|

市場調查報告書

商品編碼

1444388

詐騙偵測與預防 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029 年)Fraud Detection and Prevention - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

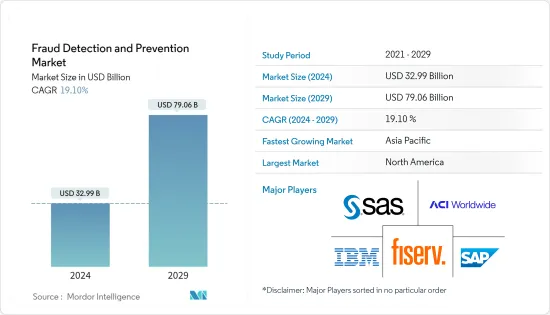

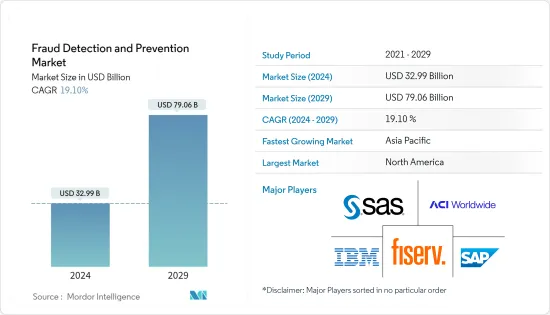

詐騙偵測和預防市場規模預計到 2024 年為 329.9 億美元,預計到 2029 年將達到 790.6 億美元,在預測期內(2024-2029 年)CAGR為 19.10%。

由於 COVID-19 大流行,各行業的公司都面臨更大的營運和財務壓力,加劇了經濟風險,例如收入和利潤減少以及市場需求損失。這些金融風險可能會導致透過操縱財務結果、歪曲事實和挪用資產等欺詐手段進行詐騙的動機增加。

主要亮點

- 從實體卡片、支票和貨幣向數位支付的根本性轉變繼續改變消費者和企業轉移價值的方式。身分、安全和信任是支付、商業和金融的基本要求,尤其是在數位化經濟中。

- 新法規的推出(例如美國對 Europay 的授權)鼓勵金融服務公司(包括 MasterCard 和 Visa)實施晶片和 PIN 技術以及先進的身份驗證解決方案,以降低偽造交易的風險。為了防止欺詐,在各個最終用戶垂直領域都觀察到了此類情況。

- 同時,零售 IT 基礎架構的顯著成長包括 POS 結帳終端機、自助結帳設備、資訊/網路亭、PC 和後台伺服器。因此,從批發商和分銷商到製造商和供應商,對 IT 的依賴日益增加,要求消費者資料具有更高的安全性。

- 此外,解決方案提供者專注於創新和研究,以提供針對這些詐騙的最強大的安全措施,包括使用預測分析、高級分析以及將人為因素與機器學習和人工智慧功能相結合,以擴大其欺詐防護系統並不斷發展以適應不斷變化的威脅。

- 在 COVID-19 帶來的不可預見和不確定的情況下,數百萬人選擇在家工作並在線購買商品和服務。世界各地都感受到了隔離的影響,人們購買家具和電子產品用於家庭、辦公室、教室和娛樂活動。然而,進入2020年以來,多起詐騙案件頻繁。因此,由於未經授權的線上產品銷售增加,特別是考慮到 COVID-19 大流行危機,預計對 FDP 解決方案和服務的需求將佔據網路銷售詐騙的最大市場規模。

詐騙檢測和預防市場趨勢

BFSI 產業預計將佔據重要市場佔有率

- 幾十年來,該行業的詐騙活動不斷發展。雖然它們以前僅限於支票和電匯欺詐,但隨著網路空間的發展以及網路犯罪領域的隨之擴大,它們已經採取了更虛擬化的形式。

- 技術滲透率的不斷提高和數位化管道(例如網路銀行和手機銀行)正在成為客戶銀行服務的重要選擇,這使得銀行利用詐騙預防解決方案變得至關重要。

- 詐騙預防和偵測是金融機構最關心的領域,它們很可能成為 IT 支出的主要驅動力之一。線上交易詐騙、保險索賠詐騙和卡片相關詐騙已擴大在保險、銀行和金融服務領域使用這些解決方案。

- 線上支付中潛在的詐騙風險最高,隨著越來越多的公司現在提供線上支付,預計詐騙風險將隨著數位客戶關係的可用性而成長。

- 在所有行業中,就詐騙活動類型而言,BFSI 最容易受到內部人員/員工的攻擊。有多起員工被指控詐騙的案例(例如印度的 PNB 詐騙)。該行業需要強大的詐騙檢測和預防解決方案來防止這些詐騙活動。

預計亞太地區將在預測期內成長最快

- 隨著亞太新興經濟體採用數位化,客戶資料和資料管道外洩的風險正在增加。因此,詐騙偵測和預防解決方案的使用正在顯著成長。

- 銀行金融卡和信用卡在詐騙活動中佔比最大,這主要是由於電子商務交易的快速增加。然而,組織意識到他們將來可能會面臨類似的威脅。因此,他們正在將系統升級到最新的可用技術。

- 據信用資訊公司 Experian 稱,印度是亞太地區數位交易詐騙風險第二高的國家。該公司還表示,該國約 48% 的消費者直接或間接經歷零售詐騙。因此,亞馬遜、Flipkart 和 Limeroad 等零售公司預計將採用最新的詐騙偵測和預防系統。

- 新加坡對資料外洩實施了嚴格的規定。該國根據該國的資料保護條款對資料外洩行為徵收了亞太地區最高的罰款之一,價值約 100 萬美元。這項法規可以確保在該國營運的公司擁有足夠的詐騙檢測和預防措施,從而促進該地區市場的成長。

- 在越南,由於數位化和物聯網(IoT)的日益普及,零售和電信業出現了許多詐騙行為。這一成長預計將推動公司納入詐騙偵測和預防系統。因此,這些因素預計將在預測期內提振亞太市場。

詐騙檢測和預防行業概述

全球詐騙偵測和預防市場競爭非常激烈。由於各種小型和大型參與者,市場適度集中。市場上的主要參與者包括 SAP SE、IBM Corporation、SAS Institute Inc.、ACI Worldwide Inc.、Fiserv Inc.、Experian PLC、DXC Technology Company 等。然而,由於產品線的重大創新,只有一些新進入者吸引了大量投資進入市場。

- 2022 年 6 月:在支付詐騙偵測方面擁有專業知識的 Advanced Fraud Solutions (AFS) 宣布與支付和金融服務技術供應商 Fiserv 合作。此次合作將使 Fiserv 和金融機構客戶能夠檢查詐騙偵測、基於風險的資金可用性和決策流程,幫助防止損失並在接受詐騙存款之前識別這些存款。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

- COVID-19 對市場影響的評估

- 市場促進因素

- 非現金支付/交易量增加

- BFSI 部門的詐騙行為日益增多

- 市場限制

- 缺乏與各垂直領域的整合能力

第 5 章:市場區隔

- 依解決方案

- 詐騙分析

- 驗證

- 報告

- 視覺化

- 治理、風險和合規 (GRC) 解決方案

- 依最終用戶規模

- 小型

- 中等規模

- 大規模

- 依詐騙類型

- 內部的

- 外部的

- 依最終用戶產業

- BFSI

- 零售

- 資訊科技和電信

- 衛生保健

- 能源與電力

- 製造業

- 其他最終用戶產業

- 依地理

- 北美洲

- 歐洲

- 亞太

- 拉丁美洲

- 中東和非洲

第 6 章:競爭格局

- 公司簡介

- SAP SE

- IBM Corporation

- SAS Institute Inc.

- ACI Worldwide Inc.

- Fiserv Inc.

- Experian PLC

- DXC Technology Company

- BAE Systems PLC

- RSA Security LLC (Dell Technologies Inc.)

- Oracle Corporation

- NICE Ltd

- Equifax Inc.

- Lexisnexis Group

- Fair Isaac Corporation

- Cybersource Corporation

- Global Payments Inc.

- Feedzai Inc.

第 7 章:投資分析

第 8 章:市場的未來

The Fraud Detection and Prevention Market size is estimated at USD 32.99 billion in 2024, and is expected to reach USD 79.06 billion by 2029, growing at a CAGR of 19.10% during the forecast period (2024-2029).

Companies across various industries are experiencing increased operational and financial pressure due to the COVID-19 pandemic, creating heightened economic risks, such as a reduction in revenue and profits and a loss of market demand. These financial risks may lead to increased motivation toward fraud through manipulation of financial results, misrepresentation of facts, and misappropriation of assets, among other fraud schemes.

Key Highlights

- The fundamental shift from physical cards, checks, and currency toward digital payments continues to transform how consumers and businesses transfer value. Identity, security, and trust are fundamental requirements for payments, commerce, and finance, especially in a digitized economy.

- Introducing new regulations, such as the US mandate of Europay, has encouraged financial service companies (including MasterCard and Visa) to implement chip and PIN technologies and advanced authentication solutions, to decrease the risk of counterfeit transactions. Such instances have been observed across various end-user verticals for the prevention of fraud.

- Concurrently, a significant rise in the retail IT infrastructure includes POS checkout terminals, self-checkout units, information/web kiosks, PCs, and back-office servers. Thus, the increasing dependency on IT, ranging from wholesalers and distributors to manufacturers and suppliers, demands greater security for consumer data.

- Moreover, solution providers are focused on innovation and research to offer the most robust security measures against these frauds, including the use of predictive analytics, advanced analytics, and a combination of the human element with machine learning and AI capabilities to scale up their fraud protection systems and evolve to suit the changing threats.

- During the unforeseen and uncertain circumstances brought on by COVID-19, millions of people choose to work from home and make purchases of goods and services online. The effects of quarantine have been felt worldwide, with people purchasing furniture and electronics for use in their homes, offices, classrooms, and recreational activities. However, since the start of 2020, several frauds have proliferated. Therefore, the demand for FDP solutions and services is anticipated to account for the greatest market size for internet sales frauds due to an increase in unauthorized online product sales, particularly in light of the COVID-19 pandemic crisis.

Fraud Detection & Prevention Market Trends

BFSI Sector is Expected to Hold Significant Market Share

- Fraudulent activities in the industry have evolved over the decades. While they were previously limited to cheque and wire frauds, with the growth of the cybersphere and the accompanying expansion of the cybercriminal realm, they have taken on more virtualized forms.

- The increasing technological penetration and digital channels, such as internet banking and mobile banking, are becoming prominent customer choices for banking services, making it crucial for banks to leverage fraud prevention solutions.

- Fraud prevention and detection are the biggest areas of concern for financial institutions, and they are likely to become one of the prominent drivers of IT spending. Online transaction fraud, insurance claim fraud, and card-related fraud have been increasing the usage of these solutions in the insurance, banking, and financial services sectors.

- The potential risk of fraud has been the highest in online payments, which is anticipated to grow in tandem with the availability of digital customer relationships as more companies are now offering online payments.

- Out of all the industries, BFSI has been most prone to insiders/employees in terms of the types of fraudulent activities. There have been multiple instances where employees have been accused of fraud (for instance, PNB fraud in India). The industry needs robust fraud detection and prevention solutions to prevent these fraudulent activities.

Asia-Pacific is Expected to Witness the Fastest Growth During the Forecast Period

- As emerging Asian-Pacific economies adopt digitalization, the risk of breach of customer data and data channels is increasing. Thus, the utilization of fraud detection and prevention solutions is growing significantly.

- Bank debit and credit cards accounted for the most substantial fraudulent activities, mainly due to the rapid increase in e-commerce transactions. However, organizations are aware that they may face a similar threat in the future. Thus, they are upgrading their systems to the latest available technology.

- According to Experian, a credit information company, India has the second-highest risk of fraud in digital transactions in the Asia-Pacific region. The company also stated that approximately 48% of consumers in the country experienced retail fraud directly or indirectly. As a result, retail companies such as Amazon, Flipkart, and Limeroad, are expected to adopt the latest fraud detection and prevention systems.

- Singapore imposed strict regulations against data breaches. The country has levied one of the highest penalties in the Asia-Pacific region, worth about USD 1 million, in case of a data breach per the country's data protection provision. This regulation may ensure that companies operating in the country have adequate fraud detection and prevention provisions, leading to the market's growth in the region.

- In Vietnam, many frauds are witnessed in the retail and telecommunication industries due to the increasing penetration of digitization and the Internet of Things (IoT). This increase is expected to propel companies to incorporate fraud detection and prevention systems. Thus, such factors are expected to boost the Asia-Pacific market during the forecast period.

Fraud Detection & Prevention Industry Overview

The Global Fraud Detection and Prevention Market is very competitive. The market is mildly concentrated due to various small and large players. The major players in the market are SAP SE, IBM Corporation, SAS Institute Inc., ACI Worldwide Inc., Fiserv Inc., Experian PLC, DXC Technology Company, and many more. However, owing to significant innovations in product lines, only some new entrants are attracting major investments into the market.

- June 2022: Advanced Fraud Solutions (AFS), which has expertise in payments fraud detection, announced the collaboration with Fiserv, a provider of payments and financial services technology. The collaboration will allow Fiserv and financial institution clients to check fraud detection, risk-based funds availability, and decision processes, helping to prevent losses and identify fraudulent deposits before they are accepted.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Market

- 4.5 Market Drivers

- 4.5.1 Increasing Volume of Non-cash Payment/Transaction Volumes

- 4.5.2 Increasing Frauds in BFSI Sector

- 4.6 Market Restraints

- 4.6.1 Lack of Integration Capability with All Verticals

5 MARKET SEGMENTATION

- 5.1 By Solution

- 5.1.1 Fraud Analytics

- 5.1.2 Authentication

- 5.1.3 Reporting

- 5.1.4 Visualization

- 5.1.5 Governance, Risk, and Compliance (GRC) Solutions

- 5.2 By Scale of End User

- 5.2.1 Small-scale

- 5.2.2 Medium-scale

- 5.2.3 Large-scale

- 5.3 By Type of Fraud

- 5.3.1 Internal

- 5.3.2 External

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Retail

- 5.4.3 IT and Telecom

- 5.4.4 Healthcare

- 5.4.5 Energy and Power

- 5.4.6 Manufacturing

- 5.4.7 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SAP SE

- 6.1.2 IBM Corporation

- 6.1.3 SAS Institute Inc.

- 6.1.4 ACI Worldwide Inc.

- 6.1.5 Fiserv Inc.

- 6.1.6 Experian PLC

- 6.1.7 DXC Technology Company

- 6.1.8 BAE Systems PLC

- 6.1.9 RSA Security LLC (Dell Technologies Inc.)

- 6.1.10 Oracle Corporation

- 6.1.11 NICE Ltd

- 6.1.12 Equifax Inc.

- 6.1.13 Lexisnexis Group

- 6.1.14 Fair Isaac Corporation

- 6.1.15 Cybersource Corporation

- 6.1.16 Global Payments Inc.

- 6.1.17 Feedzai Inc.