|

市場調查報告書

商品編碼

1444347

化妝品包裝 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Cosmetic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

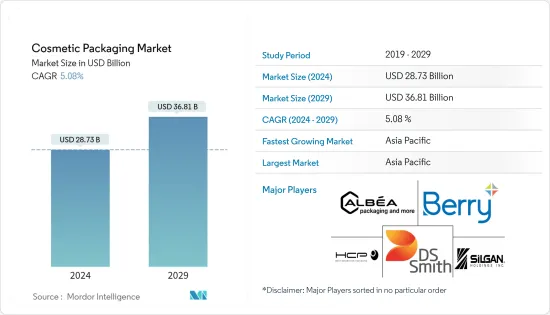

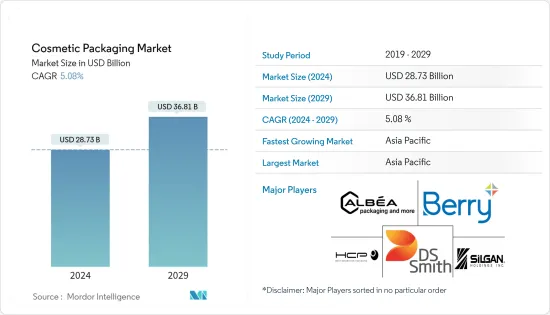

2024年化妝品包裝市場規模預估為287.3億美元,預估至2029年將達368.1億美元,預測期內(2024-2029年)CAGR為5.08%。

近年來,化妝品行業的包裝取得了突飛猛進的發展。在其他行業中,化妝品行業的包裝要求最為多樣化。所使用的材料包括玻璃、紙張和塑膠等不同金屬,這些材料可以製造不同形狀和尺寸的容器以及分配機構。

主要亮點

- 初級容器、次級軟性袋、蓋子、封閉件和噴嘴中的塑膠是化妝品行業的主要包裝材料之一。塑膠管是化妝品行業的重要容器之一,因為它可以儲存液體、固體和半固體材料並以受控比例分配產品。此外,與其他容器管相比,它可以提供更好的污染保護。

- 不同的供應商已經設計出創新的產品來滿足不斷成長的管材需求。全球市場上的主要化妝品製造商 Sally Hansen 在 Topline 的幫助下開發了一種配有塗抹器尖端的可擠壓管。此外,包裝解決方案提供商 Albea 開發了一種淚滴管,帶有用於液體配方的逐滴分配系統。此外,Cosmogen 還提供了 Squeeze'N Roll 包裝的改良版管狀版本,並附有依摩滾輪。此外,Global Packaging Inc.還開發了一種管子,管頭上有棘輪,泵上也有相應的棘輪,透過施加預定扭矩確保完美的防漏組裝,同時防止意外打開。

- 企業也希望透過應對氣候變遷和減少包裝對環境影響的計畫來推動變革。例如,斯道拉恩索推出了用於化妝品包裝的阻隔塗層、耐油脂紙板管。這種管包裝方法適用於護膚霜產品的初級包裝,被認為是塑膠管的新型、氣候友善的替代品。但化妝品行業現在似乎團結一致,透過新的周到的包裝策略和先進的配方來減少塑膠污染的影響。

- 原物料價格的波動會阻礙市場的成長。新冠疫情過後,這家製造和包裝公司面臨因中斷而導致原料成本高昂的問題。

- 此外,一些化妝品包裝展和貿易展也推廣各種新的包裝技術。例如,Cosmo Tech Expo 是印度最重要的化妝品、個人護理、香水和盥洗用品市場製造解決方案貿易展。該博覽會為參展商展示了全球 8,000 多家製造商提供的最新成分、原料、包裝、標籤、機械、 OEM和自有品牌、測試、實驗室設備和監管解決方案。同樣,CPNA(北美美容展)是美洲獲獎最多的 B2B 美容盛會。 CPNA 被公認為新美容品牌的首要發布平台,提供獨特、創新的產品並收集有關新分銷管道、包裝和製造解決方案的資訊。

- 隨著 COVID-19 的爆發,一些優質美容產品店被關閉。其中一些商店將永遠不會再開業,新開張將至少推遲一年。儘管實體藥局、大眾市場和雜貨店仍營業,但其客流量和收入卻大幅下降。然而,一些準備擴大庫存和運輸業務的美容產品品牌和零售商報告稱,電子商務銷售額明顯高於 COVID-19 之前的水平。

化妝品包裝市場趨勢

塑膠預計將佔據重要佔有率

- 塑膠因其成本低、重量輕、柔韌、耐用等因素而成為化妝品包裝中的重要材料。塑膠是製造個人護理產品的防碎和「防洩漏」瓶子、罐子、管子、蓋子和封閉件的首選材料。根據包裝機械製造商協會(PMMI) 的數據,瓶子、罐子、粉盒和管材等塑膠包裝佔據61% 的市場佔有率,在化妝品和其他個人護理產品中佔據主導地位,其中瓶子是最常用的容器,佔佔30%的市佔率。由 HDPE 生產的最常見且最便宜的化妝品瓶經濟、耐衝擊,並保持良好的防潮層。乳液瓶有各種不同的尺寸和形式,有些乳液保留在帶蓋的管中。

- 此外,化妝品容器最常見的塑膠類型是PP塑膠。然而,它們也可以採用更便宜的 PET 或高階丙烯酸塑膠。丙烯酸塑膠通常是透明的,類似於玻璃。這種材料比玻璃具有優勢,因為它不易破裂。然而,PP 塑膠比丙烯酸便宜,通常採用圓形或管狀塑膠容器。 PP塑膠容器可以模製成心形、人物形狀或方形,以適應化妝品的風格或行銷推廣。該公司主要使用罐子和罐子來存放乳霜、乳液、粉底、潤唇膏、粉餅和其他化妝品,其尺寸範圍為 20 毫米至 60 毫米,可容納 25 毫升(或更少)至 250 毫升的任何地方。

- 例如,SKS Bottle & Packaging Inc. 提供各種不同尺寸的塑膠罐,具有多種封閉選項,從帶有篩子襯裡蓋的銀色蓋到塑膠圓頂蓋。他們為潤唇膏和眼霜等產品提供 PET 罐,為乳液、香膏等提供帶有內襯蓋的白色聚丙烯厚壁罐,產品範圍還有更多。

- 長期以來,設計專家一直青睞管狀包裝,希望利用管狀包裝的便利性和攜帶性來容納化妝品和其他個人護理用品。例如,在阿拉伯聯合大公國推出了翻蓋罐裝的凡士林果凍和可擠壓塑膠管裝的多芬高級護髮系列乾油洗髮水,方便了使用。

- 隨著製造商尋求減少每件產品材料使用量的方法,塑膠在提供使用更少材料的輕質包裝解決方案方面取得了巨大的進步。此外,在過去十年中,塑膠對環境的影響減緩了該領域的放緩。

- 然而,再生塑膠的可用性和材料技術的創新使得環保包裝解決方案成為可能。參與者專注於可再填充包裝作為設計解決方案,以創造永續的功能。品牌正在擁抱自然變色,從而提供 PCR(消費後回收)塑膠。這些可再填充產品正在彌補奢侈品市場的這一差距。

- 根據2022年5月發布的資料,到2060年,包裝用塑膠用量將增加兩倍,超過3.8億噸。預計當年包裝將佔全球塑膠用量的 31%。

北美預計將佔據重要佔有率

- 美國是化妝品、個人護理產品和香水市場的最大市場之一。歐萊雅、聯合利華、寶潔公司等領導品牌主導了中國化妝品市場。同樣,該國的化妝品包裝格局也得到了整合,Albea SA、AptarGroup Inc.、Smurfit Kappa Group PLC、WestRock Co. 和 Graphic Packaging Holding Co. 等幾家重要企業佔據了市場佔有率。

- 該國的主要產品類別包括護膚品、化妝品、護髮品、香水、除臭劑和盥洗用品以及口腔化妝品。美國化妝品市場對高階化的需求不斷成長,這與全球趨勢一致。反過來,它又推動了對創新和優質包裝的需求。為了滿足高階化需求以及對創新和裝飾性包裝的強烈關注,Apatar Group Inc. 收購了 Fusion Packaging,以擴大其在化妝品領域的差異化設計和裝飾產品。

- 美國消費者也擴大使用電子商務管道購買個人護理產品。儘管線上銷售的佔有率仍然較低,但預計在預測期內將會成長。此外,聯合利華也透過線上通路銷售產品進行了新的收購。塑膠瓶和玻璃瓶是保養品最優選的包裝材料。因此,隨著該產品類別的成長,材料的使用預計也將經歷積極的成長軌跡。

- 在塑膠中,PP、PE、HPE、PET和壓克力成分是塑膠瓶最優選的材料。擴大使用線上管道將使塑膠的運輸變得比玻璃更便宜、更安全。此外,由於消費者認為這些產品更安全,美國消費市場正經歷對天然美容產品的需求。因此,美國政府提出了一項新法案,在產品貼上天然標籤之前對其進行監管。這可能會促使在將成分標記為天然成分之前對其進行更詳細的標記。

化妝品包裝行業概況

化妝品包裝市場競爭激烈,由多家全球和區域參與者組成。創新和易於部署和使用,透過產品實現端到端客戶滿意度,一直是推動市場參與者產品創新和策略的關鍵因素。主要參與者是 Silgan Holdings Inc. 和 DS Smith PLC。

2022 年 3 月 - 在洛杉磯 MakeUp 貿易展期間,國際美容產業首屈一指的全方位服務供應商 WWP Beauty 推出了一系列清新環保的統包、包裝和配件系列。

2022 年 7 月 - Quadpack 為固體市場推出可回收棒狀包裝。美容包裝製造商 Quadpack 推出了固體化妝品棒配方的新包裝系列。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 市場促進因素

- 化妝品消費增加

- 越來越注重創新和有吸引力的包裝

- 市場限制

- 日益成長的永續發展擔憂

- 產業價值鏈分析

- 產業吸引力波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

第 5 章:COVID-19 對產業的影響

第 6 章:市場區隔

- 依材料類型

- 塑膠

- 玻璃

- 金屬

- 紙

- 依產品類型

- 塑膠瓶和容器

- 玻璃瓶和容器

- 金屬容器

- 折疊紙盒

- 瓦楞紙箱

- 管和棒

- 瓶蓋和瓶蓋

- 泵浦和分配器

- 滴管

- 安瓿

- 軟塑膠包裝

- 依化妝品類型

- 頭髮護理

- 彩妝

- 皮膚護理

- 男士美容

- 除臭劑

- 其他化妝品類型

- 地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 亞太其他地區

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 中東和非洲其他地區

- 南非

- 北美洲

第 7 章:競爭格局

- 公司簡介

- Albea SA

- HCP Packaging Co. Ltd

- RPC Group PLC (Berry Global Group)

- Silgan Holdings Inc.

- DS Smith PLC

- Graham Packaging LP

- Libo Cosmetics Company Ltd

- AptarGroup Inc.

- Amcor PLC

- Cosmopak Ltd

- Quadpack Industries SA

- Rieke Corporation

- Gerresheimer AG

- Raepak Ltd

- Ball Corporation

- Verescence France

- SKS Bottle & Packaging, Inc

- Altium Packaging (Loews Corporation)

第 8 章:市場的未來前景

The Cosmetic Packaging Market size is estimated at USD 28.73 billion in 2024, and is expected to reach USD 36.81 billion by 2029, growing at a CAGR of 5.08% during the forecast period (2024-2029).

Packaging in the cosmetic industry has gone leaps and bounds in recent years. The cosmetic industry has the most varied packaging requirements among the other sectors. The materials used vary from different metals from glass, paper, and Plastics, and these materials can make containers with different shapes and sizes and dispensing mechanisms.

Key Highlights

- Plastic in primary containers, secondary flexible pouches, caps, closures, and the nozzle is one of the cosmetic industry's primary packaging materials. The plastic tube is one of the significant containers in the cosmetic industry as it can store liquid-solid and semisolid materials and dispense products in controlled proportions. Also, compared to other container tubes, it can provide better contamination protection.

- Various suppliers have devised innovative offerings to cater to the increasing tube demand. Sally Hansen, a major cosmetics manufacturer in the global market, developed a squeezable tube paired with an applicator tip with Topline's help. Additionally, Albea, a packaging solution provider, developed a Teardrop tube with a drop-by-drop dispensing system for liquid formulations. Also, Cosmogen offered a revised tube version of its Squeeze'N Roll package with an attached massage roller. Furthermore, Global Packaging Inc. had also developed a tube with a ratchet on the head of the tube and a corresponding ratchet on the pump, ensuring a perfect leakproof assembly by applying the predetermined torque while protecting the accidental opening.

- Enterprises are also looking to drive the change with a plan to combat climate change and reduce the environmental impacts of packaging. For instance, Stora Enso introduced barrier-coated, grease-resistant paperboard tubes for cosmetics packaging. This tube packaging method is suitable for the primary packaging of skin cream products and is considered a new, climate-friendly alternative to plastic tubes. But the cosmetics industry now seems united on reducing the impact of plastic pollution with new thoughtful packaging strategies and advanced formulations.

- Fluctuation of the raw material prices can hinder the growth of the market. Post-Covid, the manufacturing and packaging company is facing the issue of high raw material costs due to the disruption.

- Besides, several cosmetic packaging exhibitions and trade shows promote various new packaging technologies. For example, Cosmo Tech Expo is India's most significant manufacturing solutions trade show for the cosmetic, personal care, perfumery, and toiletries markets. The expo brings exhibitors to display the latest ingredients, raw materials, packaging, labeling, machinery, OEM and private labeling, testing, lab equipment, and regulatory solutions offered by over 8,000 manufacturers worldwide. Similarly, CPNA (Cosmoprof North America) is the most awarded B2B beauty event in the Americas. CPNA has been recognized as the premier launching platform for new beauty brands, offering unique, innovative products and gathering information about new distribution channels, packaging, and manufacturing solutions.

- With the outbreak of COVID-19, several premium beauty product outlets were shut down. Some of these stores will never open again, and new openings will get delayed for at least a year. While brick-and-mortar drugstores and mass-market and grocery stores remain open, their customer traffic and revenues have plummeted. However, some beauty-product brands and retailers with inventory and shipment operations ready to scale up report e-commerce sales significantly higher than the pre-COVID-19 levels.

Cosmetic Packaging Market Trends

Plastic is Expected to Hold Significant Share

- Plastic is a prominent material in cosmetic packaging due to its low cost, lightweight, flexibility, durability, and other factors. Plastics are a material of choice for manufacturing shatterproof and "no-spill" bottles, jars, tubes, caps, and closures for personal care products. According to the Packaging Machinery Manufacturers Institute (PMMI), at 61% market share, plastic packaging, such as bottles, jars, compacts, and tubes, dominate in cosmetics and other personal care products, where bottles are the most commonly used containers, accounting for 30% of the market. The most common and least expensive cosmetic bottles produced from HDPE are economical, impact-resistant, and maintain a sound moisture barrier. Lotion bottles come in all different sizes and forms, and some lotions remain in capped tubes.

- Moreover, the most common type of plastic used for cosmetic containers is PP plastics. However, these can also come in more affordable PET or higher-end acrylic plastic. Acrylic plastic is usually transparent and resembles glass. This material has an advantage over glass as it is not prone to breakage. However, PP plastic is more affordable than acrylic and usually comes in round or tube-like shaped plastic containers. PP plastic containers can be molded into heart shapes, character shapes, or square shapes to suit the cosmetic product's style or marketing to get distributed. Companies primarily use jars and pots for face creams, lotions, foundations, lip balms, powders, and other cosmetics, where the size ranges from 20mm to 60mm and can hold anywhere from 25 ml (or less) to 250 ml.

- For instance, SKS Bottle & Packaging Inc. offers various plastic jars in different sizes with multiple closure options, from silver caps with sifters lined caps to the plastic dome. They provide PET jars for products, such as lip balm and eye cream, and white polypropylene thick wall jars with lined caps for lotions, balms, etc., with many more ranges.

- Design experts have favored tubular packaging for a long seeking to capitalize on tubes' convenience and portability to hold cosmetics and other personal care items. For instance, introducing Vaseline Jelly in a flip-cap jar and Dove's Advanced Hair Series Dry Oil Shampoo in a squeezable plastic tube in the UAE facilitated convenient usage.

- As manufacturers seek options to reduce the amount of material used per product, plastics deliver exceptional gains in providing lightweight packaging solutions that use fewer materials. Moreover, over the last decade, plastic's environmental impacts have slowed the segment's slowdown.

- However, the availability of recycled plastics and innovations in material technology have enabled environmentally-friendly packaging solutions. The players focus on refillable packaging as a design solution to create sustainable features. Brands are embracing the natural discoloration that provides PCR (post-consumer recycled) plastics. These refillable products are bridging this gap at the luxury end of the market.

- According to data released in May 2022, the use of plastics for packaging will triple by 2060, surpassing 380 million tons. Packaging is forecast to account for 31% of global plastics use that year.

North America is Expected to Significant Share

- The US is one of the biggest markets for cosmetics, personal care products, and fragrances market. Players like L'Oreal, Unilever, Procter & Gamble Co., and other leading brands have dominated the country's cosmetics market. Similarly, the cosmetic packaging landscape in the country gets consolidated with a few significant players like Albea SA, AptarGroup Inc., Smurfit Kappa Group PLC, WestRock Co., and Graphic Packaging Holding Co. dominating market share.

- The country's primary product categories include skincare, makeup, haircare, perfumes, deodorants and toiletries, and oral cosmetics. The US cosmetics market is experiencing a growing demand for premiumization, in line with the global trend. It, in turn, drives the need for innovative and premium packaging. In sync with the premiumization demands and intense focus on innovative and decorative packaging, Apatar Group Inc. acquired Fusion Packaging to expand its differentiated design and decorative offerings for the cosmetics segment.

- The US is also experiencing an increased use of e-commerce channels to procure personal care products by consumers. While the share of online sales remains low, it is expected to grow during the forecast period. Furthermore, Unilever has made new acquisitions based on selling products through online channels. Plastic and glass bottles are the most preferred packaging materials for skincare products. Hence, with this product category's growth, the use of materials is also expected to experience a positive growth trajectory.

- In plastics, PP, PE, HPE, PET, and acrylic ingredients are the most preferred materials for plastic bottles. The increasing use of online channels will grow cheaper and safer plastics to transport than glass. Additionally, the US consumer market is experiencing a demand for beauty products categorized as natural, driven by consumer perception of these products being safer. On this account, the US government has proposed a new bill to regulate products before labeling them as natural. It will likely lead to more detailed labeling of ingredients before labeling them as natural.

Cosmetic Packaging Industry Overview

The cosmetic packaging market is highly competitive and comprises several global and regional players. Innovation and ease in deployment and usage, leading to end-to-end customer satisfaction through the product, have been the key factors driving product innovation and strategies among the market players. The key players are Silgan Holdings Inc. and DS Smith PLC.

March 2022 - During the MakeUp in Los Angeles tradeshow, WWP Beauty, a premier full-service provider to the international beauty industry, unveiled a lineup of fresh and environmentally friendly turnkey, packaging, and accessory collections.

July 2022 - Quadpack launched recyclable stick packaging for the solids market. Beauty packaging manufacturer Quadpack has launched a new packaging range for solid cosmetic stick formulas.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Consumption of Cosmetic Products

- 4.2.2 Increasing Focus on Innovation and Attractive Packaging

- 4.3 Market Restraints

- 4.3.1 Growing Sustainability Concerns

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 IMPACT OF COVID-19 ON THE INDUSTRY

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Paper

- 6.2 By Product Type

- 6.2.1 Plastic Bottles and Containers

- 6.2.2 Glass Bottles and Containers

- 6.2.3 Metal Containers

- 6.2.4 Folding Cartons

- 6.2.5 Corrugated Boxes

- 6.2.6 Tubes and Sticks

- 6.2.7 Caps and Closures

- 6.2.8 Pump and Dispenser

- 6.2.9 Droppers

- 6.2.10 Ampoules

- 6.2.11 Flexible Plastic Packaging

- 6.3 By Cosmetic Type

- 6.3.1 Hair Care

- 6.3.2 Color Cosmetics

- 6.3.3 Skin Care

- 6.3.4 Men's Grooming

- 6.3.5 Deodorants

- 6.3.6 Other Cosmetic Types

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.2.6 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 South Korea

- 6.4.3.5 Thailand

- 6.4.3.6 Rest of Asia-Pacific

- 6.4.3.7 Australia

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Argentina

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 Rest of Middle East and Africa

- 6.4.5.4 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Albea SA

- 7.1.2 HCP Packaging Co. Ltd

- 7.1.3 RPC Group PLC (Berry Global Group)

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 DS Smith PLC

- 7.1.6 Graham Packaging LP

- 7.1.7 Libo Cosmetics Company Ltd

- 7.1.8 AptarGroup Inc.

- 7.1.9 Amcor PLC

- 7.1.10 Cosmopak Ltd

- 7.1.11 Quadpack Industries SA

- 7.1.12 Rieke Corporation

- 7.1.13 Gerresheimer AG

- 7.1.14 Raepak Ltd

- 7.1.15 Ball Corporation

- 7.1.16 Verescence France

- 7.1.17 SKS Bottle & Packaging, Inc

- 7.1.18 Altium Packaging (Loews Corporation)