|

市場調查報告書

商品編碼

1444337

電子紙顯示器 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Electronic Paper Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

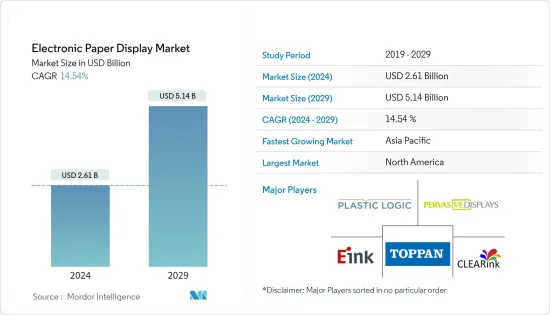

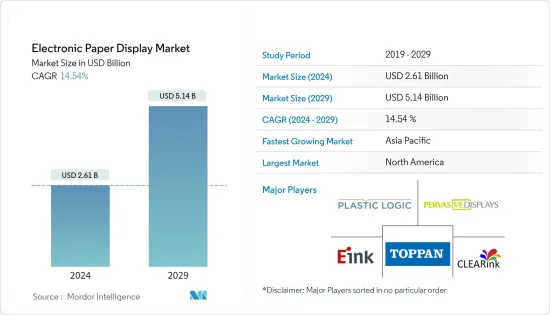

預計2024年電子紙顯示器市場規模為26.1億美元,預計到2029年將達到51.4億美元,在預測期內(2024-2029年)CAGR為14.54%。

對行動資訊的需求不斷成長,電子閱讀器數量不斷增加,以及易於使用的顯示設備的開發,是推動電子紙顯示器市場需求的一些重要因素。

主要亮點

- 目前,EPD 已被部署用於許多應用,包括零售和運輸,例如公車站和鐵路資訊板。例如,在日本,E Ink 元太科技和 Papercast 為智慧公車站計畫生產了太陽能電子紙乘客資訊顯示技術。耶路撒冷交通總體規劃團隊 (JTMT) 在公車站配備了先進的乘客資訊系統,配有太陽能電子紙顯示器。

- 電子紙顯示器廣泛應用於電子閱讀器和蓬勃發展的電子貨架標籤 (ESL) 領域。零售商店必須投入大量員工時間來為每種產品和 SKU 列印、貼上和替換商店貨架上的傳統紙質標籤。安裝微型電子紙顯示標籤可實現動態定價,並使員工能夠專注於幫助客戶。

- 除了電子閱讀器和 ESL 之外,電子紙顯示器還用於室內標牌,例如活動場所、醫院和飯店。它們重量輕,由電池供電,幾乎可以安裝在任何地方,輕鬆移動,並且可以與日曆系統整合以自動更新。其他正在嘗試的新電子紙應用包括菜單板、公共交通標誌和行李標籤。

- 與全彩替代品相比,單色顯示器具有低功耗、簡單的軟體設計、小外形尺寸和低成本等優點。彩色顯示器替代品通常更昂貴,但可提供清晰、彩色的影像和高效能圖形。根據成本和功耗等因素,彩色圖形顯示器是提高感知價值並領先於競爭對手的最佳方式,但以可承受的成本提供彩色顯示器對市場來說是一個課題。

- 電子設備領域受到COVID-19大流行爆發的嚴重影響,作為原料和成品主要供應國之一的中國等國家經歷了多重課題。該行業仍面臨產量減少、供應鏈中斷和價格波動的問題。預計知名電子公司的銷售也將很快受到影響。此外,行動限制導致戶外廣告支出減少,對電子紙顯示器的需求產生負面影響。

電子紙顯示器市場趨勢

消費性電子產業預計將佔據重要的市場佔有率

EPD 是消費性電子產品和穿戴式裝置不可或缺的一部分。由於對顯示技術的持續需求,預測期內消費性電子產品需求的成長主要推動了市場的成長。此外,手機、平板電腦和智慧型手機的廣泛普及推動了消費性電子產業的成長,這需要更有效的顯示技術。此外,大多數消費性電子產品都採用電子墨水技術,以降低眼睛疲勞並延長電池壽命。據思科系統公司稱,到 2022 年,北美和亞太地區的穿戴式設備預計將佔全球穿戴式 5G 連接的 70% 左右。

網路上免費電子書的不斷增加以及精通技術的用戶的偏好從傳統書籍轉向攜帶式電子閱讀設備預計將推動 EPD 市場的發展。大多數美國成年人擁有平板電腦、智慧型手機或電子閱讀器設備,其中大多數使用平板電腦閱讀電子書。電子墨水技術可生產低功耗紙張,例如主要用於電子書閱讀器(例如亞馬遜的 Kindle)的顯示器。

電子紙顯示器廣泛應用於穿戴式裝置產業。由於消費者健身趨勢的增加,健身追蹤器等穿戴式裝置獲得了巨大的關注。 Plastic Logic 的超薄軟性電子紙顯示器已被廣泛採用,因為它們在手錶和裝置等穿戴式裝置應用中為行動健康監測帶來了巨大的機會。

EPD 用於智慧家庭設備,例如智慧恆溫器或智慧顯示器,其中低功耗和易於讀取非常重要。 EPD 可以顯示溫度和天氣更新等資訊,甚至可以充當數位便籤紙。此外,EPD 在各種物聯網 (IoT) 設備中都有應用,其低功耗要求和不同照明條件下的可視性具有優勢。

EPD 被整合到消費品的智慧包裝和標籤中。這些標籤可以顯示動態訊息,例如產品詳細資訊、有效期限或促銷訊息。 EPD 提供了一種互動且引人注目的方式來與消費者溝通並增強產品體驗。

預計北美將佔據重要的市場佔有率

- 北美在全球 EPD 市場中佔有相當大的佔有率。由於電子閱讀器、零售、標牌和穿戴式裝置等各行業對 EPD 的需求不斷成長,該地區實現了穩定成長。電子書的普及、對節能顯示解決方案的需求以及智慧型設備的日益普及等因素推動了市場的發展。

- 北美一直是電子閱讀器的重要市場,EPD 在這一領域發揮著至關重要的作用。隨著電子書的普及和主要電子閱讀器製造商的出現,EPD 在北美獲得了巨大的關注。 EPD 提供舒適的閱讀體驗、較長的電池壽命和出色的可視性,使其成為電子閱讀器的首選。

- 北美零售業已採用電子紙顯示螢幕,特別是電子貨架標籤 (ESL)。 EPD 提供高效率的定價和資訊更新,減少體力勞動和成本。此外,北美的數位看板應用程式(例如店內顯示器和戶外廣告看板)利用 EPD 的優勢來實現節能且易於閱讀的內容。

- 北美市場以其穿戴式設備和智慧手錶的廣泛採用而聞名。 EPD 擴大融入這些設備中,提供始終開啟的顯示、出色的可視性和低功耗。北美對智慧手錶和健身追蹤器的需求推動了該領域 EPD 的成長。

- 北美是 EPD 市場技術進步和創新的中心。該地區的公司積極參與改進 EPD 技術的研發工作,例如增強色彩再現、刷新率和靈活性。這些進步有助於北美 EPD 市場的成長。

電子紙顯示器產業概況

電子紙顯示器市場適度分散,市場上有 Plastic Logic GmbH、E-Ink Holdings Inc.、Clear Ink Displays、Pervasive Displays Inc. 和 Toppan Printing 等主要參與者,市場參與者正在採取合作夥伴關係等策略,合作和收購,以增強其產品供應並獲得永續的競爭優勢。

2022年9月:顯示領域領導者之一的夏普顯示技術公司(SDTC)與數位紙技術的鼻祖、先驅、全球商業領導者之一元太科技(E Ink),宣布合作並採用SDTC 的氧化銦鎵鋅(IGZO*2) 背板用於電子閱讀器和電子記事本產品中使用的電子紙模組。近十年來,E Ink 一直在研究將氧化物薄膜電晶體 (TFT) 用於電泳技術,並計劃利用氧化物 TFT 擴展其電子紙產品範圍。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

- 產業價值鏈分析

- 評估 COVID-19 對市場的影響

第 5 章:市場動態

- 市場促進因素

- 電子顯示領域的技術創新

- 電子顯示在各個最終用戶行業的應用不斷成長

- 市場課題

- 電子紙顯示器性能限制的課題

- 電子紙顯示的關鍵要求

- 單色與彩色顯示對比

- 顯示尺寸比較

- 顯示解析度比較

第 6 章:電子紙顯示技術分析

第 7 章:市場區隔

- 最終用戶

- 消費性電子產品(穿戴式裝置、電子閱讀器、行動裝置等)

- 機構(標誌、海報等)

- 零售(分隔器和電子貨架顯示器)

- 其他最終用戶(媒體和娛樂、交通、醫療保健、工業/智慧包裝和建築應用)

- 地理

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第 8 章:競爭格局

- 公司簡介

- Plastic Logic GmbH

- E-Ink Holdings Inc.

- Clear Ink Displays

- Pervasive Displays Inc.

- Toppan Printing Co. Ltd

- LANCOM Systems GmbH

- Adafruit Industries

- Guangzhou Oed Technologies Co. Ltd

- Microtips Technology

第 9 章:投資分析

第 10 章:市場的未來

The Electronic Paper Display Market size is estimated at USD 2.61 billion in 2024, and is expected to reach USD 5.14 billion by 2029, growing at a CAGR of 14.54% during the forecast period (2024-2029).

The rising demand for on-the-move information, along with the growing number of electronic readers, and the development of easy-to-use display devices, are among some of the significant factors driving the demand for the electronic paper display market.

Key Highlights

- EPDs are currently being deployed for many applications, including retail and transport, such as bus stops and rail information boards. For instance, in Japan, E Ink Holdings and Papercast have produced a solar-powered electronic paper passenger information display technology for a smart bus stop project. The Jerusalem Transportation Master Plan Team (JTMT) has advanced passenger information systems at bus stops with solar-powered e-paper displays.

- E-paper displays are widely used in e-readers and the booming Electronic Shelf Label (ESL) segment. Retail stores must dedicate long hours of employee time to print, stick, and replace traditional paper labels on store shelves for every single product and SKU. Installing miniature e-paper display labels enables dynamic pricing and frees employees to focus on helping customers.

- In addition to e-readers and ESLs, e-paper displays have been used for indoor signage, for instance, at event venues, hospitals, and hotels. They are lightweight, battery-powered, can be mounted virtually anywhere, moved around easily, and can be integrated with calendaring systems to update automatically. Other new e-paper applications being tried include menu boards, public transit signs, and baggage tags.

- The monochrome display boasts low power consumption, easy software design, small form factors, and low cost relative to full-color alternatives. Color display alternatives are generally more expensive but provide sharp, colorful images and high-performing graphics. Depending on factors such as cost and power consumption, a color graphical display is the best way to increase the perceived value and stay ahead of the competitors but providing a colorful display at an affordable cost is a challenge for the market.

- The electronics devices segment was significantly impacted by the COVID-19 pandemic outbreak, as countries such as China, which is one of the major suppliers of raw materials and finished products, witnessed multiple challenges. The industry is still facing a reduction in production, disruption in the supply chain, and price fluctuations. The sales of prominent electronic companies are also expected to be affected shortly. Further, the restriction of the movement led to decreased outdoor advertising spending, negatively impacting the demand for electronic paper displays.

E-Paper Display Market Trends

The Consumer Electronics Industry is Expected to Hold Significant Market Share

EPD is an integral part of consumer electronics as well as wearable. Growing demand for consumer electronics over the forecast period majorly contributes to the market growth owing to the constant need for display technologies. Furthermore, the intense penetration of mobile phones, tablets, and smartphones fuels growth in the consumer electronics industry, which demands more effective display technologies. Additionally, E-ink technology is used for most consumer electronics to provide low eye strain and enhanced battery life. According to Cisco Systems, Wearables in North America and Asia Pacific are expected to account for around 70% of global wearable 5G connectivity in 2022.

The rising availability of free e-books on the internet and a shift in preference among tech-savvy users from traditional books toward portable electronic reading devices are expected to drive the EPD market. Most American adults own a tablet, smartphone, or e-reader device, with the majority using tablets for reading eBooks. Electronic ink technology produces low-power paper, like a display used primarily in e-book readers, such as Amazon's Kindle.

Electronic paper displays are widely adopted in the wearables industry. Wearables, such as fitness trackers, have gained significant traction owing to increased fitness trends across consumers. Plastic Logic's ultra-thin and flexible e-paper displays have been gaining adoption, given the enormous opportunities they open up in wearable device applications, such as watches and devices, for mobile health monitoring.

EPDs are employed in smart home devices, such as smart thermostats or smart displays, where low power consumption and easy readability are important. EPDs can display information like temperature and weather updates or even act as digital sticky notes. In addition, EPDs find applications in various Internet of Things (IoT) devices, where their low power requirements and visibility in different lighting conditions are advantageous.

EPDs are integrated into smart packaging and labels for consumer products. These labels can display dynamic information, such as product details, expiration dates, or promotional messages. EPDs provide an interactive and eye-catching way to communicate with consumers and enhance the product experience.

North America is Expected to Hold Significant Market Share

- North America holds a considerable share of the global EPD market. The region has witnessed steady growth due to the increasing demand for EPDs in various sectors, such as e-readers, retail, signage, and wearables. Factors like the popularity of e-books, the need for energy-efficient display solutions, and the growing adoption of smart devices drive the market.

- North America has been a significant market for e-readers, and EPDs play a crucial role in this segment. With the popularity of e-books and the presence of major e-reader manufacturers, EPDs have gained significant traction in North America. EPDs offer a comfortable reading experience, long battery life, and excellent visibility, making them a preferred choice for e-readers.

- The retail sector in North America has embraced electronic paper displays, particularly for electronic shelf labels (ESLs). EPDs provide efficient pricing and information updates, reducing manual labor and costs. Moreover, digital signage applications in North America, such as in-store displays and outdoor billboards, leverage the benefits of EPDs for energy-efficient and easily readable content.

- The North American market is known for its high adoption of wearable devices and smartwatches. EPDs are increasingly incorporated into these devices, offering always-on displays, excellent visibility, and low power consumption. The demand for smartwatches and fitness trackers in North America has propelled the growth of EPDs in this segment.

- North America is a hub for technological advancements and innovation in the EPD market. Companies in the region are actively involved in research and development efforts to improve EPD technology, such as enhancing color reproduction, refresh rates, and flexibility. These advancements contribute to the growth of the EPD market in North America.

E-Paper Display Industry Overview

The Electronic Paper Display Market is moderately fragmented, with the presence of major players like Plastic Logic GmbH, E-Ink Holdings Inc., Clear Ink Displays, Pervasive Displays Inc., and Toppan Printing Co. Ltd. Players in the market are adopting strategies such as partnerships, collaboration, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

September 2022: Sharp Display Technology Corporation (SDTC), one of the leading companies in the field of displays, and E Ink Holdings Inc. (E Ink), the originator, pioneer, and one of the global commercial leaders in digital paper technology, announced their collaboration and adoption of SDTC's indium gallium zinc oxide (IGZO*2) backplanes for ePaper modules used in eReader and eNote products. For almost ten years, E Ink has been researching the use of oxide thin film transistors (TFTs) for electrophoretic technology, and it plans to extend its ePaper product range utilizing oxide TFTs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technological Innovations in the Field of E-displays

- 5.1.2 Growing Applications of E-display Across Various End-user Industries

- 5.2 Market Challenges

- 5.2.1 Challenges in Performance Limitations of E-paper Displays

- 5.3 Key E-paper Display Requirements

- 5.3.1 Comparison Between Monochrome and Color Display

- 5.3.2 Comparison Between Display Sizes

- 5.3.3 Comparison Between Display Resolutions

6 ANALYSIS OF E-PAPER DISPLAY TECHNOLOGIES

7 MARKET SEGMENTATION

- 7.1 End User

- 7.1.1 Consumer Electronics (Wearable, E-readers, Mobile Devices, etc.)

- 7.1.2 Institutional (Signage, Posters, etc.)

- 7.1.3 Retail (Dividers and Electronic Shelf Displays)

- 7.1.4 Other End Users (Media and Entertainment, Transportation, Healthcare, Industrial/Smart Packaging, and Architectural Applications)

- 7.2 Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia Pacific

- 7.2.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles*

- 8.1.1 Plastic Logic GmbH

- 8.1.2 E-Ink Holdings Inc.

- 8.1.3 Clear Ink Displays

- 8.1.4 Pervasive Displays Inc.

- 8.1.5 Toppan Printing Co. Ltd

- 8.1.6 LANCOM Systems GmbH

- 8.1.7 Adafruit Industries

- 8.1.8 Guangzhou Oed Technologies Co. Ltd

- 8.1.9 Microtips Technology