|

市場調查報告書

商品編碼

1444022

電動車充電站 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Electric Vehicle Charging Station - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

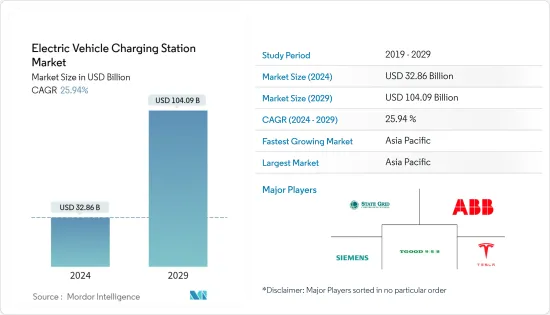

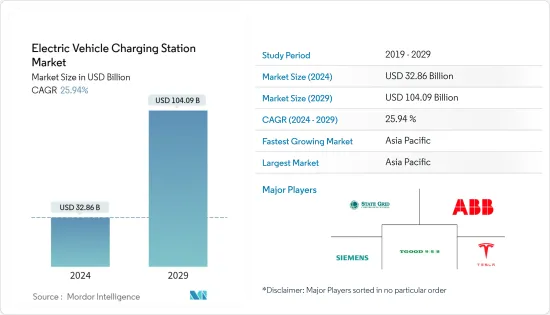

電動車充電站市場規模預計到2024年為328.6億美元,預計到2029年將達到1,040.9億美元,在預測期內(2024-2029年)CAGR為25.94%。

COVID-19 大流行迫使約 95% 的汽車相關公司在封鎖期間暫停員工工作。在全球範圍內,由於製造業活動的停止,封鎖的影響是巨大且前所未有的。然而,隨著全球經濟活動的恢復和汽車產量的增加,市場恢復了動力。隨著經濟逐漸重回正軌,未來五年市場可能會出現顯著成長。

從長遠來看,電動車充電基礎設施的成長可歸因於嚴格的排放和燃油經濟性標準的製定、政府的激勵措施以及電動車銷售的增加,這些都產生了對充電站的需求。一些知名企業也在投資電動車充電站的開發。例如,

主要亮點

- 2022 年 10 月,Octopus Energy Generation 對英國電動車充電基礎設施進行了首次投資。它計劃向位於曼徹斯特的電動車公共充電網路Be投資高達1.1億英鎊。 EV 代表其 Sky 基金 (ORI SCSp) 在英國各地擴展和安裝新的充電點。該協議將有助於 Be.EV 與 Be.EV 的 150 個公共充電點網路的擴展。 EV 承諾在英格蘭北部及其他地區增加 1,000 個充電站。

電動車充電站市場正在見證各種新技術,預計在未來幾年上市。市場上的各個參與者正在研究無線充電和自主充電機器人等技術,這可能會使車輛充電變得更加方便。例如,

主要亮點

- 2021 年 1 月,西門子股份公司推出了一款新型高功率充電器 Sicharge D。它具有可擴展的高充電功率,最高可達 300 kW。該充電站還支援 150 至 1,000 伏特的電壓和高達 1,000 的充電電流。

歐洲和北美地區預計將佔據重要市場佔有率,其次是亞太地區。該地區的成長得益於電動車銷售和生產,以及未來幾年電動車和商用車在該地區主要國家的滲透。

電動車 (EV) 充電站市場趨勢

公共充電站引領電動車充電站市場

公共電動車充電站的可用性對於世界各地購買電動車至關重要。在購買電動車時,公共充電樁能否快速充電被視為關鍵標準。預計這將增加公共充電領域的收入成長。由於電動車用戶數量不斷增加,亞太地區持續快速安裝公共充電站,特別是中國、印度和韓國。例如,

- 2022年10月,Ather Energy宣佈在印度56個城市安裝第580個公共快速充電點Ather Grid。隨著公司擴大其全國覆蓋範圍,Ather Energy 計劃再安裝 820 個電網,到 2023 會計年度末使電網總數達到 1400 個。 Ather Grids 在各個市場進行策略性安裝,目前 60% 的安裝位於二線和三線城市。

這些國家正在實施透過提供補貼和降低稅收來鼓勵電動車使用的政策。他們還透過為電動車相關企業提供補助或製定優惠政策,使其能夠更快地擴張,從而促進電動車製造商和相關行業的發展。經濟成長、城市化、出行需求的穩定成長,以及為促進儲能和環境永續發展而增加的電動車投資,預計將推動公共充電站領域的成長。

世界各國政府推出了各種計劃和舉措,鼓勵買家選擇電動車而不是傳統汽車。

- 加州 ZEV 計畫就是此類舉措之一,目標是到 2025 年讓 150 萬輛電動車上路。印度、中國、英國、韓國、法國、德國、挪威和荷蘭等國家為希望購買電動車的人們提供各種激勵措施。

這些發展和因素預計將有助於公共充電站領域的成長。

亞太地區可能在市場中發揮關鍵作用

在亞太地區,中國是最大的電動車和公車市場。中國電動車充電站市場得到了純電動車市場的大力支持,並得到了政府的大力支持。中國擴大了購買新能源汽車(NEV)的獎勵措施。 2020 年1 月,特斯拉汽車公司在上海開設了一座耗資20 億美元的工廠,該工廠在2020 年3 月每週組裝近3,000 輛汽車,當時這家電動車巨頭的所有其他全球工廠都因COVID-19 大流行關閉。

- 根據中國充電基礎設施促進會2020年8月發布的資料,聯盟成員報告稱,截至2020年7月,全國已安裝並投入營運的公共充電站約56.6萬個。其中,交流充電站32.6萬個,充電站24萬個。皆為直流,488則具備交流電和直流功能。 2020年7月,全國所有充電站充電總電量達到6.7億度,年增52.4%。

隨著對無排放汽車的需求增加,日本的電動車市場正在經歷成長。政府也在電動車市場大力投資。日本政府的目標是到2050 年將國內銷售的所有新車轉變為電動或混合動力汽車。政府還制定了到2050 年將每輛車二氧化碳排放量和其他溫室氣體排放量減少約80% 的目標。此外,私部門公司也採取主動行動並建立策略夥伴關係來開發充電基礎設施。例如,

- 2022年11月,PT PLN (Persero) 與 PT Industri Ion Mobilitas 在雅加達會議中心 (JCC) 簽署了關於電動馬達充電解決方案和服務的合作備忘錄 (MoU),希望加速基於電池的電動汽車的使用印尼的車輛(KBLBB)。此次合作將從雅加達的 100 個公共充電站 (SPLU) 開始。

預計此類發展和舉措將在未來幾年推動市場對電動車充電站的需求。

電動車 (EV) 充電站產業概況

電動車充電站市場相當整合。該市場由幾家公司主導,例如中國國家電網公司、ABB、西門子、青島特好電氣和特斯拉公司。

一些參與者正在與政府合作開發充電基礎設施。例如,

- 2022 年11 月,Yulu 與卡納塔克邦政府簽署了一份合作備忘錄,並宣布計劃投資120 億印度盧比,部署一支由10 萬輛電動車(EV) 組成的車隊,並在全國範圍內營運該州最大的電動車電池充電和交換基礎設施。未來五年。

- 2022 年 10 月,盧森堡政府宣布,在首次徵集向投資電動車充電基礎設施項目的公司提供財政援助的項目後,選擇了 29 個項目。參與企業建設充電容量至少為175千瓦的充電站的投資將獲得最高50%的補貼。

此外,該公司還與充電基礎設施和充電站的其他參與者建立策略合作夥伴關係。例如;

- 2021年4月,西門子有限公司與Hinduja集團旗下Switch Mobility Automotive Limited簽署了進入印度電動商用車領域的合作備忘錄(MoU)。

- 2021 年 3 月,BP 加入寶馬集團和戴姆勒移動,成為數位充電解決方案合作夥伴,推動電氣化。 BP 將與寶馬集團和戴姆勒移動一起成為數位充電解決方案 (DCS) 領域的合作夥伴,DCS 是歐洲領先的為汽車製造商和車隊營運商提供數位充電解決方案的開發商之一。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場區隔(市場規模,價值 10 億美元)

- 依車型分類

- 搭乘用車

- 商務車輛

- 依充電器類型

- 交流充電站

- 直流充電站

- 依應用類型

- 民眾

- 私人的

- 依地理

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第 6 章:競爭格局

- 供應商市佔率

- 公司簡介

- ABB Ltd.

- ChargePoint Inc.

- Schneider Electric SE

- Siemens AG

- Tesla Motors Inc.

- Evbox (ENGIE)

- Leviton Manufacturing Co. Inc.

- SemaConnect Inc.

- The Newmotion BV (Acquired by Shell)

- EFACEC Power Solutions SGPS

- Evgo (Acquired by LS Power)

- EV Solutions (Webasto)

- Chargemaster Limited (BP Pulse)

- Qingdao Tgood Electric Co. Ltd

- Wanbang Digital Energy Pte. Ltd. (Star Charge)

- The State Grid Corporation of China (SGCC)

第 7 章:市場機會與未來趨勢

The Electric Vehicle Charging Station Market size is estimated at USD 32.86 billion in 2024, and is expected to reach USD 104.09 billion by 2029, growing at a CAGR of 25.94% during the forecast period (2024-2029).

The COVID-19 pandemic compelled about 95% of all automotive-related companies to put their workforces on hold during the lockdowns. Globally, the repercussions of the lockdown were immense and unprecedented due to the halt of manufacturing activities. However, the market regained its momentum as economic activities resumed and vehicle production rose worldwide. As the economies are gradually back on track, the market is likely to witness significant growth over the next five years.

Over the long term, the growth of the electric vehicle charging infrastructure can be attributed to the enactment of stringent emission and fuel economy norms, government incentives, and the increasing sales of electric vehicles, which are generating a demand for charging stations. Some prominent players are also investing in the development of electric vehicle charging stations. For instance,

Key Highlights

- In October 2022, Octopus Energy Generation made its first investment in the UK EV charging infrastructure. It is planning to invest up to GBP 110 million in Manchester-based EV public charging network Be. EV on behalf of its Sky fund (ORI SCSp) to scale and install new charge points across the United Kingdom. The agreement will contribute to the expansion of Be.EV's 150-strong public charge point network, with Be. EV is committing to adding 1,000 more charge points across the North of England and beyond.

The electric vehicle charging station market is witnessing various new technologies that are expected to hit the market in the coming years. Various players in the market are working on technologies such as wireless charging and autonomous charging robots, which may make vehicle charging convenient. For instance,

Key Highlights

- In January 2021, Siemens AG launched a new high-power charger Sicharge D. It features scalable, high charging power of up to 300 kW. The charging station also supports voltages between 150 and 1,000 volts and charging currents of up to 1,000.

Europe and North American regions are expected to hold a significant share of the market, followed by the Asia-Pacific region. The growth in this region is supported by electric vehicle sales and production, coupled with the penetration of electric cars and commercial vehicles in the major countries in the region over the coming years.

Electric Vehicle (EV) Charging Station Market Trends

Public charging stations are leading the Electric Vehicle Charging Station Market

The availability of public EV charging stations is critical in the purchase of electric vehicles all over the world. When purchasing an electric vehicle, public charging access to fast charging is regarded as a critical criterion. This is expected to increase revenue growth in the public charging segment. Due to the growing number of EV users, the Asia Pacific region continues to install public charging stations at a rapid pace, particularly in China, India, and South Korea. For instance,

- In October 2022, Ather Energy announced the installation of the 580th public fast charging point, the Ather Grid, across 56 cities in India. As the company expands its national footprint, Ather Energy plans to install 820 more grids, bringing the total to 1400 by the end of FY23. Ather Grids are strategically installed across markets, with 60% of current installations in tier-II and tier-III cities.

These countries are implementing policies that encourage the use of electric vehicles by providing subsidies and lowering taxes. They also promote the growth of EV manufacturers and related industries by providing grants or enacting preferential policies for EV-related businesses to allow them to expand more quickly. A steady increase in economic growth, urbanization, travel demand, and increased investments in electric mobility to contribute to energy storage and environmental sustainability are expected to fuel the growth of the public charging station segment.

Governments worldwide have introduced various schemes and initiatives to encourage buyers to choose electric vehicles over conventional vehicles.

- The California ZEV program, which aims to have 1.5 million electric vehicles on the road by 2025, is one such initiative. India, China, the United Kingdom, South Korea, France, Germany, Norway, and the Netherlands are some of the countries offering various incentives for people looking to purchase an electric vehicle.

Such developments and factors are expected to contribute to the growth of the public charging station segment.

Asia-Pacific Region Likely to Play Key role in the Market

In Asia-Pacific, China is the largest market for electric cars and buses. The Chinese electric vehicle charging station market is well supported by its battery electric vehicle market, backed by generous support from the government. China extended the incentives relating to purchasing new energy vehicles (NEVs). In January 2020, Tesla Motors inaugurated a USD 2 billion facility in Shanghai, which was assembling nearly 3,000 cars per week in March 2020 when all the other global facilities of the electric vehicle giant were shut down due to the COVID-19 pandemic.

- According to the data released in August 2020 by the China Electric Charging Infrastructure Promotion, members of the Alliance reported that about 566,000 public charging stations were installed and started operations across the country by the end of July 2020. Of these, 326,000 are AC, 240,000 are DC, and 488 are equipped with AC and DC capabilities. In July 2020, the total charging power of all stations across the country reached 670 million kWh, a Y-o-Y increase of 52.4%.

The electric vehicle market in Japan is experiencing growth as the demand for emission-free vehicles increases. The government is also investing heavily in the electric vehicle market. The Japanese government aims to transform all the new cars sold in the country into electric or hybrid vehicles by 2050. The government also set a target to reduce CO2 emissions and other greenhouse gasses by about 80% per vehicle by 2050. Moreover, the private sector companies are also taking initiatives and indulging in strategic partnerships to develop charging infrastructure. For instance,

- In November 2022, PT PLN (Persero) and PT Industri Ion Mobilitas signed a memorandum of understanding (MoU) on Electric Motor Charging Solutions and Services at the Jakarta Convention Center (JCC) in the hope of accelerating the use of Battery-Based Electric Motorized Vehicles (KBLBB) in Indonesia. The partnership will begin with 100 Public Electricity Charging Station (SPLU) units in Jakarta.

Such developments and initiatives are expected to drive the demand for electric vehicle charging stations in the market over the coming years.

Electric Vehicle (EV) Charging Station Industry Overview

The electric vehicle charging station market is fairly consolidated. The market is led by a few companies, such as the State Grid Corporation of China, ABB, Siemens, Qingdao Tgood Electric Co., Ltd, and Tesla Inc.

Several Players are partnering with the government to develop charging infrastructure. For instance,

- In November 2022, Yulu signed an MoU (memorandum of understanding) with the Karnataka government and announced its plans to invest INR 12 billion in deploying a fleet of 100,000 electric vehicles (EV) and operationalizing the state's largest EV battery charging and swapping infrastructure over the next five years.

- In October 2022, the Luxembourg government announced that 29 projects were chosen following the first call for projects granting financial aid to companies investing in charging infrastructure projects for electric vehicles. The companies involved will receive a subsidy of up to 50% on investments related to the deployment of charging stations with a charging capacity of at least 175 kilowatts.

Moreover, companies are also indulging in strategic partnerships with other players for charging infrastructure and stations. For instance;

- In April 2021, Siemens Limited and the Hinduja group's Switch Mobility Automotive Limited signed a memorandum of understanding (MoU) to enter the Indian electric commercial vehicles segment.

- In March 2021, BP joined BMW Group and Daimler Mobility as a partner in digital charging solutions to drive electrification. BP will become a partner, along with BMW Group and Daimler Mobility in Digital Charging Solutions (DCS), one of Europe's leading developers of digital charging solutions for automotive manufacturers and vehicle fleet operators.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD billion)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Charger Type

- 5.2.1 AC Charging Station

- 5.2.2 DC Charging Station

- 5.3 By Application Type

- 5.3.1 Public

- 5.3.2 Private

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 ABB Ltd.

- 6.2.2 ChargePoint Inc.

- 6.2.3 Schneider Electric SE

- 6.2.4 Siemens AG

- 6.2.5 Tesla Motors Inc.

- 6.2.6 Evbox (ENGIE)

- 6.2.7 Leviton Manufacturing Co. Inc.

- 6.2.8 SemaConnect Inc.

- 6.2.9 The Newmotion BV (Acquired by Shell)

- 6.2.10 EFACEC Power Solutions SGPS

- 6.2.11 Evgo (Acquired by L.S. Power)

- 6.2.12 EV Solutions (Webasto)

- 6.2.13 Chargemaster Limited (BP Pulse)

- 6.2.14 Qingdao Tgood Electric Co. Ltd

- 6.2.15 Wanbang Digital Energy Pte. Ltd. (Star Charge)

- 6.2.16 The State Grid Corporation of China (SGCC)