers struggle with reliability. The failure of the LED may be the main issue, but it mentions other issues like interface contamination and thermo-mechanical stress brought on by moisture absorption. These factors lead to early intrinsic wear-out of optocouplers..

Optocouplers Market Trends

Increasing Industrial Automation to Drive the Market

- The industrial sector has traditionally been among the leading adopters of advanced technologies. As the industry is going through another technological shift, the adoption of advanced technologies such as AI, IoT, ML, automation, and robotics has grown significantly. The "Industry 4.0" concept is driving the digital transformation of the field, enabling industries to deliver real-time decision-making, enhanced productivity, flexibility and agility.

- As many electrical and electronic devices and circuits need to be installed to support this infrastructure, this shift in trend is creating a favorable market outlook for the growth of the studied market. Optocouplers are designed to protect sensitive control circuitry from voltage fluctuations and unwanted noise or electromagnetic interference. Additionally, optocouplers also enable isolation in industrial applications ranging from the motor control circuit of servo automation systems and industrial robots, power supply, and photovoltaic (PV) inverters to data communication and digital logic interface circuits, the growing adoption of automation solutions is expected to drive their demand during the forecast period.

- Furthermore, in industrial automation applications, the optocoupler is responsible for transmitting data across the isolation barrier while filtering out unwanted noise. Failure of the component to reject unwanted noise can lead to data-transmission errors. The factors involved in defining CMR are the common-mode voltage (VCM ) and the rise and fall times of the transient signal (dv/dt). The failure point is determined by increasing either VCM or the dv/dt until the optocoupler's output signal crosses into the opposite logic state.

- Industrial automation communication is witnessing increased demand for optocouplers in developing nations such as India, China, and others. Additionally, the increased adoption of automation in the manufacturing sector is also driving the market as optocouplers forms an integral part of the automation process.

- The region with the most installations was Asia and Australia; an estimated 266,000 units had already been installed by 2020. In Asia and Australia, it is expected that there will be 370,000 Industrial Robots installed by 2024.

- As an industrial robot consists of a robot arm, a Human Machine Interface (HMI) panel, and a control cabinet, different robot components and interfaces must be isolated to ensure the safe operation of the complete robot systems. As optocouplers are among the effective solutions to impart isolation among electrical isolation between two circuits and help the robotic systems facilitate effective communication among various functional units, the increasing adoption of robotics and other automation solutions is expected to drive their demand during the forecast period.

Asia Pacific is Expected to be the Fastest Growing Market

- Optocouplers have most commonly been utilized to provide safety isolation for compliance with domestic and international regulatory requirements. Significant investments in the semiconductor industry, coupled with the increasing demand for efficient optoelectronic components in the industrial sector, bolstered the growth of optocouplers in the Asia-Pacific region.

- East Asia significantly contributes to innovative energy-efficient products and the automotive sector. However, optocouplers also offer another often-overlooked benefit: isolation from electrical noise. China is one of the major influencing factors in the region, owing to its strong foothold in the semiconductor market. The region is also one of the significant contributors to the global automotive sector and the smart energy-efficient products market.

- The Government of India has the right initiatives to boost the country's economy through deluging interest in manufacturing. In terms of export and production, the electronic industry in India is making remarkable growth. The increasing demand for efficient optoelectronic components in the industrial sector, coupled with substantial investments in the semiconductor industry, is estimated to bolster the sales of optocouplers in the region. Moreover, government initiatives encouraging the growth of the local semiconductor market are projected to attract new players.

- In India, To create electronic manufacturing clusters, the government has announced 19 EMCs (electronic manufacturing clusters), three of which have been allotted to the Andhra Pradesh government.

- According to the National Bureau of Statistics of China, The industrial sector accounted for around 31.7 % of China's gross domestic product by 2023. Industry 4.0, also known as the Fourth Industrial revolution, is the manufacturing automation and upgrading industry practices, thus driving the demand for optocouplers in the industrial sector.

- Optocouplers can either be used as a switching device or with other electronic devices to isolate low and high-voltage circuits. In electronics, embedded systems often rely on optocouplers to receive input signals from external sensors or switches. The Indian government has recently announced an INR 7,325 crore (USD 888.2 million) PLI Scheme (Production Linked Incentive) for domestic manufacturers of laptops, tablets, personal computers, and servers for four years. This PLI scheme may get INR 3.26 lakh crore (USD 39.5 billion) in production and INR 2.45 lakh crore (USD 29.7 million) in exports over the next four years.

Optocouplers Industry Overview

The Optocouplers Market is Semi-Consolidated with the presence of major players like Shenzhen Kento Electronic Co. Ltd, Everlight Electronics Co. Ltd, Senba Sensing Technology Co. Ltd, ON Semiconductor Corporation, and Broadcom Inc. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In November 2022 - Vishay IntertechnologyInc. (VSH) is making significant efforts to diversify its discrete product line to strengthen its position in the burgeoning optocouplers market. The company introduced the linear optocoupler VOA300. The automotive-grade VOA300 device has a 5300 Vrmsisolation voltage, among the highest in the industry.

In August 2022 - Toshiba Electronic Devices & Storage Corporation expanded its smart gate driver photocouplers lineup. "TLP5222," a 2.5A output smart gate driver photocoupler, has a built-in automatic recovery function from protective operations. The lineup also includes TLP5212, TLP5214, and TLP5214A, which do not have a built-in automatic recovery function but reset to their normal operation by a signal input to their LED.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

- 4.5 Global Optocoupler Shipments

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Hybrid Electric Vehicles

- 5.1.2 Increasing Industrial Automation

- 5.2 Market Restraints

- 5.2.1 Intrinsic Wear-out

- 5.3 Regulatory Environment

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Phototransistor-based Optocoupler

- 6.1.2 Optocoupler based on the Photo Darlington Transistor

- 6.1.3 Optocoupler based on Photo TRIAC

- 6.1.4 Optocoupler with Photo SCR

- 6.1.5 Other Types

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 Communication

- 6.2.4 Industrial

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Shenzhen Kento Electronic Co. Ltd

- 7.1.2 Everlight Electronics Co. Ltd

- 7.1.3 Senba Sensing Technology Co. Ltd

- 7.1.4 ON Semiconductor Corporation

- 7.1.5 Broadcom Inc.

- 7.1.6 Vishay Intertechnology Inc.

- 7.1.7 Renesas Electronics Corporation

- 7.1.8 Toshiba Electronic Devices & Storage Corporation (Toshiba Corp.)

- 7.1.9 Isocom Components Ltd

- 7.1.10 Panasonic Corporation

- 7.1.11 Standex Electronics Inc.

- 7.1.12 Skyworks Solutions Inc.

- 7.1.13 Sharp Devices Europe

- 7.1.14 LITE-ON Technology Inc. (Lite-On Technology Corporation)