|

市場調查報告書

商品編碼

1443966

生質燃料:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Biofuels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

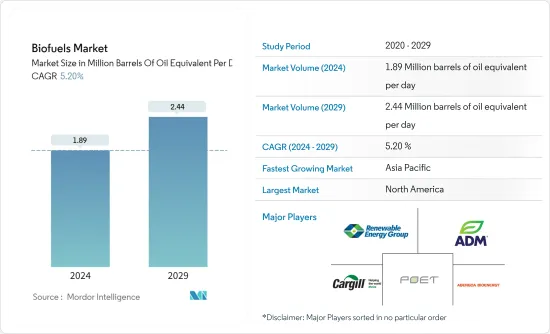

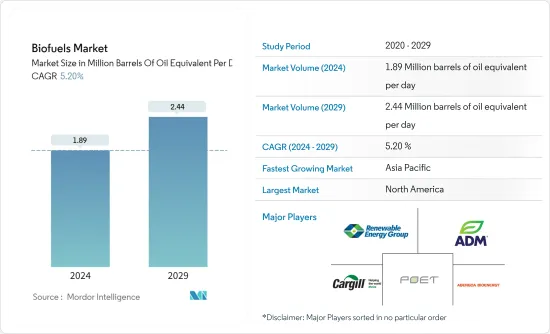

2024年生質燃料市場規模預計為每天189萬桶油當量,預計到2029年將達到每天244萬桶油當量,預測期內(2024-2029年)年複合成長率為5.20% . 成長於

主要亮點

- 從中期來看,對安全、永續和清潔能源的需求不斷成長,加上政府要求提高汽車燃料混合比例,預計將推動全球對生質燃料的需求。

- 另一方面,儘管生質燃料具有許多好處,但生質燃料的高生產成本預計可能會限制市場成長。

- 然而,隨著最近的技術進步,生質燃料產量正在增加,預計這將為市場擴張提供機會。

- 北美主導市場,並可能在預測期內實現最高的年複合成長率。該地區的成長是由生產能力的快速成長和生質燃料需求的增加所推動的。

生質燃料市場趨勢

乙醇預計將出現顯著成長

- 在全球範圍內,由於內燃機中石化燃料的燃燒,運輸業是最大的溫室氣體排放。為了限制溫室氣體排放,世界各國正採用促進可再生能源使用的標準。乙醇等生質燃料是交通運輸領域的清潔能源來源,可能會促進未來生質燃料市場的發展。

- 根據可再生燃料協會(RFA)預測,2022年美國將生產1,540億加侖燃料乙醇,成為全球領先的生質燃料生產國。

- 全球對生質燃料的需求是由北美、印度、巴西、歐洲、印尼和馬來西亞等國家的初級混合指令所推動的。例如,印度要求到 2025 年乙醇混合量達到 20%。在印度尼西亞,計劃於 2023 年開始混合 35% 的生物柴油,而在巴西,現有的乙醇混合指令為 27%。這些措施凸顯了各國擴大使用生質燃料。

- 此外,2022年3月,巴西經濟部宣布取消包括其他產品在內的乙醇進口關稅,以緩解通膨壓力。預計這將鼓勵將乙醇摻入汽油中並刺激市場。

- 2022年,SGP BioEnergy宣布將與巴拿馬政府合作,在巴拿馬開發全球最大的生質燃料分銷和生產中心,預計生質燃料產能為18萬桶/日。同樣,美國能源局在 2023 年向 17 個計劃撥款 1.18 億美元,用於擴大乙醇和其他生質燃料的生產,以滿足美國運輸和製造業的需求。預計這些趨勢可能會重振生質燃料市場。

- 因此,鑑於上述幾點,預計乙醇產業在預測期內生質燃料市場將顯著成長。

預計北美將主導市場

- 北美地區擁有以石化燃料為中心的最大航空市場之一,並擁有發達的交通基礎設施。北美地區一直處於減少排放以遏制溫室效應的最前線。

- 據美國能源情報署稱,到 2022 年,美國生物柴油總產量將達到 16 億加侖。

- 2022年1月,美國環保署宣布了一項新舉措,簡化石化燃料的審查,排放生質燃料市場帶來重大推動。同樣,美國能源局將要求 2022 年 12 月後安裝的加油設備減少 30%,其中包括天然氣、丙烷、液化氫、電力、E85 或含有 20% 或更多生物柴油的柴油混合物。稅額扣抵。此類激勵措施可能會促進生質燃料市場的發展。

- 同樣,加拿大政府計劃從 2022 年 4 月起將每噸排放的碳排放稅從 10 加幣提高到 50 加元,鼓勵普及溫室氣體排放較低的生質燃料。

- 綜上所述,由於政府政策和生產能力,北美地區很可能主導生質燃料市場。

生質燃料產業概況

生質燃料市場是分散的。主要企業包括(排名不分先後)Archer Daniels Midland Company、Abengoa Bioenergy SA、Renewable Energy Group Inc.、Cargill Incorporated 和 POET LLC。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2028 年之前生質燃料生產的歷史與預測

- 生質燃料消費的歷史趨勢與 2028 年預測

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 對安全、永續和清潔能源的需求不斷成長

- 抑制因素

- 生質燃料生產成本高

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 汽油種類

- 乙醇

- 生質柴油

- 其他燃料類型

- 材料

- 棕櫚油

- 麻風樹

- 砂糖作物

- 粗粒

- 其他原料

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 丹麥

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 印尼

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Abengoa Bioenergy SA

- Cargill Incorporated

- Shell PLC

- Wilmar International Ltd.

- Renewable Energy Group Inc.

- Archer Daniels Midland Company

- BP PLC

- POET LLC

- Neste Oyj

- Verbio Vereinigte BioEnergie AG

第7章 市場機會及未來趨勢

- 生質燃料生產的技術進步

簡介目錄

Product Code: 49858

The Biofuels Market size is estimated at 1.89 Million barrels of oil equivalent per day in 2024, and is expected to reach 2.44 Million barrels of oil equivalent per day by 2029, growing at a CAGR of 5.20% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, the increasing demand for secure, sustainable, and clean energy coupled with government mandates for increasing blending in automotive fuels is expected to propel the demand for biofuels across the globe.

- On the other hand, the high cost of production of biofuels, even with all the benefits associated with them, is likely to restrain the growth of the market.

- Nevertheless, with the recent technological advancements, the production of biofuels has increased, which is going to act as an opportunity for the market's expansion.

- North America dominates the market, and it is likely to witness the highest CAGR during the forecast period. The growth is attributed to the rapid increase in production facilities coupled with the increase in demand for biofuels in the region.

Biofuels Market Trends

Ethanol Likely to Experience a Significant Growth

- Globally, the transportation sector is the biggest emitter of greenhouse gases due to the combustion of fossil fuels in its internal combustion engines. To limit the emission of greenhouse gases, countries worldwide have adopted norms to promote the use of renewable energy resources. Biofuels such as ethanol affirm themselves as a cleaner energy source for the transportation sector, which could lead to a developed biofuel market in the future.

- According to the Renewable Fuels Association (RFA), in 2022, the United States produced 15,4 billion gallons of fuel ethanol, making it the leading producer of biofuel in the world.

- Primary blending mandates that drive the global demand for biofuels are set in North America, India, Brazil, Europe, Indonesia, Malaysia, etc. For instance, in India, there is a mandate to begin 20% ethanol blending by 2025. In Indonesia, a commission of 35% biodiesel blending is expected to start in 2023, whereas in Brazil, the existing order for ethanol blending is 27%. Such measures highlight the increase in the use of biofuels across countries.

- Furthermore, in March 2022, Brazil's Ministry of Economy announced the withdrawal of import tariffs on ethanol, including other products, to alleviate inflationary pressures. This is expected to boost the ethanol blend in gasoline and drive the market.

- In 2022, SGP BioEnergy announced the development of the world's most extensive biofuel distribution and production hub in Panama, in association with the country's government, which is estimated to produce 180,000 barrels per day of biofuel. Similarly, in 2023, the US Department of Energy awarded USD 118 million for 17 projects to scale up ethanol and other biofuels to help America's transportation and manufacturing needs. Such trends are likely to ramp up the biofuel market.

- Therefore, owing to the above points, the ethanol segment is expected to experience significant growth in the biofuels market during the forecast period.

North America is Expected to Dominate the Market

- The North American region houses one of the biggest aviation markets, primarily fossil fuels, and a well-established transportation infrastructure. The North American region has been at the forefront of lowering emissions to limit the greenhouse effect.

- According to the U.S. Energy Information Administration, the total production volume of biodiesel production in the United States was 1.6 billion gallons by 2022

- In January 2022, the US Environmental Protection Agency announced a new initiative for streamlining the review of biofuels and chemicals that can significantly replace higher GHG-emitting fossil fuels, providing a significant push to the biofuels market. Similarly, the US Department of Energy announced an Alternative Fuel Infrastructure Tax Credit of 30% for the fueling equipment for natural gas, propane, liquefied hydrogen, electricity, E85, or diesel fuel blends containing a minimum of 20% biodiesel installed on or after December 2022. Such incentive measures would likely promote the biofuel market.

- Similarly, in Canada, the government aimed to increase carbon taxes by CAD 10 to CAD 50 per ton of emissions from April 2022, thereby pushing for wider adoption of biofuels that emit less GHG.

- Hence, owing to the above points, the North American region is likely to dominate the biofuels market due to government policies and production capacity.

Biofuels Industry Overview

The biofuels market is fragmented. Some of the major players include (in no particular order) Archer Daniels Midland Company, Abengoa Bioenergy SA, Renewable Energy Group Inc., Cargill Incorporated, and POET LLC., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Biofuel Production Historic and Forecast, till 2028

- 4.3 Biofuel Consumption Historic and Forecast, till 2028

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Demand for Secure, Sustainable, and Clean Energy

- 4.6.2 Restraints

- 4.6.2.1 High Cost of Production of Biofuels

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Industry Attractiveness - Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Ethanol

- 5.1.2 Biodiesel

- 5.1.3 Other Fuel Types

- 5.2 Feedstock

- 5.2.1 Palm Oil

- 5.2.2 Jatropha

- 5.2.3 Sugar Crop

- 5.2.4 Coarse Grain

- 5.2.5 Other Feedstock

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States of America

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Denmark

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Indonesia

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Abengoa Bioenergy SA

- 6.3.2 Cargill Incorporated

- 6.3.3 Shell PLC

- 6.3.4 Wilmar International Ltd.

- 6.3.5 Renewable Energy Group Inc.

- 6.3.6 Archer Daniels Midland Company

- 6.3.7 BP PLC

- 6.3.8 POET LLC

- 6.3.9 Neste Oyj

- 6.3.10 Verbio Vereinigte BioEnergie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Production of Biofuels

02-2729-4219

+886-2-2729-4219