|

市場調查報告書

商品編碼

1441677

建築化學品:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Construction Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

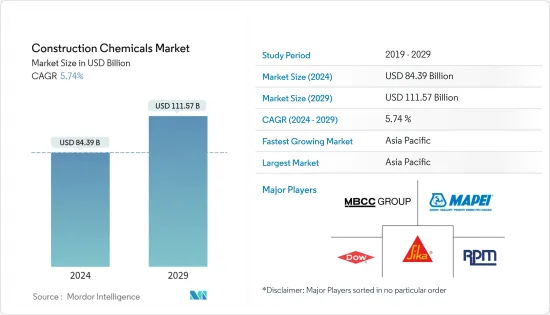

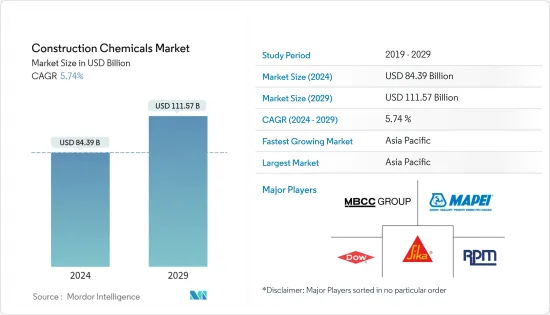

2024年建築化學品市場規模估計為843.9億美元,預計到2029年將達到1115.7億美元,在預測期間(2024-2029年)以5.74%的複合年增長率增長。

主要亮點

- COVID-19的爆發對2020年的市場產生了負面影響。當 COVID-19 大流行開始時,世界各地的建築工作都停止了,特別是在中國、美國、美國和歐洲國家等主要建築中心。由於全球建築業的成長,預計市場在預測期內將穩定成長。

- 短期來看,亞太地區(尤其是亞洲國家)建設活動的成長以及對水性產品需求的增強是推動研究市場成長的一些因素。

- 有關揮發性有機化合物排放的環境法規不斷加強,仍是所研究市場成長的限制因素。

- 此外,美國對永續材料和即將開展的建設計劃的日益關注可能會提供市場成長機會。

- 亞太地區主導市場,預計在整個預測期內將繼續主導市場。

建築化學品市場趨勢

住宅領域的需求增加

- 精英階層是奢華的代名詞,精英住宅指的是豪華住宅。對具有世界一流設計和設施的封閉式社區的公寓、頂層公寓、別墅和平房的需求正在迅速增加,開發商正在推出計劃來滿足這種需求。

- 許多居民對在世界各地購買豪華住宅表現出極大的興趣,以尋求舒適、聲望和隱私。因此,這促使了全球精英住宅計劃數量的增加。

- 由於中國和印度住宅建築市場的擴張,亞太地區預計將錄得最高成長率。亞太地區擁有最大的低成本住宅建築市場,以中國、印度和東南亞各國為首。

- 不斷成長的經濟實力和高所得群體的大量投資預計將增加美國、加拿大、德國、英國、印度和日本等地區對豪華住宅的需求。因此,這可能有利於建築化學品市場。

- 2021 年 10 月,聖保羅州住宅協會 (Secovi-SP) 記錄聖保羅住宅銷售量為 5,555 套。由於消費者在住宅方面的支出,這一數字可能會進一步增加。此外,巴西單戶住宅的成長趨勢預計將在未來支持住宅建設產業。

- 因此,基於上述因素,住宅領域預計將在預測期內主導市場。

亞太地區主導市場

- 亞太地區的建築業是世界上最大的,並且由於人口成長、中階收入增加和都市化穩步成長。

- 基礎設施建設活動的增加以及歐盟主要公司進入盈利的中國市場進一步加速了該行業的擴張。

- 另外,中國在過去的50年裡經歷了多次維修,建造了許多建築物,目前都面臨嚴重的損壞,因此現有舊建築的維修計劃非常重要,不僅在都市區和鄉村都很受歡迎。 。顯示建築化學品的主要標記區域。

- 台灣建設公司閃亮建築商業有限公司計劃於 2022 年 2 月在台灣和中國推出價值 300 億新台幣(10.8 億美元)的新住宅計劃。該計畫包括台灣價值108億新台幣的計劃和中國成都價值1900萬新台幣的項目。

- 此外,印度政府正在積極推動住宅建設,目標是為約13億人提供住宅。未來七年,該國的住宅投資可能約為 1.3 兆美元。預計該國將新建6,000萬套住宅。

- 新石化設施的開發刺激了私營部門的需求,而榜鵝數位區的工業和建築計劃則促進了新加坡公共部門的需求。基礎設施產業預計也將經歷相對健康的成長,主要受到改善公路、鐵路和其他大眾交通工具基礎設施以及能源和公共建設計劃投資的推動。政府計劃在 2022 年投資 280 億新元(209 億美元)來擴大和改善交通系統。

- 因此,所有這些市場趨勢預計將在預測期內推動該地區建築化學品的需求。

建築化學品產業概況

建築化學品市場本質上是分散的。市場主要企業包括西卡股份公司、MBCC集團、RPM國際公司、MAPEI SpA、陶氏化學等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 亞太地區住宅和商業建設活動呈上升趨勢

- 水性產品需求增加

- 抑制因素

- VOC排放法規和熟練勞動力短缺

- 由於 COVID-19 的影響,情況不利

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(收益,百萬美元)

- 產品類別

- 混凝土外加劑

- 表面處理

- 維修/維修

- 保護塗層

- 工業地板材料

- 防水的

- 黏劑/密封劑

- 水泥漿錨

- 水泥助磨劑

- 最終用戶產業

- 商業的

- 工業

- 基礎設施/公共場所

- 住宅

- 地區

- 亞太地區

- 北美洲

- 歐洲

- 南美洲

- 中東

- 非洲

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率分析

- 主要企業採取的策略

- 公司簡介(公司簡介、財務狀況、產品/服務、近期狀況)

- 3M

- Arkema Group

- Ashland

- MBCC Group(BASF SE)

- Bolton Group

- Cementaid International Ltd

- CHRYSO GROUP

- CICO Group

- Conmix Ltd

- Dow

- Fosroc Inc.

- Franklin International

- GCP Applied Technologies Inc.

- Henkel AG &Co. KGaA

- LafargeHolcim

- MAPEI SpA

- MUHU(China)Construction Materials Co. Ltd

- Nouryon

- Pidilite Industries Ltd

- RPM International Inc.

- Selena Group

- Sika AG

- Thermax Limited

第7章市場機會與未來趨勢

簡介目錄

Product Code: 47467

The Construction Chemicals Market size is estimated at USD 84.39 billion in 2024, and is expected to reach USD 111.57 billion by 2029, growing at a CAGR of 5.74% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 outbreak negatively impacted the market in 2020. With the COVID-19 pandemic's beginning, construction work stopped worldwide, especially in major construction hubs, like China, India, the United States, and European nations. The market is projected to grow steadily in the forecast period owing to global growth in the construction sector.

- Over the short term, growing construction activities in the Asia-Pacific region, especially in Asian countries, and strengthening demand for water-based products are some of the factors driving the growth of the market studied.

- Increasing environmental regulations regarding VOC emissions remains a constraint for the growth of the market studied.

- Moreover, increasing focus on sustainable materials and upcoming construction projects in the United States will likely provide market growth opportunities.

- Asia-Pacific has dominated the market and is expected to continue dominating it through the forecast period.

Construction Chemicals Market Trends

Increasing Demand from Residential segment

- Elite class is synonymous with luxury, and elite housing refers to luxurious residences. The demand for apartments, penthouses, villas, and bungalows in gated communities with world-class designs and amenities is increasing rapidly, and developers are launching projects to cater to such demands.

- Many residents have been showing huge interest in buying luxury homes globally for comfort, prestige, and privacy. Therefore, this has been increasing the number of elite housing projects worldwide.

- The highest growth rate in this regard was expected to be registered in the Asia-Pacific region, owing to China's and India's expanding housing construction market. Asia-Pacific has the largest low-cost housing construction segment, which China, India, and various Southeast Asian countries lead.

- The growing economic strength and high investments by the high-income category are expected to increase the demand for luxury homes in geographies of the United States, Canada, Germany, the United Kingdom, India, and Japan. Thus, it is likely to benefit the construction chemicals market.

- In October 2021, Sao Paulo State Housing Union (Secovi-SP) recorded 5,555 new residential units sold in Sao Paulo. The number is more likely to rise owing to consumer spending on residential housing units. Moreover, the growing trend for single-family housing in Brazil is expected to support the residential construction industry in the upcoming period.

- Therefore, based on the abovementioned factors, the residential segment is expected to dominate the market during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific construction sector is the largest in the world and is growing at a healthy rate, owing to the rising population, increase in middle-class incomes, and urbanization.

- Increasing infrastructure construction activities and the entry of major players from the European Union into the lucrative market of China have further fueled the industry's expansion.

- In addition, many renovations have been taking place in China over the past 50 years, many buildings have been built, and they are facing severe damage now, and hence renovation of existing old building projects is very popular in the city and countryside as well as depicting a major marker area for construction chemicals.

- In February 2022, Shining Building Business Co., a building construction company in Taiwan, planned to launch new housing projects worth NTD 30 billion (USD 1.08 billion) in Taiwan and China. The plan included projects valued at NTD 10.8 billion in Taiwan and NTD 19 million in Chengdu, China.

- Moreover, the Indian Government has been actively boosting housing construction, aiming to provide homes to about 1.3 billion people. The country will likely witness around USD 1.3 trillion of investment in housing over the next seven years. It is also expected to see the construction of 60 million new homes in the country.

- New petrochemical facilities development boosted the private sector demand, while industrial and building projects in the Punggol Digital District contributed to the public sector demand in Singapore. The infrastructure sector is also expected to post relatively healthy growth, mainly driven by the efforts to upgrade the country's road, rail, and other public transport infrastructure and investment in energy and utilities construction projects. The Government had been planning to invest SGD 28 billion (USD 20.9 billion) in the expansion and upgrading of the transport system by 2022.

- Hence, all such market trends are expected to drive the demand for construction chemicals in the region during the forecast period.

Construction Chemicals Industry Overview

The construction chemicals market is fragmented in nature. Some of the major players in the market include Sika AG, MBCC Group, RPM International Inc., MAPEI SpA, and Dow, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Residential and Commercial Construction Activities in the Asia-Pacific Region

- 4.1.2 Strengthening Demand for Water-based Products

- 4.2 Restraints

- 4.2.1 Regulations for VOC Emissions and Inadequacy of Skilled Labor

- 4.2.2 Unfavorable Conditions Arising Due to the COVID-19 Impact

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Revenue in USD Million)

- 5.1 Product Type

- 5.1.1 Concrete Admixture

- 5.1.2 Surface Treatment

- 5.1.3 Repair and Rehabilitation

- 5.1.4 Protective Coatings

- 5.1.5 Industrial Flooring

- 5.1.6 Waterproofing

- 5.1.7 Adhesive and Sealants

- 5.1.8 Grout and Anchor

- 5.1.9 Cement Grinding Aids

- 5.2 End-user Industry

- 5.2.1 Commercial

- 5.2.1.1 Office Space

- 5.2.1.2 Retails

- 5.2.1.3 Education Institutes

- 5.2.1.4 Hospitals

- 5.2.1.5 Hotels

- 5.2.1.6 Other Commercials

- 5.2.2 Industrial

- 5.2.2.1 Cement

- 5.2.2.2 Iron and Steel

- 5.2.2.3 Capital Goods

- 5.2.2.4 Automobile

- 5.2.2.5 Pharmaceutical

- 5.2.2.6 Paper

- 5.2.2.7 Petrochemical (Including Fertilizers)

- 5.2.2.8 Food and Beverage

- 5.2.2.9 Other Industrials

- 5.2.3 Infrastructure and Public Places

- 5.2.3.1 Roads and Bridges

- 5.2.3.2 Railways

- 5.2.3.3 Metros

- 5.2.3.4 Airports

- 5.2.3.5 Water

- 5.2.3.6 Energy

- 5.2.3.7 Government Buildings

- 5.2.3.8 Statues and Monuments

- 5.2.4 Residential

- 5.2.4.1 Elite Housing

- 5.2.4.2 Middle-class Housing

- 5.2.4.3 Low-cost Housing

- 5.2.1 Commercial

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China (Including Taiwan)

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 Indonesia

- 5.3.1.5 Australia and New Zealand

- 5.3.1.6 South Korea

- 5.3.1.7 Thailand

- 5.3.1.8 Malaysia

- 5.3.1.9 Philippines

- 5.3.1.10 Bangladesh

- 5.3.1.11 Vietnam

- 5.3.1.12 Singapore

- 5.3.1.13 Sri Lanka

- 5.3.1.14 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Benelux

- 5.3.3.7 Turkey

- 5.3.3.8 Switzerland

- 5.3.3.9 Scandinavian Countries

- 5.3.3.10 Poland

- 5.3.3.11 Portugal

- 5.3.3.12 Spain

- 5.3.3.13 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Chile

- 5.3.4.5 Rest of South America

- 5.3.5 Middle-East

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Kuwait

- 5.3.5.5 Egypt

- 5.3.5.6 Rest of Middle-East

- 5.3.6 Africa

- 5.3.6.1 South Africa

- 5.3.6.2 Nigeria

- 5.3.6.3 Algeria

- 5.3.6.4 Morocco

- 5.3.6.5 Rest of Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles (Overview, Financials, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Ashland

- 6.4.4 MBCC Group (BASF SE)

- 6.4.5 Bolton Group

- 6.4.6 Cementaid International Ltd

- 6.4.7 CHRYSO GROUP

- 6.4.8 CICO Group

- 6.4.9 Conmix Ltd

- 6.4.10 Dow

- 6.4.11 Fosroc Inc.

- 6.4.12 Franklin International

- 6.4.13 GCP Applied Technologies Inc.

- 6.4.14 Henkel AG & Co. KGaA

- 6.4.15 LafargeHolcim

- 6.4.16 MAPEI S.p.A

- 6.4.17 MUHU (China) Construction Materials Co. Ltd

- 6.4.18 Nouryon

- 6.4.19 Pidilite Industries Ltd

- 6.4.20 RPM International Inc.

- 6.4.21 Selena Group

- 6.4.22 Sika AG

- 6.4.23 Thermax Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Upcoming Construction Projects in the United States

- 7.2 Increasing Focus on Sustainable Materials

02-2729-4219

+886-2-2729-4219