|

市場調查報告書

商品編碼

1444178

異丙醇 (IPA) -市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Isopropyl Alcohol (IPA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

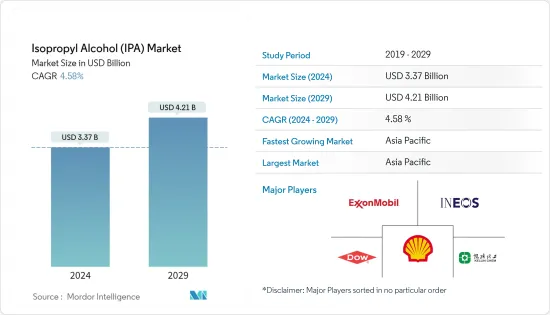

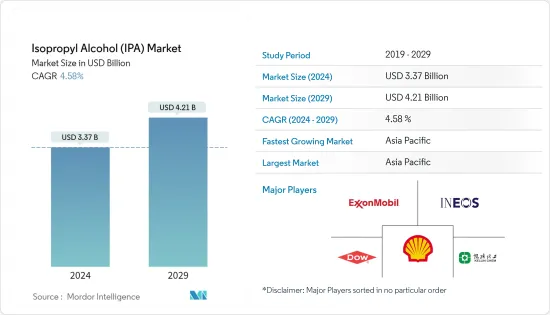

異丙醇(IPA)市場規模預計到2024年為33.7億美元,在預測期內(2024-2029年)預計到2029年將達到42.1億美元,年複合成長率為4.58%。

COVID-19感染疾病導致多個行業的產量減少,包括化學品、油漆和塗料。然而,消毒劑產量的增加彌補了這一下降。

主要亮點

- 從中期來看,化妝品和個人保健產品的使用增加、IPA 作為清洗劑的廣泛使用以及製藥行業對 IPA 用於消毒劑製造的持續需求預計將推動市場成長。

- 另一方面,生產丙酮的替代方案的可用性仍然是市場的主要關注點之一。

- 生物基異丙醇的創新可能會在未來幾年創造市場機會。

- 亞太地區主導全球市場,中國、印度和日本的需求龐大。

異丙醇(IPA)市場趨勢

醫藥板塊佔市場主導地位

- 製藥業是異丙醇的最終用戶。濃度為 70% 的異丙醇用於酒精棉籤和擦拭巾中,用於清潔傷口。它也存在於洗手液和滴耳劑中。口腔沖洗劑也含有一定量的異丙醇。

- 異丙醇也用於清潔產品。一般來說,製藥業可以在膠囊或錠劑製造過程中安全地使用少量異丙醇。 IPA 用於使用溶劑形成藥物中間體。

- 近年來,印度、美國和德國等幾個國家增加了藥品支出,提振了 IPA 市場。例如,根據全印度化學家和藥劑師組織的報告,2022 年 8 月印度藥品市場成長了 12.1%。

- COVID-19大流行的不確定性引起的日益嚴重的健康問題對所研究市場的製藥領域產生了重大的積極影響,這尤其體現在乾洗手劑的銷售上。這項因素進一步增加了對異丙醇的需求。

- 根據英國製藥工業協會 (ABPI) 的數據,製藥業是英國第三大產業,每年為英國經濟貢獻 140 億歐元(165.641 億美元)。

- 英國政府承諾在脫歐後繼續投資研發,到2027年將其佔GDP的比例提高到2.4%。製藥業已經佔英國研發總支出的近一半,這項額外投資只會幫助美國繼續發展。對跨國製藥公司來說,沙烏地王國是一個極具吸引力的地點。

亞太地區主導市場

- 亞太地區主導整個市場。化學工業的投資以及該地區對化妝品和藥品的需求不斷增加等因素預計將推動異丙醇市場的成長。

- 中國是全球第二大醫藥市場。到2022年,該國藥品銷售額預計將達到1,750億美元。

- 預計到 2026 年,中國醫療保健市場將達到近 2,000 億元(310.2 億美元),比 2016 年成長 10 倍。醫療保健產業的成長,加上COVID-19的爆發,刺激了國內醫藥產業的需求,帶動了市場需求。

- 此外,印度擁有世界上最大的油漆和塗料工業之一。亞太地區住宅建設活動的快速成長對於油漆和塗料行業以及 IPA 來說是一個積極的訊號。印度政府計劃投資1,205億美元發展27個產業叢集,預計將推動該國商業建設。政府也計劃到2032年建造100個新機場。

- 根據電子情報技術產業協會(JEITA)統計,2021年日本電子產業總產值為10.95兆日圓(976.375億美元)。此外,2022年上半年產值較2021年同期下降0.4%,日本電子業銷售額達53,900億日圓(480,608.3億美元)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 全球不斷成長的個人護理產業

- IPA被廣泛用作清洗劑

- 製藥業消毒劑生產對 IPA 的需求增加

- 抑制因素

- 可用於生產丙酮的替代方案

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔

- 目的

- 製程和製備溶劑

- 清洗劑/乾燥劑

- 塗料和染料溶劑

- 中間的

- 其他用途

- 最終用戶產業

- 化妝品和個人護理

- 藥品

- 電子產品

- 油漆和塗料

- 化學品

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率分析(%)

- 主要企業採取的策略

- 公司簡介

- China National Petroleum Corporation

- Dow

- ENEOS Corporation

- ExxonMobil Corporation

- Ineos

- Kailing Chemical(Zhangjiagang)Co. Ltd

- LCY GROUP

- LG Chem

- Mitsui Chemicals Inc.

- Shell PLC

- Yancheng Super Chemical Technology Co. Ltd.

- Zhejiang Xinhua Chemical Co. Ltd.

第7章市場機會與未來趨勢

- 生物基異丙醇創新

The Isopropyl Alcohol Market size is estimated at USD 3.37 billion in 2024, and is expected to reach USD 4.21 billion by 2029, growing at a CAGR of 4.58% during the forecast period (2024-2029).

Due to the COVID-19 pandemic, production in various industries like chemicals and paints, and coatings decreased. However, this decrease was compensated by the growth in the production of sanitizers.

Key Highlights

- In the medium term, the increasing use of cosmetic and personal care products, the wide usage of IPA as cleaning agents, and continued demand for IPA from the pharmaceutical industry for sanitizer production are likely to drive the market's growth,

- On the flip side, the availability of alternative ways to produce acetone remains one of the major concerns for the market.

- Innovation in bio-based isopropyl alcohol is likely to create opportunities for the market in the coming years.

- Asia-Pacific dominates the market worldwide, with huge demand generated from China, India, and Japan.

Isopropyl Alcohol (IPA) Market Trends

The Pharmaceutical Segment to Dominate the Market

- The pharmaceutical segment is an end-user of isopropyl alcohol. Isopropyl alcohol of 70% concentration is used in alcohol swabs and wipes for cleaning wounds. It is also found in hand sanitizers and ear drops. Oral mouthwash solutions also contain isopropyl alcohol in some quantity.

- Isopropyl alcohol is also used in cleaning supplies. Generally, in the pharmaceutical industry, isopropyl alcohol can be used in small and safe quantities in capsule or tablet manufacturing processes. IPA is used in the formation of pharmaceutical intermediates using solvents.

- Several countries, like India, the United States, and Germany, increased their expenditure on pharmaceuticals/medicines over the recent years, thus boosting the IPA market. For instance, the Indian pharma market grew by 12.1% during August 2022, as the All India Organization of Chemists and Druggists reported.

- The increasing health concerns caused by the uncertainties of the COVID-19 pandemic have had a significantly positive impact on the pharmaceuticals segment of the market studied, which was especially reflected in the sales of hand sanitizers. This factor further boosted the demand for isopropyl alcohol.

- The pharmaceutical sector is the third largest industry in the United Kingdom and, according to the Association of the British Pharmaceutical Industry (ABPI), it adds EUR 14 billion (USD 16.5641 billion) to the British economy per year.

- The UK government pledged to continue R&D investment post-Brexit, increasing to 2.4% of GDP by 2027. The pharmaceutical industry already accounts for nearly half of total R&D spending in the United Kingdom and this additional investment will only help to continue to make the United Kingdom a very attractive location for multinational pharma companies.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominates the overall market. Factors such as investment in the chemical industry and increasing demand for cosmetic and pharmaceutical products in the region are expected to drive the growth of the isopropyl alcohol market.

- China is the second-largest market for pharmaceuticals globally. The pharmaceutical sales of the country are expected to reach USD 175 billion by 2022.

- The healthcare market is expected to reach nearly CNY 200 billion (USD 31.02 billion) in 2026, increasing tenfold from 2016 in China. This growth in the healthcare industry, added to the outbreak of COVID-19, spurred the demand for the pharmaceutical industry in the country, thereby driving the market demand.

- Additionally, India has one of the world's most extensive paints and coatings industries. The rapidly increasing housing construction activity in the Asia-Pacific region is a positive sign for the paints and coatings sector and IPA. The Indian government's target of investing USD 120.5 billion to develop 27 industrial clusters is expected to boost commercial construction in the country. The government has also planned to construct 100 new airports by 2032.

- According to the Japan Electronics and Information Technology Industries Association (JEITA), the total production value of the electronics industry in Japan accounted for JPY 10.95 trillion (USD 97637.5 million) in 2021. Further, in the first six months of 2022, the production value of the Japanese electronics industry reached JPY 5.39 trillion (USD 48060.83 million), registering a decline of 0.4% compared to the same period in 2021.

Isopropyl Alcohol (IPA) Industry Overview

The isopropyl alcohol (IPA) market is consolidated in nature. Some of the major players in the market include Shell PLC, INEOS, ExxonMobil Corporation, Dow, and Kailing Chemical (Zhangjiagang) Co. Ltd. among others (not in any particular order)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Personal Care Industry Globally

- 4.1.2 Wide Usage of IPA as Cleaning Agents

- 4.1.3 Growing Demand for IPA from the Pharmaceutical Industry for Sanitizer Production

- 4.2 Restraints

- 4.2.1 Alternative Ways Available to Production of Acetone

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Application

- 5.1.1 Process and Preparation Solvent

- 5.1.2 Cleaning and Drying Agent

- 5.1.3 Coating and Dye Solvent

- 5.1.4 Intermediate

- 5.1.5 Other Applications

- 5.2 End-user Industry

- 5.2.1 Cosmetics and Personal Care

- 5.2.2 Pharmaceutical

- 5.2.3 Electronics

- 5.2.4 Paints and Coatings

- 5.2.5 Chemicals

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 China National Petroleum Corporation

- 6.4.2 Dow

- 6.4.3 ENEOS Corporation

- 6.4.4 ExxonMobil Corporation

- 6.4.5 Ineos

- 6.4.6 Kailing Chemical (Zhangjiagang) Co. Ltd

- 6.4.7 LCY GROUP

- 6.4.8 LG Chem

- 6.4.9 Mitsui Chemicals Inc.

- 6.4.10 Shell PLC

- 6.4.11 Yancheng Super Chemical Technology Co. Ltd.

- 6.4.12 Zhejiang Xinhua Chemical Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in Bio-based Isopropyl Alcohol