|

市場調查報告書

商品編碼

1444281

銦鎵鋅氧化物 -市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Indium Gallium Zinc Oxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

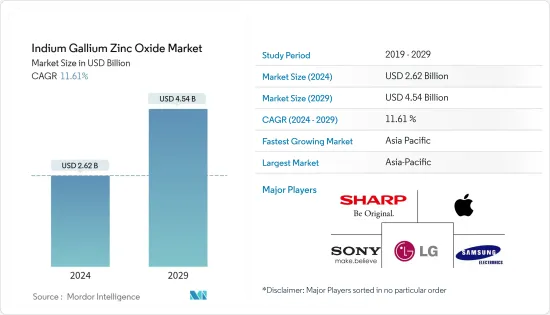

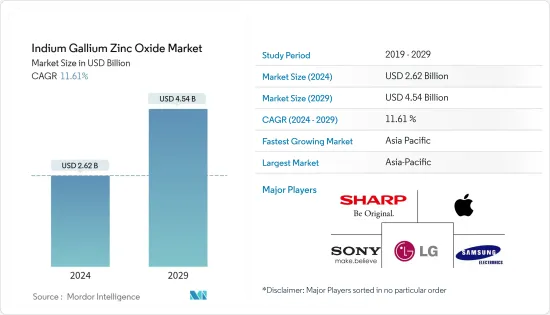

銦鎵鋅氧化物市場規模預計到2024年為26.2億美元,在預測期內(2024-2029年)預計到2029年將達到45.4億美元,年複合成長率為11.61%。

自 2012 年應用於 LCD 以來,氧化銦鎵鋅 (IGZO) 一直是各種新發展的推動力,不僅適用於液晶,也適用於其他顯示技術。由 IGZO 製成的薄膜電晶體是最熱門的產品之一,因為與低溫多晶矽 (LTPS) 製成的 TFT 相比,它們具有更高的性能,並且可以超薄且靈活地製造。可以整合到各種設備中。

主要亮點

- 全行業向小型化趨勢的轉變,特別是在實現性能的同時減輕重量和尺寸,使 IGZO 成為受歡迎的選擇。

- 經過最初的實施階段後,IGZO 的應用已擴展到廣泛的消費性電器產品,例如配備相同創新技術顯示器的智慧型手機和筆記型電腦。這家老牌消費電子公司已經發布了多款採用 IGZO 顯示器的產品,包括戴爾公司的 Dell XPS 13 筆記型電腦、雷蛇公司的 Razer Blade 14 遊戲筆記型電腦以及蘋果公司的 iPad mini 2 和 iPad Air。

- 雖然顯示器市場主要由非晶質(a-Si) 和 LTPS LCD 佔據主導地位,它們合計佔據智慧型手機顯示器市場的最大佔有率,但氧化銦鎵鋅技術的市場正在穩步成長,並且勢頭強勁。隨著平板電腦、智慧型手機、筆記型電腦和電視等顯示設備的觸控靈敏度更高、解析度更高、能源效率更高的需求不斷增加,對 IGZO 顯示器的需求也在增加。

- 供應商的持續開發和IGZO領域不斷增加的研究將進一步推動未來市場的成長。 2019 年 6 月,三星電子在佛羅裡達州奧蘭多舉行的 InfoComm 2019 展會上宣佈在全球推出 Wall Luxury。最新版本的三星 IGZO 驅動的模組化 MicroLED 螢幕可以客製化為任何尺寸和長寬比,增強了生活空間的內部裝飾,讓客戶在舒適的家中體驗卓越的圖像品質。

- 遊戲市場對於 IGZO 市場來說是一個有吸引力的機會,因為需要更高品質的 HMD 成本和功能改進來支援高品質內容的持續部署。英特爾表示,AR/VR 市場的商機仍然巨大,預計到 2021 年耳機硬體銷售額將超過 450 億美元。

- 由於中國是原料和最終產品的主要供應國之一,預計電子設備將受到新冠肺炎 (COVID-19 ) 感染疾病的嚴重影響。該行業面臨產量減少、供應鏈中斷和價格波動的問題。預計近期各大電子企業的銷售將受到影響。

銦鎵鋅氧化物市場趨勢

穿戴式裝置獲得顯著的市場佔有率

- 隨著消費者健身趨勢的興起,穿戴式裝置越來越受到重視。據思科系統公司稱,連網穿戴裝置的數量預計將從 2018 年的 5.93 億台成長到 2022 年的 11.5 億台。

- 隨著物聯網的出現,穿戴式感測設備在日常生活中的應用越來越重要,例如運動、健康檢查、商業等中的生命訊號監測。

- 在非晶質大面積基板上製造的非晶態氧化銦鎵鋅 (a-IGZO) 薄膜電晶體 (TFT) 由於其與人體的彈性相容性和低成本,對於構建穿戴式感測設備來說是令人興奮的。它是一個平台。這導致材料具有優異的機械穩定性、良好的導電性和透光性等特性。薄膜電晶體(TFT)和氣體感測器在1.9m厚的PMMA上製造,基板表現出優異的電晶體性能。

- 低溫溶液處理的非晶質IGZO 薄膜可作為新興穿戴式電子產品的室溫 VOC(揮發性有機化合物)感測器的絕佳候選者。它們用於靈活的電子應用,例如用於生鮮食品的穿戴式電子標籤等。

- 慢性病患者數量的增加增加了傳統醫療資源的壓力。這推動了穿戴式醫療設備的普及,這些設備可以幫助患者獲得更方便、更容易獲得的護理服務。這些舉措進一步推動了所研究的細分市場。

- 由於不活躍的生活方式、不健康的用餐和肥胖,一些新興和已開發地區的糖尿病患者數量不斷增加,促使市場相關人員開發智慧穿戴醫療設備。

亞太地區將經歷最快的成長

- 亞太地區正經歷最快的成長,智慧型手機、電視、筆記型電腦和穿戴式裝置等消費性電子產品的普及很高。 IGZO-TFT及其應用已獲得JST(日本科學技術振興機構)的專利並授權給Sharp Corporation。日本Sharp Corporation公司率先開始生產配備IGZO-TFT的液晶面板。Sharp Corporation在智慧型手機、平板電腦、32吋液晶顯示器中使用IGZO-TFT,有效推動市場。

- 2019年11月,Sharp Corporation與日本廣播公司(NHK)共同開發了30吋4K軟性有機LED(OLED)顯示器。有機發光二極體顯示器具有在30英寸對角線(約76cm)軟性薄膜基板的每個RGB子像素中形成的發光元件(RGB發光方法),並且是世界上最大的有機發光二極體顯示器之一。馬蘇。世界。此顯示器使用 IGZO 薄膜電晶體 (TFT) 來驅動 OLED 元件。

- 中國是有利的市場之一,由於智慧型手機和電視領域提供低成本IGZO,預計將帶來高收益,這正在提振市場需求。

- 據報道,包括重慶惠科、京東方科技、中航國際、TCL在內的多家中國企業都對收購中電熊貓液晶科技以加強其在中國液晶顯示器行業的地位表現出了濃厚的興趣。京東方已表示將停止擴大 LCD 產能,但可能會關注 CEC-Panda 的 IGZO 技術,該技術可以驅動 OLED。

- 亞太地區是 2021 年智慧型手機的主要市場,預計該地區將在預測期內繼續提供最大的成長機會。可支配收入的增加、通訊基礎設施的發展、預算型智慧型手機的出現以及產品發布數量的增加等因素都促進了智慧型手機市場的成長。

- 在印度等開發中國家,資料價格自 2013 年以來下降了 95%,導致智慧型手機用戶數量增加。非政府貿易協會和倡導團體印度工商會 (ASSOCHAM) 表示,到 2022 年,印度智慧型手機用戶數量預計將增加近一倍,達到 8.59 億,年複合成長率為 12.9。 %。

銦鎵鋅氧化物產業概況

由於各公司正在使用氧化銦鎵鋅進行新技術創新,因此氧化銦鎵鋅市場適度分散,使市場競爭激烈。市場的最新發展包括:

- 2022年4月,天馬微電子宣布與廈門國貿控股集團合作,投資330億元興建8.6代a-Si IGZO液晶面板產品線。

- 2022 年 1 月 - Sharp Corporation Visual Solutions Europe 推出首款基於創新 IGZO 面板的專業顯示器。 PN-K321H 是同類產品中最薄的型號,可提供四倍全高清 3840x2160 解析度,呈現令人驚嘆的逼真影像。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

- 調查系統

- 二次調查

- 主要研究途徑及主要受訪者

- 對資料進行三角測量並產生見解

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 技術簡介

- 市場促進因素

- 高解析度技術的進步

- 致力於節能技術

- 市場限制因素

- 低溫多晶(LTPS)等競品

- 評估 COVID-19 對產業的影響

第5章市場區隔

- 按用途

- 智慧型手機

- 穿戴式裝置

- 壁掛式顯示器

- 電視機

- 平板電腦、筆記本、筆記型電腦

- 其他應用

- 按最終用戶

- 車

- 家用電器

- 衛生保健

- 工業的

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他地區

第6章 競爭形勢

- 公司簡介

- Sharp Corporation

- Apple Inc.

- Sony Corporation

- ASUSTEK Computer Inc.

- LG Electronics

- AU Optronics

- Samsung Electronics Co. Ltd

- Fujitsu Limited

第7章 投資分析及未來趨勢

- 投資分析

- 未來市場展望

The Indium Gallium Zinc Oxide Market size is estimated at USD 2.62 billion in 2024, and is expected to reach USD 4.54 billion by 2029, growing at a CAGR of 11.61% during the forecast period (2024-2029).

Ever since its incorporation in LCDs back in 2012, Indium Gallium Zinc Oxide (IGZO) has become a driving force in various new developments not just specific to liquid crystals but in other display technologies. Thin-film transistors consisting of IGZO are among the products gaining the most traction owing to their enhanced performance compared to TFTs made with low-temperature-poly-silicon (LTPS), as well as their ability to be made ultra-thin and flexible for integration into a wide variety of devices.

Key Highlights

- A shift toward the trend of miniaturization across the industries, particularly aiming to reduce the weight and size while achieving performance, has made the IGZO a popular choice.

- Post the initial incorporation phase, IGZO's application has extended to a wide range of consumer electronics, such as smartphones and laptops, featuring the same innovative technology display. Established consumer electronics players have launched a few products, such as Dell XPS 13 laptop from Dell Inc., Razer Blade 14 gaming laptop from Razer Inc., and iPad mini 2 & iPad Air from Apple, featuring the IGZO display.

- The market for displays was predominantly dominated by Amorphous Silicon (a-Si) and LTPS LCD, combining to form the largest percentage of the smartphone displays market, but steady, the market for indium gallium zinc oxide technology is gaining traction. As the demand for enhanced touch sensitivity, higher resolution, and power-efficient display devices, such as tablets, smartphones, laptops, and televisions, are on the rise, demand for IGZO displays is gaining momentum.

- Continuous developments from the vendors and increasing research in the IGZO space would augment the market's growth in the coming times. In June 2019, Samsung Electronics Co. Ltd announced the global launch of the Wall Luxury at InfoComm 2019 in Orlando, Florida. The latest version of Samsung's modular MicroLED screen with IGZO can be custom-tailored to any size and aspect ratio, enhancing the interior of the living space, ensuring customers can experience superior picture quality in the comfort of their own homes.

- The gaming market is an attractive opportunity for the IGZO market, owing to the demand for higher-quality HMDs cost and functionality improvements to support the ongoing rollout of high-quality content. According to Intel, the revenue opportunity of the AR/VR market remains strong, and it is estimated to exceed USD 45 billion in headset hardware sales by the year 2021.

- The electronics devices are expected to be impacted significantly by the COVID-19 outbreak, as China is one of the major suppliers of raw materials and finished products. The industry is facing a reduction in production, disruption in the supply chain, and price fluctuations. The sales of prominent electronic companies are expected to be affected in the near future.

Indium Gallium Zinc Oxide Market Trends

Wearable Devices to Gain Significant Market Share

- Wearable devices have gained significant traction, owing to the boom in the fitness trend across consumers. According to Cisco Systems, the number of connected wearable devices is expected to increase from 593 million in 2018 to 1,105 million in 2022.

- With the advent of the internet of things, wearable sensing devices are gaining importance in the daily lives of applications like vital signal monitoring during sports and health diagnostics, enterprises, etc.

- Amorphous indium gallium zinc oxide (a-IGZO) thin-film transistors (TFTs) fabricated on flexible large-area substrates are an exciting platform to build wearable sensing devices due to their flexibility conformability to the human body, and low cost. This provides material properties of superb mechanical stability, good electrical conductivity, and optical transparency. Thin film transistors (TFTs) and gas sensors are fabricated on a 1.9 µm thick PMMA, where the substrate exhibits excellent transistor performances.

- Low-temperature solution-processed amorphous IGZO film can serve as a good candidate for room-temperature VOCs (volatile organic compounds) sensors for emerging wearable electronics. These are used in flexible electronic applications such as wearable electronic tags used in perishable food, etc.

- The rising number of chronic patients increases the conventionally available healthcare resources burden. This, in turn, promotes the popularity of wearable medical devices that could assist patients with more convenient and accessible care services. These initiatives further drive the studied segment.

- Due to inactive lifestyles, unhealthy diets, and obesity, some of the emerging and developed regions are witnessing a rising number of diabetic patients, encouraging the market players to develop smart wearable medical devices.

Asia Pacific to Witness Fastest Growth

- Asia-Pacific is witnessing the fastest growth due to the high amount of penetration of consumer electronic devices such as smartphones, televisions, laptops, wearables, etc. IGZO-TFT and its applications are patented by JST (Japan Science and Technology Agency) and have been licensed to Sharp. Sharp, a Japanese firm, was the first to start production of LCD panels incorporating IGZO-TFT. Sharp uses IGZO-TFT for smartphones, tablets, and 32" LCDs, which drives the market efficiently.

- In November 2019, Sharp Corporation and Japan Broadcasting Corporation (NHK) co-developed a 30-inch 4K flexible organic LED (OLED) display. The OLED display, with light-emitting elements formed onto each of the RGB subpixels (RGB light emission method) of a 30-inch-diagonal (approx. 76 cm) flexible film substrate, is one of the largest displays of its kind in the world. This display employs IGZO thin-film transistors (TFTs) to drive the OLED elements.

- China is one of the lucrative markets and computes high revenue rotation because of the availability of low-cost IGZO in the segment of smartphones and televisions, which drives the demand in the market.

- Reportedly, several Chinese companies, including Chongqing HKC, BOE Technology, AVIC International Holding, and TCL, show a keen interest in taking control of CEC-Panda LCD Technology to consolidate their position in China's liquid-crystal display industry. Though BOE stated that it would stop expanding its LCD production capacity, it is probably eyeing CEC-Panda's IGZO technology that can drive OLED.

- Asia-Pacific was the prominent market for smartphones in 2021, and the region is expected to continue to offer maximum growth opportunities over the forecast period. Factors such as growing disposable income, development of telecom infrastructure, the emergence of budget-centric smartphones, and the rising number of product launches contribute to the growth of the smartphone market.

- Developing nations, such as India, witnessed a fall in data costs by 95% since 2013, resulting in an increase in smartphone users. According to the Associated Chambers of Commerce and Industry of India, a non-governmental trade association and advocacy group (ASSOCHAM), the number of smartphone users in the country is expected to almost double to 859 million by 2022, growing at a CAGR of 12.9%.

Indium Gallium Zinc Oxide Industry Overview

The indium gallium zinc oxide market is moderately fragmented as the players are innovating with new technologies using indium gallium zinc oxide, which is making the market competitive. Some of the recent developments in the market are -

- April 2022 - Tianma Microelectronics Co. Ltd announced collaborating with Xiamen International Trade Holding Group Co. Ltd, investing CNY 33 billion to build a product line categorizing the 8.6 generation a-Si IGZO LCD panel.

- January 2022 - Sharp Visual Solutions Europe unveiled its first professional display based on an innovative IGZO panel. The PN-K321H is the slimmest model in its class and achieves quad full-HD 3840x2160 resolution for stunning realistic image production.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research Approach and Key Respondents

- 2.4 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Market Drivers

- 4.4.1 Advancement in High Resolution Technologies

- 4.4.2 Emphasis on Energy-saving Technology

- 4.5 Market Restraints

- 4.5.1 Competitors, Such as Low-temperature Polycrystalline Silicon (LTPS)

- 4.6 Assessment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Smartphones

- 5.1.2 Wearable Devices

- 5.1.3 Wall-Mounted Displays

- 5.1.4 Televisions

- 5.1.5 Tablets, Notebook and Laptops

- 5.1.6 Other Appplications

- 5.2 By End-User

- 5.2.1 Automotive

- 5.2.2 Consumer Electronics

- 5.2.3 Healthcare

- 5.2.4 Industrial

- 5.2.5 Other End-users Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Sharp Corporation

- 6.1.2 Apple Inc.

- 6.1.3 Sony Corporation

- 6.1.4 ASUSTEK Computer Inc.

- 6.1.5 LG Electronics

- 6.1.6 AU Optronics

- 6.1.7 Samsung Electronics Co. Ltd

- 6.1.8 Fujitsu Limited

7 INVESTMENT ANALYSIS AND FUTURE TRENDS

- 7.1 Investment Analysis

- 7.2 Future of the Market