|

市場調查報告書

商品編碼

1444212

電容式壓力感測器 -市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Capacitive Pressure Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

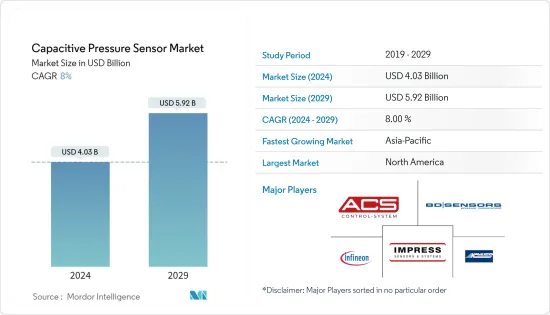

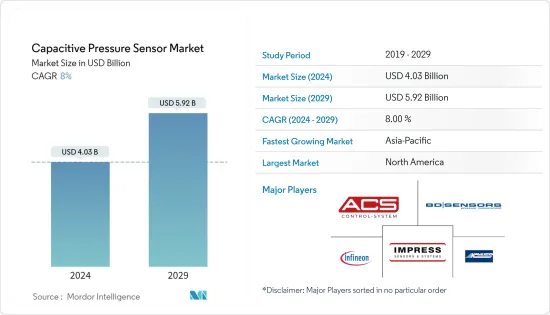

電容式壓力感測器市場規模預計到 2024 年為 40.3 億美元,預計到 2029 年將達到 59.2 億美元,在預測期內(2024-2029 年)年複合成長率為 8%。

主要亮點

- 帶電容單元的壓力感測器旨在為現有設備提供獨特且準確的結果。陶瓷材料的獨特優勢使感測器能夠提供長期穩定性和可靠性以及耐高壓性。

- 與電阻感測技術相比,電容式壓力感測器因其卓越的靈敏度、準確性和無磨損問題而變得越來越受歡迎。這些感測器提供了許多出色的功能,並且在許多應用中擴大取代電阻感測器。此外,感測器技術的進步正在導致小型感測器的開發和過渡,為行業領導者創造了許多機會。

- 電容式壓力感測器簡單而堅固的機械結構可實現多種工業應用。電容式壓力感測器使用陶瓷,這使得它們能夠承受惡劣的工業條件並提供更快的反應時間。

- 隨著 MEMS 技術的進步,電容式壓力感測器變得越來越小,並可用於更多產業。電容式壓力感測器的小型化降低了製造成本。因此,電容式壓力感測器因其廉價、高效和廣泛的應用而不斷成長。

- 此外,去年汽車尤其是電動車的銷量大幅成長。預計未來將進一步成長,也將影響電容式壓力感測器市場。

- 此外,由於世界各國政府實施的封鎖和其他規則和法規,COVID-19 對市場產生了重大影響。然而,在疫情後的情況下,由於汽車、醫療保健、石油和天然氣等行業的快速成長,市場出現了顯著成長。

- 不過,進入門檻並不是很高,現在很多公司都提供電容式壓力感知器。這導致了非常激烈的價格競爭、產品之間難以區分以及市場成長放緩。

電容式壓力感測器的市場趨勢

預計汽車產業市場將顯著成長

- 設計和製造汽車用壓力感測器時最重要的考慮因素之一是它們在各種溫度、振動、介質、衝擊和電磁條件下都能正常工作。換句話說,感測器必須足夠耐用才能執行其功能。

- 隨著自動駕駛汽車和電動車的出現,汽車產業的快速發展強調了應用設備的小型化,這主要推動了市場的成長。

- 目前,各大汽車製造商都在提高電動車領域的產能。大眾和西門子 2022 年 6 月的聲明就是一個例子。他們宣布打算進行 4.5 億美元的重大投資,這將使 Electrify America 的估值達到 24.5 億美元。這項共同努力的目標是到 2026 年將美國和加拿大的 Electrify America 充電站數量增加一倍。

- 據EV-Volumes.com稱,預計2022年上半年全球電動車新純電動車和插電式混合動力車銷量將超過430萬輛。由於汽車的巨大需求及其快速發展,電容式壓力感測器市場預計將擴大。

- 此外,根據 IEA 的數據,預計 2022 年將售出 1,020 萬輛插電式電動車 (PEV)。此外,2022年歐洲五個主要市場的電動車銷量大幅成長。此外,美國全電動汽車和插電式電動車銷量將於 2022 年達到頂峰。例如,根據EERE和美國能源局阿貢國家統計局的數據,美國實驗性插電式電動車(PEV)的銷售到2022年將增加至918,500輛,而2021年為607,600輛。電動車的成長可能會增加全球對電容式壓力感測器的需求。

北美地區預計將主導市場

- 由於整個大陸穩定的產業結構,北美預計將主導電容式壓力感測器市場。該地區正在進行越來越多的研發 (R&D),使其成為創新和市場啟動的領導者。

- 電容式感測器的醫療應用在過去一年中顯示出顯著成長。人工呼吸器、人工呼吸器、生命徵象監測儀和氣流應用是主要的醫療最終用戶應用。許多科技公司正在進行新的研究並將血壓監測產品推向市場。例如,科技巨擘蘋果已經申請了血壓監測袖帶的專利。

- 該地區也引領航太和國防工業。美國是國防支出最高的國家。根據SIPRI統計,2022年全球軍事開支實際成長3.7%,達到2.24兆美元的新高。 2013 年至 2022 年,全球支出大幅成長 19.0%,並且自 2015 年以來每年都持續成長。此外,美國宇航局還宣布了未來計劃的計劃,重點是擴大和探索太陽系。航太和工業的崛起可能會進一步增加該地區對電容式壓力感測器的需求。

- 此外,該地區組織對各行業的大規模投資正在推動電容式壓力感測器及其應用市場的發展。

電容式壓力感測器產業概況

電容式壓力感測器市場高度分散,參與者眾多。隨著電容式壓力感測器的產品成本下降,我們看到提供該產品的公司數量增加。此外,對產品進一步差異化的需求導致供應商採取有競爭力的定價策略。該市場有一些主要參與者,例如 ACS-Control-System GmbH、BD Sensors GmbH、Infineon Technologies 和 TE Connectivity。

- 2023 年 6 月:英飛凌科技股份公司推出兩款新型 XENSIV 氣壓 (BAP) 感測器:KP464 和 KP466。這些感測器專為汽車應用而設計,具有多種優勢。 KP464 非常適合引擎控制管理,而 KP466 BAP 感知器專門用於增強座椅舒適度功能。 KP464 和 KP466 感測器是高性能、高精度、緊湊型數位絕對壓力感測器,採用電容測量原理。

- 2023 年 5 月:Dwyer Instruments 發布其最新的工業差壓變送器。 Dwyer 系列 IDPT 工業差壓變送器採用耐用、防水外殼設計,可承受惡劣的工業環境。具有出色的精度和穩定性,非常適合在各種工業應用中長期使用。此壓力變送器具有一個範圍從 0-0.25" WC 到 0-1" WC 的壓電感測器。客戶可以選擇 0.25% 或 0.25% 的精確度選項。 0.5% 滿量程。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究成果

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 技術簡介

- 市場促進因素

- 強調小型化以及將先進技術整合到產品中

- 汽車和工業領域的應用越來越多

- 市場限制因素

- 產品缺乏差異化

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 按最終用戶

- 車

- 醫療保健

- 化學和石化

- 航太

- 發電

- 其他最終用戶

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭形勢

- 公司簡介

- ACS-Control-System GmbH

- BD Sensors GmbH

- Impress Sensors &Systems Ltd

- Infineon Technologies Inc.

- Kavlico

- Metallux SA

- Murata Manufacturing Co. Ltd

- TE Connectivity Ltd

- Pewatron AG

- Bourns Ltd

- Sensata Technologies Holding NV

- VEGA Controls Ltd

第7章 投資分析

第8章市場機會及未來趨勢

The Capacitive Pressure Sensor Market size is estimated at USD 4.03 billion in 2024, and is expected to reach USD 5.92 billion by 2029, growing at a CAGR of 8% during the forecast period (2024-2029).

Key Highlights

- Pressure sensors with a capacitive cell have been designed to offer unique and accurate results to the existing equipment. The distinct advantages of ceramic material allow sensors to provide long-term stability and reliability with high resistance to pressure.

- Capacitive pressure sensors have become increasingly popular compared to resistive sensing technology due to their impressive sensitivity, accuracy, and lack of wear and tear issues. Due to their numerous standout features, these sensors increasingly replace resistive sensors in many applications. Additionally, advancements in sensor technology have resulted in the creation and shift towards smaller sensors, presenting numerous opportunities for industry leaders.

- The capacitive pressure sensor's simple and robust mechanical structure enables several industrial applications. Capacitive pressure sensors can sustain harsh industrial conditions due to the use of ceramics and provide a quicker response rate.

- As MEMS technology has improved, capacitive pressure sensors have become smaller, which has made them useful in more industries. The miniaturization of capacitive pressure sensors has reduced their production costs. Hence, the capacitive pressure sensor market is growing with its cheap, efficient, and wide array of applications.

- Furthermore, sales of automobiles, particularly electric vehicles, have increased significantly in the last year. That is expected to grow more in the future and thus will impact the market for capacitive pressure sensors as well.

- Additionally, the COVID-19 impacted the market very heavily due to lockdowns and other rules and regulations imposed by governments around the globe. However, in the post pandemic scenario, the market had grown a lot due to the fast growth of the industries that used it, such as the automotive, medical, oil and gas, and other industries.

- However, there is not as much of a barrier to entry, many companies now offer capacitive pressure sensors. This makes prices very competitive and makes it hard to differentiate one product from another, which is slowing market growth.

Capacitive Pressure Sensor Market Trends

Automotive Segment is Expected to Observe Significant Market Growth

- One of the most important things when designing and making pressure sensors for use in cars is that they work well in a wide range of temperatures, vibrations, media, shocks, and electromagnetic conditions. In other words, the sensor must be durable enough to do its job.

- The rapid evolution of the automotive sector, with the advent of autonomous vehicles or electric vehicles, emphasizes the miniaturization of equipment for applications, primarily driving the market's growth.

- Major automotive manufacturers are currently increasing their manufacturing capacity in the electric vehicle sector. An example is the announcement by Volkswagen and Siemens made in June 2022. They stated their intention to invest a significant amount of USD 450 million, which would value Electrify America at USD 2.45 billion. This collaborative effort aims to double the number of Electrify America charging stations across the US and Canada by 2026.

- The global sales of electric vehicles will cross 4.3 million new BEVs and PHEVs during the first half of 2022, as stated by EV-Volumes.com. The huge demand for automotive vehicles and their rapid developments are expected to augment the capacitive pressure sensor market.

- Additionally, According to IEA, In 2022, an estimated 10.2 million units of plug-in electric light vehicles (PEVs) were sold. Additionally, electric vehicle sales in Europe's five major markets witnessed a significant increase in 2022. Also, United States sales of all-electric and plug-in electric vehicles peaked in 2022. For instance, according to EERE and the U.S. Department of Energy's Argonne National Laboratory, plug-in electric vehicle (PEV) sales reached 918,500 units in the United States in 2022, compared to 607,600 units in 2021. Such rise in electric vehicles is likely to boost the demand for capacitive pressure sensors gloablly.

North America Region is Expected to Dominate the Market

- North America is expected to dominate the capacitive pressure sensor market due to the stable industrial structure across the continent. More and more research and development (R&D) is being done in the area, making it the leader in innovation and getting it to market.

- Medical applications of capacitive sensors have shown significant growth over the past year. Respirators, ventilators, vital sign monitors, and airflow applications are major medical end-user applications. Many tech companies are conducting new research and launching their products on the market for monitoring blood pressure. For instance, technology giant Apple Inc. filed a patent application for a blood pressure monitoring cuff.

- The region also leads the aerospace and defense industries. The United States is the country with the highest defense spending. According to SIPRI, World military expenditure increased by 3.7% in real terms in 2022, reaching a new peak of USD 2,240 billion. Global spending has experienced a significant growth of 19.0% over the span of 2013-22 and has consistently risen each year since 2015. In addition, NASA has announced its plans for future projects, focusing on expanding and exploring the solar system. Such rise in aerospace and industries are likely to bring more demand for capacitive pressure sensors in the region.

- Additionally, These massive investments across various industries by organizations in the region are driving the market for capacitive pressure sensors and their applications.

Capacitive Pressure Sensor Industry Overview

The Capacitive Pressure Sensor Market is highly fragemented with numerous players. With the declining product cost of capacitive pressure sensors, a rise in the number of players offering the product is observed. Additionally, the need for more differentiation in the product offerings made the vendors adopt competitive pricing strategies. The market has several leading players, such as ACS-Control-System GmbH, BD Sensors GmbH, Infineon Technologies, TE Connectivity, etc.

- June 2023: Infineon Technologies AG introduced its two new XENSIV barometric air pressure (BAP) sensors: the KP464 and KP466. These sensors are specifically designed for automotive applications and offer a range of benefits. The KP464 is ideal for engine control management, while the KP466 BAP sensor is specifically intended for enhancing seat comfort functions. The KP464 and KP466 sensors are high-performance, high-precision, and compact digital absolute pressure sensors that utilize the capacitive measurement principle.

- May 2023: Dwyer Instruments released its latest industrial differential pressure transmitter. The Series IDPT industrial differential pressure transmitter from Dwyer is designed with durable and water-resistant housing, ensuring it can withstand challenging industrial environments. It offers exceptional accuracy and stability, making it ideal for long-term use in various industrial applications. This pressure transmitter features a capacitive pressure sensor for ranges of 0 to 0.25 in w.c. to 0 to 1 in w.c. and a piezo sensor for ranges of 0 to 2.5 in w.c. to 0 to 10 in w.c. Customers can choose between accuracy options of 0.25% or 0.5% full-scale.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Technology Snapshot

- 4.3 Market Drivers

- 4.3.1 Emphasis on Miniaturization and Integration of Advanced Technology in Products

- 4.3.2 Growing Number of Applications in the Automotive and Industrial Sectors

- 4.4 Market Restraints

- 4.4.1 Lack of Product Differentiation

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By End User

- 5.1.1 Automotive

- 5.1.2 Medical

- 5.1.3 Chemical and Petrochemical

- 5.1.4 Aerospace

- 5.1.5 Power Generation

- 5.1.6 Other End Users

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ACS-Control-System GmbH

- 6.1.2 BD Sensors GmbH

- 6.1.3 Impress Sensors & Systems Ltd

- 6.1.4 Infineon Technologies Inc.

- 6.1.5 Kavlico

- 6.1.6 Metallux SA

- 6.1.7 Murata Manufacturing Co. Ltd

- 6.1.8 TE Connectivity Ltd

- 6.1.9 Pewatron AG

- 6.1.10 Bourns Ltd

- 6.1.11 Sensata Technologies Holding NV

- 6.1.12 VEGA Controls Ltd