|

市場調查報告書

商品編碼

1443978

草甘膦 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Glyphosate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

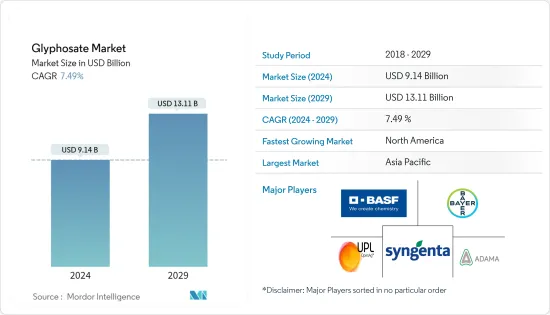

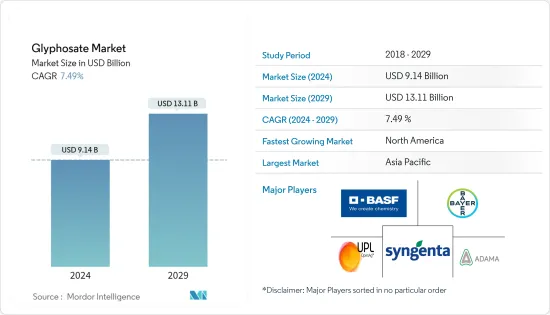

2024年草甘膦市場規模預計為91.4億美元,預計到2029年將達到131.1億美元,在預測期內(2024-2029年)CAGR為7.49%。

主要亮點

- 隨著耐除草劑作物面積的增加以及越來越多的國家批准作物耐除草劑技術,隨著農民的迅速採用,市場預計將無機成長。相對於機械耕作系統的產品優勢,如成本低、土壤少、環境退化等,支持了草甘膦市場的擴張。已開發市場對環境危害的擔憂仍然存在,但由於缺乏有效的草甘膦替代品,預計市場成長不會放緩。

- 對蔬菜種植者帶來的大部分好處都與草甘膦的多功能性和靈活性有關。草甘膦已註冊用於幾乎所有蔬菜作物,並且可以在大多數情況下使用。就處理的總面積而言,大部分草甘膦的使用發生在大田作物出苗後後期。北美和亞太地區是草甘膦利潤豐厚的市場。基因改造作物的採用,加上耕地的可用性,預計將在未來幾年推動亞太地區草甘膦市場的發展。

- 草甘膦目前已獲批准在歐盟使用,有效期至2022 年12 月15 日。這意味著在此日期之前它可以作為PPP 中的活性物質使用,並且每種產品均已獲得國家當局的授權並進行了安全評估。歐洲食品安全局(EFSA)表示需要更多時間重新評估該農藥,並將其推遲到 2023 年 7 月。

- 2022年,印度政府因擔心對人類和動物健康造成風險,限制印度使用化學草甘膦。然而,政府只允許透過害蟲防治業者(PCO)使用它。 PCO 獲準使用致命化學物質來治療囓齒動物等害蟲。草甘膦及其製劑已廣泛註冊,目前在包括歐盟和美國在內的 160 多個國家/地區使用。

草甘膦除草劑市場趨勢

基因改造耐除草劑作物的商業化

耐除草劑(HT)作物能夠抵抗強效除草劑,為農民提供了有效控制雜草的多種選擇。此外,農民不需要翻耕土壤,而他們通常會這樣做來除草。據美國農業部稱,基改耐除草劑作物目前約佔全球草甘膦使用量的 56%。基因改造 (GE) 種子已在美國用於主要大田作物的商業化推廣,採用率迅速提高。美國 90% 以上的玉米、陸地棉和大豆現在都是使用基因改造品種生產的。耐除草劑(HT)作物能夠耐受強效除草劑(如草甘膦、草銨膦和麥草畏),為農民提供了多種有效雜草控制的選擇。

根據美國農業部調查資料,2021年和2022年,大豆HT種植面積小幅成長至95%,棉花在2021年達到94%的高位。2022年,國內玉米麵積約90%種植了HT種子。在美國,沒有一種農藥能達到如此密集且廣泛的使用。未來,草甘膦可能仍然是全球應用最廣泛的農藥,在量化生態和人類健康影響方面,其需求可能會成長。

大豆、玉米、棉花和甜菜等大田作物的種植面積達數百萬英畝,草甘膦處理的總面積和施用量最高。平均而言,每年有 84% 的草甘膦施用在大豆、玉米或棉花上。這三種大田作物的抗草甘膦(GR)品種已被廣泛採用。大田作物的平均單次施用量範圍為 0.72 至 1.00 磅。 ae/英畝。因此,草甘膦對於農業環境中的使用者來說仍然是一種有用的除草劑,因為它具有廣譜應用的性質,使用簡單,並且通常具有成本效益。

亞太和北美是潛在市場

亞太地區和北美地區為草甘膦除草劑市場的公司提供了同樣有吸引力的機會。由於耐除草劑雜交品種的普及程度不斷提高,預計北美地區仍將是草甘膦的最大市場之一。據估計,美國近 56% 的草甘膦用於耐除草劑作物。基因改造作物在北美進行商業化種植,包括馬鈴薯、南瓜/南瓜、苜蓿、茄子、甜菜、木瓜、油菜籽、玉米、大豆和棉花。

在亞太地區,市場預計將實現更快的成長。該地區擁有世界上最高的耕地面積和最高的農作物多樣性。更多採用零耕等先進農業實踐預計將帶動該地區草甘膦除草劑市場的成長。然而,中國已批准種植耐除草劑雜交品種。

耐除草劑的基因改造作物可以幫助農民在不損害作物的情況下控制雜草。例如,當環斑病毒威脅夏威夷木瓜產業和夏威夷木瓜農民的生計時,植物科學家開發了抗環斑病毒的彩虹木瓜,稱為基因改造木瓜,它對病毒有抵抗力,現在在夏威夷各地種植並出口到日本。此外,基因改造(GM)作物有助於減少農業溫室氣體(GHG)排放,並可能減少生產排放;基因改造產量的增加還可以緩解土地利用變化和相關排放。

環境部批准種植基改芥末,以支持基改作物的商業種植,包括透過提高產量、降低糧食生產成本、減少農藥需求以及抵抗病蟲害來提高糧食安全。基因轉殖芥菜雜交種 DMH-11 是由印度農作物基因操作中心 (CGMCP) 開發的。迄今為止,政府只批准了一種基因改造作物——Bt 棉花——用於商業種植。

草甘膦除草劑產業概況

全球草甘膦市場由拜耳作物科學公司、巴斯夫、先正達公司、安道麥農業解決方案有限公司和 UPL 有限公司等公司佔據主導地位。這些公司透過專注於全球範圍內的新產品發布、合作夥伴關係、合併和收購來擴大其業務活動。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 市場促進因素

- 市場限制

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場區隔

- 類型

- 基因改造作物

- 非基因改造作物

- 應用

- 穀物和穀物

- 豆類和油籽

- 水果和蔬菜

- 經濟作物

- 其他作物類型

- 地理

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 西班牙

- 義大利

- 法國

- 德國

- 俄羅斯

- 英國

- 歐洲其他地區

- 亞太

- 印度

- 中國

- 日本

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 非洲其他地區

- 北美洲

第 6 章:競爭格局

- 最常用的策略

- 市佔率分析

- 公司簡介

- Adama Agricultural Solutions Ltd

- BASF SE

- Bayer Cropscience AG

- UPL Limited

- FMC Corporation

- Zhejiang Xinan Chemical Industrial Group Company Ltd

- Nufarm Limited

- DuPont

- Syngenta International

- Dow AgroSciences

第 7 章:市場機會與未來趨勢

The Glyphosate Market size is estimated at USD 9.14 billion in 2024, and is expected to reach USD 13.11 billion by 2029, growing at a CAGR of 7.49% during the forecast period (2024-2029).

Key Highlights

- With the area under herbicide-tolerant crops increasing and more countries approving herbicide-tolerance technology for crops, the market is expected to grow inorganically with rapid farmer adoption. Product advantages over mechanical tillage systems, like low cost, less soil, and environmental degradation, support the glyphosate market expansion. Its concerns for the environmental hazards remain in developed markets, but the market is not expected to slow down on account of the lack of availability of efficient alternatives to glyphosate.

- Most of the benefits conveyed to vegetable growers relate to glyphosate's versatility and flexibility. Glyphosate is registered for nearly all vegetable crops and can be used in most circumstances. The majority of glyphosate use, in terms of total acres treated, occurs during late postemergence to the crop in field crops. North America and Asia-Pacific are lucrative markets for glyphosate. GM crop adoption, coupled with arable land availability, is expected to drive the Asia Pacific glyphosate market over the coming years.

- Glyphosate is currently approved for use in the European Union until 15 December 2022. This means it can be used as an active substance in PPPs until that date, and each product is authorized by national authorities with a safety evaluation. European Food Safety Authority (EFSA) stated that it required more time to reassess the pesticide, pushing it back to July 2023.

- In 2022, The Indian government restricted the use of chemical glyphosate in India, fearing risks to human and animal health. However, the government allowed its use only through pest control operators (PCOs). PCOs are licensed to use deadly chemicals for treating pests such as rodents. Glyphosate and its formulations are widely registered and are currently used in over 160 countries, including the European Union and the United States.

Glyphosate Herbicide Market Trends

Commercialization of Genetically Engineered Herbicide-tolerant Crops

Herbicide-tolerant (HT) crops, which resist potent herbicides, provide farmers with various options for effective weed control. Also, the farmers do not need to till the soil, which they normally do to get rid of weeds. According to the USDA, genetically engineered herbicide-tolerant crops now account for about 56% of global glyphosate use. Genetically Engineered (GE) seeds were commercially introduced in the United States for major field crops, with adoption rates increasing rapidly. Over 90 percent of US corn, upland cotton, and soybeans are now produced using GE varieties. Herbicide-tolerant (HT) crops, which tolerate potent herbicides (such as glyphosate, glufosinate, and dicamba), provide farmers with a wide variety of options for effective weed control.

According to USDA survey data, in 2021 and 2022, soybean HT acreage increased slightly to 95 percent, and cotton reached a high of 94 percent in 2021. In 2022, approximately 90 percent of domestic corn acres were planted with HT seeds. No pesticide has come remotely close to such intensive and widespread use in the United States. Glyphosate may remain the most widely applied pesticide worldwide in the future, and its demand may grow in quantifying ecological and human health impacts.

With millions of acres planted, large field crops, such as soybeans, corn, cotton, and sugar beets, have the highest total area treated and pounds applied with glyphosate. On average, 84% of glyphosate, in terms of volume, is applied to soybeans, corn, or cotton per year. These three field crops have glyphosate-resistant (GR) varieties that have been widely adopted. The average single application rate for field crops ranges from 0.72 to 1.00 lbs. a.e./acre. Thus, glyphosate remains a useful herbicide for users in agricultural settings because of its nature of the broad-spectrum application, is simple to use, and is often cost-effective.

Asia-Pacific and North America are Potential Markets

The Asia-Pacific and the North American regions present equally attractive opportunities to companies operating in the glyphosate herbicide market. On account of the increasing levels of penetration of herbicide-tolerant hybrids, the North American region is expected to remain one of the largest markets for glyphosate. It is estimated that almost 56% of glyphosate usage in the United States is for herbicide-tolerant crops. GM crops are grown commercially in North America, including potato, squash/pumpkin, alfalfa, aubergine, sugar beet, papaya, rape oilseed, maize, soya beans, and cotton.

In the Asia-Pacific region, the market is expected to achieve faster growth. The region has the highest arable land in the world with the highest crop diversity. Increased adoption of advanced agricultural practices such as zero-tillage is expected to deliver growth to the glyphosate herbicide market in the region. However, China has provided approval to grow herbicide-tolerant hybrids.

GMO crops that are tolerant to herbicides help farmers control weeds without damaging the crops. For example, when the ringspot virus threatened the Hawaii papaya industry and the livelihoods of Hawaiian papaya farmers, plant scientists developed the ringspot virus-resistant Rainbow papaya called GMO papaya, which is resistant to a virus and now it is grown all over Hawaii and exported to Japan. In addition, Genetically modified (GM) crops can help reduce agricultural greenhouse gas (GHG) emissions and possible decreases in production emissions; GM yield gains also mitigate land-use change and related emissions.

Environment Ministry Approves the Cultivation of GM Mustard for those supporting commercial cultivation of GM crops, including greater food security due to increased yields, reduced costs for food production, reduced need for pesticides, and resistance to pests and disease. The transgenic mustard hybrid DMH-11 has been developed by the Centre for Genetic Manipulation of Crop Plants (CGMCP) in India. The government has so far approved only one GM crop, Bt cotton, for commercial cultivation.

Glyphosate Herbicide Industry Overview

The global glyphosate market is consolidated with the dominance of players such as Bayer CropScience AG, BASF Corporation, Syngenta AG, Adama Agricultural Solutions Ltd, and UPL Limited. These companies are expanding their business activities by focusing on new product launches, partnerships, mergers, and acquisitions across the world.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 GM Crops

- 5.1.2 Non-GM Crops

- 5.2 Application

- 5.2.1 Grains and Cereals

- 5.2.2 Pulses and Oilseeds

- 5.2.3 Fruits and Vegetables

- 5.2.4 Commercial Crops

- 5.2.5 Other Crop Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 Italy

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Russia

- 5.3.2.6 United Kingdom

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Adama Agricultural Solutions Ltd

- 6.3.2 BASF SE

- 6.3.3 Bayer Cropscience AG

- 6.3.4 UPL Limited

- 6.3.5 FMC Corporation

- 6.3.6 Zhejiang Xinan Chemical Industrial Group Company Ltd

- 6.3.7 Nufarm Limited

- 6.3.8 DuPont

- 6.3.9 Syngenta International

- 6.3.10 Dow AgroSciences