|

市場調查報告書

商品編碼

1441647

鋯:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Zirconium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

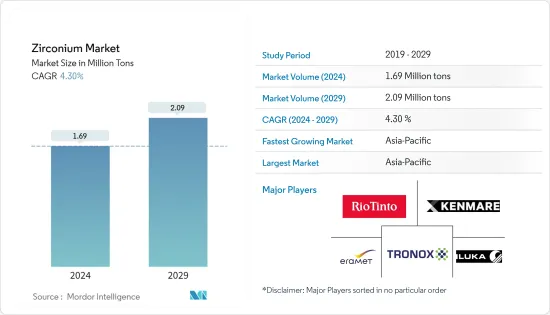

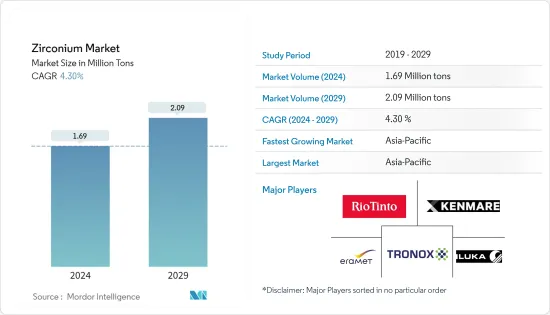

預計2024年鋯市場規模為169萬噸,預計到2029年將達到209萬噸,在預測期內(2024-2029年)年複合成長率為4.30%。

由於感染疾病COVID-19的人數迅速增加,許多國家實施了封鎖,這對全球經濟產生了重大影響。由於經濟和工業活動暫時停頓,鋯市場鋼鐵、水泥、能源化學、陶瓷等終端行業的生產和需求都受到影響。然而,由於對核能資源開發的日益關注,預計市場在預測期內將實現正成長。

主要亮點

- 從中期來看,推動市場成長的主要因素將是鑄造廠和耐火材料的成長、亞太地區核能發電廠數量的增加以及表面塗層使用的加速。

- 另一方面,減少對鋯石的依賴可能會嚴重阻礙市場成長。

- 整形外科醫療保健行業對鋯的需求不斷成長,以及與汽車行業相關的嚴格排放標準預計將為所研究的市場創造機會。

- 中國在研究市場中佔據主導地位,佔總收益的大部分,預計在預測期內年複合成長率最快。

鋯市場趨勢

鋯英石粉/砂需求增加

- 鋯石具有與所有有機和無機砂黏結劑黏結的能力,酸度低,熱膨脹係數低,高溫下空間穩定性高,高溫下化學穩定性好,可回收性好。

- 在陶瓷中,鋯砂因其非常有價值的特性而被使用,例如用於遮光的高屈光。諸如賦予陶瓷體和玻璃基體優異的機械強度、韌性和耐久性的能力等輔助優勢是公認的特性,可以在陶瓷行業的特定領域得到應用,從而可以滿足偏愛這些特性的市場。

- 在鑄造應用中,它被廣泛用作砂型鑄造、包模鑄造法和考斯沃斯鑄造(鋁)的基材。它還用作壓鑄模具塗料和耐火材料塗料以及清洗劑,以降低其他鑄砂的潤濕性。

- 鋯英砂用於製造模具和型芯,與矽砂相比具有顯著的優勢,因為它具有耐火性、低膨脹性、降低鋼水潤濕性以及高導熱性。

- 鋯石鑄砂可以使金屬具有更好的光潔度,減少「卡住」的機會並改善金屬的凝固。提高金屬滲透阻力並賦予鑄件均勻的光潔度。

- 由於上述因素,預計預測期內對鋯英粉/砂的需求將會增加。

中國壟斷市場

- 中國在全球市場佔有率中佔據主導地位,並作為當前成長最快的核能消費國而受到歡迎。由於人們對核能資源開發的日益關注,預計對鋯的需求將會增加。

- 中國是世界上最大的鋼鐵生產國。根據世界鋼鐵協會發布的報告顯示,中國鋼鐵產量1,950.5噸,佔全球的53%。此外,2021年,中國政府核准新建電爐43座,粗鋼總產能2,933萬噸/年。因此,新鋼廠的建設很可能帶動耐火材料市場,從而增加國內鋯消費量。

- 由於基礎建設步伐加快,中國的住宅和商業建築不斷增加。預計將增加水泥和鋼鐵業對耐火材料的需求,擴大市場開拓。

- 目前,中國作為核能成長最快的消費國而越來越受歡迎。該國擁有 50 座運作的核子反應爐,總合淨容量為 47,518 兆瓦。由於人們對核能資源開發的日益關注,預計對鋯的需求將會增加。

- 根據中國核能研究計劃,到2035年,核能發電廠的運作容量將達到約180GW。因此,核能發電產能的增加很可能會增加國內鋯的消耗量。

- 預計耐火材料和陶瓷等行業的成長將在預測期內推動受調查市場的成長。

鋯行業概況

全球鋯市場整合,前五名公司佔據全球消費量的主要佔有率。大部分鋯消費發生在亞太地區和歐洲。市場上的主要企業包括 Iluka Resources Limited、Rio Tinto、Tronox Holdings PLC、Kenmare Resources PLC 和 Eramet。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 亞太地區核能發電廠的成長

- 鑄造和耐火材料產業持續成長

- 加速在表面塗料中的使用

- 抑制因素

- 減少對鋯石的依賴

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

- 進出口

- 貿易監理政策分析

- 價格趨勢

第5章市場區隔

- 發生類型

- 鋯石

- 氧化鋯

- 其他發生類型

- 應用

- 鋯英石粉/碎砂

- 鋯石乳濁劑

- 耐火材料(氧化鋯)

- 鋯石化學品

- 金屬鋯石

- 地區

- 生產

- 澳洲

- 巴西

- 中國

- 印度

- 印尼

- 南非

- 烏克蘭

- 世界其他地區

- 消耗

- 中國

- 美國

- 日本

- 歐洲聯盟

- 印度

- 俄羅斯

- 世界其他地區

- 生產

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)分析

- 主要企業採取的策略

- 公司簡介

- Australian Strategic Materials Ltd

- Base Resources Limited

- Binh Dinh Minerals Company

- Doral Mineral Sands Pty Ltd

- Eramet

- Iluka Resources Limited

- INB

- Kenmare Resources PLC

- Lanka Mineral Sands Limited

- MZI Resources Ltd

- Rio Tinto

- Tronox Holdings PLC

第7章市場機會與未來趨勢

- 增加在醫療保健領域的使用,特別整形外科植入

- 嚴格的汽車排放標準

The Zirconium Market size is estimated at 1.69 Million tons in 2024, and is expected to reach 2.09 Million tons by 2029, growing at a CAGR of 4.30% during the forecast period (2024-2029).

A sharp increase in the number of COVID-19 cases led to numerous countries resorting to lockdowns, which significantly affected the global economy. The economic and industrial activities came to a temporary halt, which led the zirconium market to witness repercussions in terms of both production and demand from end-user industries, such as iron and steel, cement, energy and chemicals, and ceramics. However, the increasing focus on developing nuclear power resources is expected to help the market achieve positive growth during the forecast period.

Key Highlights

- Over the medium term, the major factors driving the market's growth are the growth in foundries and refractories, the increasing number of nuclear power stations in Asia-Pacific, and the accelerating usage of surface coatings.

- On the other hand, the reducing dependence on zircon is likely to hinder the growth of market significantly.

- The rising demand for zirconium in the healthcare sector for orthopedics and stringent emission standards pertaining to the automotive industry are expected to create the opportunities for the market studied.

- China dominated the market studied, accounting for a major share of the total revenue, and it is expected to witness the fastest CAGR over the forecast period.

Zirconium Market Trends

Increasing Demand from Zircon Flour/Sand

- Zircon is widely used in ceramics and foundry, mostly in the form of sand and flour (milled sand), due to its various properties, such as the ability to bind with all organic and inorganic sand binders, low acidity, low thermal expansion coefficient, and high spatial stability at increased temperatures, chemical stability at high temperatures, and good recyclability.

- In ceramics, zircon sand is used for its highly valuable properties, such as its high refractive index for opacification. Its ancillary benefits, including its ability to impart greater mechanical strength, toughness, and durability to ceramic bodies and glass matrices, are established attributes and enable it to find applications in specific segments of the ceramic industry, thereby catering to markets with a preference for these attributes.

- In foundry applications, it is used widely as a molding base material for sand casting, investment casting, and Cosworth casting (aluminum). It is also used as a mold coating in die casting and refractory paints and washes, as it reduces the wettability of other foundry sands.

- Zircon sand is used for mold and core manufacturing, where its refractoriness, low expansion, reduced wettability by molten steel, and high thermal conductivity offer significant advantages over silica sand.

- Zircon foundry sands produce a better metal finish, a lesser likelihood of 'burn-on,' and improved metal solidification. It increases the resistance to metal penetration and imparts a uniform finish to the casting.

- Owing to the aforementioned factors, the demand for zircon flour/sand is expected to grow over the forecast period.

China to Dominate the Market

- China dominated the global market share for zirconium, and it is gaining popularity as the fastest-growing consumer of nuclear energy in the present scenario. The increasing focus on developing nuclear power resources is expected to increase the demand for zirconium.

- China is the largest steel producer in the world. According to the report published by World Steel Association, China accounted for 53% of the overall production of steel in the world, which is 1950.5 metric tons. Additionally, in 2021, the Chinese government approved the construction of 43 new EAFs with a total crude steel capacity of 29.33 million mt/year. Thus, the construction of new steel plants is likely to drive the market for refractories, thereby increasing the consumption of zirconium in the country.

- The increased pace of infrastructural activities has led to an increase in residential and commercial buildings in China. This is expected to drive the demand for refractories in the cement and iron steel industries, thereby driving the market studied.

- China is currently gaining popularity as the fastest-growing consumer of nuclear energy. The country has 50 operable nuclear reactors, with a combined net capacity of 47,518 MW. The increasing focus on the development of nuclear power resources is expected to increase the demand for zirconium.

- According to China's Atomic Energy Research Initiative, by 2035, nuclear plants operation should reach around 180 GW. Thus, increasing nuclear power production capacities is likely to increase the consumption of zirconium in the country.

- The growth in industries, such as refractories and ceramics, is expected to drive the market studied in the forecast period.

Zirconium Industry Overview

The global zirconium market is consolidated, with the top five companies accounting for major shares of global consumption. Most of the consumption of zirconium is in the Asia-Pacific region and Europe. The major players in the market include Iluka Resources Limited, Rio Tinto, Tronox Holdings PLC, Kenmare Resources PLC, and Eramet.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growth of Nuclear Power Stations in the Asia-Pacific

- 4.1.2 Consistent Growth in Foundries and Refractories

- 4.1.3 Accelerating Usage in Surface Coatings

- 4.2 Restraints

- 4.2.1 Reducing Dependence on Zircon

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Import and Export

- 4.5.1 Trade Regulatory Policy Analysis

- 4.5.2 Price Trends

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Occurrence Type

- 5.1.1 Zircon

- 5.1.2 Zirconia

- 5.1.3 Other Occurrence Types

- 5.2 Applications

- 5.2.1 Zircon Flour/Milled Sand

- 5.2.2 Zircon Opacifier

- 5.2.3 Refractories (Zirconia)

- 5.2.4 Zircon Chemicals

- 5.2.5 Zircon Metal

- 5.3 Geography

- 5.3.1 Production

- 5.3.1.1 Australia

- 5.3.1.2 Brazil

- 5.3.1.3 China

- 5.3.1.4 India

- 5.3.1.5 Indonesia

- 5.3.1.6 South Africa

- 5.3.1.7 Ukraine

- 5.3.1.8 Rest of the World

- 5.3.2 Consumption

- 5.3.2.1 China

- 5.3.2.2 United States

- 5.3.2.3 Japan

- 5.3.2.4 European Union

- 5.3.2.5 India

- 5.3.2.6 Russia

- 5.3.2.7 Rest of the World

- 5.3.1 Production

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Australian Strategic Materials Ltd

- 6.4.2 Base Resources Limited

- 6.4.3 Binh Dinh Minerals Company

- 6.4.4 Doral Mineral Sands Pty Ltd

- 6.4.5 Eramet

- 6.4.6 Iluka Resources Limited

- 6.4.7 INB

- 6.4.8 Kenmare Resources PLC

- 6.4.9 Lanka Mineral Sands Limited

- 6.4.10 MZI Resources Ltd

- 6.4.11 Rio Tinto

- 6.4.12 Tronox Holdings PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Usage in the Healthcare Sector, Especially Orthopedic Implants

- 7.2 Stringent Emission Standards Pertaining to Automotive