|

市場調查報告書

商品編碼

1444185

農業界面活性劑:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Agricultural Surfactant - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

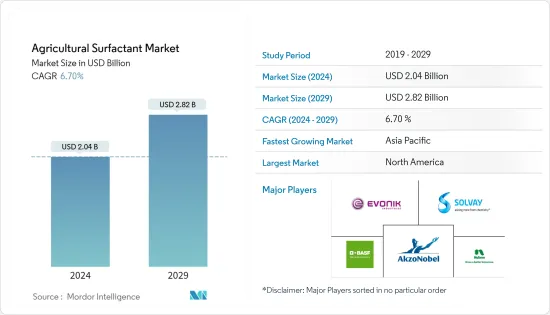

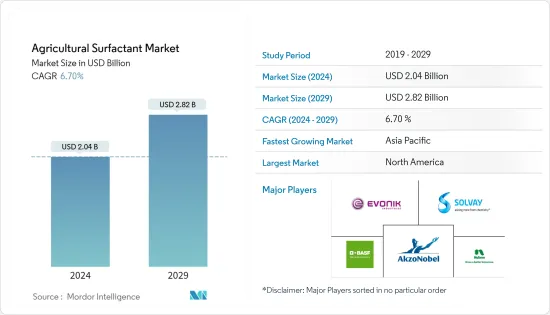

農業界面活性劑市場規模預計2024年為20.4億美元,預計到2029年將達到28.2億美元,在預測期內(2024-2029年)持續成長,年複合成長率為6.70%。

COVID-19 的爆發影響了農業表面活性劑市場。北美等關鍵地區已經受到了疫情的影響,包括突然關閉、供應鏈崩壞和政府限制。生物基界面活性劑的使用不斷增加正在引發市場投資。

農業界面活性劑主要與水性除草劑噴霧溶液一起使用,以增強液體的乳化、分散、鋪展、潤濕或其他表面改性特性。除草劑處理溶液中幾乎總是存在表面活性劑,以改善噴霧液滴的保留和活性成分向植物葉子的滲透。由於精密農業和保護性農業的廣泛採用,農業表面活性劑的使用量正在增加。

農用表面活性劑市場趨勢

食品需求的增加和土地的減少正在推動市場

世界人口正在迅速成長,世界糧食需求每天增加近 20 萬人。過去 100 年間,世界人口幾乎翻了兩番,預計到 2050 年將達到 92 億。養活不斷成長的人口對世界構成威脅。 2030年,人均農業用地預計將從2005年的2,200平方公尺減少到1,800平方公尺。這種情況正在變得越來越糟,各種作物害蟲每年造成全球作物損失的 10-16%。因此,農民正在將作物保護作為滿足全球不斷成長的糧食需求的重要策略。對農藥的需求正在推動農用界面活性劑市場的發展。

北美主導農用界面活性劑市場

北美在農業界面活性劑市場中佔有最大佔有率,佔35%。預計該地區在預測期內將穩定成長,特別是由於政府採取了各種提高產量和維持食品、飼料和生質燃料行業原料持續供應的措施。推動成長的主要因素是生物表面活性劑使用量的增加和原料的充足供應。然而,環境問題以及健康和安全問題預計將阻礙市場成長。它們作為肺表面活性劑在新生兒呼吸窘迫(NRD)症候群中的應用可能是未來的一個機會。美國憑藉個人護理和食品加工等行業的擴張主導了全部區域的市場。

農用表面活性劑產業概況

農用界面活性劑市場較為分散。市場上的主要企業正在遵循策略,透過收購、新產品發布、擴張和投資、協議、夥伴關係、協作和合資企業來開拓新的地區。投資研發是市場領導採取的另一個策略。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 類型

- 陰離子的

- 非離子型

- 陽離子的

- 雙性戀

- 目的

- 殺蟲劑

- 除草劑

- 殺菌劑

- 其他用途

- 基板

- 合成

- 生物基

- 作物應用

- 以作物為基礎

- 穀物和穀物

- 油籽

- 水果和蔬菜

- 非農作物為主

- 草坪和裝飾草坪

- 其他作物的應用

- 以作物為基礎

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 最採用的策略

- 市場佔有率分析

- 公司簡介

- Corteva Agriscience

- Evonik Industries

- BASF SE

- Akzonobel

- Solvay SA

- Wilbur-Ellis Company

- Croda International PLC

- Huntsman

- Nufarm Limited

- Helena Chemical Company

- Air Products and Chemicals

- Kao Corporation

- Clariant

- Lamberti SPA

- Brandt Consolidated Inc.

- Interagro(Uk)Ltd

- Tanatex Chemicals BV

- Garrco Products Inc.

第7章市場機會與未來趨勢

The Agricultural Surfactant Market size is estimated at USD 2.04 billion in 2024, and is expected to reach USD 2.82 billion by 2029, growing at a CAGR of 6.70% during the forecast period (2024-2029).

The COVID-19 outbreak impacted the agricultural surfactant market. Major regions like North America witnessed the impact of the pandemic, such as sudden shutdown, collapsed supply chain, and government restrictions. Increasing usage of biobased surfactants is leading to investments in the market.

Agricultural surfactants are mainly used with water-based herbicide spray solutions as they accentuate the emulsifying, dispersing, spreading, wetting, or other surface modifying properties of liquids. Surfactants are almost always present in herbicide treatment solutions to improve spray droplet retention and penetration of active ingredients into plant foliage. The increasing usage of agricultural surfactants is due to the high adoption of precision farming and protected agriculture.

Agricultural Surfactants Market Trends

Rising Demand for Food and Shrinking Land Driving the Market

The global population is increasing exponentially, and every day, nearly 200,000 people are being added to the world's food demand. The world's human population increased nearly fourfold in the past 100 years, and it is projected to reach 9.2 billion by 2050. Supplying food to this growing population has become a global threat. Farmland per capita in 2030 is expected to decrease to 1800 m2 from 2,200 m2 in 2005. Various crop pests are causing 10-16% of global crop losses annually, worsening the scenario. Therefore, farmers are adopting crop protection as the key strategy to meet the growing food demand globally. The demand for crop protection chemicals is driving the market for agricultural surfactants.

North America Dominates the Agricultural Surfactant Market

North America holds the largest part of the agricultural surfactant market, at 35%. The region is expected to grow steadily during the forecast period, especially with the various government initiatives to increase yield and maintain a continuous supply of raw materials for the food, feed, and biofuel industries. Major factors driving the growth are the increasing usage of bio-surfactants and the abundant availability of raw materials. However, environmental concerns and health and safety issues are anticipated to hinder the market's growth. Their usage as lung surfactants in the Neonatal Respiratory Distress (NRD) syndrome is likely to act as an opportunity in the future. The United States dominated the market across the region due to the expansion of industries, such as personal care and food processing.

Agricultural Surfactants Industry Overview

The market for agricultural surfactants is fragmented. The key players in the market have been following strategies to explore new regions through acquisitions, new product launches, expansions and investments, agreements, partnerships, collaborations, and joint ventures. Investment in R&D is another strategy adopted by market leaders. Some of the major players in the market are Evonik Industries AG, Dow Corning Corp., AkzoNobel NV, and Solvay SA (Belgium).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Anionic

- 5.1.2 Nonionic

- 5.1.3 Cationic

- 5.1.4 Amphoteric

- 5.2 Application

- 5.2.1 Insecticide

- 5.2.2 Herbicide

- 5.2.3 Fungicide

- 5.2.4 Other Applications

- 5.3 Substrate

- 5.3.1 Synthetic

- 5.3.2 Bio-based

- 5.4 Crop Application

- 5.4.1 Crop-based

- 5.4.1.1 Grains and Cereals

- 5.4.1.2 Oilseeds

- 5.4.1.3 Fruits and Vegetables

- 5.4.2 Non-crop-based

- 5.4.2.1 Turf and Ornamental Grass

- 5.4.2.2 Other Crop Applications

- 5.4.1 Crop-based

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Italy

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Rest of Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Corteva Agriscience

- 6.3.2 Evonik Industries

- 6.3.3 BASF SE

- 6.3.4 Akzonobel

- 6.3.5 Solvay SA

- 6.3.6 Wilbur-Ellis Company

- 6.3.7 Croda International PLC

- 6.3.8 Huntsman

- 6.3.9 Nufarm Limited

- 6.3.10 Helena Chemical Company

- 6.3.11 Air Products and Chemicals

- 6.3.12 Kao Corporation

- 6.3.13 Clariant

- 6.3.14 Lamberti SPA

- 6.3.15 Brandt Consolidated Inc.

- 6.3.16 Interagro (Uk) Ltd

- 6.3.17 Tanatex Chemicals BV

- 6.3.18 Garrco Products Inc.